Bitcoin Price

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Could Bitcoin Ever Hit a New All-Time High?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Fallout from crypto contagion subsides but no market reversal just yet

The blockchain industry showed some surprising resilience in July, which may point to a period of greater fundamental support for the crypto space overall in the short term. In looking at a wide variety of indicators, including Bitcoin’s (BTC) price action, open interest on Ether (ETH) and activity in GameFi, there are some strong signals to suggest that a bullish sentiment is returning to this space. Smooth sailing from now on is not a given, though. Cointelegraph Research’s latest Investor Insights analyzes key indicators from different sectors of the blockchain industry to navigate those potentially treacherous crypto waters. In the latest edition, Cointelegraph Research’s bearish-to-bullish index was a level C indicating a short-term cautionary time. While there are still mixed signals...

Is your SOL safe? What we know about the Solana hack | Find out now on The Market Report

On this week’s episode of “The Market Report,” Cointelegraph’s resident experts discuss the latest updates concerning the recent Solana (SOL) hack. To kick things off, we broke down the latest news in the markets this week: Bitcoin realized price bands form key resistance as bulls lose $24K, significant whale activity between $22,000 and $24,800 adds to the complexity of the current spot market setup. Bitcoin (BTC) consolidated lower on Aug. 9 after familiar resistance preserved a multi-month trading range. When will we finally break out of this price range and make the move towards $30K? Institutions flocking to Ethereum for 7 straight weeks as Merge nears: Report, “Greater clarity” around the Merge has driven institutional inflows into Ethereum products, according to a CoinShares report....

Bitcoin likely to transition to a risk-off asset in H2 2022, says Bloomberg analyst

Bitcoin is likely to transition from a risk-on to a risk-off asset in the second half of 2022, as the macroeconomic environment is rapidly shifting towards a recession, said Mike McGlone, senior commodity strategist at Bloomberg, in a recent interview with Cointelegraph. McGlone predicted: “ I see it transitioning to be more of a risk-off asset like bonds and gold, then less of a risk-on asset like the stock market.” According to the analyst, the crypto market has flushed out most of the speculative excesses that marked 2021 and it is now ripe for a fresh rally. McGlone also pointed out that the Fed’s aggressive hiking of interest rates will lead the global economy to a deflationary recession, which will ultimately favor Bitcoin: “I fully expect we’re going to have a prett...

How Bitcoin whales make a splash in markets and move prices

Deriving their names from the size of the massive mammals swimming around the earth’s oceans, cryptocurrency whales refer to individuals or entities that hold large amounts of cryptocurrency. In the case of Bitcoin (BTC), someone can be considered a whale if they hold over 1,000 BTC, and there are less than 2,500 of them out there. As Bitcoin addresses are pseudonymous, it is ofte difficult to ascertain who owns any wallet. While many associates the term “whale” with some lucky early adopters of Bitcoin, not all whales are the same, indeed. There are several different categories: Exchanges: Since the mass adoption of cryptocurrencies, crypto exchanges have become some of the biggest whale wallets as they hold large amounts of crypto on their order books. Institutions and corpor...

Interview with Kevin O’Leary: $28K Bitcoin next or lower? | Market Talks with Crypto Jebb

With the price of Bitcoin (BTC) holding above $22,000, more and more market players are turning bullish again. Does this mean that we could see BTC go to $28,000 in the short term or will it fall below its current levels? Join us as we discuss this and other topics with Crypto Jebb and Mr. Wonderful, himself, Kevin O’Leary. In this week’s episode of Market Talks, we welcome businessman, entrepreneur, author, winemaker and television presenter, Mr. Kevin O’Leary. O’Leary, best known as the shark on the hit reality TV show Shark Tank, is the chairman of O’Shares Investments and a strategic investor in WonderFi. Mr. O’Leary’s success story starts where most entrepreneurs begin — with a big idea and zero cash. The main topic of discussion on the show is whether BTC will go as high as $28...

Crypto contagion deters investors in near term, but fundamentals stay strong

The past six-odd months have been nothing short of a financial soap opera for the cryptocurrency market, with more drama seemingly unfolding every other day. To this point, since the start of May, a growing number of major crypto entities have been tumbling like dominoes, with the trend likely to continue in the near term. The contagion, for the lack of a better word, was sparked by the collapse of the Terra ecosystem back in May, wherein the project’s associated digital currencies became worthless almost overnight. Following the event, crypto lending platform Celsius faced bankruptcy. Then Zipmex, a Singapore-based cryptocurrency exchange, froze all customer withdrawals, a move that was mirrored by crypto financial service provider Babel Finance late last month. It is worth noting that si...

Will the Bitcoin mining industry collapse? Analysts explain why crisis is really opportunity

Bitcoin mining involves a delicate balance between multiple moving parts. Miners already have to face capital and operational costs, unexpected repairs, product shipping delays and unexpected regulation that can vary from country to country — and in the case of the United States, from state to state. On top of that, they also had to contend with Bitcoin’s precipitous drop from $69,000 to $17,600. Despite BTC price being 65% down from its all-time high, the general consensus among miners is to keep calm and carry on by just stacking sats, but that doesn’t mean the market has reached a bottom just yet. In an exclusive Bitcoin miners panel hosted by Cointelegraph, Luxor CEO Nick Hansen said, “There’s going to definitely be a capital crunch in publicly listed companies or at least ...

3AC: A $10B hedge fund gone bust with founders on the run

Three Arrow Capital (3AC), a Singapore-based crypto hedge fund that at one point managed over $10 billion worth of assets, became one of the many crypto firms that went bankrupt in this bear market. However, the fall of 3AC wasn’t purely a market-driven phenomenon. As more information surfaced, the collapse looked more like a self-inflicted crisis brought upon by an unchecked decision-making process. To put it concisely, the hedge fund made a series of large directional trades in Grayscale Bitcoin Trust (GBTC), Luna Classic (LUNC) and Staked Ether (stETH) and borrowed funds from over 20 large institutions. The May crypto crash led to a series of spiral investment collapse for the hedge fund. The firm went bust and the loan defaults have led to mass contagion in crypto. The first hint...

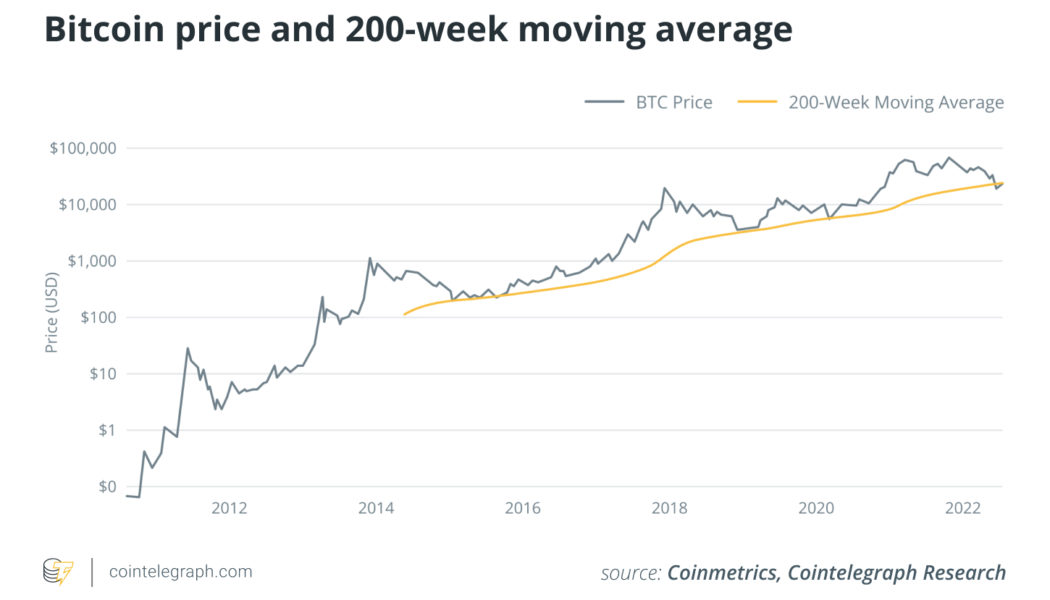

Sentiment and inflation: Factors putting pressure on Bitcoin price

Subsequently, there are fears that Bitcoin prices will take longer to recover. Bitcoin (BTC) has been hovering around the $20,000 range for several weeks now after the coin lost over 60% of its value from its peak in November. The recent plunge wiped out over $600 million from its market cap and caused rising concerns of a bubble burst. Negative investor sentiment Cryptocurrency investors have been on edge since Bitcoin’s fall to around $20,000. Many of them fear that more unprecedented selloffs by key players could precipitate a bigger downtrend. Further declines are likely to amplify losses and make it harder for the market to recover in the medium term. As such, many investors are holding off additional investments. Besides the fall of cryptocurrencies, the decimation of linchpin crypto...