Bitcoin Price

Willy Woo: ‘Peak fear’ but on-chain metrics say it’s not a bear market

Bitcoin analyst and co-founder of software firm Hypersheet Willy Woo believes that on-chain metrics show that BTC is not in a bear market despite observing “peak fear” levels. Speaking on the What Bitcoin Did podcast hosted by Peter McCormack on Jan. 30, Woo cited key metrics such as a strong number of long term holders (wallets holding for five months or longer) and growing rates of accumulation suggest that the market has not flipped the switch to bear territory: “Structurally on-chain, it’s not a bear market setup. Even though I would say we’re at peak fear. No doubt about it, people are really scared, which is typically […] an opportunity to buy.” I guess BTC is in demand lately pic.twitter.com/5h1IeMT2lK — Willy Woo (@woonomic) January 29, 2022 In the short term, Woo noted that ...

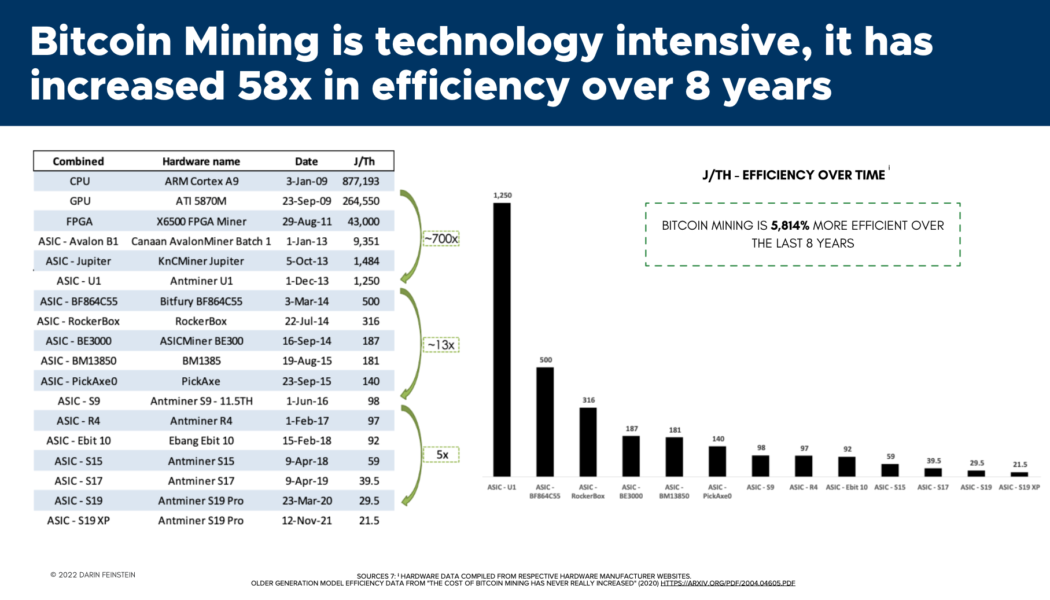

Bitcoin miners believe global hash rate to grow ‘aggressively’

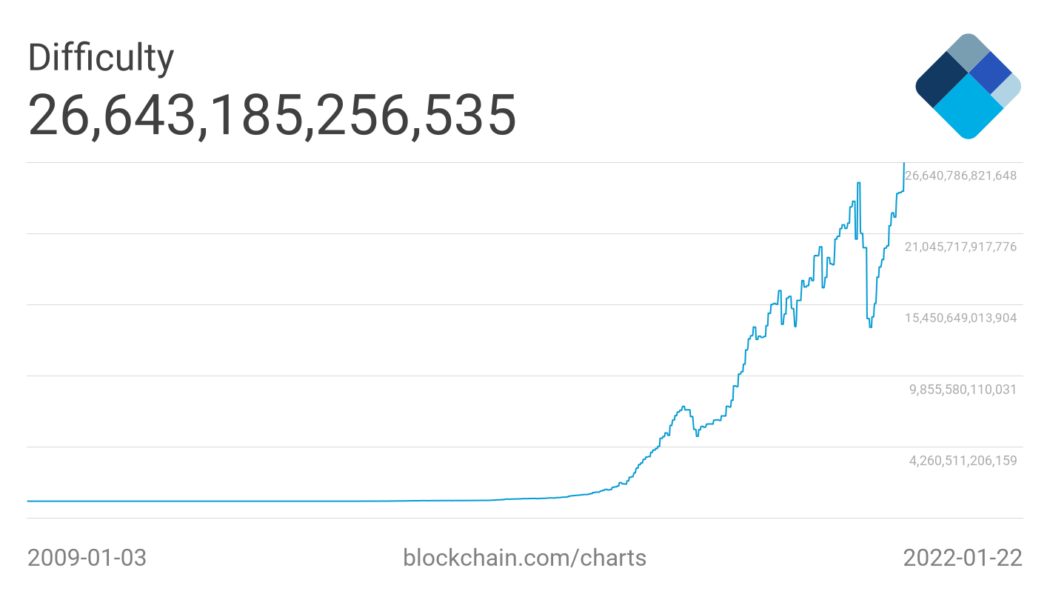

Bitcoin (BTC) seems to be on everyone’s mind lately as the world recently witnessed the price of BTC take a rather unexpected bearish turn this month. On January 21, 2022, Bitcoin reached six-month lows, sinking below $40,000 for the first time in months. While some panicked, other industry experts pointed out that the Bitcoin network has become verifiably stronger than ever before. The growth of the Bitcoin network has become apparent, as hash rate figures for BTC continue to set new highs this month. For example, on Jan. 22, the BTC network recorded an all-time high of 26.643 trillion with an average hash rate of 190.71 exahash per second (EH/s). The hash rate will continue to grow, which is a good thing Samir Tabar, chief strategy officer at Bit Digital — a publicly listed Bitcoin...

McDonald’s jumps on Bitcoin memewagon, Crypto Twitter responds

Prominent crypto entrepreneurs and supporters, who shared memes on Twitter about doing odd jobs amid an ongoing market crash, were joined by global fast-food giant McDonalds — the brand infamously linked with temporary Bitcoin (BTC) market crashes. BTC’s price has seen a steady downfall ever since breaching an all-time high of $69,000 back in November 2022. Eventually, as Bitcoin started trading below the $40,000 mark, crypto millionaires and investors on Twitter started sharing memes about getting jobs at fast-food restaurants. Source: Twitter/PlanB Salvadoran President Nayib Bukele, too, embraced the meme culture and uploaded a new profile picture that shows him at one of his speeches sporting a badly photoshopped McDonald’s branded cap and T-shirt. #NewProfilePic pic.twitter....

Analysts say Bitcoin’s bounce at $36K means ‘it’s time to start thinking about a bottom’

Bears remain in full control of the cryptocurrency market on Jan. 24 and to the shock of many, they managed to pound the price of Bitcoin (BTC) to a multi-month low at $32,967 during early trading hours. This downside move filled a CME futures gap that was left over from July 2021. Data from Cointelegraph Markets Pro and TradingView shows that the $36,000 level was overwhelmed in the early trading hours on Monday, leading to a sell-off that dipped below $33,000 before dip buyers arrived to bid the price back above $35,500. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the macro factors at play in the global financial markets and what to be on the lookout for in the months ahead. “Rate hikes don’t kill risk assets” F...

Bitcoin records all-time high network difficulty amid price fluctuations

The Bitcoin (BTC) network has recorded a new all-time high mining difficulty of 26.643 trillion with an average hash rate of 190.71 exahash per second (EH/s) — signaling strong community support despite an ongoing bear market. The Bitcoin network difficulty is determined by the overall computational power, which co-relates to the difficulty in confirming transactions and mining BTC. As evidenced by the blockchain.com data, the network difficulty saw a downfall between May and July 2021 due to various reasons including a blanket ban on crypto mining from China. BTC network difficulty. Source: Blockchain.com. As the displaced miners resumed operations from other countries, however, the network difficulty saw a drastic recovery since August 2021. As a result, on Saturday, the BTC network reco...

Bitcoin falls to $36K, traders say bulls need a ‘Hail Mary’ to avoid a bear market

Bitcoin (BTC) price continues to sell-off and the knock-on effect is an even sharper correction in altcoins and DeFi tokens. At the time of writing, BTC price has sank to its lowest level in 6 months and most analysts are not optimistic about an immediate turn around. Data from Cointelegraph Markets Pro and TradingView shows that a wave of selling that began late in the day on Jan. 20 continued into midday on Friday when BTC hit a low of $36,600. BTC/USDT 1-day chart. Source: TradingView Here’s a check-in with what analysts have to say about the current downturn and what may be in store for the coming weeks. Traders expect consolidation between $38,000 and $43,000 The sudden price drop in BTC has many crypto traders predicting various dire outcomes along the lines of an ext...

Analysts warn that Bitcoin could dip to $38K ‘before an eventual breakout’

The cryptocurrency market faced another day of weakness on Jan. 18 as the price of Bitcoin (BTC) dropped lower and additional pressure was also put on the altcoin market. Currently, the crypto Fear and Greed Index registered “Extreme Fear” among investors and some traders caution that BTC price could soon fall below its recent $39,000 swing low. Crypto Fear & Greed index. Source: Alternative Data from Cointelegraph Markets Pro and TradingView shows that bulls lost control of the $42,000 support level during the early trading hours on Jan. 18 as bears hammered the BTC price to a daily low of $41,250. BTC/USDT 1-day chart. Source: TradingView January is historically weak for Bitcoin Many crypto holders who were disappointed by the lack of a blow-off top to close out 2021 are ...

El Salvador’s Bitcoin wallet onboards 4M users with Netki partnership

El Salvador, the first country to make Bitcoin (BTC) a legal tender, has onboarded 4 million users for its government-backed BTC wallet Chivo in partnership with digital identity provider Netki, according to an announcement. Netki has announced that Chivo wallet onboarded over 4 million new users in 45 days using the company’s flagship Know Your Customer (KYC)/Anti-Money Laundering (AML) product, OnboardID. The platform also claimed that it had facilitated the compliant onboarding of 70% of the country’s previously unbanked population. El Salvador passed the Bitcoin bill in June of last year and officially made Bitcoin a legal tender in September. Nayib Bukele, the president of the small Central American nation, made it clear that the goal was to offer digital banking facilities...

Bitcoin cycle is far from over and miners are in it for the long haul: Fidelity report

Fidelity Digital Assets — the crypto wing of Fidelity Investments which has $4.2 trillion assets under management–shared their “two sats” on the future of the digital assets space. The key takeaways touched upon miners’ behavior and Bitcoin (BTC) network adoption. In the annual report released last week, the group shared some insights into the world of BTC mining: “As Bitcoin miners have the most financial incentive tho make the best guess as to the adoption and value of BTC (…) the current bitcoin cycle is far from over and these miners are making investments for the long haul.” The report stated that the recovery in the hash rate in 2021 “was truly astounding”, particularly when faced the world’s second-largest economy China banning Bitcoin in 2021. The rebound in hash rate s...

Institutional investment will boost Bitcoin to $75,000, says SEBA CEO

The CEO of Switzerland-based financial institution SEBA Bank shared his predictions for Bitcoin (BTC) in 2022. A boon for BTC bulls, Guido Buehler was optimistic about institutional adoption and a price increase to $75,000 per coin. He explained in an interview that at SEBA, asset pools are looking for the right time to invest; however, they need the right counterparties and the necessary regulation in order to deploy capital. When pressed on whether Bitcoin would hit new highs this year, Buehler thinks it’s possible, “The question is always time.” He noted that with BTC dominance bottoming out at 40%, it’s a pivotal moment for investors looking for a directional play. The interview took place at the Crypto Finance Conference in St. Moritz, Switzerland, where “sophistic...

Was $39,650 the bottom? Bitcoin bulls and bears debate the future of BTC price

Bitcoin (BTC) price made a quick pop above $43,100 in the U.S. trading session but uncertainty is still the dominant sentiment among traders on Jan. 11 and bulls and bears are split on whether this week’s drop to $39,650 was BTC’s bottom. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has traded tightly around the $42,000 level as the global financial markets digested U.S. Federal Reserve Chair Jerome Powell’s statements on the upcoming fiscal policy changes. BTC/USDT 1-day chart. Source: TradingView Powell indicated that the central bank is prepared to “raise interest rates more over time” if inflation continues to persist at high levels, but analysts were quick to note further comments, suggesting that a low...

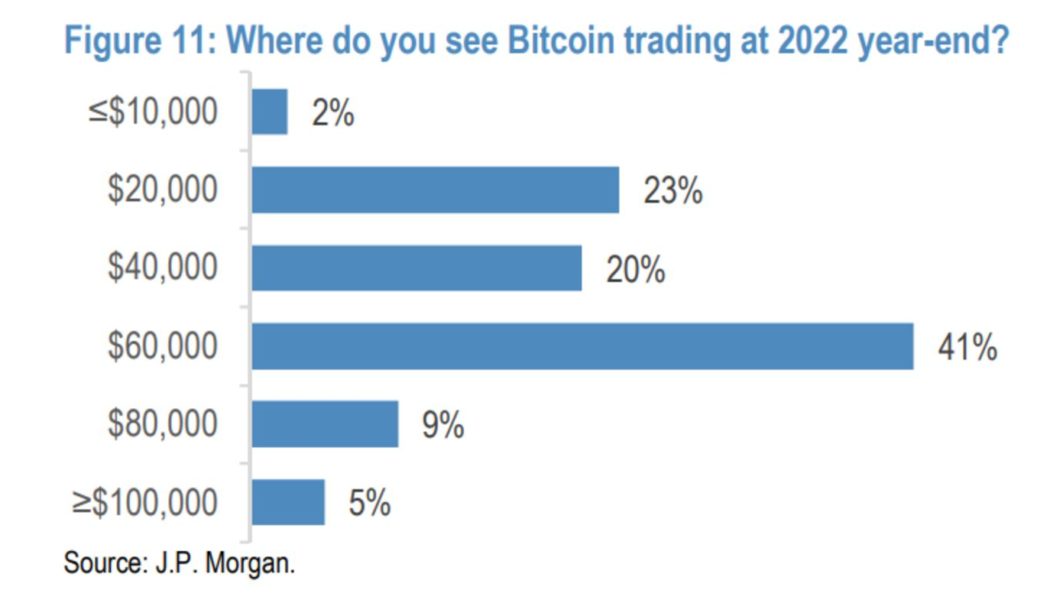

Wall Street still not convinced on Bitcoin $100K this year: JPMorgan survey

One of the world’s largest investment banks has its Bitcoin (BTC) price predictions ready for 2022. In a recent poll, JPMorgan Chase asked its clients, “Where do you see Bitcoin trading at 2022 year-end?” Just 5% said they saw the digital coin reaching $100,000, and 9% saw it breaking previous all-time highs, reaching over $80,000. The bank is known for its wealthy client portfolio. While some BTC bulls may welcome the news that 14% of JPMorgan’s clients expect at least a twofold increase, it’s not the fireworks the crypto market is accustomed to. On balance, however, the survey is generally positive. Most clients (55%) see BTC trading at $60,000 or above at the end of the year, with only one quarter expecting prices to slide from the recent lows of $40,000. “I’m not surprised by Bit...