Bitcoin Price

Altcoins stage a relief rally while Bitcoin traders decide whether to buy the dip

The similarity in price action between the crypto and traditional financial markets remains quite strong on May 10 as traders enjoyed a relief bounce across asset classes following the May 9 rout, which saw Bitcoin (BTC) briefly dip to $29,730. Market downturns typically translate to heavier losses in altcoins due to a variety of factors, including thinly traded assets and low liquidity, but this also translates into larger bounces once a recovery ensues. Daily cryptocurrency market performance. Source: Coin360 Several projects notched double-digit gains on May 10, including a 15.75% gain for Maker (MKR), the protocol responsible for issuing the DAI (DAI) stablecoin, which likely benefited from the fallout from Terra (LUNA) and its TerraUSD (UST) stablecoin. Other notable gainers incl...

Bitcoin retests key $30K support zone as data highlights BTC whale accumulation

Sentiment across the cryptocurrency market plunged even deeper on May 9 as an escalation in the ongoing sell-off intensified with bears pushing Bitcoin (BTC) to $30,334, its lowest price since July 2021. Crypto Fear & Greed Index. Source: Alternative.me Multiple factors like rising interest rates, the end of easy money policies by the Federal Reserve, declining stock prices and concerns related to Terra’s UST stablecoin maintaining its $1 peg are all impacting sentiment within the crypto market. Data from Cointelegraph Markets Pro and TradingView shows that an afternoon of heavy selling on May 9 hammered the price of BTC to a daily low of $30,334 as bulls frantically regrouped to defend the psychologically important $30,000 price level. BTC/USDT 1-day chart. Source: TradingView H...

Bitcoin price falls to $31K as traders prepare for a ‘rocky’ road and more downside

“When it rains, it pours” is an old saying finding new relevance in the cryptocurrency markets on May 9 as traders face another day of pain and the current price decline brings Bitcoin (BTC) to its lowest level in 2022. Data from Cointelegraph Markets Pro and TradingView shows that the BTC selloff on May 9 intensified as the trading day progressed with Bitcoin hitting a daily low of $31,000 as bulls scrambled to mount what amounted to a weak defense. BTC/USDT 1-day chart. Source: TradingView Here’s a look at some of the developments that led up to May 9’s price declines and what traders can look for as the crypto market heads deeper into bear territory. Further downside is a possibility Bitcoin bulls have struggled to establish a solid floor of support over the past couple of m...

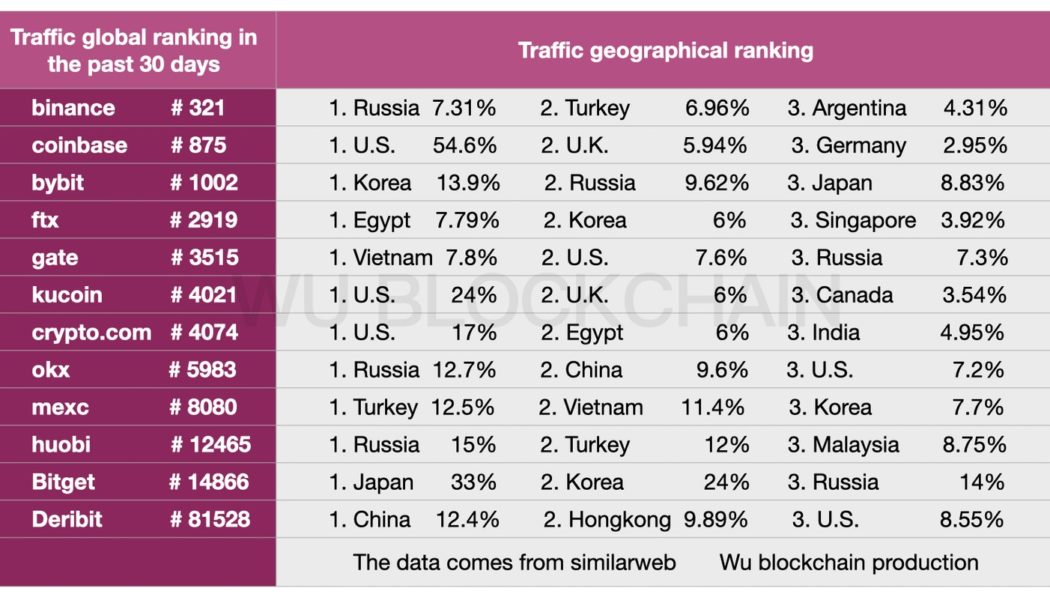

Deribit and OKX attract significant traffic from China despite a blanket ban: Report

Data from website traffic metric provider Similarweb shows that Deribit and OKX continue to attract significant traffic sources from China despite a blanket ban on crypto transactions and foreign exchanges last year. China has banned the use of cryptocurrencies more than a dozen times in the last decade. However, the one imposed in September last year was considered the harshest one. Several crypto exchanges including Huobi and Binance had shut doors for the Chinese traders in fear of regulatory action. The strict regulatory reforms ensured that Chinese traders mainly shifted their focus to decentralized exchanges (DEXs) and protocols. Chinese crypto traders have always found a way to bypass strict crypto regulatory measures imposed by the government. While many believed the blanket ban on...

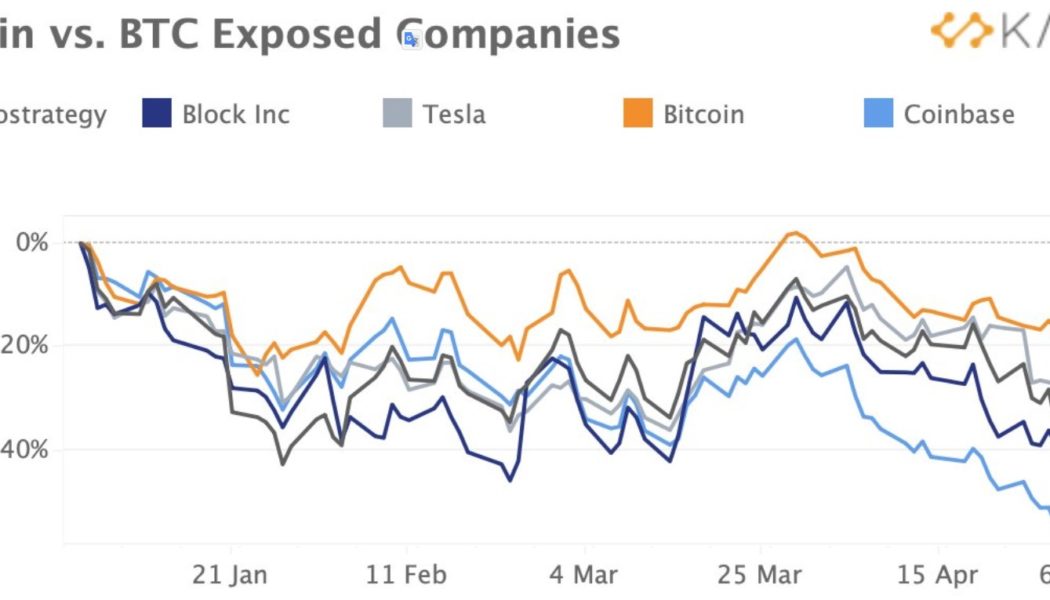

Fed FOMC comments and Bitcoin ‘bear channel’ could kickstart a decline to $28K

The start of May has seen a continuation of the weakness in crypto and equities markets and at the moment, there is no indication of any short-term factors that could reverse the bearish trend. Equities markets are also in a downtrend and according to researcher Clara Medalie, the price of stocks from companies with exposure to Bitcoin (BTC) have also taken a notable hit. Bitcoin vs. BTC exposed companies. Source: Twitter Medalie said: “Block, Tesla, Microstrategy and Coinbase are down between 20%–50%.” Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt by Bitcoin (BTC) bulls to rally above $39,000 was easily defended by bears, resulting in a pullback to the $38,200 level. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts ...

“DeFi is not decentralized at all,” says former Blockstream executive

Samson Mow, former chief strategy officer at Blokstream and founder of JAN3, is convinced that most decentralized finance protocols can’t compete with Bitcoin when it comes to providing an effective monetary network because of their lack of decentralization. As Mow pointed out, DeFi projects are governed by entities that can modify the protocol at will. “At the fundamental level, money should be immutable,” explained Mow. “If you can change it at will, then you’re no better than a fiat currency governed by the Fed.” Bitcoin’s decentralization makes it very difficult to modify its protocol, which is why Mow considers it a unique candidate for becoming a truly global monetary system. Mow pointed out that despite the immutability of Bitcoin’s base layer, developers can still build appli...

Home sweet hodl: How a Bitcoiner used BTC to buy his mom a house

There’s a special bond between mothers and their sons. For pseudonymous Alan, a 28-year-old engineer, a Bitcoin (BTC) loan helped his mom to buy a house. Alan told Cointelegraph that he took out a Bitcoin-backed loan in 2021 — serendipitously on his sister’s birthday — to gift his mom the tax-free money. She then used the funds to buy a house in North Yorkshire, England, while Alan kept his Bitcoin. Yorkshire, England, known as “God’s own country.” Source: North Yorkshire City Council Alan first used Bitcoin in 2012, learning it was a useful currency to buy things on the internet. He used the peer-to-peer (P2P) service localbitcoins.com, whose team are regular Cointelegraph contributors, to buy Bitcoin. Alan described the process of buying Bitcoin from real people as a “bizarre experience....

Altcoins sell-off as Bitcoin price drops to its ‘macro level support’ at $38K

The cryptocurrency market and wider global financial markets fell under pressure on April 26 after the hype surrounding Elon Musk’s purchase of Twitter began to fade and concerns about the state of the global economy took the forefront again. Tech-related stocks were some of the hardest-hit assets on April 26 and this pullback was followed by sharp declines in crypto prices as risk assets become persona non grata in these turbulent markets. Data from Cointelegraph Markets Pro and TradingView shows that after holding support at $40,500 through the early trading hours on April 26, the price of Bitcoin (BTC) dumped 6.21% in afternoon trading to hit a low of $38,009. BTC/USDT 1-day chart. Source: TradingView April 26’s price action looks to be a continuation of the weakness se...

Bitcoin hits $40K, investors pump Dogecoin (DOGE) after Musk confirms Twitter purchase

The cryptocurrency market fell under pressure in the early trading hours on April 25, but a brief spurt of bullish price action sparked after media headlines announced that Elon Musk had reached a deal to purchase Twitter for $44 billion. Data from Cointelegraph Markets Pro and TradingView shows that after dropping as low as $38,210 in the opening trading hours on Monday, Bitcoin (BTC) price staged a 5.72% rally to hit an intraday high at $40,366 as news of Twitter’s sale spread across news outlets. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts and on-chain data have to say about Bitcoin’s short-term outlook. Declining exchange reserves point to strong accumulation The recent bearish sentiment that has dominated the crypto market was addressed b...

Analysts say Bitcoin has ‘already capitulated,’ target $41.3K as the most hold level

Traders’ struggle to build sustainable bullish momentum persisted across the cryptocurrency market on April 20 after prices slid lower during the afternoon trading session and ApeCoin (APE) appaers to be one of the few tokens that is defying the current market-wide downturn. Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt by Bitcoin (BTC) bulls to breakout above $42,000 was soundly rejected by bears, resulting in a pullback to a daily low of $40,825 before the price was bid back above $41,000. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several market analysts are saying about the weakness in Bitcoin and what levels traders are looking at as a good spot for opening new positions. Whales accumulate near $...

Bitcoin price slides below $40K following a ‘lackluster’ breakout

Extreme fear is once again the dominating sentiment across the cryptocurrency community after Bitcoin (BTC) faced another day of trading below the $40,000 level and the United States grapples with the highest Consumer Price Index (CPI) print since 1981. Crypto Fear & Greed Index. Source: Alternative.me Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt to rally above $40,000 ran into a wall of resistance at $40,650 and BTC price eventually tumbled back below $39,600. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the current state of Bitcoin and what could potentially come next as financial markets grapple with an increasing amount of uncertainty. Bitcoin is simply re-testing a major S/R zone ...

Bitcoin price dip to $39.2K places BTC back in ‘bear market’ territory

The cryptocurrency market took a turn for the worse on April 11 after concerns related to rising inflation, the prospect of several more interest rates by the U.S. Federal Reserve and fear of a global food shortage led to widespread weakness across global financial markets. Data from Cointelegraph Markets Pro and TradingView shows that bears broke through the bulls’ defensive line at $42,000 in the early trading hours on Monday to drop Bitcoin (BTC) to a daily low of $39,200 and several analysts project even lower prices in the short-term. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about Monday’s move lower and whether or not traders should expect more downside over the coming days. $40,000 or bust The dip below $40,000 was foreshadowed b...