Bitcoin Price

Traders think Bitcoin bottomed, but on-chain metrics point to one more capitulation event

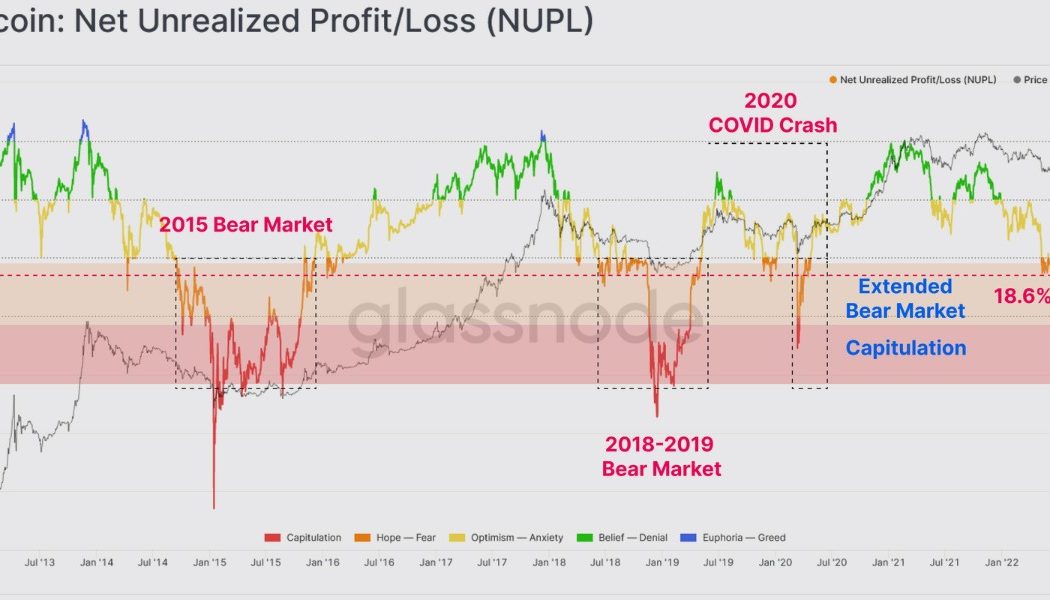

The bull market euphoria that carried prices to new highs throughout 2021 has given way to bear market doldrums for any Bitcoin (BTC) buyer who made a purchase since Jan. 1, 2021. Data from Glassnode shows these buyers “are now underwater” and the market is gearing up for a final capitulation event. Bitcoin net unrealized profit/loss. Source: Glassnode As seen in the graphic above, the NUPL, a metric tha is a measure of the overall unrealized profit and loss of the network as a proportion of the market cap, indicates that “less than 25% of the market cap is held in profit,” which “resembles a market structure equivalent to pre-capitulation phases in previous bear markets.” Based on previous capitulation events, if a similar move were to occur at the current levels, t...

Will Bitcoin Be Able to Bounce Back?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

5 reasons why Bitcoin could be a better long-term investment than gold

The emergence of forty-year high inflation readings and the increasingly dire-looking global economy has prompted many financial analysts to recommend investing in gold to protect against volatility and a possible decline in the value of the United States dollar. For years, crypto traders have referred to Bitcoin (BTC) as “digital gold,” but is it actually a better investment than gold? Let’s take a look at some of the conventional arguments investors cite when praising gold as an investment and why Bitcoin might be an even better long-term option. Value retention One of the most common reasons to buy both gold and Bitcoin is that they have a history of holding their value through times of economic uncertainty. This fact has been well documented, and there’s no denying that gold has ...

Major crypto firms reportedly cut up to 10% of staff amid bear market

Gemini, a cryptocurrency trading platform founded by brothers Cameron and Tyler Winklevoss, is the latest industry firm to lay off a significant part of its staff due to unfavorable market conditions. Winklevoss’ crypto business Gemini Trust reportedly cut 10% of its employees amid the ongoing bear crypto market, the founders wrote in a notice to employees on June 2, as Bloomberg reported. As part of its first major headcount cut, Gemini will refocus on products that are “critical” to the firm’s mission, the brothers said, adding that “turbulent market conditions” are “likely to persist for some time.” The notice reportedly reads: “This is where we are now, in the contraction phase that is settling into a period of stasis — what our industry refers to as “crypto winter. […] Thi...

Here are 3 altcoins that could surge once Bitcoin flips $35K to support

Bitcoin (BTC) and the wider cryptocurrency market are taking a breather after the rally on May 31. Meanwhile, most altcoins remain severely oversold, with most between 70% and 90% below their all-time highs. Total altcoin index capitalization What is clear is that fear is everywhere and blood is in the water. Risk-on markets are suffering worldwide, but it is exactly these kinds of conditions that create opportunities where professional money accumulates and adds to positions. Let’s take a look at three altcoins that could be positioned for a rebound if the broader market enters a new uptrend. ADA could be setting up for an 80% surge Cardano (ADA) has a significantly bullish update coming very soon. The much anticipated Vasil hard fork, which increases performance and adds more Plutu...

On-chain data shows Bitcoin long-term holders continuing to ‘soak up supply’ around $30K

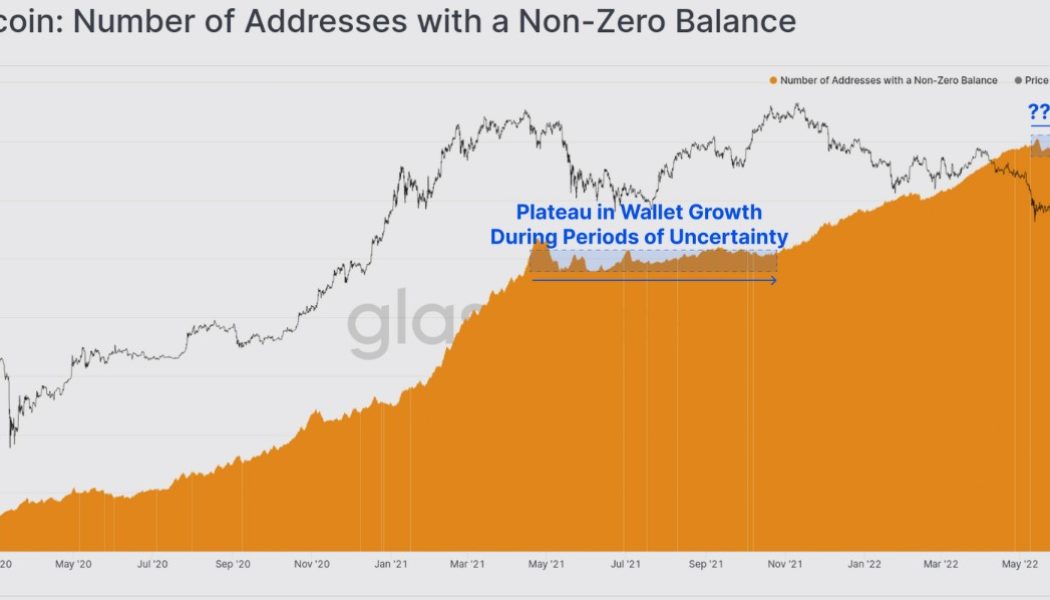

Bear markets are typically marked by a capitulation event where discouraged investors finally abandon their positions and asset prices either consolidate as inflows to the sector taper off or a bottoming process begins. According to a recent report from Glassnode, Bitcoin hodlers are now “the only ones left” and they appear to be “doubling down as prices correct below $30K.” Evidence of the lack of new buyers can be found looking at the number of wallets with non-zero balances, which has plateaued over the past month, a process that was seen after the crypto market sell-off in May of 2021. Number of Bitcoin addresses with a non-zero balance. Source: Glassnode Unlike the sell-offs that occurred in March 2020 and November 2018, which were followed by an upswing in on-chain activity tha...

Crypto’s youngest investors hold firm against headwinds — and headlines

These can be anxious times for holders of cryptocurrencies, especially those who entered the market in late 2021 when prices were cresting. Bitcoin (BTC), Ether (ETH) and especially altcoins now appear to be undergoing a major reset, down 50% or more from November highs. Some worry that a whole generation of crypto adopters could be lost if things crumble further. “If the market decline continues, it will become too painful and retail investors will bail,” Eben Burr, president of Toews Asset Management, told Reuters earlier this month. “Everyone has a breaking point.” But, all the gloom and doom could be overdone. It’s “unnerving,” acknowledged Callie Cox, United States investment analyst at eToro, but it’s only par for the course for a market that scarcely existed a decade ago. Bitcoin, a...

On-chain data flashes Bitcoin buy signals, but the bottom could be under $20K

Every Bitcoin investor is searching for signals that the market is approaching a bottom, but the price action of this week suggests that we’re just not there yet. Evidence of this can be found by looking at the monthly return for Bitcoin (BTC), which was hit with a rapid decline that “translated to one of the biggest drawdowns in monthly returns for the asset class in its history,” according to the most recent Blockware Solutions Market Intelligence Newsletter. Bitcoin monthly returns. Source: Blockware Solutions Bitcoin continues to trade within an increasingly narrow trading range that is slowly being compressed to the downside as global economic strains mount. Whether the price continues to trend lower is a popular topic of debate among crypto analysts and the dominant opini...

3 metrics contrarian crypto investors use to know when to buy Bitcoin

Buying low and selling high is easier said than done, especially when emotion and volatile markets are thrown into the mix. Historically speaking, the best deals are to be found when there is “blood on the streets,” but the danger of catching a falling knife usually keeps most investors planted on the sidelines. The month of May has been especially challenging for crypto holders because Bitcoin (BTC) dropped to a low of $26,782, and some analysts are now predicting a sub-$20,000 BTC price in the near future. It’s times like these when fear is running rampant that the contrarian investor looks to establish positions in promising assets before the broader market comes to its senses. Here’s a look at several indicators that contrarian-minded investors can use to spot opportune moments for ope...

Falling wedge pattern points to eventual Ethereum price reversal, but traders expect more pain first

The cryptocurrency market was hit with another round of selling on May 26 as Bitcoin (BTC) price dropped to $28,000 and Ether (ETH) briefly fell under $1,800. The ETH/BTC pair also dropped below what traders deem to be an important ascending trendline, a move that traders say could result in Ether price correcting to new lows. ETH/USDT 1-day chart. Source: TradingView Here’s a rundown of what several analysts in the market are saying about the move lower for Ethereum and what it could mean for its price in the near term. Price consolidation will eventually result in a sharp move A brief check-in on what levels of support and resistance to keep an eye on was provided by independent market analyst Michaël van de Poppe, who posted the following chart showing Ether trading near its range ...

‘Extreme fear’ grips Bitcoin price, but analysts point to signs of a potential reversal

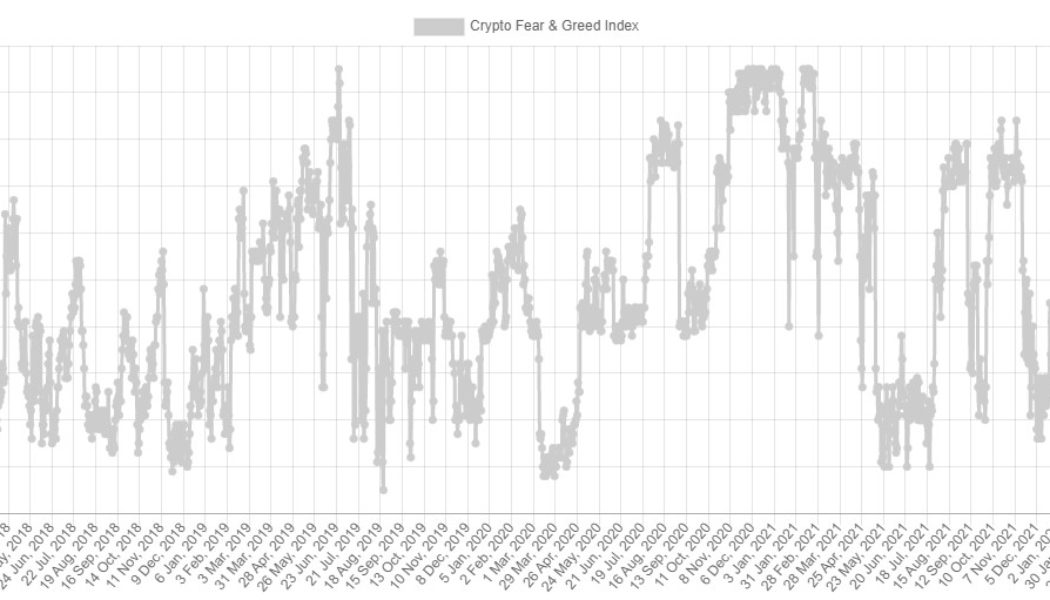

The cryptocurrency market settled into a holding pattern on May 25 after traders opted to sit on the sidelines ahead of the midday Federal Open Market Committee (FOMC) meeting where the Federal Reserve signaled that it intends to continue on its path of raising interest rates. According to data from Alternative.me, the Fear and Greed Index seeing its longest run of extreme fear since the market crash in Mach 2020. Crypto Fear & Greed Index. Source: Alternative Data from Cointelegraph Markets Pro and TradingView shows that the price action for Bitcoin (BTC) has continued to compress into an increasingly narrow trading range, but technical analysis indicators are not providing much insight on what direction a possible breakout could take. BTC/USDT 1-day chart. Source: TradingView Here’s ...