Bitcoin Price

These 3 cryptocurrencies are taking an even bigger hit during Bitcoin’s price slump

The cost to purchase one Bitcoin (BTC) has dropped almost 10% in the last seven days and has been eyeing extended declines as it drops below $40,000, its interim psychological support, on Jan. 10. BTC/USD weekly price chart. Source: TradingView Nonetheless, the losses suffered by Bitcoin still appear less than that of some of its top crypto rivals’ performances. For instance, Cardano (ADA), the seventh-largest cryptocurrency by market valuation, has dropped by nearly 11% to around $1.15 in the last seven days. Similarly, Ripple (XRP), the eighth-largest by market capitalization, has dipped by around 10% to nearly $0.75 in the same period. Meanwhile, some cryptocurrencies listed among the top 50 digital assets have experienced bigger losses between 15% and 30% in the last week. They i...

Billionaire investor Bill Miller puts 50% of net worth in Bitcoin

Investor Bill Miller is bullish on Bitcoin (BTC) despite the cryptocurrency touching multi-month lows below $40,000 in early January 2022. Miller no longer considers himself just a “Bitcoin observer” but rather a real Bitcoin bull, as he said in a WealthTrack interview last Friday. The billionaire investor now holds 50% of his net worth in Bitcoin and related investments in major industry firms like Michael Saylor’s MicroStrategy and BTC mining firm Stronghold Digital Mining. An early Amazon investor, Miller owns almost 100% of the rest of his portfolio in Amazon, he noted. Miller bought his first Bitcoin back in 2014 when BTC was trading around $200 and then purchased a “little bit more overtime” when it became $500. The investor did not buy it for years until BTC plummeted to $30,000 aft...

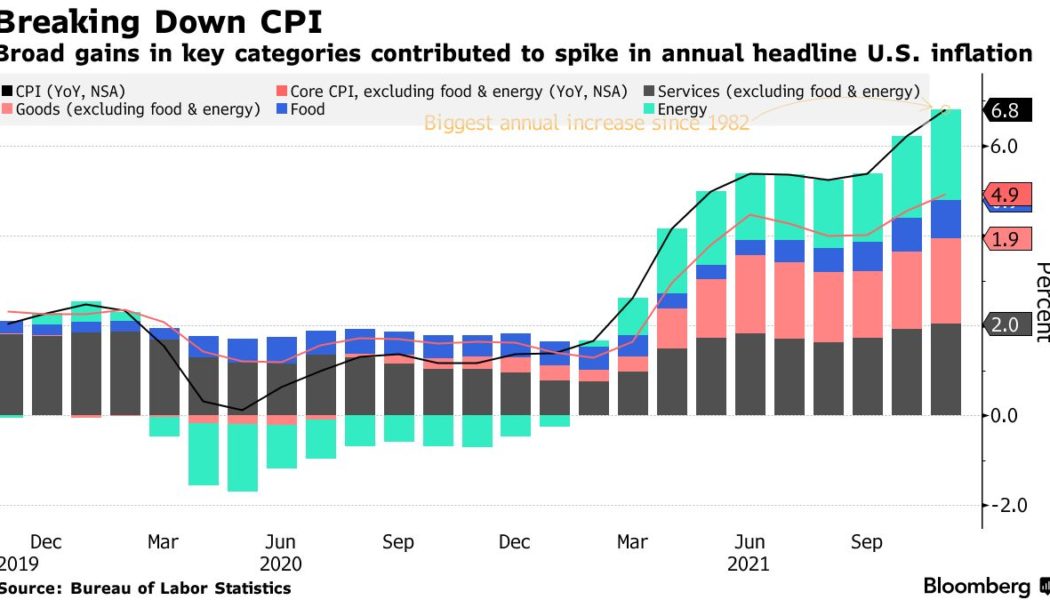

Bitcoin crash ahead? Expert warns higher inflation could whip BTC price to $30K

Bitcoin (BTC) may end up falling to as low as $30,000 if the U.S. inflation data to be released on Wednesday comes any higher than forecasted, warns Alex Krüger, founder of Aike Capital, a New York-based asset management firm. The market expects the widely-followed consumer price index (CPI) to rise 7.1% for the year through December and 0.4% month-over-month. This surge highlights why the U.S. Federal Reserve officials have been rooting for a faster normalization of their monetary policy than anticipated earlier. U.S. headline inflation. Source: Bureau of Labor Statistics, Bloomberg Further supporting their preparation is a normalizing labor market, including a rise in income and falling unemployment claims, according to data released on Jan. 7. “Crypto assets are at the furthest en...

Will this time be different? Bitcoin eyes drop to $35K as BTC price paints ‘death cross’

Bitcoin (BTC) formed a trading pattern on Jan. 8 that is widely watched by traditional chartists for its ability to anticipate further losses. In detail, the cryptocurrency’s 50-day exponential moving average (50-day EMA) fell below its 200-day exponential moving average (200-day EMA), forming a so-called “death cross.” The pattern appeared as Bitcoin underwent a rough ride in the previous two months, falling over 40% from its record high of $69,000. BTC/USD daily price chart. Source: TradingView Death cross history Previous death crosses were insignificant to Bitcoin over the past two years. For instance, a 50-200-day EMA bearish crossover in March 2020 appeared after the BTC price had fallen from nearly $9,000 to below $4,000, turning out to be lagging than predictive. ...

Bitcoin leverage ratio reaches new highs

The estimated leverage ratio for Bitcoin (BTC) hit a new all-time high last night according to CryptoQuant. Further metrics point to growing leveraged interest, but liquidations have remained relatively low. According to on-chain analytics resource CryptoQuant, while the Bitcoin price fell off a cliff over the past 24 hours, the estimated leverage ratio reached 0.224, an all-time high. The metric works by dividing exchanges’ open interest by their coin reserve. The result shows how much leverage traders are using on average. A higher ratio, such as 0.22, indicates that more investors are taking high leverage risks. Conversely, lower values mean traders are increasingly risk-averse in their derivative trading. The blue line on the graph below, it’s trended upwards since June 201...

Raoul Pal says ‘reasonable chance’ crypto market cap could 100X by 2030

Former Goldman Sachs hedge fund manager and Real Vision CEO Raoul Pal thinks that the crypto market cap could increase 100X by the end of this decade. At the time of writing, the total market cap of the global crypto sector stands at $2.2 trillion, and Pal told podcast Bankless Brasil “there’s a reasonable chance” this figure could grow to around $250 trillion if the crypto network adoption models continue on their current trajectory. Pal drew comparisons between the current benchmarks of other markets and asset classes such as equities, bonds and real estate, noting that they all have a market cap between “$250-$350 trillion.” “If I look at the total derivatives market, it’s $1 quadrillion. I think there’s a reasonable chance of this being a $250 trillion asset class, which is 100X from h...

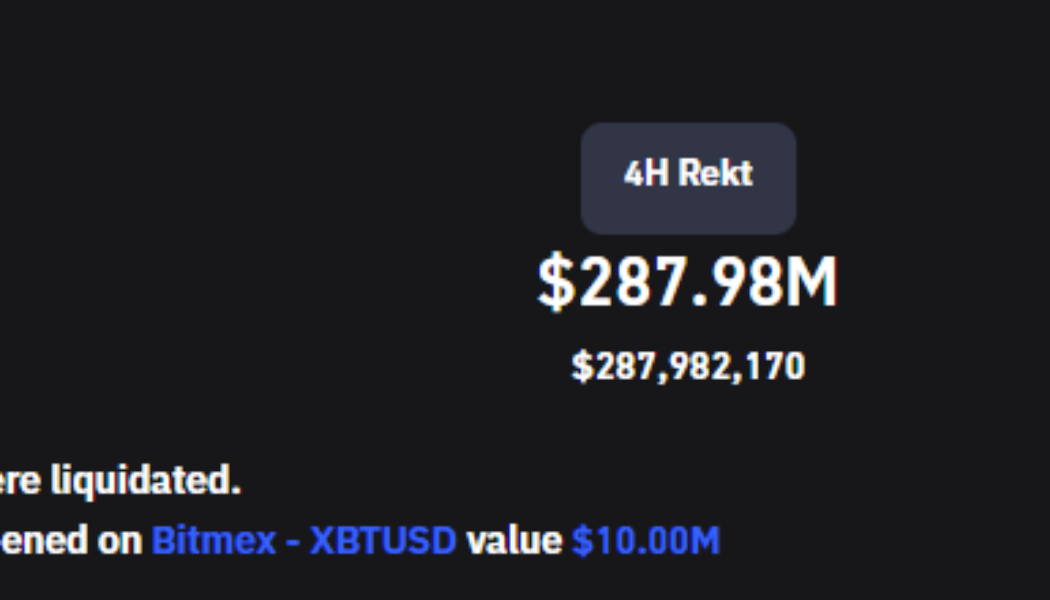

Bitcoin price drops to $43.7K after Fed minutes re-confirm plans to hike rates

Bitcoin (BTC) and the wider cryptocurrency market fell under as equities markets pulled back at the closing bell after minutes from the Federal Reserve’s December FOMC meeting showed that the regulator is committed to decreasing its balance sheet and increasing interest rates in 2022. As stock markets corrected, BTC price followed suit by dropping below $44,000, setting off a cascade of liquidations that reached $222 million in less than an hour. Total liquidations. Source: Coinglass Data from Cointelegraph Markets Pro and TradingView shows that after oscillating around support at $46,000 for the past couple of days, Bitcoin was hit with a wave of selling that pulled the price to an intraday low of $43,717. BTC/USDT 4-hour chart. Source: TradingView Based on the current situati...

Nexo co-founder targets Bitcoin at $100K by mid-2022

Another promising price prediction has appeared for Bitcoin bulls in 2022. Antoni Trenchev, co-founder and managing partner of Nexo, said that Bitcoin (BTC) could hit the $100,000 milestone as soon as the summer in an interview with CNBC. Despite BTC opening the year with bearish price action, while the Fear & Greed Index shows “extreme fear,” the Bulgarian business mogul set the record straight: “Every time that investors and the broader community write off Bitcoin, it outperforms significantly. This has been the case in 2020 when it rallied close to 1,000% and in 2021 where it rallied 63%. I’m quite bullish on Bitcoin.” As one of the world’s largest lending institutions in the digital finance industry, Nexo is privy to insights from serving 2.5 million users across 200...

Institutional tax-loss harvesting weighs on the Bitcoin price as 2021 comes to a close

2021 has been a breakout year for the cryptocurrency market as a whole despite the year-end struggles that have kept the price of Bitcoin (BTC) pinned below $48,000, much to the chagrin of the cadre of folks who had been calling for a $100,000 BTC moonshot. Data from Cointelegraph Markets Pro and TradingView shows that the past 24 hours have been a rollercoaster ride for the top cryptocurrency after a brief dip below $46,000 in the early trading hours on Dec. 30 was quickly bought up to push the BTC price back above $47,500 by midday. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the year-end price action for Bitcoin and what to expect in 2022 as the mass adoption of blockchain technology and cryptocurrencies continue...

Bitcoin ‘died’ 45 times in 2021 as media still eager to post BTC obituaries

As Bitcoin (BTC) was hitting new historical highs above $68,000 this year, global cryptocurrency naysayers were increasingly blasting BTC for its extreme volatility and potential risks. According to Bitcoin Obituaries data by Bitcoin education portal 99Bitcoins, the original cryptocurrency was declared “dead” as many as 45 times in 2021, which is at least three times more than in 2020. Despite the growing number of Bitcoin critics in 2021, the number of obituaries is still significantly less this year than was recorded in 2017, the year when BTC first reached close to $20,000. That year, Bitcoin “died” 124 times. Incepted in 2010, 99Bitcoins’ Bitcoin Obituaries list has English-language statements, including content about the fact that Bitcoin “is or will be worthless.” To qualify an obitu...

Analysts warn that possible downside wick could push BTC price as low as $44K

It looks as though the year-end rally that many crypto traders had hoped for will have to wait until 2022, as Bitcoin (BTC) bears gained the upper hand on Dec. 28 and hammered the price of BTC below support at $48,000. Data from Cointelegraph Markets Pro and TradingView shows that an early morning wave of selling broke through BTC support at $50,000 and was followed by a second wave in the early afternoon that dropped the top cryptocurrency to a daily low of $47,318 before bulls managed to stem the outflow. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what several market analysts are saying about the reasons behind this latest correction and what to look out for as 2021 comes to a close. A bearish RSI divergence prior to the reversal Insight into the technical reasons ...

Bitcoin rises above $51K as the dollar flexes muscles against the euro

Bitcoin (BTC) regained its bullish strength after reclaiming $50,000 last week and continued to hold the psychological level as support on Dec. 27. Meanwhile, its rival for the top safe-haven spot, the U.S. dollar, also bounced off a critical price floor, hinting that it would continue rallying through into 2022. Triangle breakout The U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, has been trending towards the apex of a “symmetrical triangle” pattern on its daily chart. In doing so, the index has been treating the structure’s lower trendline as its solid support level, thus hinting that its next breakout would resolve to the upside. DXY daily price chart featuring symmetrical triangle setup. Source: Tradi...