Bitcoin Price

Time in the market: Ways to approach crypto investing in 2023

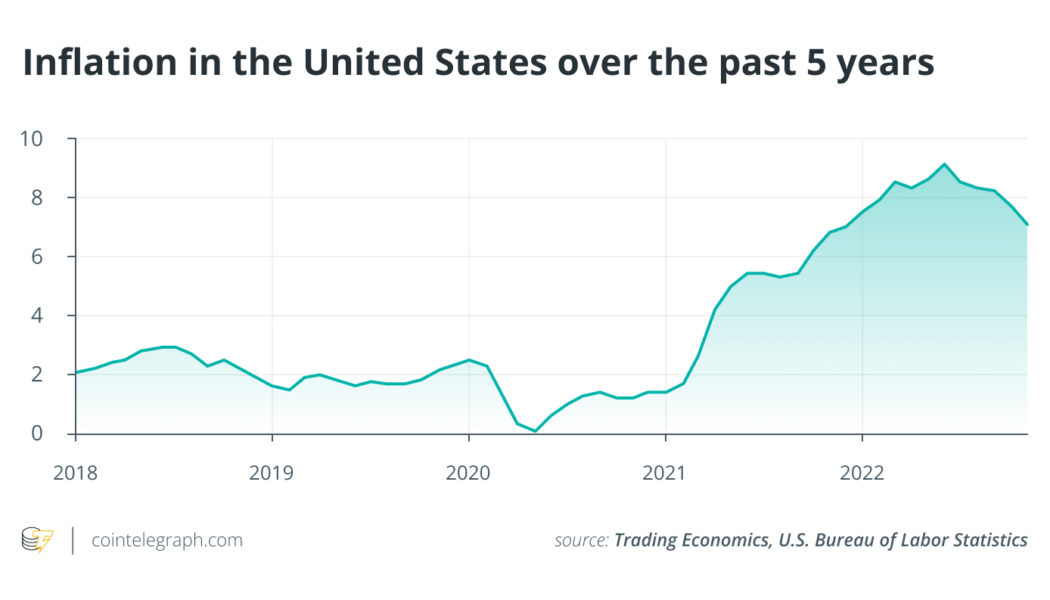

2022 was brutal for cryptocurrency and nonfungible token (NFT) investors. Bitcoin (BTC) hit its yearly low on Nov. 21, almost exactly a year after it reached its all-time high price of $69,044. After such a tumultuous year, how should crypto investors plan for 2023? Firstly, this space has critical risks worth considering before investing. Macroeconomic risks Investors must recognize the macro and systemic risks impacting the crypto industry as 2023 draws near. The war in Ukraine has led to an energy crisis caused by sanctions on Russian energy. The United States Federal Reserve’s monetary policy response to inflation continues to unsettle markets. The crypto contagion from recent bankruptcies continues injecting volatility into the market, with increasing regulatory pressure and miner cap...

Bitcoin miner Core Scientific reportedly filing for Chapter 11 bankruptcy

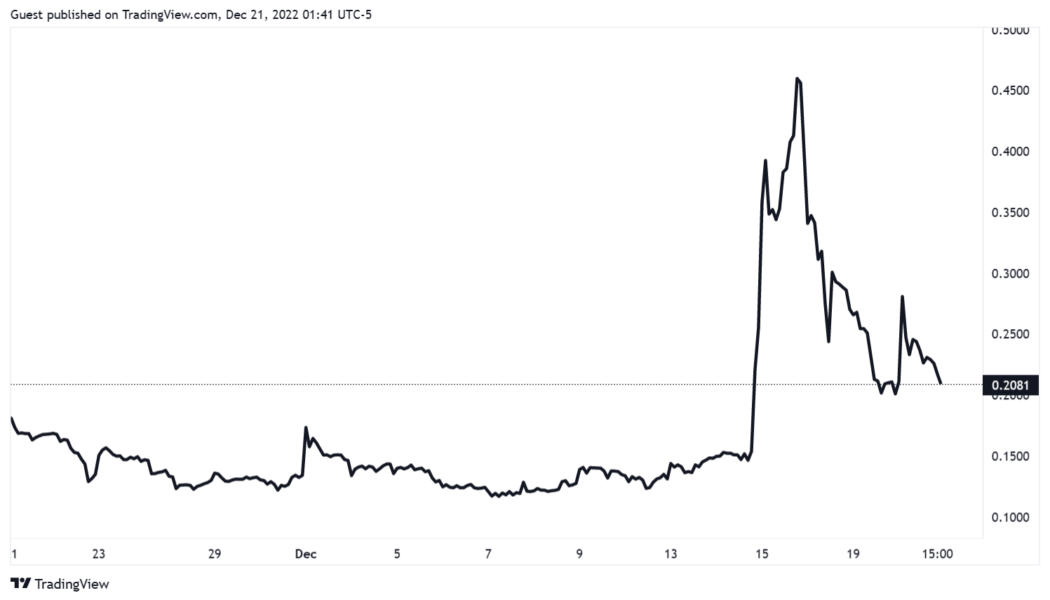

Just days after a creditor offered to help Core Scientific avoid possible bankruptcy, reports have emerged confirming the Bitcoin (BTC) mining company’s fate. Core Scientific is reportedly filing for Chapter 11 bankruptcy protection in Texas owing to falling revenue and low BTC prices. On Dec. 14, financial services platform B. Riley offered to provide Core Scientific with $72 million in non-cash financing — $40 million with zero contingencies and $32 million with conditions — to retain value for stakeholders. The decision was made after Core’s valuation fell from $4.3 billion in July 2021 to $78 million at the time of reporting. As a direct result of an extended bear market, Core Scientific had to sell 9,618 BTC in April to stay operational. A CNBC report quoted a person familiar wit...

Data shows the Bitcoin mining bear market has a ways to go

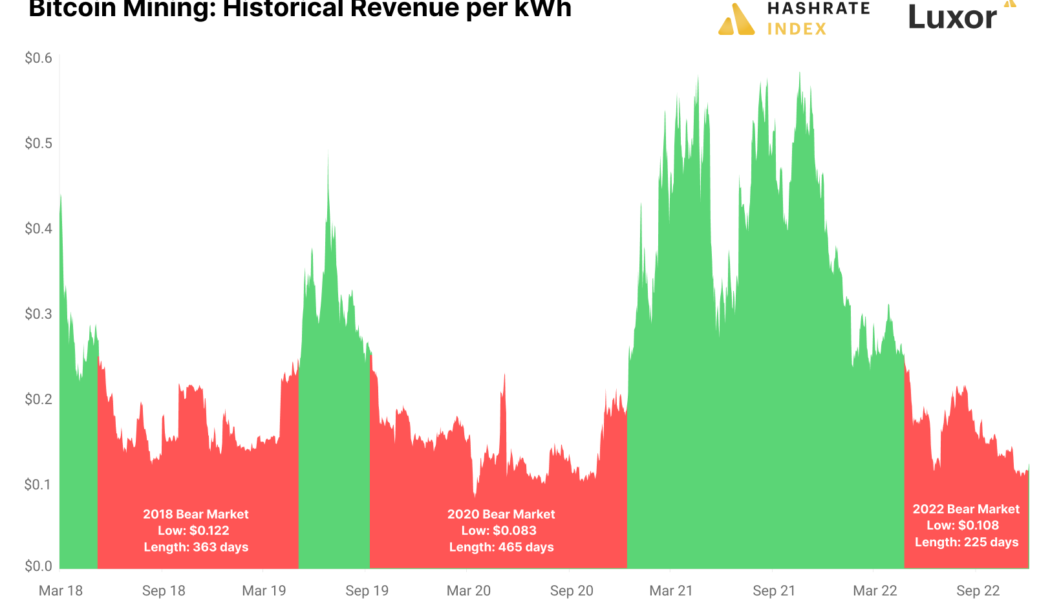

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...

Vitalik Buterin on the crypto blues: Focus on the tech, not the price

Ethereum co-founder Vitalik Buterin has shared some sage advice for traders feeling the blues of the crypto bear market: Focus on the tech rather than the price. The Ethereum co-founder made the recommendation in response to a Dec. 3 post from self-described crypto investor CoinMamba, echoing what many crypto investors are likely feeling at the moment. After 9 years in crypto I’m kinda exhausted. I want to move on and do something different with my life. Tired of all these scammers and fraudsters.. — CoinMamba (@coinmamba) December 3, 2022 “After 9 years in crypto I’m kinda exhausted. I want to move on and do something different with my life. Tired of all these scammers and fraudsters,” CoinMamba said. The crypto industry has continued to be bombarded with unsavoury news since&...

Non-whale Bitcoin investors break new BTC accumulation record

Some non-whale Bitcoin (BTC) investors seem to have had zero issues with the cryptocurrency bear market as well as fear, uncertainty and doubt (FUD) around the fall of FTX, on-chain data suggests. Smaller retail investors have turned increasingly bullish on Bitcoin and started accumulating more BTC despite the ongoing market crisis, according to a report released by the blockchain intelligence platform Glassnode on Nov. 27. According to the data, there are at least two types of retail Bitcoin investors that have been accumulating the record amount of BTC following the collapse of FTX. The first type of investors — classified as shrimps — defines entities or investors that hold less than 1 Bitcoin, $16,500 at the time of writing, while the second type — crabs — are a category of addresses h...

Canada crypto regulation: Bitcoin ETFs, strict licensing and a digital dollar

In October, Toronto-based Coinsquare became the first crypto trading business to get dealer registration from the Investment Industry Regulatory Organization of Canada (IIROC). That means a lot as now Coinsquare investors’ funds enjoy the security of the Canadian Investment Protection Fund in the event of insolvency, while the exchange is required to report its financial standing regularly. This news reminds us about the peculiarities of Canadian regulation of crypto. While the country still holds a rather tight process of licensing the virtual asset providers, it outpaces the neighboring United States in its experiments with crypto exchange-traded funds (ETFs), pension funds’ investments and central bank digital currency (CBDC) efforts. An era of restricted dealers Coinsquare, which...

How bad is the current state of crypto? On-chain analyst explains

Despite the market downturn and the widespread negative sentiment in the industry in the wake of the FTX collapse, on-chain data still show reasons to be bullish on Bitcoin (BTC). As pointed out by on-chain analyst Will Clemente, it’s enough to look at the positions of long-term holders, which reached an all-time high despite their profitability being at an all-time low. “Long-term holders buy heavily into the bear market. They set the floor, […] and then those long-term holders distribute their holdings to new market participants in the bull market,” he told Cointelegraph in an exclusive interview. Another positive trend worth noticing after the FTX collapse, in Clemente’s opinion, is that the average crypto user is increasingly turning away from exchanges and taking self-cust...

Nayib Bukele announces Bitcoin prescription for El Salvador: 1 BTC a day

As the world’s first nation to adopt Bitcoin (BTC) as a legal tender in September 2021, El Salvador is going back to its BTC buying days after a pause for months amid bearish market conditions. El Salvador President Nayib Bukele announced on Nov.16 that the Central American nation will start purchasing BTC on a daily basis starting from Nov.17. The announcement comes nearly three months after the nation made its last BTC purchase in July 2022. We are buying one #Bitcoin every day starting tomorrow. — Nayib Bukele (@nayibbukele) November 17, 2022 El Salvador started buying BTC in September 2021, right after making it a legal tender. At the time, BTC was in the mid of a bull market and every purchase made by the nation looked lucrative as the price was hitting a new all-time high every other...

Why are institutions accumulating crypto in 2022? Fidelity researcher explains

Institutions’ investment in crypto has increased in 2022 despite the bear market, according to a recent survey by Fidelity Digital Assets. In particular, the amount of large investors betting on Ethereum have doubled in the last two years, as revelead by Chris Kuiper, the Head of Research at Fidelity Digital Assets in a recent interview with Cointelegraph. “The percentage of respondents saying they were invested in Ethereum doubled from two years ago”, pointed out Kuiper. Kuiper pointed out that Ethereum’s appeal in the eyes of institutions is likely to increase even more now that after the Merge, Ether has become a more environmentally friendly, yield-bearing asset. In general, according to the same survey, institutional players are accumulating crypto despite the cr...

14 years since the Bitcoin white paper: Why it matters

Happy white paper day, Bitcoin. It’s been 14 years since Satoshi Nakamoto first sent an email to the Cypherpunk mailing list with the subject line, “Bitcoin P2P e-cash Paper.” The email included a link to the white paper, an outline of what would soon become a one trillion-dollar market. The first sentence of the email has become iconic among the Bitcoin community: “I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.” Over the past 14 years, Bitcoin (BTC) has morphed from a hobbyist pastime into a globally recognized brand. Bitcoin has been adopted as legal tender in regions of the global south such as El Salvador and the Central African Republic. It is used by freedom fighters and campaigners while being a tool for financial eman...

Core Scientific reveals financial distress in SEC filing, says its end may be near

Bitcoin miner Core Scientific filed forms with the United States Securities and Exchange Commission (SEC) on Oct. 26 indicating that will not make payments due in late October and early November. The company blamed low Bitcoin prices, increased electricity costs, an increase in the global Bitcoin hash rate and litigation with the bankrupt crypto lender Celsius for the situation. The payments the company will skip would have gone to equipment and other financing and two promissory notes. Its creditors may decide to exercise remedies such as accelerating the debt or suing the company, it noted. Those actions, in turn, could result in “events of default under the Company’s other indebtedness agreements” and more creditor remedies against the company. It adds: “The Company anticipates that exi...

Bitcoin analysts map out the key bull and bear cases for BTC’s price action

Research has detailed Bitcoin’s recent record-low volatility and, while traders expect an eventual price breakout, the Oct. 26 BTC price move to $21,000 is not yet being interpreted as confirmation that $20,000 has now become support. In a recent “The Week On-chain Newsletter,” Glassnode analysts mapped out a bull case and a bear case for BTC. According to the report, the bear case includes limited on-chain transaction activity, stagnant non-zero address growth and reduced miner profits presenting a strong Bitcoin sell-off risk, but data also shows that long-term hodlers are more determined than ever to weather the current bear market. The bull case, on the other hand, entails an increase in whale wallets, outflow from centralized exchanges and hodling by longer-term investors. Stall...