Bitcoin Price

Low inflation or bust: Analysts say the Fed has no choice but to continue raising rates

As economic conditions continue to worsen, financial experts worldwide are increasingly placing the blame at the feet of the United States Federal Reserve after the central bank was slow to respond to rising inflation early on. Financial markets are currently experiencing their worst stretch of losses in recent history, and it doesn’t appear that there is any relief in sight. May 24 saw the tech-heavy Nasdaq fall another 2%, while Snap, a popular social media company, shed 43.1% of its market cap in trading on May 23. This past couple of months have been absolutely brutal for the markets… 8 consecutive weeks of red candles in the #SPX, #NASDAQ and #BTC… no significant bounces pic.twitter.com/hgU2VwIoxh — Crypto Phoenix (@CryptoPheonix1) May 24, 2022 Much of the recent turmoil again c...

Crypto funds under management drop to a low not seen since July 2021

Digital asset investment products saw $141 million in outflows during the week ending on May 20, a move that reduced the total assets under management (AUM) by institutional funds down to $38 billion, the lowest level since July 2021. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, Bitcoin (BTC) was the primary focus of outflows after experiencing a decline of $154 million for the week. The removal of funds coincided with a choppy week of trading that saw the price of BTC oscillate between $28,600 and $31,430. BTC/USDT 1-day chart. Source: TradingView Despite the sizable outflow, the month-to-date BTC flow for May remain positive at $187.1 million, while the year-to-date figure stands at $307 million. On a more positive note, the multi-asset cat...

Bitcoin Pizza Day rewind: A homage to weird and wonderful BTC purchases

Happy Bitcoin Pizza Day! Before you dial for a Margherita to commemorate the world’s first real-world Bitcoin transaction, here’s a slice of trivia: What do a family holiday to Japan, a 50 Cent album, a steak dinner, and a framed cat photo all have in common? They were all paid for with Bitcoin (BTC) by members of the Cointelegraph Bitcoin community! And just like the Bitcoin pizzas that cost 10,000 BTC, which are now worth more than $300 million, the community’s Bitcoin purchases have also skyrocketed. Benjamin de Waal, the VP of Engineering at Bitcoin exchange Swan Bitcoin told Cointelegraph, “I spent 7 BTC on a family trip to Japan a few years back.” In today’s value, 7 BTC is worth well over $200,000 — but Ben’s happy because his kids are happy: “It would have be...

20% drop in the S&P 500 puts stocks in a bear market, Bitcoin and altcoins follow

Whoever coined the phrase “sell in May and go away” had brilliant insight and the performance of crypto and stock markets over the past three weeks has shown that the expression still rings true. May 20 has seen a pan selloff across all asset classes, leaving traders with few options to escape the carnage as inflation concerns and rising interest rates continue to dominate the headlines. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) taking on water below $29,000 and traders worry that losing this level will ensure a visit to the low $20,000s over the coming week. BTC/USDT 1-day chart. Source: TradingView As reported by Cointelegraph, some analysts warn that BTC could possibility decline to $22,700 based on its historical price performance fo...

Contrarian Bitcoin investors identify buy zones even as extreme fear grips the market

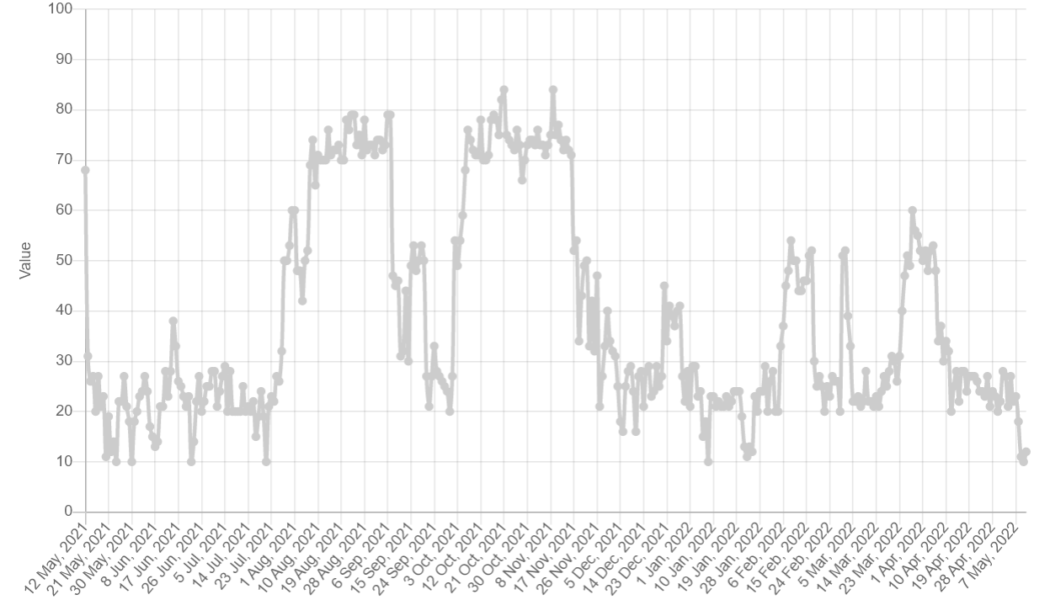

Bitcoin (BTC) support at the $30,000 level has proven to be quite resilient amidst the turmoil of the past two weeks with many tokens in the top 100 now showing signs of consolidation after prices bounced off their recent lows. Fear & Greed Index. Source: Alternative.me During high volatility and sell-offs, it’s difficult to take a contrarian view and traders might consider putting some distance from all the noise and negative news-flow to focus on their core convictions and reason for originally investing in Bitcoin. Several data points suggest that Bitcoin could be approaching a bottom which is expected to be followed by a lengthy period of consolidation. Let’s take a look at what experts are saying. BTC may have already reached “max pain” The spike in realize...

Bitcoin is discounted near its ‘realized’ price, but analysts say there’s room for deep downside

There are early signs of the “dust settling” in the crypto market now that investors believe that the worst of the Terra (LUNA) collapse looks to be over. Viewing Bitcoin’s chart indicates that while the fallout was widespread and quite devastating for altcoins, BItcoin (BTC) has actually held up fairly well. Even with the May 12 drop to $26,697 marking the lowest price level since 2020 multiple metrics suggest that the current levels could represent a good entry to BTC. BTC/USDT 1-day chart. Source: TradingView The pullback to this level is notable in that it was a retest of Bitcoin’s 200-week exponential moving average (EMA) at $26,990. According to cryptocurrency research firm Delphi Digital, this metric has historically “served as a key area for prior...

Bitcoin price could bounce to $35K, but analysts say don’t expect a ‘V-shaped recovery’

Altcoins saw a relief bounce on May 13 as the initial panic sparked by Bitcoin’s sell-off Terra’s UST collapse and multiple stablecoins losing their dollar peg begins to decrease and risk loving traders look to scoop up assets trading at yearly lows. Daily cryptocurrency market performance. Source: Coin360 Despite the significant correction that occurred over the past week, Bitcoin (BTC) bulls have managed to claw their way back to the $30,000 zone, a level which has been defended multiple times during the 2021 bull market. Here’s a look at what several analysts have to say about the outlook for Bitcoin moving forward as the price attempts to recover in the face of multiple headwinds. Is a short squeeze pending? Insight into the minds of derivatives traders was provided by ...

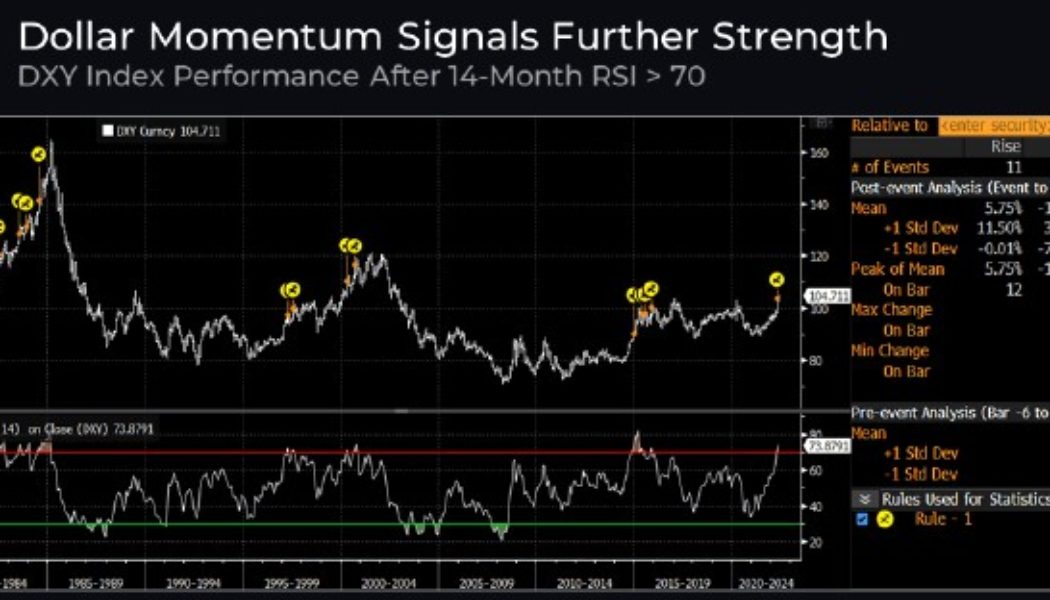

Buy the dip, or wait for max pain? Analysts debate whether Bitcoin price has bottomed

It has been a rough week for the cryptocurrency market, primarily because of the Terra ecosystem collapse and its knock-on effect on Bitcoin (BTC), Ethereum (ETH) and altcoin prices, plus the panic selling that took place after stablecoins lost their peg to the U.S. dollar. The bearish headwinds for the crypto market have been building since late 2021 as the U.S. dollar gained strength and the United States Federal Reserve hinted that it would raise interest rates throughout the year. According to a recent report from Delphi Digital, the 14-month RSI for the DXY has now “crossed above 70 for the first time since its late 2014 to 2016 run up.” DXY index performance. Source: Delphi Digital This is notable because 11 out of the 14 instances where this previously occurred “led to a strong...

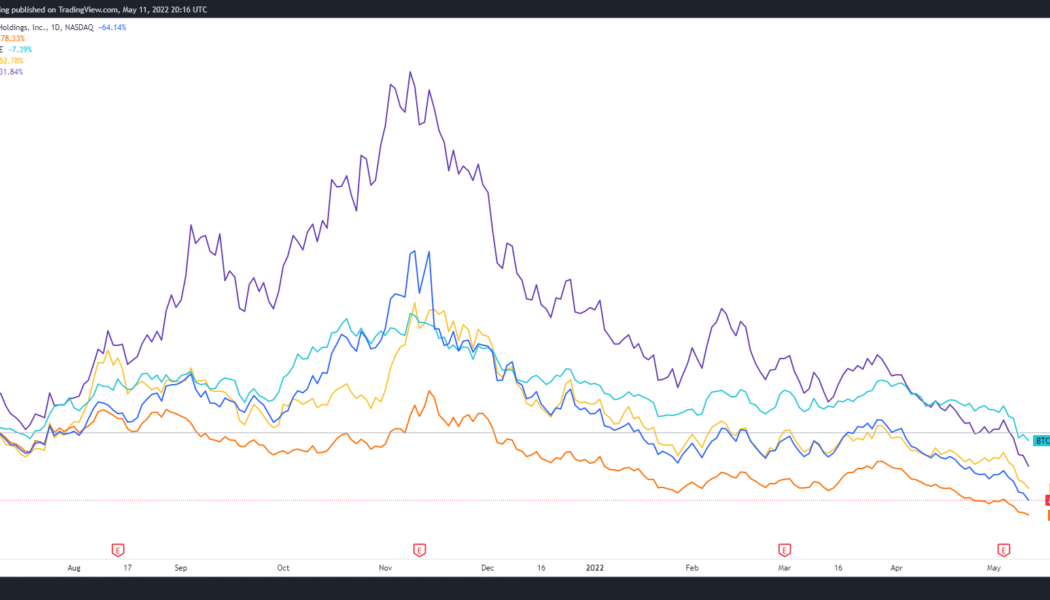

Crypto-associated stocks hammered as COIN and HOOD drop to record lows

Bad news continues to dominate crypto media headlines and May 12’s juiciest tidbit was the unexpected collapse of the Terra ecosystem. In addition to the weakness seen in equities, listed companies with exposure to blockchain startups and cryptocurrency mining have also declined sharply. Bitcoin mining stocks continue bleeding… Mining investors probably wish they had simply bought bitcoin instead at the beginning of 2022, as most bitcoin mining stocks have underperformed bitcoin by a wide margin. pic.twitter.com/anSoUEoUJ1 — Jaran Mellerud (@JMellerud) May 11, 2022 While it may be easy to blame the current pullback solely on Terra’s implosion, the truth is that the price of Bitcoin mining stocks has largely mirrored the performance of BTC since reaching a peak in November...

Untethered: Here’s everything you need to know about TerraUSD, Tether and other stablecoins

The crypto winter could be claiming more casualties among the stablecoin camp. The de-pegging of TerraUSD (UST) on Tuesday triggered market sell-offs, and now Tether (USDT) appears to be losing its footing, having slipped against the U.S. dollar. The algorithmic stablecoin UST is, as the name implies, algorithmically backed. LUNA, the ecosystem’s corresponding token, has sunk over 95% since Tuesday, while UST continues to languish around the $0.50 mark. Cointelegraph’s resident experts shared their explanations for why UST crashed in a special edition of “The Market Report” yesterday. The plan for Terraform Labs’ algorithmic stablecoin continues to roll out, but UST is still struggling. [embedded content] Data from Cointelegraph Markets Pro confirmed that various stable...

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

Michael Saylor assuages investors after market slumps hurts MSTR, BTC

MicroStrategy’s CEO and Bitcoin proponent Michael Saylor is confident his firm’s BTC holdings will more than cover a potential margin call on Bitcoin-backed loans. The American business intelligence and software giant made headlines in 2021 with a number of major investments into Bitcoin. Saylor was a driving force behind MicroStrategy’s decision to convert its treasury reserve into BTC holdings. Global markets have suffered major losses in early May and Microstrategy’s stock has not been spared. MSTR has seen its value drop by 24% and the value of Bitcoin has also slumped considerably along with the wider cryptocurrency markets. This is cause for concern as the company’s subsidiary MacroStrategy took out a $205 million loan from Silvergate Bank in March 2022, with a portion of MicroStrate...