Bitcoin Price

Bitcoin rallied, but analysts say it’s ‘more of the same’ until $46K becomes support

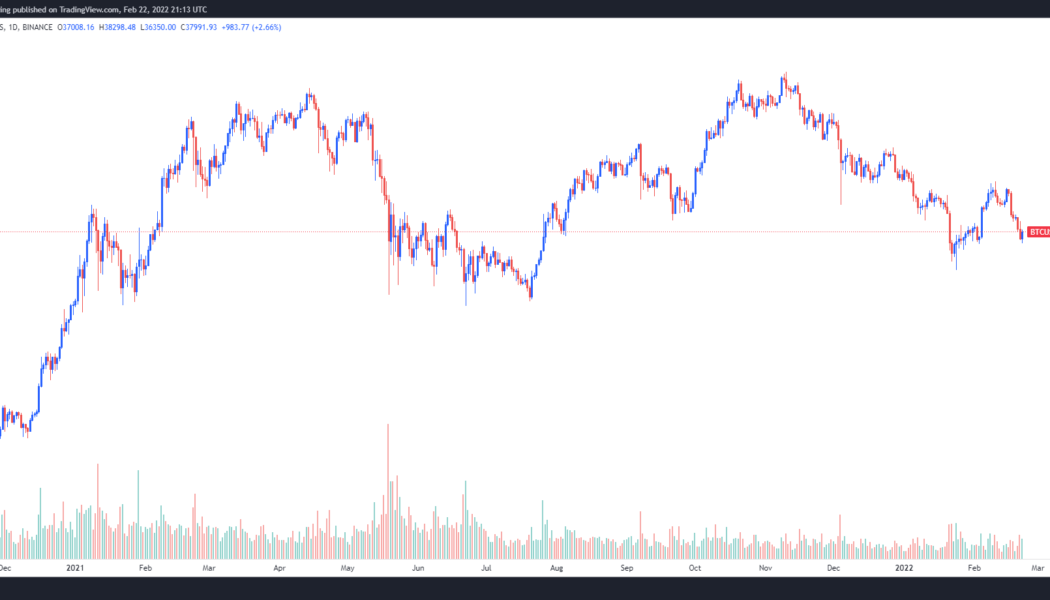

“Volatility” is the word of the month and that is exactly what cryptocurrency investors saw today as Bitcoin rallied after concerns over the Biden administration’s executive order on crypto turned out to be a ‘nothingburger’. Data from Cointelegraph Markets Pro and TradingView shows that after trading near the $39,000 mark for the past few days, the price of Bitcoin (BTC) spiked 10.42% to an intraday high at $42,606 on as cautious traders flooded back into the market. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what traders and analysts in the market are saying about this latest move and the areas of support and resistance to keep an eye on. “Different pump, same story” Wednesday’s move for Bitcoin was just a repeat of recent be...

Crypto mining’s cost: How has hardware availability changed the industry?

Cryptocurrency mining has been and remains an attractive endeavor not only for fans of alternative financial instruments but also for those serious about investing. When deciding whether to start mining, potential miners keep several well-known factors in mind: equipment and electricity costs, suitable climate and favorable legislation in the country of operation. At least, that was the case until recently. In 2022, the situation changed and became more complicated. A few years ago, it was possible to mine cryptocurrencies by purchasing a graphics processing unit (GPU), reading a guide on how to construct a rig and simply mining coins. Such income was attractive for many online entrepreneurs, and soon new miners flooded the global market. Yet over time, the complexity of mining has i...

Crypto funds register largest weekly inflows since December

Inflows into cryptocurrency investment funds rose sharply last week, offering cautious optimism that investors are broadening their exposure to digital assets despite geopolitical uncertainty and monetary tightening from central banks. Digital asset investment products registered $127 million worth of cumulative inflows for the week ending March 6, according to CoinShares data. A CoinShares representative told Cointelegraph that this was the highest weekly inflows since Dec. 12, 2021. The increase was also significantly higher than the $36 million of inflows registered the previous week. Like in previous weeks, Bitcoin (BTC) products recorded the largest weekly inflows at $95 million. Bitcoin fund flows have increased for seven consecutive weeks. Ether (ETH) funds saw inflows totaling $25 ...

Bitcoin slides under $39K, leading some traders to forecast a weekend ‘oversold bounce’

March 4 saw another day of seesaw price action for Bitcoin (BTC) and the wider cryptocurrency market as the global economic fallout from the ongoing conflict in Ukraine weighs heavily on a majority of the world’s financial markets. Data from Cointelegraph Markets Pro and TradingView shows that after holding $41,000 in the early trading hours on March 4, a wave of selling in the afternoon dropped the price of BTC below $39,100. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts have to say about the outlook for BTC moving forward as the world faces a period of increased economic uncertainty. A potential retest of $38,000 BTC/USD 1-week chart. Source: Twitter According to Rekt Capital, $43,100 is an important level for BTC because the last time Bitcoin clo...

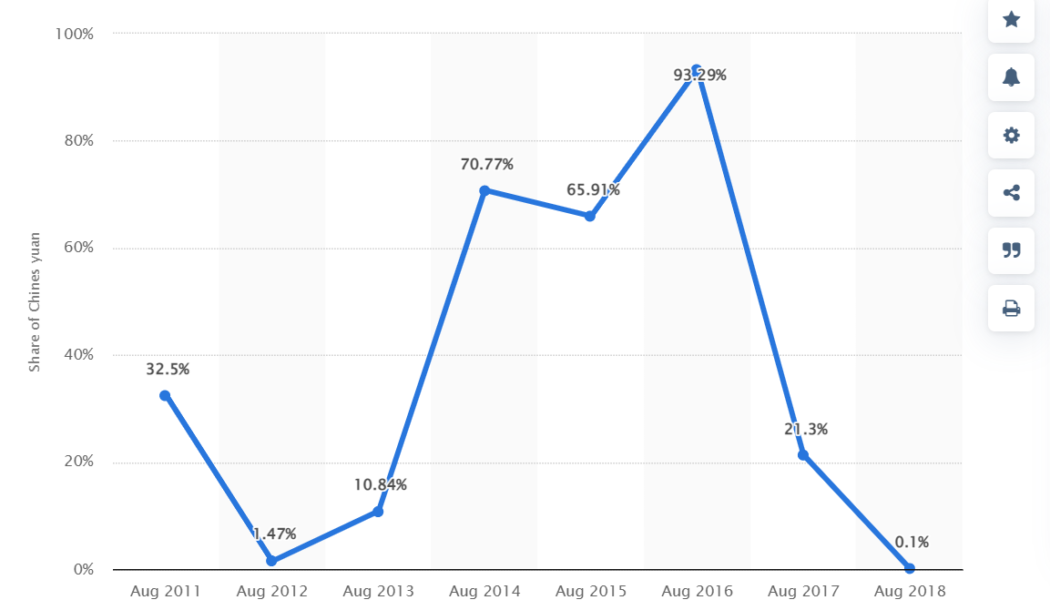

China’s share in Bitcoin transactions declined 80% post crackdown: PBoC

People’s Bank of China, the central bank of the country, claimed in a recent note that China’s share in the global Bitcoin (BTC) transactions has rapidly dropped from over 90% to 10%. The Financial Stability Bureau of the Chinese central bank released a comprehensive note on Wednesday discussing the impact of the crypto crackdown on the financial markets. The official notice claimed that all peer-to-peer exchanges in the country had been eradicated, which eventually curbed the hype around digital currency transactions. A Google translated version of the note read: “The global proportion of Bitcoin transactions in China dropped rapidly from more than 90% to 10%. Severely cracked down on illegal financial activities such as disorderly handling of finance and crackdown on illegal fund-r...

Analysts say bulls will aim for $48K now that Bitcoin’s ‘accumulation phase’ has begun

Investor sentiment across the cryptocurrency ecosystem has seen a significant shift in the positive direction over the past week, despite events in the wider world. Currently, Bitcoin (BTC) is back above $43,500 and many altcoins are also witnessing double-digit gains. Crypto Fear & Greed index. Source: Alternative The ongoing conflict in Ukraine and recent actions taken by governments to limit access to banking services may have helped to shine a light on the value of holding cryptocurrencies, which offers some protection against uncontrollable events and what some might perceive as government overreach. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has oscillated between $43,350 and $45,400 on March 2 as the world awaits some form of resolution to th...

Bitcoin price spike to $39K leads traders to say ‘the panic is over for a few days’

Global financial markets and crypto markets were pummeled over the past 24-hours as the invasion of Ukraine by Russian forces sent investors scrambling and sell-offs took place across most asset classes. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) hit a low of $34,333 in the early trading hours on Feb. 24, shortly after the Ukraine incursion began, and has since climbed its way back to $38,500 after an unexpected short-squeeze may have rapped bearish investors on the knuckles. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about BTC price and how the ongoing conflict could impact crypto markets in the short-term. BTC in a “great buy area” Bitcoin’s collapse on the night of Feb. 23 was not unexp...

FTX CEO weighs in on Bitcoin market outlook amid Ukraine crisis

The world woke up to a “sea of red” that was not necessarily limited to the financial markets, as Russia declared war on Ukraine early Thursday. The traditional financial markets along with the crypto markets have been sliding bearishly for the past week and saw a rapid decline early on Thursday. Apart from crude oil prices, which jumped to an eight-year high above $100, the majority of stocks has lost over 5%. The Russian invasion on Thursday triggered the bears leading to a $500-billion crypto market sell-off, where the majority of the cryptocurrencies lost critical support to trade at a three-month low. The crypto market capitalization saw a 10% decline during early morning Asian trading hours, falling below the $1.5-trillion mark. Bitcoin (BTC) is considered an inflation hedge, and man...

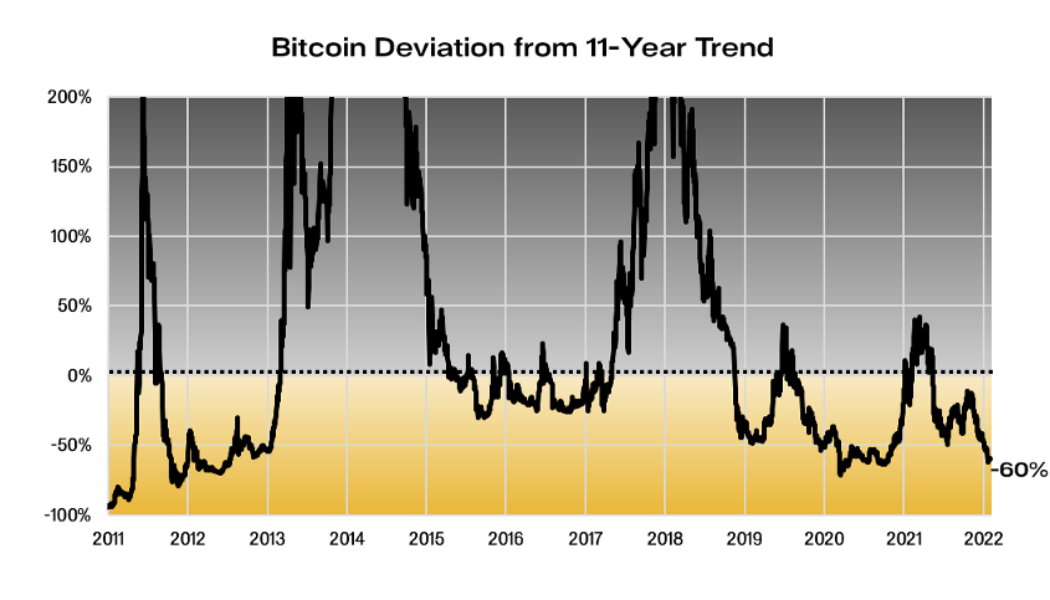

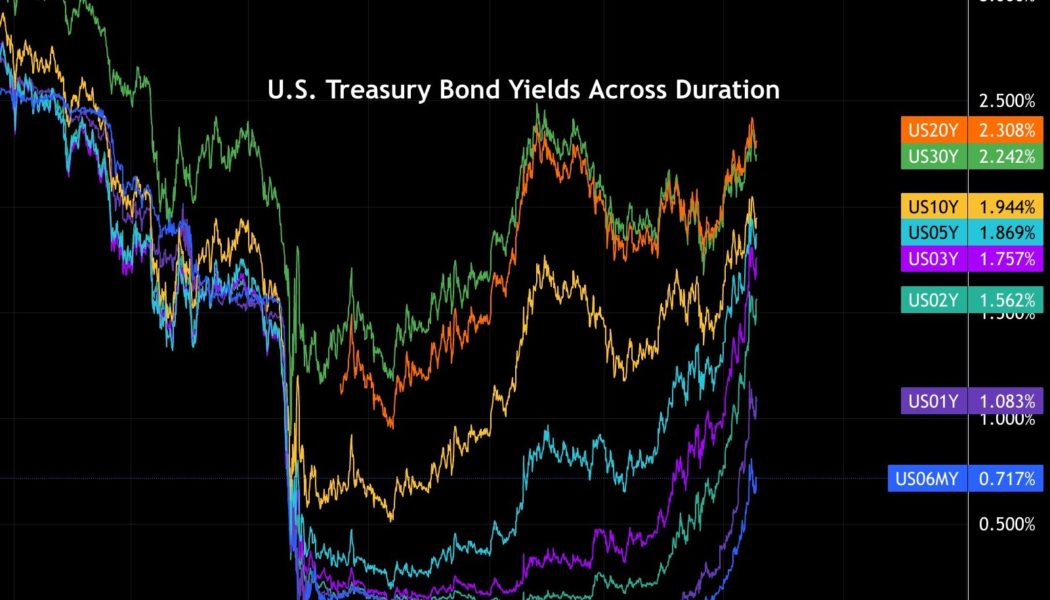

Hedge fund report says Bitcoin price is ‘at a relatively inexpensive place’

There has been a lot of focus on the performance of the stock and cryptocurrency markets over the past year or two as the trillions of dollars that have been printed into existence since the start of the COVID pandemic have driven new all-time highs, but analysts are now increasingly sounding the alarm over warning signs coming from the debt market. Despite holding interest rates at record low levels, the cracks in the system have become more prominent as yields for U.S. Treasury Bonds “have been rising dramatically” according to markets analyst Dylan LeClair, who posted the following chart showing the rise. U.S. Treasury bond yields across duration. Source: Twitter LeClair said, “Since November yields have been rising dramatically — bond investors begun to realize that w/ inflation ...

Few calls to ‘Buy The Dip’… but uber-rich Family Offices are keen on crypto

Short term social media data suggests that traders aren’t calling for buying the Bitcoin (BTC) dip right now… but the long term picture is much brighter, with separate research showing that 77% of family offices in the U.S. are either looking at, or have invested in crypto. The BTFD data was compiled from posts mentioning “buy the dip” on social media platforms such as Twitter, Reddit, Discord and Telegram by K J Lanaul and published on the Insights Santiment blog earlier this week. It tells a positive story too, in a roundabout way. The research indicated that many traders over the past year have called for buying the dip too early on a downward trend, with the price often falling significantly further afterward and failing to recover for months at a time. “Often the crowd una...

Bitcoin price could ‘probe lower’ as volumes dip and macroeconomic issues loom overhead

Bitcoin’s sell-off appears to be taking a pause even though the United States rolled out new sanctions against Russia on Feb 22. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) continues to hover slightly below $38,000, which some analysts have identified as a significant support and resistance zone. BTC/USDT 1-day chart. Source: TradingView Here’s a closer look at what analysts are saying about Bitcoin price and what levels to keep an eye on in the short-term. 25% of entities are underwater On-chain data outlet, Glassnode, posted the following chart analyzing the percentage of entities in profit and the analysts concluded “that the proportion of on-chain entities in profit is oscillating between 65.78% and 76.7% of the network.” Percent...

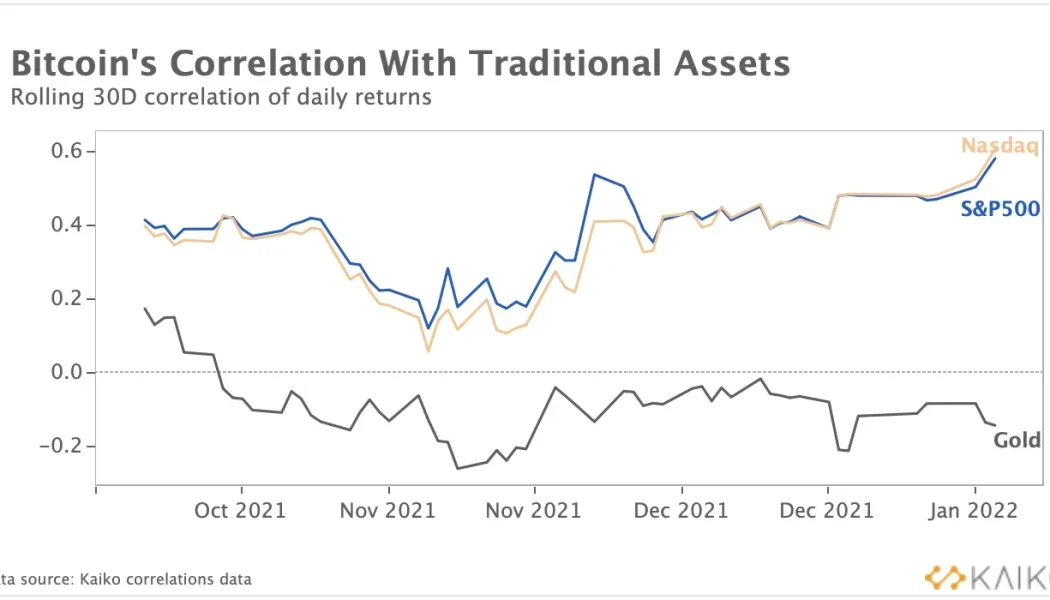

Can Bitcoin break out vs. tech stocks again? Nasdaq decoupling paints $100K target

A potential decoupling scenario between Bitcoin (BTC) and the Nasdaq Composite can push BTC price to reach $100,000 within 24 months, according to Tuur Demeester, founder of Adamant Capital. Bitcoin outperforms tech stocks Demeester depicted Bitcoin’s growing market valuation against the tech-heavy U.S. stock market index, highlighting its ability to break out every time after a period of strong consolidation. “It may do so again within the coming 24 months,” he wrote, citing the attached chart below. BTC/USD vs. Nasdaq Composite weekly price chart. Source: Tuur Demeester, StockCharts.com BTC’s price has grown from a mere $0.06 to as high as $69,000 more than a decade after its introduction to the market, as per data tracked by the BraveNewCoin Liquid Index fo...