Bitcoin Price

‘People should invest in all of the major layer-1s,’ says a veteran trader

Scott Melker, veteran trader and pocaster, is convinced that major layer-1 protocols should be part of everyone’s investment portfolio. Instead of picking individual crypto projects, such as NFTs or blockchain games, Melker thinks it makes more sense to bet on the blockchain infrastructure on which these projects are built. “Any of these small projects could absolutely go nuts. But you’re going to have trouble choosing what they are. You should just own the layer-1 and the infrastructure that they’re all built on,” he said in an exclusive interview with Cointelegraph. “You may not own a Bored Ape, but Ethereum holders have certainly benefited from the success of Bored Apes!” he pointed out. Talking about his portfolio construction, Melker revealed that about 6...

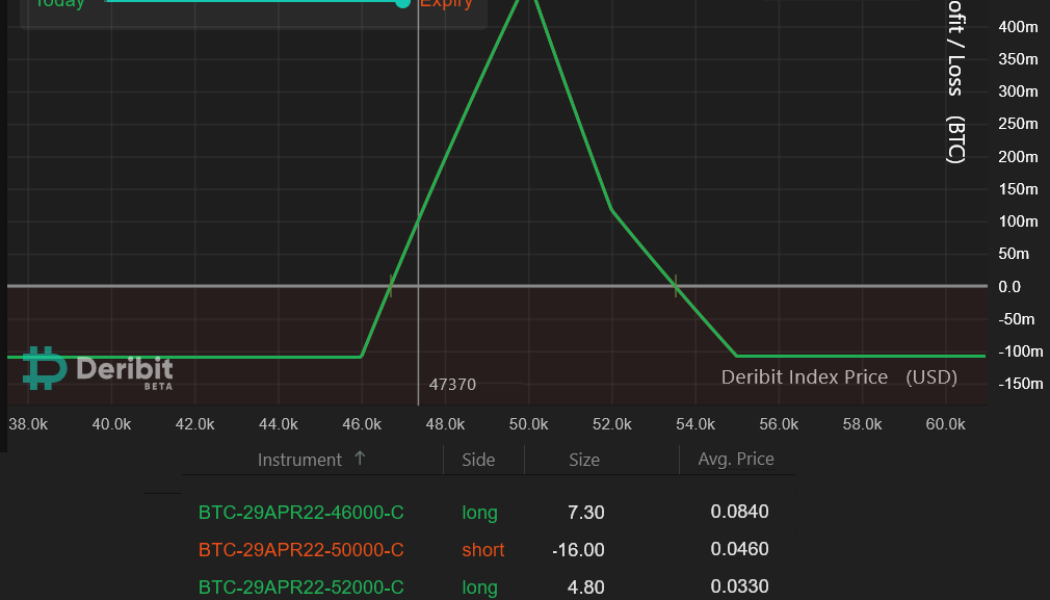

Here’s how pro traders use Bitcoin options to profit even during a sideways market

Bitcoin (BTC) price swings might be impossible to predict, but there is a strategy frequently used by pro traders that yields high returns with minimal cost. Typically, retail traders rely on leveraged futures positions which are highly susceptible to forced liquidations. However, trading Bitcoin options provide excellent opportunities for investors aiming to maximize gains while limiting their losses. Using multiple call (buy) options can create a strategy capable of returns six times higher than the potential loss. Moreover, these can be used in bullish and bearish circumstances, depending on the investors’ expectations. The regulatory uncertainty surrounding cryptocurrencies has long been a significant setback for investors and this is another reasons why neutral market strategies...

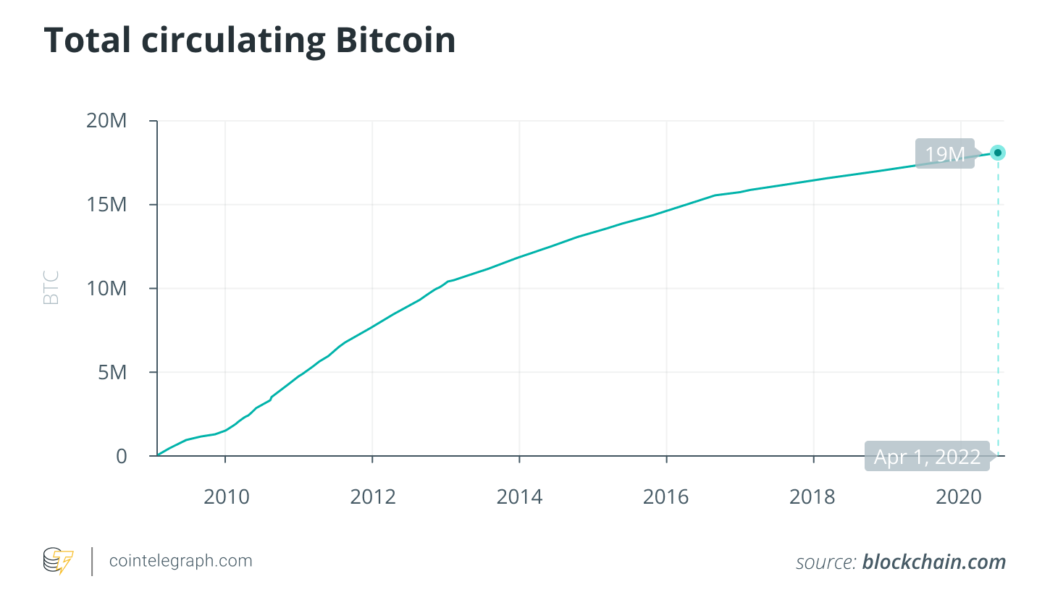

Just 2 million Bitcoin left to mine: Bitcoin hits the 19 million milestone

The 19th millionth Bitcoin (BTC) was mined on Friday, a landmark occasion for the number one cryptocurrency. Nineteen million Bitcoin are now in circulation, with just 2 million Bitcoin yet to be minted (or mined) until roughly the year 2140. In block 730002, mined by SBI Crypto, the 19 millionth Bitcoin entered circulation. SBI Crypto earned 6.32 BTC, roughly $293,000 for the trouble in transaction fees and block reward. A momentous occasion, the Bitcoin community was quick to celebrate the milestone event. The 19,000,000th bitcoin was just mined. Only 2 million more bitcoin to go. — Pomp (@APompliano) April 1, 2022 The CEO of possibly one of the world’s most ESGfriendly Bitcoin miners, Kjetil Hove Pettersen of Kryptovault, told Cointelegraph “we have only two...

Bitcoin recovers the $46K level, but several factors could prevent a stronger breakout

After dropping below $45,000 on March 31, Bitcoin (BTC) surprised investors with a quicker-than-expected recovery to the $46,500 level. Data from Cointelegraph Markets Pro and TradingView shows that bears managed to drop BTC to an overnight low of $44,210 before bulls showed up in force to lift the price back above $46,500 by midday. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about the short-term outlook for Bitcoin moving forward and what developments could present headwinds for the top cryptocurrency as a new month gets underway. The macro environment continues to impact BTC price Events in the global financial market continue to have a large impact on cryptocurrency markets and are likely to continue to do so for the foreseeable future. Accord...

Seven common mistakes crypto investors and traders make

Investing in cryptocurrencies and digital assets is now easier than ever before. Online brokers, centralized exchanges and even decentralized exchanges give investors the flexibility to buy and sell tokens without going through a traditional financial institution and the hefty fees and commissions that come along with them. Cryptocurrencies were designed to operate in a decentralized manner. This means that while they’re an innovative avenue for global peer-to-peer value transfers, there are no trusted authorities involved that can guarantee the security of your assets. Your losses are your responsibility once you take your digital assets into custody. Here we’ll explore some of the more common mistakes that cryptocurrency investors and traders make and how you can protect yourself from un...

A retest is expected, but most analysts expect Bitcoin price to extend much higher

The mood across the cryptocurrency market has seen a notable improvement in the last week as prices are on the rise with Bitcoin (BTC) now trading near $48,000 while Ether (ETH) attempting to hold above $3,400. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has been oscillating around $48,000 since it broke out above $45,000 early on March 28 and bulls are now debating whether a bull run to $80,000 is on the cards. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the outlook for BTC moving forward and what levels to keep an eye on in case of a price pullback or another breakout to the upside. Bitcoin breaks above its 1-year moving average “Keeping it simple is often best” accordi...

Bitcoin hits $44K, but traders want to see a few daily closes here before a move higher

Morale across the cryptocurrency ecosystem is rising on March 24 as several days of positive moves have helped lift Bitcoin (BTC) back above $44,000 and Ether bulls took control at $3,100. The climbing price of BTC comes amid a backdrop of surging inflation and rising interest rates, which could see up to seven hikes over the course of 2022, according to Minneapolis Federal Reserve President Neel Kashkari. BTC/USDT 1-day chart. Source: TradingView Data from Cointelegraph Markets Pro and TradingView shows that after trading near $43,000 throughout the morning session on March , a midday spike lifted the price of BTC to an intraday high at $44,186 where it bumped up against a major resistance zone. Bitcoin needs to flip $44,000 into support A look at the weekly chart shows that “Bitcoi...

Crypto rallies to $2T market cap as institutions signal readiness to enter

Bitcoin (BTC) and the broader cryptocurrency market rallied on Thursday, as the total value of digital assets crossed $2 trillion for the first time in over three weeks amid signs of a clear shift in market sentiment — headlined by Goldman Sachs, no less. BTC printed an intraday high of $44,253, having gained more than 3% during the session, according to data from Cointelegraph Markets Pro and TradingView. The largest cryptocurrency by market capitalization has now recovered over 33% from its January low. The total crypto market cap has gained over 7% since Monday to reach nearly $2.1 trillion, according to Coingecko data. The market capitalization figure also reached $2 trillion on CoinMarketCap. While not bullish, Bitcoin’s Fear & Greed Index has escaped “extreme fear” and is n...

Bitcoin bulls take aim at $45K while some analysts warn of possible correction

The bullish narrative is beginning to build across the cryptocurrency ecosystem on March 22 as the price of Bitcoin (BTC) briefly spiked above $43,000 while Ether (ETH) has reclaimed support at $3,000 following a deposit of $110 million worth of ETH into Lido’s liquidity pools. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin rallied 6.15% from a low of $40,884 in the early hours of Tuesday to an intraday high at $43,380 before consolidating around support at $42,300. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about Bitcoin’s recent price action and which support and resistance levels to keep an eye on moving forward. BTC price could correct lower A foreshadowing of Bitcoin’s move on March 22 was pro...

Bitcoin rally hopes diminish as pro traders flip bearish, retail interest at 12-month lows

Bitcoin (BTC) has been trapped in a symmetrical triangle for 56 days and the trend change could last until early May, according to price technicals. Currently, the support level stands at $38,000, while the triangle resistance for daily close stands at $43,600. Bitcoin mining up, retail interest down Bitcoin/USD price at FTX. Source: TradingView The week started with a positive achievement for the Bitcoin network as the Lightning Network capacity reached a record-high 3,500 BTC. This solution allows extremely cheap and instant transactions on a secondary layer, known as off-chain processing. After cryptocurrency mining activities were banned in China in 2021, publicly-listed companies in the United States and Canada attracted most of this processing power. As a result, Bitcoin’s hash...

Bitcoin beats owning COIN stock by 20% since Coinbase IPO

Buying a Coinbase stock (COIN) to gain indirect exposure in the Bitcoin (BTC) market has been a bad strategy so far compared to simply holding BTC. Notably, COIN is down by nearly 50% to almost $186, if measured from the opening rate on its IPO on April 14, 2021. In comparison, Bitcoin outperformed the Coinbase stock by logging fewer losses in the same period — a little over 30% as it dropped from nearly $65,000 to around $41,700 BTC/USD (orange) vs. COIN price (blue). Source: TradingView What’s bothering Coinbase? The correlation between Coinbase and Bitcoin has been largely positive to date, however, suggesting that many investors consider them as assets with similar value propositions. That is primarily due to the buzz around how COIN could become a simpler onboarding experi...

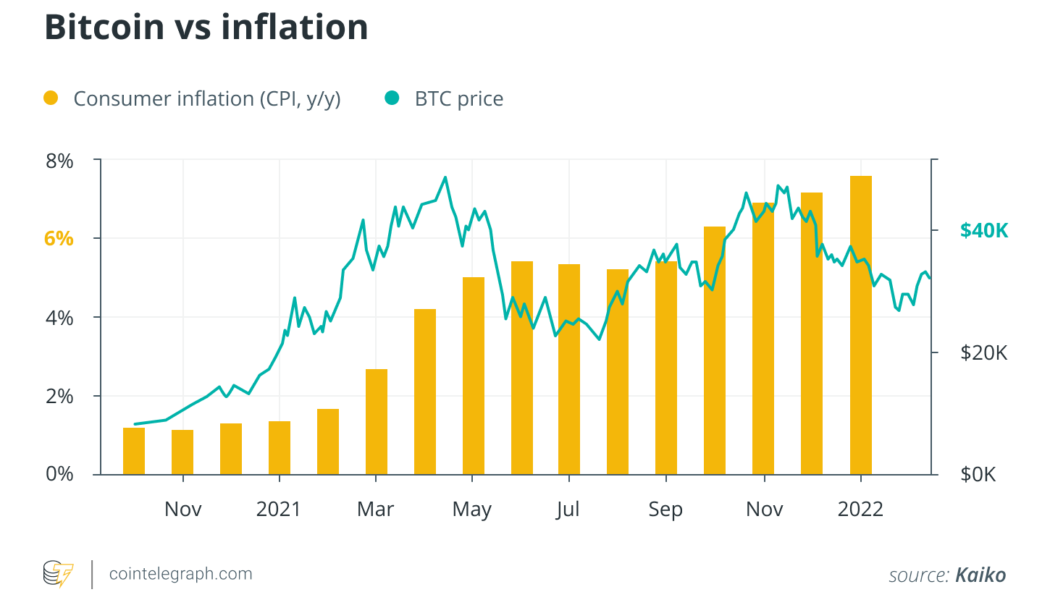

Inflation spikes in Europe: What do Bitcoiners, politicians and financial experts think?

Rising prices are grabbing headlines all over the world. Across the pond in the United States, inflation recently broke a 40-year record. The situation is severe in Europe, with prices rising over 5% across the Eurozone and 4.9% in the United Kingdom. While prices rise, Bitcoin (BTC) is flatlining at around $39,000. It poses many questions: Is Bitcoin an effective hedge against rising prices, what role can Bitcoin play in a high inflation environment and did Bitcoiners know that inflation was coming? Experts from the world of Bitcoin, finance and even European politics responded to these questions, sharing their views with Cointelegraph about the alarming price rises in Europe. From data analysts Kaiko’s monthly report, the Bitcoin price marched ahead of inflation, implying...