Bitcoin Price

Mining worldwide: Where should crypto miners go in a changing landscape?

One of the main themes among the crypto community in 2021 was China’s aggressive policy toward mining, which led to a complete ban on such activities in September. While mining as a type of financial activity has not gone away and is unlikely to disappear, Chinese cryptocurrency miners had to look for a new place to set up shop. Many of them moved to the United States — the world’s new mining mecca — while some left to Scandinavia and others to nearby Kazakhstan, with its cheap electricity. Mining activities can’t stay under the radar forever, and governments around the world have begun to raise concerns over electricity capacity and power outages. Erik Thedéen, vice-chair of the European Securities and Markets Authority — who also serves as director general of the Swedish Fina...

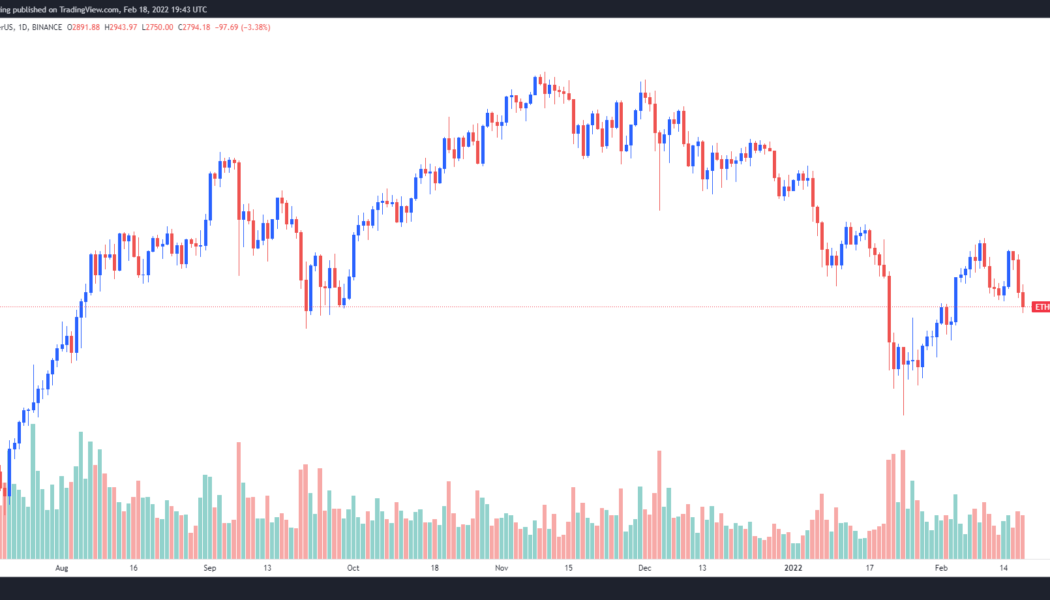

Analyst say Ethereum price could fall to $1,700 if the current climate prevails

Bitcoin (BTC) and Ether (ETH) price are still being hard hit by the current wave of volatility and this is leading traders to go back to the drawing board and readjust their short-term expectations. On Feb.17, Bitcoin price briefly dipped below $40,000 and Ether failed to hold support at $2,900, raises the chance of a drop to $2,500. Data from Cointelegraph Markets Pro and TradingView shows that after hovering near the $2,900 support level through the morning trading hours, Ether was hit with a wave of selling that dropped it to an intraday low of $2,752. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about the price drop for Ether and whether or not more downside is expected as global tensions continue to rise. Ethereum’s nex...

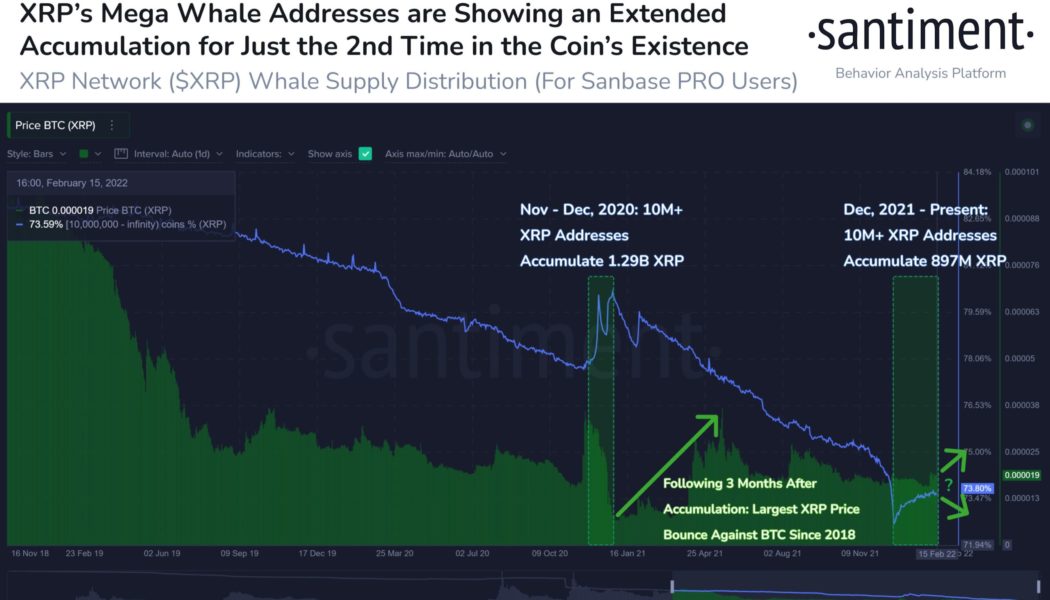

XRP ‘mega whales’ scoop up over $700M in second-biggest accumulation spree in history

XRP addresses that hold at least 10 million native units have returned to accumulating more in the past three months, a similar scenario that preceded a big rally for the XRP/USD and XRP/BTC pairs in late 2020. The return of XRP ‘mega whales’ A 76% spike in XRP “mega whale” addresses since December 2021 has been noted by analytics firm Santiment showing that they added a total of 897 million tokens, worth over $712 million today, to their reserves. The platform further highlighted that the XRP accumulation witnessed in the last three months was the second-largest in the coin’s existence. The first massive accumulation took place in November-December 2020 that saw whales depositing a total of 1.29 billion XRP to their addresses. XRP supply into ...

U.S. inflation breaks 40-year record: Can Bitcoin serve as a hedge asset?

On Feb. 9, the United States Bureau of Labor Statistics reported that the Consumer Price Index, a key measure capturing the change in how much Americans pay for goods and services, has increased by 7.5% compared to the same time last year, marking the greatest year-on-year rise since 1982. In 2019, before the global COVID-19 pandemic broke out, the indicator stood at 1.8%. Such a sharp rise in inflation makes more and more people consider the old question: Could Bitcoin, the world’s largest cryptocurrency, become a hedge asset for high-inflation times? What’s up with the inflation spike? Ironically, the fundamental reason behind the unprecedented inflation spike is the U.S. economy’s strong health. Immediately after the COVID-19 crisis, when 22 million jobs were slashed and national econom...

Bitcoin price is ‘likely starting the next push up’ if $42K holds as support

The cryptocurrency market remains in a state of flux as investors are once again focused on what steps the U.S. Federal Reserve might take to combat rising inflation and markets wobble as the situation in Ukraine remains tense. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) has hovered around the $44,000 support level and traders are hopeful that an inverse head and shoulders chart pattern will lead to a sustained bullish breakout. BTC/USDT 1-day chart. Source: TradingView Here’s a survey of what several analysts in the market are keeping an eye on moving forward as global issues from inflation to war continue to make their presence felt in the cryptocurrency market. On-Balance Volume shows a bullish reversal Insight into what may lie ahead for Bi...

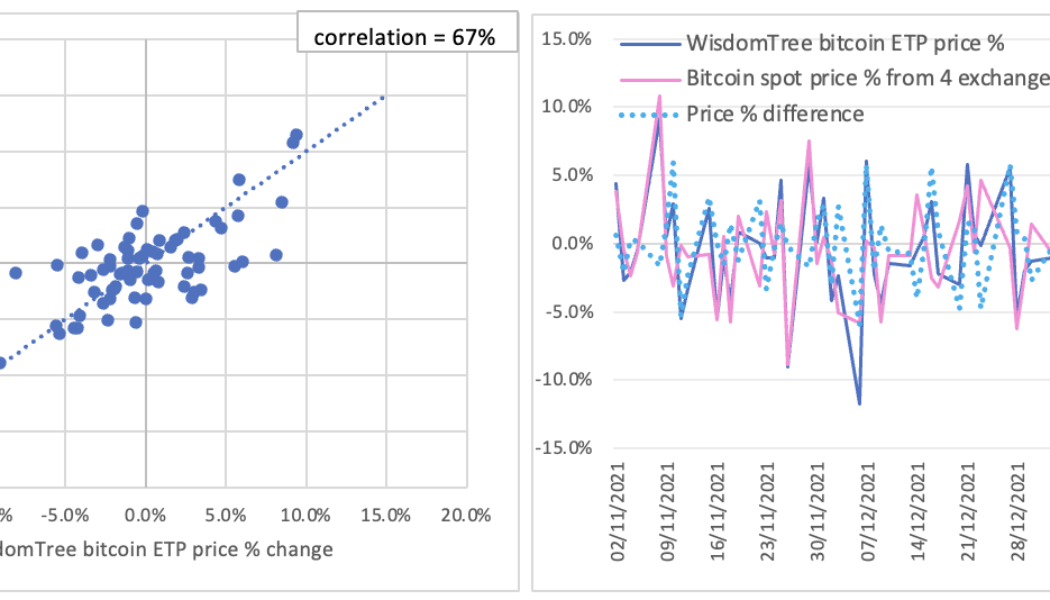

Here’s why the SEC keeps rejecting spot Bitcoin ETF applications

It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed. The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”. Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in ...

Bitcoin price consolidates in critical ‘make or break’ zone as bulls defend $42K

The waiting game continues for crypto traders after Bitcoin (BTC) is once again pinned below resistance at $43,000 and awaiting some spark in momentum that can sustain a rally back to the $50,000 range. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has traded in a range between $41,500 and $43,000 over the past couple of days and with tensions between Ukraine and Russia escalating, many traders are less than optimistic about Bitcoin’s short-term prospects. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about their short-term expectations for Bitcoin price. Is Bitcoin on a path to zero? Well-known cryptocurrency perma-bear Peter Schiff made sure to chime in on the latest struggles for Bitcoin by post...

Investors underestimate Bitcoin’s “huge upside potential”, Fidelity researcher says

Chris Kuiper, Head of Research at Fidelity Digital Assets, is convinced that Bitcoin (BTC) should be treated separately from other digital assets and believes it plays an exclusive role in investors’ portfolios. Fidelity Digital Assets’ latest report, titled Bitcoin First, targets two main concerns that Fidelity’s clients have raised towards BTC — eventually being replaced by some other cryptocurrencies and lower upside potential left compared to other coins. According to Kuiper, BTC offers a unique value proposition as the most decentralized and censorship-resistant monetary network. That, according to him, is a non-incremental sort of innovation similar to the invention of the wheel. “You can’t reinvent something that’s already been invented in terms of the m...

Analysts say Bitcoin price is in the ‘profit-taking’ zone with a ceiling at $45K

The price action for Bitcoin (BTC) continues to tantalize investors and once again, concerns over the state of the global economy and rising inflation have prompted warnings that the Fed’s upcoming interest rate hikes could do more damage then good to the state of the market. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has hovered near the $43,000 support level in trading on Feb. 11 after rallying 20% from the $37,000 leve over the past week. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts expect next for BTC and the wider cryptocurrency market. “Expecting a move to $40,000” Insight into the bullish and bearish scenarios related to Bitcoin price was offered by crypto trader and pseudonymous Twitter analyst ‘Crypto_Ed_NL’, w...

Analysts say Bitcoin price is in the ‘profit-taking’ zone with a ceiling at $45K

The price action for Bitcoin (BTC) continues to tantalize investors and once again, concerns over the state of the global economy and rising inflation have prompted warnings that the Fed’s upcoming interest rate hikes could do more damage then good to the state of the market. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has hovered near the $43,000 support level in trading on Feb. 11 after rallying 20% from the $37,000 leve over the past week. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts expect next for BTC and the wider cryptocurrency market. “Expecting a move to $40,000” Insight into the bullish and bearish scenarios related to Bitcoin price was offered by crypto trader and pseudonymous Twitter analyst ‘Crypto_Ed_NL’, w...

Bitcoin bulls look to push price above $45K to validate bullish trend reversal

The mood across the cryptocurrency ecosystem has shifted to cautious optimism on Feb. 7, as Bitcoin (BTC) bulls managed to bid its price back above support at $44,000 with the help of several positive developments, including the announcement that “Big Four” auditor KPMG has added BTC and Ether (ETH) to its corporate treasury. Data from Cointelegraph Markets Pro and TradingView shows that, after hovering around $42,500 during the early morning on Feb. 7, a midday wave of buying lifted the BTC price to a high of $44,500 as short traders scrambled to close their positions. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about Feb. 7’s move from Bitcoin and what could possibly come next as traders look to capitalize on the sudden spike in price...

Bitcoin price dips below $37K as a descending channel pattern comes back into play

The crypto market is once again in the red on Feb. 2 as global financial markets continue to see increased volatility. Data from Cointelegraph Markets Pro and TradingView shows that after spending the morning hovering around $38,200, BTC was hit with a wave of selling that pushed the price to $36,800. BTC/USDT 1-day chart. Source: TradingView Here is what several analysts and traders are saying about Wednesday’s Bitcoin price action and what areas to keep an eye on moving forward. Bulls are in trouble below $36,700 Insight into the major support and resistance zones of note for Bitcoin was provided by crypto trader and pseudonymous Twitter user ‘HornHairs’, who posted the following chart indicating a solid level of support near $37,400. BTC/USDT 1-hour chart. Source: Twitter Ac...