Bitcoin Price

Gold vs BTC correlation signals Bitcoin becoming safe haven: BofA

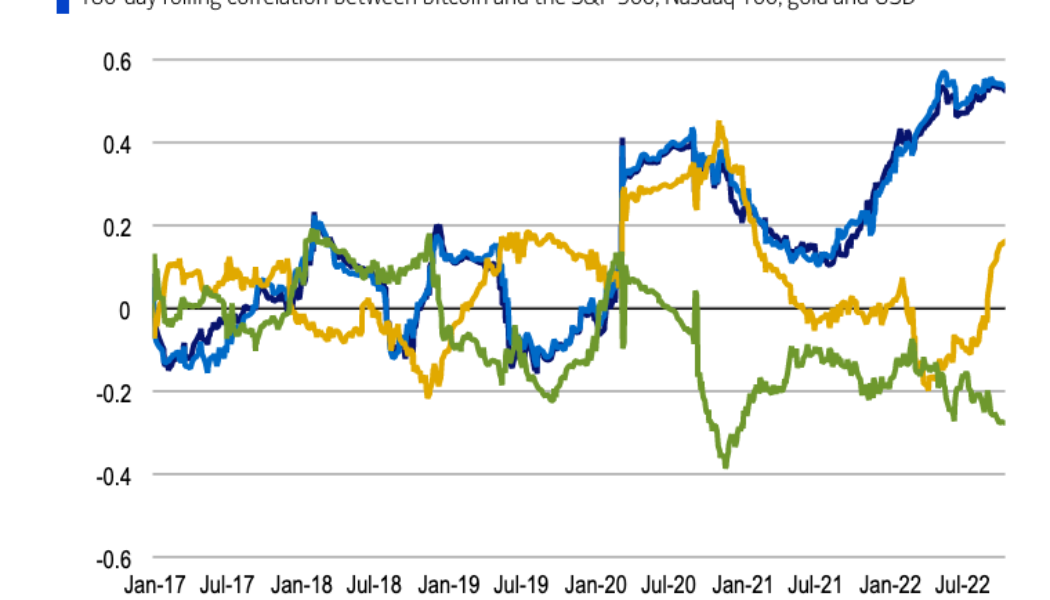

Despite the ongoing cryptocurrency bear market, investors have been increasingly looking at Bitcoin (BTC) as a safe haven, a new study suggests. The rise in the correlation between Bitcoin and gold (XAU) is one of the major indicators demonstrating investors’ confidence in BTC amid the ongoing economic downturn, according to digital strategists at the Bank of America. Bitcoin’s correlation with gold — which is commonly viewed as an inflation hedge — has been on the rise this year, hitting its highest yearly levels in early October. The growing correlation trend started on Sept. 5 after remaining close to zero from June 2021 and turning negative in March 2022, BofA strategists Alkesh Shah and Andrew Moss said in the report. “Bitcoin is a fixed-supply asset that may eventually become an infl...

Bitcoin miner profitability under threat as hash rate hits new all-time high

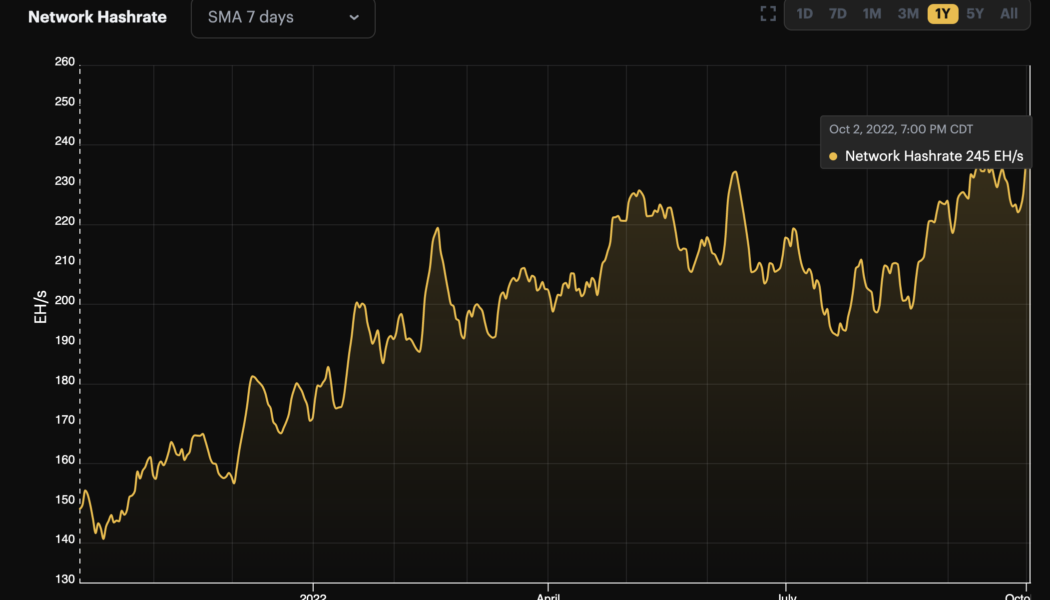

The Bitcoin hash rate hit a new all-time high above 245 EH/s on Oct. 3, but at the same time, BTC miner profitability is near the lowest levels on record. With prices in the low $20,000 range and the estimated network-wide cost of production at $12,140, Glassnode analysis suggests “that miners are somewhat on the cusp of acute income distress.” Bitcoin network hash rate. Source: Hashrate Index Generally, difficulty, a measure of how “difficult” it is to mine a block, is a component of determining the production cost of mining Bitcoin. Higher difficulty means additional computing power is required to mine a new block. Utilizing a Difficulty Regression Model, the data shows an R2 coefficient of 0.944 and the last time the model flashed signs of the miners’ distress was during BTC...

Bitcoin profitability for long-term holders decline to 4-year low: Data

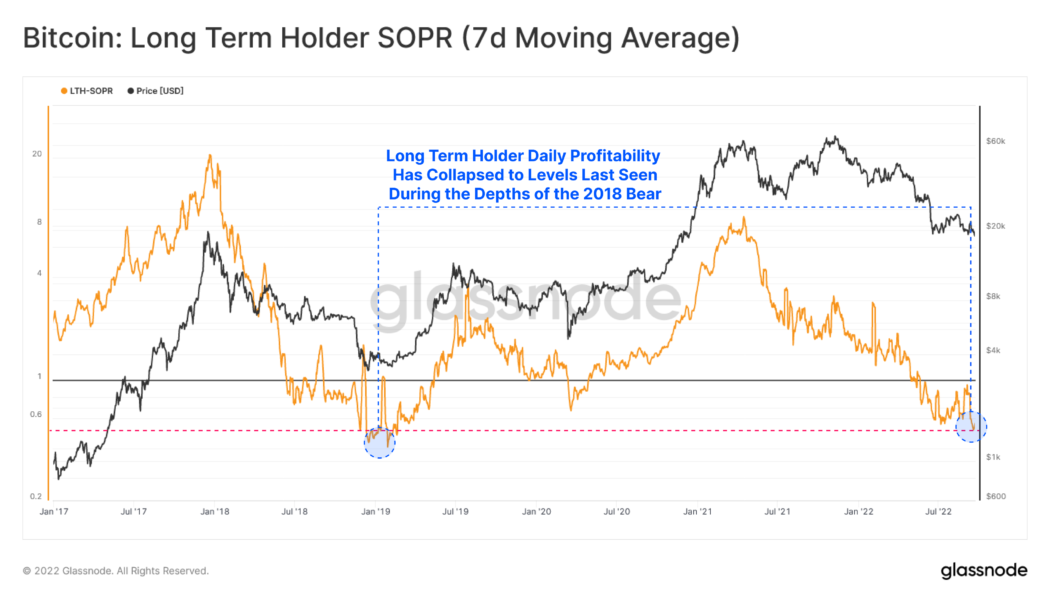

Bitcoin’s (BTC) long-term profitability has declined to levels last seen during the previous bear market in December 2018. According to data shared by crypto analytic firm Glassnode, BTC holders are selling their tokens at an average loss of 42%. Bitcoin long term holders. Source: Glassnode The Glassnode data indicate that long-term holders of the top cryptocurrency selling their tokens have a cost basis of $32,000, meaning the average buying price for these holders selling their stack is above $30,000. The current market downturn added to the declining profitability can be attributed to several macroeconomic factors. The BTC market still has a heavy correlation with the stock market, especially tech stocks, which are currently seeing an even bigger downtrend than crypto. The rising inflat...

Mainstream media sentiment shifts in favor of Bitcoin amid fiat currency woes

Despite USD bringing an onslaught to stocks, commodities and its rival currencies, BTC holds steady at the $19,000 to $20,000 mark, leaving mainstream media no choice but to put BTC into the headlines. American daily newspaper The New York Times highlighted BTC’s 6.5% increase in the last seven days and noted that this had caught the attention of crypto bulls and bears. Meanwhile, Fortune Magazine’s crypto outlet has also compared Bitcoin’s standout performance to other assets like the Japanese yen, Chinese yuan and gold, apart from the euro and pound. With fiat currencies like the euro and the Great British pound sterling failing to hold their ground against the United States dollar (USD), mainstream media outlets have started to put Bitcoin (BTC) into the spotlight for its st...

Ethereum risks another 10% drop versus Bitcoin as $15.4M exits ETH investment funds

Ethereum’s Merge on Sep. 15 turned out to be a sell-the-news event, which looks set to continue. Notably, Ether (ETH) dropped considerably against the U.S. dollar and Bitcoin (BTC) after the Merge. As of Sep. 22, ETH/USD and ETH/BTC trading pairs were down by more than 20% and 17%, respectively, since Ethereum’s switch to Proof-of-Stake (PoS. ETH/USD and ETH/BTC daily price chart. Source: TradingView What’s eating Ether bulls? Multiple catalysts contributed to Ether’s declines in the said period. First, ETH’s price fall against the dollar appeared in sync with similar declines elsewhere in the crypto market, driven by Federal Reserve’s 75 basis points (bps) rate hike. Second, Ethereum faced a lot of flak for becoming too centralized ...

Crypto and stocks soften ahead of Fed rate hike, but XRP, ALGO and LDO look ‘interesting’

Prices remain soft across the market as traders await Federal Reserve Chair Jerome Powell’s statement on the size of the next interest rate hike. At the moment, the market consensus is a 0.75 bps rate hike and a sliver of analysts are banking on 1%. Stocks also appear en-route to close the day in the red, with the Dow down 0.75%, and the S&P 500 and Nasdaq registering a 0.79% and 0.64% loss. Bitcoin continues to fight what appears to be a losing battle at the $19,000 mark, while Ether (ETH) dug a little deeper into its post-Merge dip by making an intra-day low at $1,329. While BTC, Ether and altcoins aren’t making any notable moves that defy the current downtrend, from the perspective of market structure and technical analysis, there are a few interesting developments occurr...

‘FED sledgehammer’ will further batter BTC, ETH prices — Bloomberg analyst

The United States Federal Reserve’s inflation “sledgehammer” is about to batter the prices of Bitcoin (BTC) and Ether (ETH) down even further, before reaching back to new all-time highs in 2025, according to Bloomberg analyst Mike McGlone. Ahead of the latest Fed interest rate hike to be announced this week, the market is expecting a minimum of a 75-basis-point increase, however some fear it could be as high as 100 basis points, which would represent the biggest rate hike in 40 years. Speaking with financial news outlet Kitco News on Saturday, McGlone, senior commodity strategist of Bloomberg Intelligence, suggested that further market carnage is on the cards for BTC, ETH and the broader crypto sector as Fed’s actions will continue to dampen investor sentiment: “We have to turn over to the...

The Ethereum Merge to proof-of-stake is complete — What’s next? | Interview with Dr. Julian Hosp

In this week’s episode of Market Talks, we welcome Julian Hosp, CEO and co-founder of Cake DeFi. Julian Hosp is the CEO and co-founder of Cake DeFi, a highly intuitive online platform dedicated to providing access to decentralized financial services. He is widely regarded as a leading influencer in the crypto and blockchain space with over one million followers across all of his channels globally. He is also a best-selling author and his vision is to bring blockchain awareness and understanding to a billion more people by 2025. The Merge has been all over the place recently, with different news outlets, influencers and YouTube channels covering the event as much as possible, but why does the Ethereum Merge actually matter, and why is it such a significant event in crypto? We ask...

Hot CPI report puts a dent in Bitcoin and Ethereum rally, stocks also lose ground

Crypto and stock markets are feeling the pain after the Sept. 13 inflation report printed an unexpectedly hot figure that showed headline inflation rising by 0.1% month-over-month. Even with gas prices falling to multi-month lows and a cooling housing market, core inflation saw a 0.6% month-over-month bump and year-to-year inflation sits at 8.3%. This chart from @TheTerminal shows why this #CPI number is so disappointing. The contribution of energy has declined, as expected; but services inflation is now rising sharply. Not what the #FOMC will have wanted to see. pic.twitter.com/BsfwFsuyD5 — John Authers (@johnauthers) September 13, 2022 While market participants and investors had estimated the next Federal Reserve interest hike to be a hefty 0.75 basis points, many also subscribed to a lo...

Time for a breakout? Bitcoin price pushes at key resistance near $23K

On Sept. 12, Bitcoin is doing Bitcoin things as usual. Since Sept. 9 the price has broken out nicely, booking a near 16% gain and rallying into the long-term descending trendline which appears to have resistance at $23,000. BTC/USDT 1-day chart. Source: TradingView Perhaps BTC and the wider market are turning bullish ahead of the Ethereum Merge which is scheduled for Sept. 14, or maybe the elusive bottom is finally in. Weekly chart data from TradingView shows that on June 27 and Aug. 15, Bitcoin’s relative strength index had dropped to lows not seen since 2019. BTC/USDT 1-day chart. Source: TradingView Currently, the metric has rebounded from a near oversold 31 to its current 38.5 reading. Some traders might also note a bullish divergence on the metric, where the RSI follows an ascen...

3 reasons why Bitcoin traders should be bullish on BTC

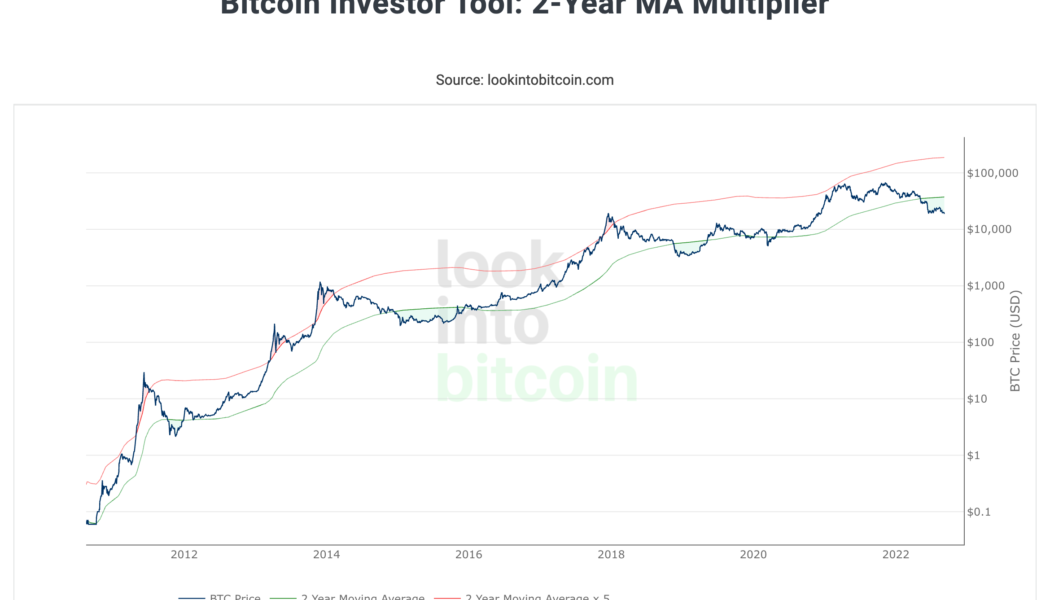

Bitcoin (BTC) has been in a rut, and BTC’s price is likely to stay in its current downtrend. But like I mentioned last week, when nobody is talking about Bitcoin, that’s usually the best time to be buying Bitcoin. In the last week, the price took another tumble, dropping below $19,000 on Sept. 6 and currently, BTC bulls are struggling to flip $19,000–$20,000 back to support. Just this week, Federal Reserve Chairman Jerome Powell reiterated the Fed’s dedication to doing literally whatever it takes to combat inflation “until the job is done,” and market analysts have increased their interest rate hike predictions from 0.50 basis points to 0.75. Basically, interest rate hikes and quantitative tightening are meant to crush consumer demand, which in turn, eventually leads to a decrease in...