Bitcoin Price

Analysts say 2022 will be ‘defined by agility and cost-efficiency’ instead of ‘blockchain purity’

The entire crypto market took great strides toward mass adoption in 2021 and now that the year is nearly complete, analysts are setting their price targets for 2022. Many analysts supported calls for a $100,000 (BTC) price before the end of 2021 and although this seems unlikely, most investors expect the key price level to be tackled before Q2 of 2022. Here’s a look at some of the Bitcoin price predictions analysts are expecting in 2022. Bitcoin is still on track to surpass $100,000 Analysts has been more reticent in providing off the cuff Bitcoin predictions ever since PlanB’s stock-to-flow model incorrectly predicted a $98,000 BTC price by the end of November, even though the model had been spot on from August through October. While some traders are now questioning the validity of ...

Ether’s growth as independent asset fuels ETH-BTC flippening narrative

The narrative surrounding Ether (ETH) of it fast transforming into an independent asset has been around for some time now. However, the last few months have seen this notion gain an increasing amount of mainstream traction, as is best highlighted by the fact that, since Oct. 1, ETH has showcased substantial northbound movement against Bitcoin (BTC). To put things into perspective, toward the beginning of November, the one-month realized correlation between the BTC/ETH pair dipped as low as 60%, its lowest ever in the currency’s decade-old history. Furthermore, since the start of the year, while Bitcoin registered gains of 105%, Ether went up by a whopping 505%, thus outperforming the flagship crypto by nearly five times. Ether gaining an upper hand is perhaps best reflected in that, ...

Traders delay $100K Bitcoin prediction, but still expect a blow-off top in 2022

Bullish traders that drank the “Bitcoin to $100,000 by year-end” Kool-Aid are now coming to terms with the fact that there may be no Santa Claus rally to wrap up 2021. At the moment, the pipe dream has morphed into simple hopes that the top cryptocurrency can at least finish the year above $50,000. Data from Cointelegraph Markets Pro and TradingView shows that the bounce in price seen in BTC following remarks from Federal Reserve Chair Jerome Powell has pretty much evaporated and over the past 48-hours the price has swept fresh lows at $45,500 and from the look of things, the price could drop even further. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what traders think about Bitcoin’s current price action and what could be in store for the remainder o...

Here’s why Bitcoin traders expect choppy markets for the remainder of 2021

Inflation concerns and a general sense of trepidation about the future of the global economy continue to put a damper on Bitcoin and altcoin prices and currently the Crypto Fear and Greed index is solidly in the ‘fear’ zone where it has been parked since the beginning of December. Crypto Fear & Greed Index. Source: Alternative Despite the brief bump in prices seen across the markets following the recent Federal Open Market Committee (FOMC) meeting where Fed Chair Jerome Powell indicated that interest rates would remain low for the time being, the overall sentiment in the crypto market continues to wane, signaling that 2021 could end on a bearish note. BTC price could dampen due to macro concerns In a recent report from Delphi Digital, analysts noted that the price of Bitcoin (BTC...

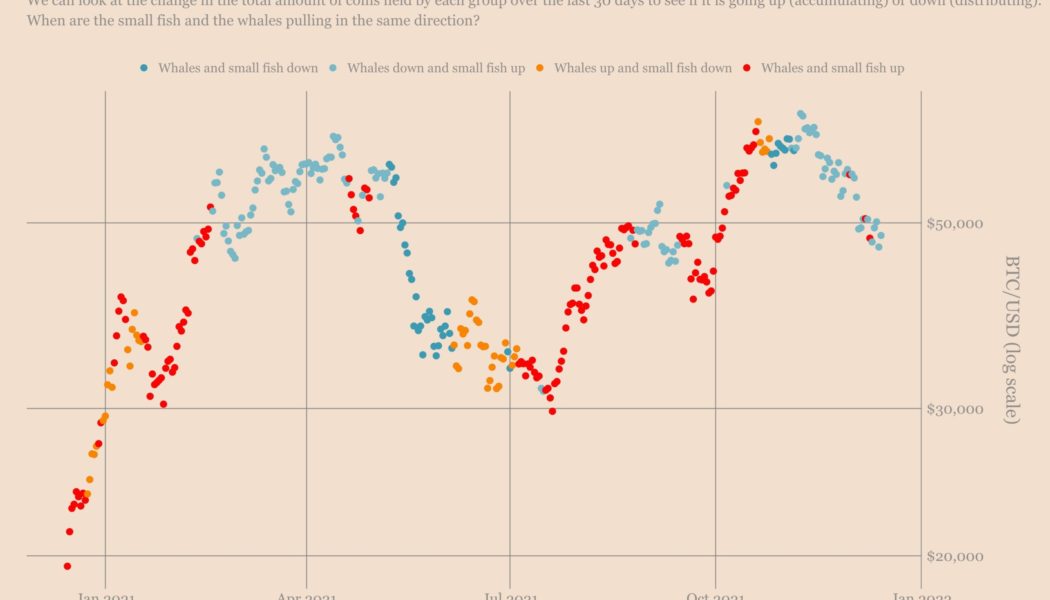

Fish food? Data shows retail investors are buying Bitcoin, whales are selling

Bitcoin (BTC) staged an impressive recovery after dropping to its three-month low of $42,333 on Dec. 4, rising to as high as $51,000 since. The BTC price retracement primarily surfaced due to increased buying activity among addresses that hold less than 1 BTC. In contrast, the Bitcoin wallets with balances between 1,000 BTC and 10,000 BTC did little in supporting the upside move, data collected by Ecoinometrics showed. “Bitcoin is still stuck in a situation where small addresses are willing to stack sats [the smallest unit account of Bitcoin], while the whale addresses aren’t really accumulating,” the crypto-focused newsletter noted after assessing the change in Bitcoin amounts across small and rich wallet groups, as shown in the graph below. Bitcoin on-chain ...

Bitcoin pushes for $50K! Is the downtrend finally over? | Tune in now to The Market Report w/ Sam Bourgi

Join Cointelegraph host and analyst Benton Yaun alongside resident market experts Jordan Finneseth and Marcel Pechman as they break down the latest news in the markets this week. Here’s what to expect in this week’s markets news breakdown: the price of Bitcoin (BTC) climbed to $49,000 after news that the Federal Reserve would raise interest rates and curtail its bond-buying program. Why did this announcement have an impact on Bitcoin? Top executives from six major crypto companies faced the United States House of Representatives’ Financial Services Committee during a special hearing on digital assets on Dec. 8. With the largely positive response from Washington, has crypto finally turned a corner to be ready for business with the government? Once again, a tweet from Tesla C...

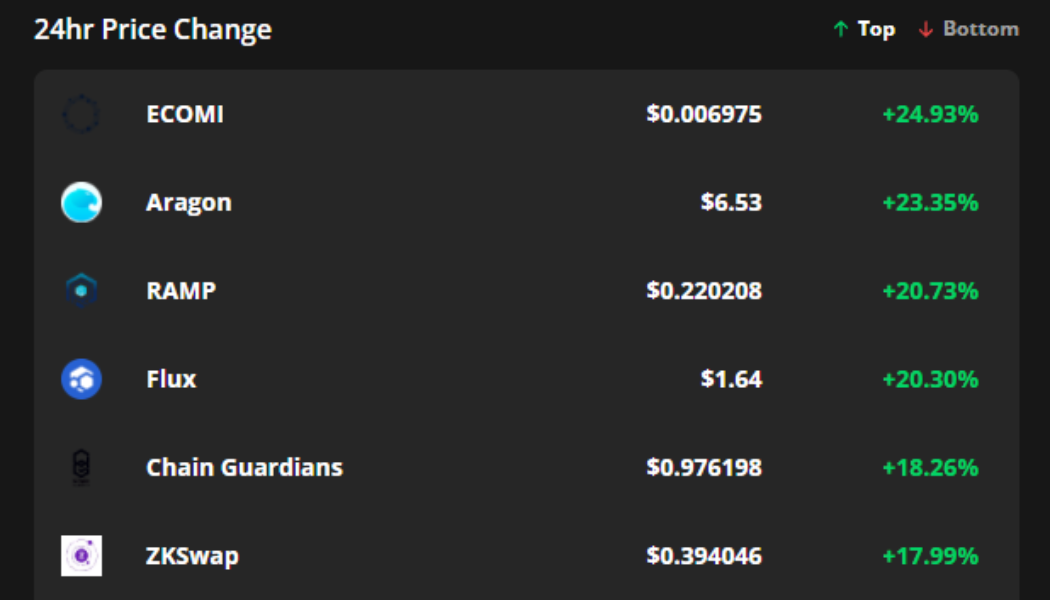

ECOMI, Aragon and Ramp breakout after Bitcoin price pushes above $49K

Cryptocurrency prices and investor sentiment reversed course on Dec. 15 after Federal Reserve chairman Jerome Powell confirmed the bank’s plan to hike interest rates in 2022 and slow down the bond purchasing program that had been in play since the emergence of the coronavirus in March 2020. Following the announcement, Bitcoin (BTC) price tacked on a 1.65% gain, bringing the price above $49,000 and Ether trekked back above the $4,000 mark. Altcoins followed suit with their usual double-digit gains and for the moment, it appears as if bulls have taken back control of the market. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were ECOMI (OM...

Look out below! Analysts eye $40K Bitcoin price after today’s dip to $45.7K

On Monday, Bitcoin’s short-term outlook worsened after the price fell to an intra-day low at $45,672, a far cry from the weekend’s promising rally above the $50,000 level. With the year nearly complete, and all-time highs nearly 33% away, traders are most likely readjusting their expectations and pushing the $100,000 BTC target a bit further into 2022. Daily cryptocurrency market performance. Source: Coin360 Day traders, 4-hour chart watchers and over-leveraged longs are likely freaking out (unless they went short from $50,000 over the weekend or at this morning’s weakness), but let’s zoom out a little bit to see where Bitcoin price stands. BTC/USDT daily chart. Source: TradingView On the daily timeframe, we can see the price struggling to breakout away from the trend of daily lower ...

Bitcoin price slips below $47K as stocks, crypto prepare for this week’s FOMC meeting

Bitcoin (BTC) bulls are once again on the defensive foot after the breakout momentum that put the price above $50,000 on the weekend evaporated and pulled the price under $47,000. Analysts say the slight pullback in equities markets and the upcoming Federal Open Market Committee (FOMC) meeting are the primary reasons for Dec. 13’s pullback and a few suggest that a revisit to the swing low at $42,000 could be on the cards. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what analysts are saying about the current Bitcoin price action and what they expect in the short term. Fed tapering talks put pressure on the market The current headwinds facing BTC are in large part being influenced by regulatory matters in the United States, as highlighted in a recent report from D...

Point of no return? Crypto investment products could be key to mass adoption

The first Bitcoin (BTC) futures exchange-traded fund (ETF) was launched in the United States back on October 19, 2021. Since then, a number of other cryptocurrency investment products have been launched in various markets. That first ETF, the ProShares Bitcoin Strategy ETF, quicklybecame one of the top ETFs of all time by trading volume on its debut, and soon after, several other Bitcoin futures ETFs were launched in the United States, providing investors with different investment options. To Martha Reyes, head of research at cryptocurrency trading platform Bequant, these options are important. Speaking to Cointelegraph, Reyes pointed out that in traditional finance, ETFs have “proved to be incredibly popular in recent years, with ETF assets expected to reach $14 trillion by 2024.” Reyes s...

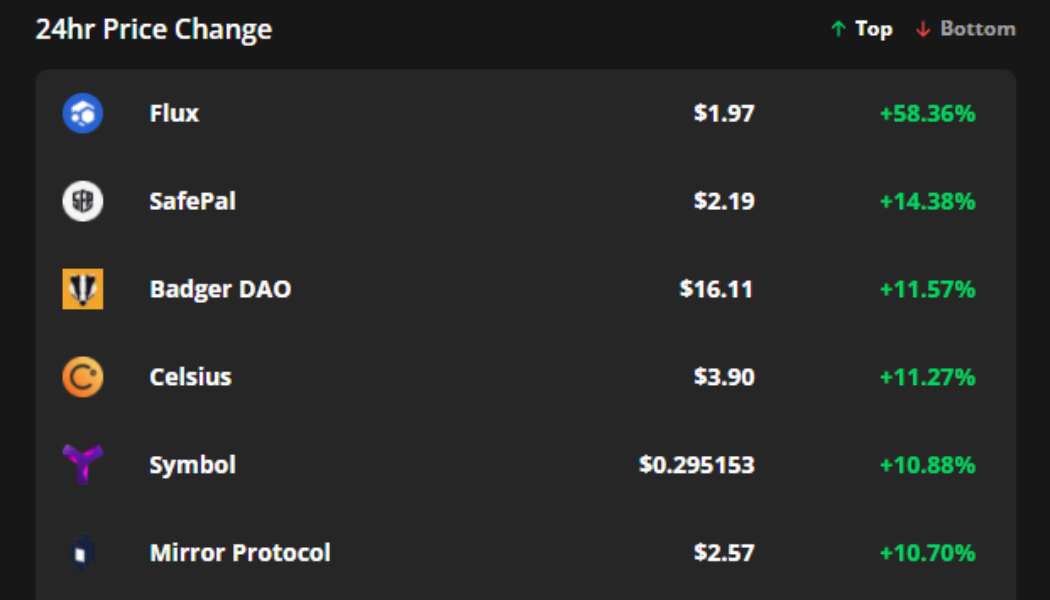

FLUX, SFP and Badger DAO surge even as Bitcoin price falls to $47K

The year-long mantra that the crypto market would see a blow-off top in December has proven to be a dud thus far and for the last week, most cryptocurrencies have been under sell pressure and Bitcoin (BTC) is encountering difficulty in trading above $47,000. That said, it’s not all bad news for cryptocurrency holders on Dec. 10 because several altcoins have managed to post double-digit gains due to new exchange listings and protocol upgrades. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Flux (FLUX), SafePal (SFP) and Badger DAO (BADGER). FLUX benefits from the “Binance bump” Flux is a GPU mineable proof-of-work p...