Bitcoin Regulation

Here’s how blockchains are helping to advance the global energy grid

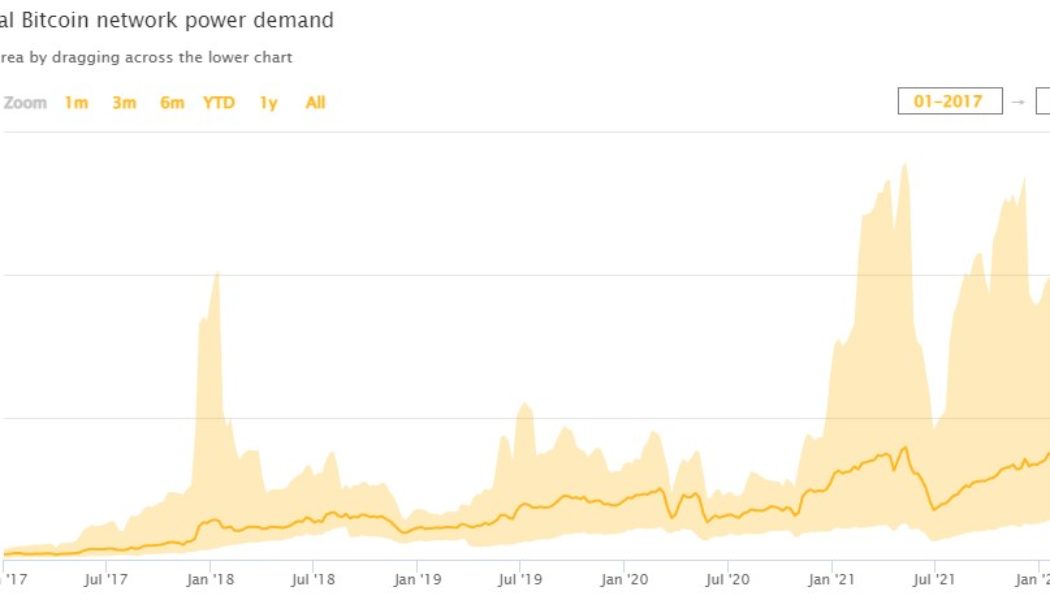

The blockchain industry’s impact on the energy sector has been a major source of controversy over the past five years. Governments and environmental protection advocates have routinely expressed concerns about the amount of energy required to keep the Bitcoin network secure. Data shows the network’s energy consumption now rivals the yearly energy consumed by some small countries. Historical Bitcoin network power demand. Source: CCAF While much of the debate has centered around the negative environmental impacts of Bitcoin (BTC) mining, the drive to maximize earnings from mining and integrate blockchain technology with the energy grid has also introduced new developments that have the potential to be beneficial in the long term. Here’s a look at several developments that have arisen out of ...

Goldman Sachs reportedly eyes crypto derivatives markets with FTX integration

Goldman Sachs, one of the leading investment banks in the United States is reportedly trying to onboard some of its derivatives products into FTX.US crypto derivatives offerings. Goldman Sachs has been in talks with FTX over regulatory and public listing help, and aims to expand into crypto derivatives offering by leveraging some of its own derivatives tools and services, reported Barron’s. FTX.US, the U.S. subsidiary of global cryptocurrency exchange FTX is currently seeking to offer brokerage services for its derivatives offerings. This would allow the crypto exchange to handle the collateral and margin requirements internally rather than depending on “futures commission merchants” (FCMs). FTX.US president Brett Harrison said: “We have multiple FCMs already committed to integrating ...

Crypto’s youngest investors hold firm against headwinds — and headlines

These can be anxious times for holders of cryptocurrencies, especially those who entered the market in late 2021 when prices were cresting. Bitcoin (BTC), Ether (ETH) and especially altcoins now appear to be undergoing a major reset, down 50% or more from November highs. Some worry that a whole generation of crypto adopters could be lost if things crumble further. “If the market decline continues, it will become too painful and retail investors will bail,” Eben Burr, president of Toews Asset Management, told Reuters earlier this month. “Everyone has a breaking point.” But, all the gloom and doom could be overdone. It’s “unnerving,” acknowledged Callie Cox, United States investment analyst at eToro, but it’s only par for the course for a market that scarcely existed a decade ago. Bitcoin, a...

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

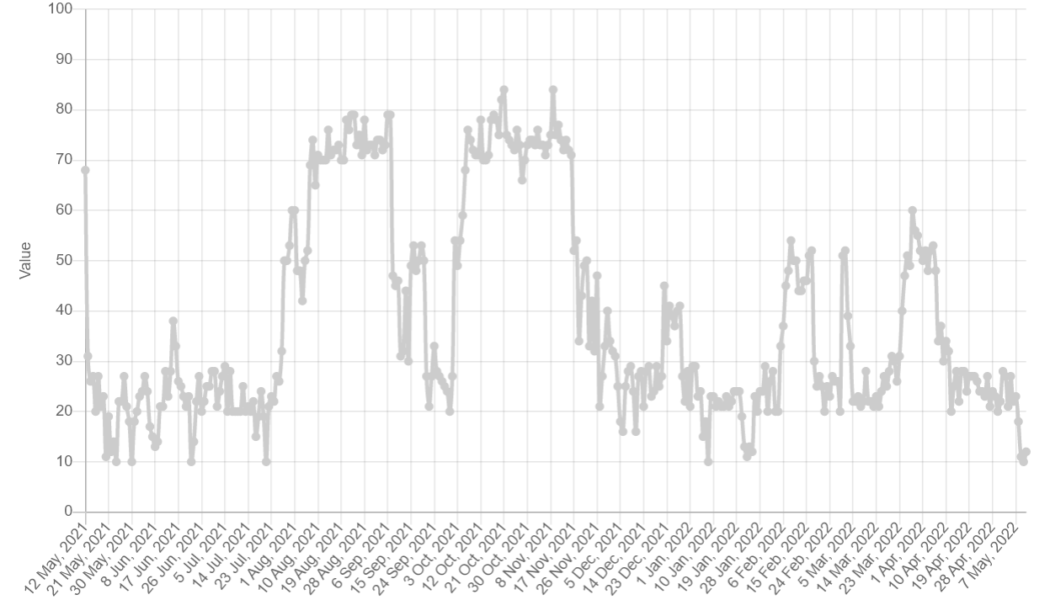

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

Crypto Bahamas: Regulations enter critical stage as gov’t shows interest

The crypto community and Wall Street converged last week in Nassau, Bahamas, to discuss the future of digital assets during SALT’s Crypto Bahamas conference. The SkyBridge Alternatives Conference (SALT) was also co-hosted this year by FTX, Sam Bankman-Fried’s cryptocurrency exchange. Anthony Scaramucci, founder of the hedge fund SkyBridge Capital, kicked off Crypto Bahamas with a press conference explaining that the goal behind the event was to merge the traditional financial world with the crypto community: “Crypto Bahamas combines the crypto native FTX audience with the SkyBridge asset management firm audience. We are bringing these two worlds together to create a more equitable financial system.” Traditional finance eyes crypto as regulations take shape The combination of traditional ...

Law Decoded: The difference between New York City and New York State, April 25-May 2

Last week, New York dominated crypto media headlines in very different ways. In New York State, the local Assembly voted in favor of the bill that would ban for two years any new mining operations that rely on proof-of-work (PoW) consensus mechanisms and use fossil fuel-generated energy. A temporary moratorium, which could be extended after the state’s Department of Environmental Conservation provides its assessments of the industry’s carbon footprint, marks the first major legislative attack on PoW mining on environmental grounds in the United States. The push mobilized the community — after digital asset advocacy groups rang the alarm on Twitter. Then, proponents of the ban had to endure three hours of a heated debate to narrowly pass the draft. There’s hope for an even tighter fig...

Cuban central bank makes it official: VASP licensing coming in May

In a move that could potentially foster the growth of Cuba’s nascent tech industry, the Banco Central de Cuba (BCC), the country’s central bank, will begin issuing licenses for Bitcoin (BTC) and other virtual asset services providers, or VASPs. According to the Official Gazette No. 43 published Tuesday, which includes a Central Bank of Cuba resolution, anyone wanting to provide virtual-asset-related services must acquire a license first from the central bank. It reads: “The Central Bank of Cuba, when considering the license request, evaluates the legality, opportunity and socioeconomic interest of the initiative, the characteristics of the project, the responsibility of the applicants and their experience in the activity.” Furthermore, the document states that those organizations that do n...

EU officials considered Bitcoin trading ban to enforce proposed mining ban

European Union (EU) officials discussed banning Bitcoin trading during a debate on a proposal to ban Proof of Work mining according to documents obtained through a freedom of information request. According to a report, published by German digital culture organization Netzpolitik, officials from the EU went as far as suggesting that an all out ban on trading Bitcoin (BTC) should be enforced in order to curb its overall energy consumption. The most worrying comments from the crypto community’s perspective came from a document that detailed the minutes from an EU meeting with Sweden’s financial supervisor and an environmental protection agency in which officials suggested that regulators pressure the Bitcoin community to switch to a Proof of Stake (PoS) mechanism, instead of its current...

EU officials considered Bitcoin trading ban to enforce proposed mining ban

European Union (EU) officials discussed banning Bitcoin trading during a debate on a proposal to ban Proof of Work mining according to documents obtained through a freedom of information request. According to a report, published by German digital culture organization Netzpolitik, officials from the EU went as far as suggesting that an all out ban on trading Bitcoin (BTC) should be enforced in order to curb its overall energy consumption. The most worrying comments from the crypto community’s perspective came from a document that detailed the minutes from an EU meeting with Sweden’s financial supervisor and an environmental protection agency in which officials suggested that regulators pressure the Bitcoin community to switch to a Proof of Stake (PoS) mechanism, instead of its current...

Half of assessed jurisdictions don’t have ‘adequate laws and regulatory structures’ — FATF

The Financial Action Task Force, or FATF, reported that many countries, including those with virtual asset service providers (VASPs), are not in compliance with its standards on Combating the Financing of Terrorism (CFT) and Anti-Money Laundering (AML). In a report released Tuesday on the “State of Effectiveness and Compliance with the FATF Standards,” the organization said 52% of the assessed jurisdictions in 120 countries had “adequate laws and regulatory structures in place” to assess risks and verify beneficial owners of companies. In addition, the FATF reported that only 9% of countries were “substantially effective” in this area. “Countries need to prioritize their efforts and demonstrate improvements in recording, reporting and verifying information regarding legal perso...

Law Decoded: Paris is always a good idea, even for talking crypto policy — April 11–18

Last week was the Paris Blockchain Week, and the epicenter of crypto policy and regulatory conversation moved to the French capital accordingly. Cointelegraph reported extensively from the ground and ran a series of interviews with some of the crypto industry’s captains who shared their thoughts on the state of regulatory affairs. For one, Binance’s Changpeng Zhao said that he was excited to see regulators embracing financial innovation and introducing crypto-friendly policies, calling it a major trend of 2022. Bertrand Perez, chief operating officer of the Web3 Foundation, opined that many policymakers, including some in the European Union, still tend to act too fast on crypto regulation without getting properly educated on the subject first. Ripple’s Brad Garlinghouse even filled in the ...

Iran to stiffen penalties for illegal use of subsidized energy in crypto mining

The Iranian government will increase penalties for the use of subsidized energy in crypto mining. The move marks another step in the tightening of mining regulation in the country that had faced energy shortages in recent years. On April 16, the Tehran Times reported, citing the country’s Power Generation, Distribution, and Transmission company, that the government plans to drastically increase the fines rates for the mining operators who use subsidized electricity. The company’s representative Mohammad Khodadadi Bohlouli specified: “Any use of subsidized electricity, intended for households, industrial, agricultural and commercial subscribers, for mining cryptocurrency is prohibited.” According to Bohlouli, the fines for the use of subsidized energy in mining will rise by...