Bitcoin Price

Hodlers and whales: Who owns the most Bitcoin in 2022?

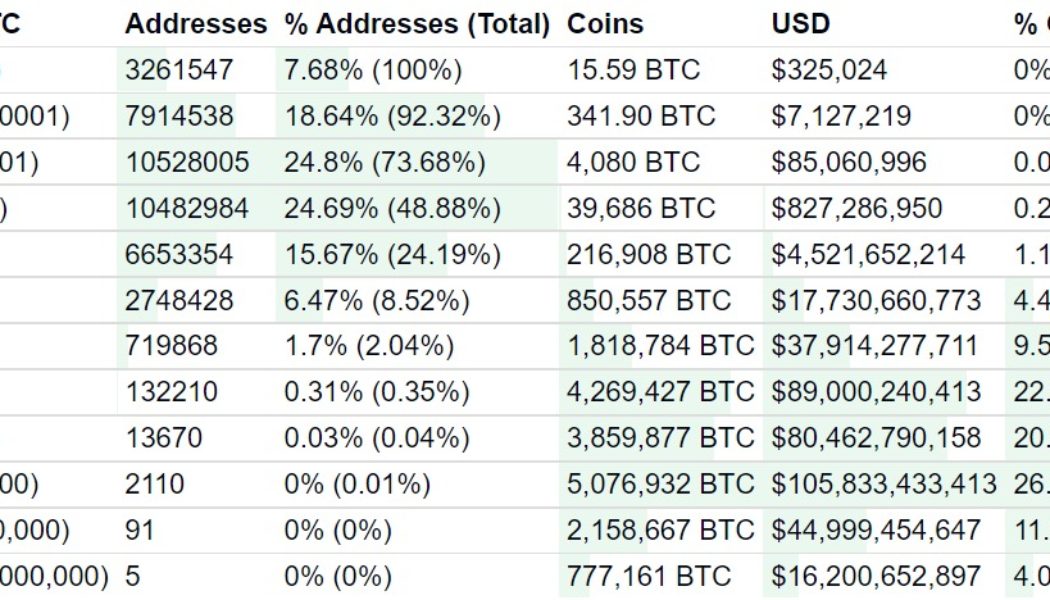

One of the main features of the Bitcoin blockchain is its transparency. Bitcoin lets anyone see every transaction that has ever been made on its network and check the balance of every address out there. Because of this transparency, we’re able to know who owns the most Bitcoin (BTC) in 2022. It’s important to look at who owns the most BTC, as the cryptocurrency’s supply is limited to 21 million coins. In February, Kim Grauer, director of research at blockchain forensics firm Chainalysis, told Cointelegraph that an estimated 3.7 million BTC have been lost, effectively deflating the cryptocurrency’s circulating supply. Experts estimate that as Bitcoin’s adoption rises, demand for it will skyrocket. As 3.7 million coins are estimated to be lost and a significant amount is being held on-chain ...

What determines the Bitcoin price?

Various factors impacting Bitcoin’s price include the supply and demand of BTC, competition from other cryptocurrencies and news, cost of production and regulation. Supply and demand Those with a background in economics are aware of the law of supply and demand. However, if you are unfamiliar with this concept, let’s help you to understand. As per this law, supply and demand market forces work together to determine the market price and the quantity of a specific commodity. For instance, the demand for an economic good declines as the price increases, and sellers will produce more of it or vice-versa. An event called Bitcoin halving impacts the Bitcoin’s price like the situation in which the supply of BTC decrease whereas the demand for BTC increases. As a result of the hi...

Not giving up: VanEck refiles with SEC for spot Bitcoin ETF

VanEck, one of the first firms in the world to ever file for a Bitcoin (BTC) exchange-traded fund (ETF), is not giving up on its plans to launch a spot Bitcoin ETF in the United States. The firm has refiled an application for a physically-backed Bitcoin ETF with the U.S. Securities and Exchange Commission (SEC). Filed on June 24, VanEck’s latest Bitcoin ETF application comes months after the SEC rejected its previous spot Bitcoin ETF request on November 12, 2021. The securities regulator based its decision on the ETF on its alleged inability to meet standards to protect investors and the public interest as well as to “prevent fraudulent and manipulative acts and practices.” In the latest filing, VanEck provided a wide number of reasons for the SEC to approve a Bitcoin ETF this time. T...

Deutsche Bank analysts see Bitcoin recovering to $28K by December

Analysts from Deutsche Bank forecast Bitcoin (BTC) rebounding to $28,000 by December 2022 as the cryptocurrency market continues to grapple with gloomy times. Bitcoin and the wider cryptocurrency markets have endured a tough six months, with the value of BTC, in particular, enduring its worst quarter in 10 years. Macroeconomic conditions around the world have played a role, with stagnating markets and fears of inflation driving conventional stock markets and their crypto-counterparts down to painful lows. A report from Deutsche Bank analysts Marion Laboure and Galina Pozdnyakova provides an interesting perspective on the medium-term outlook for BTC. Their insights suggest that cryptocurrency markets have mirrored movements of the Nasdaq 100 and S&P 500 since late 2021. The pair believe...

Worst quarter in 11 years as Bitcoin price and activity plunges

Bitcoin (BTC) has seen its worst quarterly loss in 11 years with price and activity on the blockchain both plunging over the last three months. The second quarter ending June 30 saw Bitcoin’s price fall from around $45,000 at the start of the quarter to trade at $19,884 before midnight ET on June 30 according to CoinGecko, representing a 56.2% loss according to crypto analytics platform Coinglass. It’s the steepest price fall since the third quarter of 2011, when BTC fell from $15.40 to $5.03, a loss of over 67% and worse than the bear markets of 2014 and 2018, when Bitcoin’s price slumped 39.7% and 49.7% in their worst quarters respectively. The past quarter saw eight weekly red candles in a row for Bitcoin and the month of June saw a draw down of over 37%, the heaviest monthly losses sin...

NYDIG study calculates the value of regulation worldwide in terms of BTC price gains

The need for regulation is a common theme in discussions about cryptocurrency, and the claim is often taken to be self-evident. Now, financial services company New York Digital Investment Group (NYDIG) has done some number crunching to prove the point. In a new study, NYDIG quantifies the effect of regulation on the price of Bitcoin (BTC) worldwide. NYDIG studied Bitcoin prices at regular intervals following regulatory events affecting digital asset taxation, accounting and payments, as well as decisions on the legality of service providers and the digital assets themselves. The research looked at the Americas, Europe, China and Asia except for China, and confined itself to the period between September 30, 2011, and March 31, 2022. The number of regulatory events considered in the study va...

Bitcoin’s bottom might not be in, but miners say it ‘has always made gains over any 4-year period’

Your favorite trader is saying Bitcoin (BTC) bottomed. At the same time, the top on-chain indicators and analysts are citing the current price range as a “generational buy” opportunity. Meanwhile, various crypto and finance media recently reported that Bitcoin miners sending a mass of coins to exchanges are a sign that $17,600 was the capitulation move that pins the market bottom. There’s so much assurity from various anon and doxed analysts on Crypto Twitter, yet Bitcoin price is still in a clear downtrend, and the metrics don’t fully reflect that traders are buying every dip. A critical component of BTC price that many investors often overlook is the condition and sentiment of Bitcoin miners, which is exactly why Cointelegraph had a chat with Rich Ferolo of Blockware Solutions and ...

It seems NFT-themed Bored & Hungry restaurant no longer accepts crypto

The Los Angeles Times reported Friday that recently opened NFT-themed burger joint Bored & Hungry no longer accepts cryptocurrency as a form of payment for its food. When questioned, one Bored & Hungry employee told the Los Angeles Times “Not today — I don’t know.” The individual didn’t give any indication of when the decision was made to cut crypto from the menu of payment options, nor did they know if crypto payments would be making a return. Bored & Hungry initially launched back in April of this year. At the time, one worker told the Los Angeles Times that the majority of its customers didn’t seem to care about crypto payment options, also noting that customers were generally indifferent to “the restaurant’s fidelity to the crypto cause.” Another Bored & Hungry restaura...

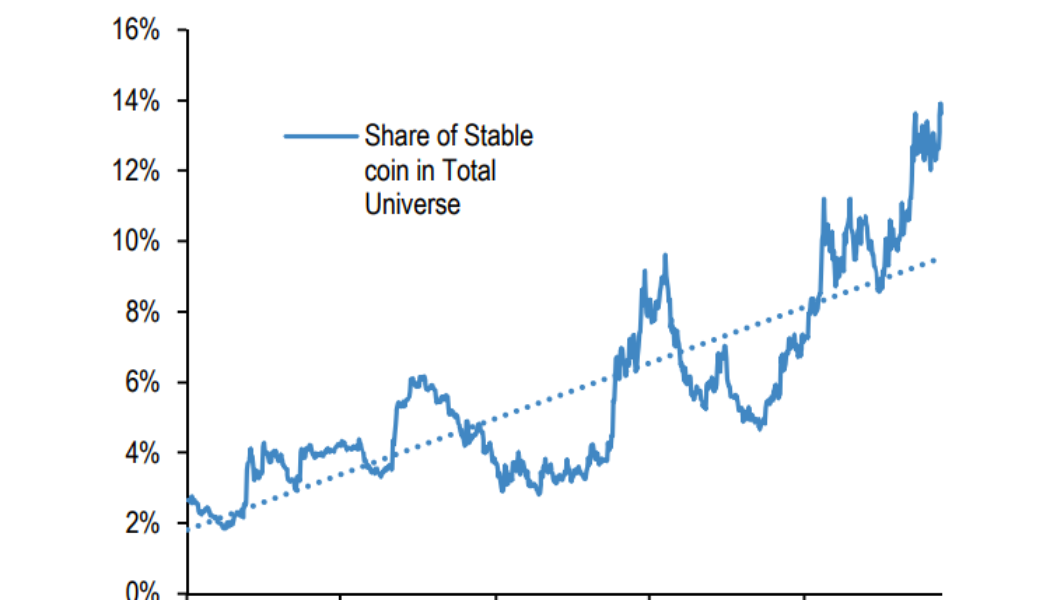

Record stablecoin market share points to crypto upside: JPMorgan

The rapid surge in share of stablecoins like Tether (USDT) in the cryptocurrency market may point to an upcoming crypto upside, according to analysts at the American investment bank JPMorgan Chase. The percentage of stablecoins in the total crypto market value has been on the rise, reaching new historical highs in mid-June, JPMorgan strategists believe. Led by JPMorgan crypto market analyst Nikolaos Panigirtzoglou, the analysts provided their industry insights in the bank’s new investor note shared with Cointelegraph. Released on June 15, the investor note reads that the share of all stablecoins rose to above 14%, or a “new historical high, which brings it to well above its trend since 2020.” “The share of stablecoins in total crypto market cap looks excessively high, pointing to ove...

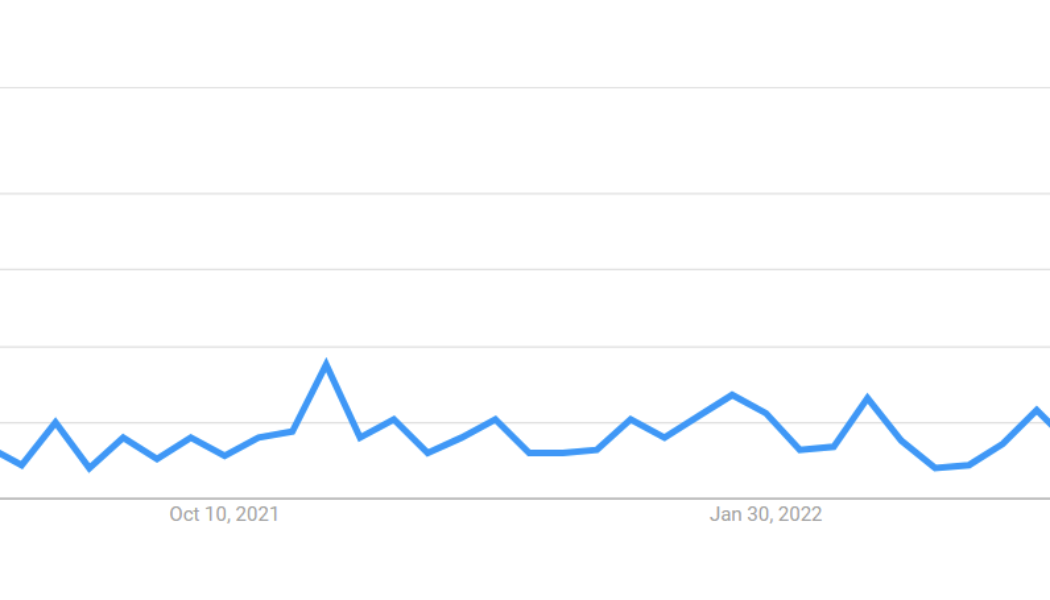

‘Bitcoin dead’ Google searches hit new all-time high

Collapsing Bitcoin (BTC) prices are reviving renewed speculation about the demise of the leading cryptocurrency, according to Google search trends. Google searches for “Bitcoin dead” spiked in the week ending Friday, June 18, and likely reached the highest level on record. Google Trends tracks interest in search terms over time, assigning scores of 1 to 100 based on the total number of user queries. The data are anonymized, categorized by topic and aggregated based on location. Google searches for “bitcoin dead” hit all time highs over the weekend. pic.twitter.com/oDXNqGEeIL — Alex Krüger (@krugermacro) June 20, 2022 “Bitcoin dead” achieved a score of 100 for the period between June 12–18 based on preliminary data that is reflected by the dotted line. The last time the se...

El Salvador president addresses bear market concerns with Bitcoin hopium

El Salvador introduced BTC as legal tender on September 7, 2021, when its market price was around $50,000. Ever since, Bukele’s government made significant returns on their initial BTC investments as Bitcoin rallied to its all-time high of $69,000, which was redirected to the country’s various infrastructure development initiatives. However, as tensions rise amid falling BTC prices, Bukele decided to share advice for fellow Bitcoin investors that may be concerned about the prolonged bear market. Nayib Bukele, the president who helped Bitcoin (BTC) gain legal tender status in El Salvador, addressed the rising concerns of investors as BTC began trading for under $20,000 for the first time in 18 months. I see that some people are worried or anxious about the #Bitcoin market price. My advice: ...

Bitcoin critics say BTC price is going to $0 this time, but these 3 signals suggest otherwise

Like clockwork, the onset of a crypto bear market has brought out the “Bitcoin is dead” crowd who gleefully proclaim the end of the largest cryptocurrency by market capitalization. If #Bitcoin can collapse by 70% from $69,000 to under $21,000, it can just as easily fall another 70% down to $6,000. Given the excessive leverage in #crypto, imagine the forced sales that would take place during a sell-off of this magnitude. $3,000 is a more likely price target. — Peter Schiff (@PeterSchiff) June 14, 2022 The past few months have indeed been painful for investors, and the price of Bitcoin (BTC) has fallen to a new 2022 low at $20,100, but the latest calls for the asset’s demise are likely to suffer the same fate as the previous 452 predictions calling for its death. Bitcoin obitu...