Bitcoin Price

Bitcoin price rally provides much needed relief for BTC miners

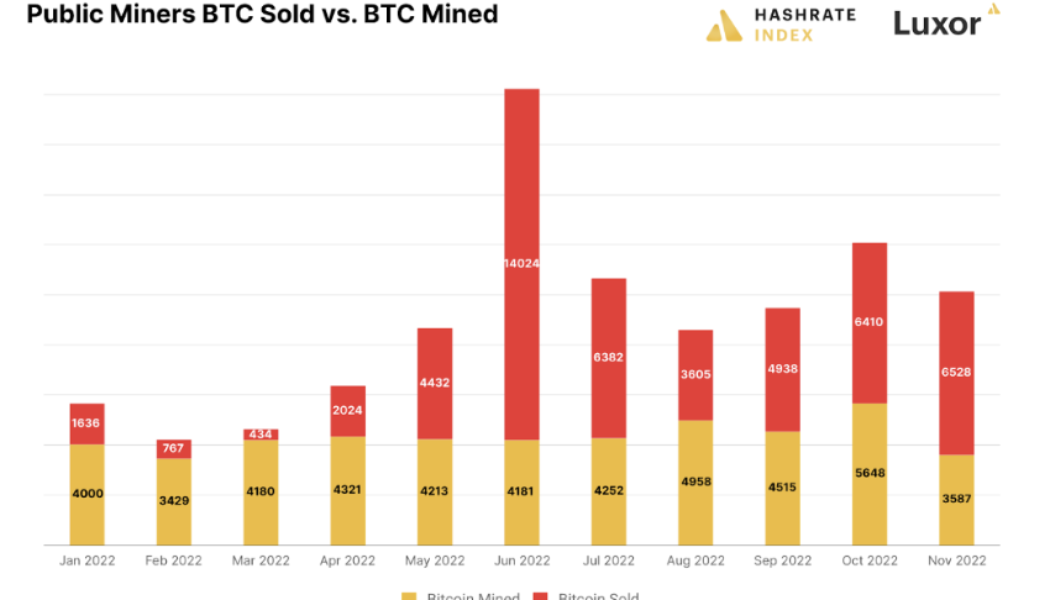

Bitcoin mining powers network transactions and BTC price. During the 2021 bull run, some mining operations raised funds against their Bitcoin ASICs and BTC reserves. Miners also preordered ASICs at a hefty premium and some raised funds by conducting IPOs. As the crypto market turned bearish and liquidity seized within the sector, miners found themselves in a bad situation and those who were unable to meet their debt obligations were forced to sell the BTC reserves near the market bottom or declare bankruptcy Notable Bitcoin mining bankruptcies in 2022 came from Core Scientific, filing for bankruptcy, but BTC’s early 2023 performance is beginning to suggest that the largest portion of capitulation has passed. Despite the strength of the current bear market, a few miners were able to i...

Bitcoin crowd sentiment hit multi-month high as BTC price touches $21K

Bitcoin (BTC) price climbed to a four-month high above $21,000 in the third week of January, relishing trader’s hope. The market has seen the most substantial investor optimism since July due to the January BTC price rebound. According to data shared by crypto analytic firm Santiment, the trading crowd sentiment has touched its highest in six months and second highest bullish sentiment in the past 14 months. The data indicates that traders are treating Bitcoin’s price rebound as a signal of a possible bigger breakout in the near future. The term “crowd/investor sentiment” describes how investors generally feel about a specific asset or financial market. It refers to the mood or tenor of a market, or the psychology of its participants, as expressed by activity and changes ...

Scaramucci to invest in crypto firm founded by former FTX US boss

SkyBridge Capital founder Anthony Scaramucci is investing in a crypto company founded by the former president of FTX US. According to an email to Bloomberg, Scaramucci said he would be investing his own personal funds to support ex-FTX US president Brett Harrison’s new venture, which became known just three weeks after the collapse of crypto exchange FTX. It is understood that the crypto software company — which doesn’t yet have a name — will enable crypto traders to create algorithmic-based strategies to access different markets — both centralized and decentralized. It is also understood that Harrison has been seeking a fundraising target as high as $10 million for a $100 million valuation. In a Jan. 14 tweet responding to Harrison’s lengthy thread on Sam Bankman-Fried and his ...

Can Canada stay a crypto mining hub after Manitoba’s moratorium?

Canada has remained a peculiar regulatory alternative to the neighboring United States in regard to cryptocurrency. While its licensing process has become more stringent than in some countries, Canada was the first to approve direct crypto exchange-traded funds. State pension funds have invested in digital assets, and crypto mining firms have moved to the country to take advantage of the cool temperatures and cheap energy prices. But the gold rush for miners in Canada may be slowing down. In early December, the province of Manitoba — rich in hydroelectric resources — enacted an 18-month moratorium on new mining projects. This move resembled a recent initiative in the U.S. state of New York that stopped the renewal of licenses for existing mining operations and required any new proof-of-wor...

Bitcoin price rally over $21K prompts analysts to explore where BTC price might go next

After Bitcoin (BTC) hit a yearly high of $21,095 on Jan. 13, where is it headed next? Bitcoin is currently witnessing an uptick in bullish momentum after the positively perceived Consumer Price Index (CPI) report was followed by a strong rally across the crypto market. The recent rally in Bitcoin is creating increased volume levels and higher social engagement on whether the price is in a breakout of fakeout mode. Is the Bitcoin bear market over? While the market is still technically in a bear market compared to last week, investor sentiment is improving. According to the Fear and Greed Index, a crypto-specific metric that measures sentiment using five weighted sources, investors’ feelings about the market hit a monthly high. Bitcoin Fear and Greed index. Source: alternative.me Bitco...

Nebraskangooner gives his opinions on whether news affects BTC price

On Dec. 28, Cointelegraph’s Crypto Trading Secrets podcast interviewed trader Nebraskangooner, gathering his opinions on several topics. “Flat and completely sideways and uneventful,” Nebraskangooner said when asked about his thoughts on Bitcoin’s (BTC) price lately. The crypto bear market saw the price of Bitcoin struggle throughout 2022, falling significantly from its all-time high above $60,000 seen in 2021. Nebraskangooner gave a few thoughts on Bitcoin’s possible location within the bear market and a potential bottom for the asset. Regarding his view on Bitcoin’s price, Nebraskangooner said he primarily looks to price charts for evaluation rather than mainstream news events. “I’ve never really been a believer in too much news affecting anything,” he explained, continuing: “I thi...

Belgian MP receives Bitcoin salary for a year: Here’s what he learned

At the end of January 2022, member of the Belgian parliament Christophe De Beukelaer became the first European politician to convert his salary to Bitcoin (BTC). Celebrating the anniversary of this experiment, Cointelegraph reached out to a lawmaker to know more about his experience. Back in 2022, Beukelaer, who represents Humanist Democratic Centre (CDH) party, cited the example of New York City Mayor Eric Adams and how American politicians are working to make their native states or cities Bitcoin hubs to justify his decision. The Brussels MP’s monthly salary of 5,500 euros ($6,140) was to be converted to Bitcoin using the Bit4You crypto trading platform. Related: Belgium says BTC, ETH and other decentralized coins are not securities “I did this political act of paying in Bitcoin to...

El Salvador’s Bitcoin strategy evolved with the bear market in 2022

Cryptocurrency adoption has been on the rise in El Salvador in recent years, with the country becoming the first in the world to adopt Bitcoin (BTC) as a legal tender. This landmark decision has attracted the attention of the global cryptocurrency community and has sparked discussions on the potential benefits and challenges of widespread adoption. El Salvador’s controversial move with its cryptocurrency adoption would not have been possible if it was not due to President Nayib Bukele, who garnered international attention after announcing the Bitcoin adoption plan and passed it into law. The legislation required all businesses within the country to accept Bitcoin as a form of payment for goods and services. As a legal tender, Bitcoin now has the same status as traditional fiat currencies, ...

Macroeconomic data points toward intensifying pain for crypto investors in 2023

Undoubtedly, 2022 was one of the worst years for Bitcoin (BTC) buyers, primarily because the asset’s price dropped by 65%. While there were some explicit reasons for the drop, such as the LUNA-UST crash in May and the FTX implosion in November, the most important reason was the U.S. Federal Reserve policy of tapering and raising interest rates. Bitcoin’s price had dropped 50% from its peak to lows of $33,100 before the LUNA-UST crash, thanks to the Fed rate hikes. The first significant drop in Bitcoin’s price was due to growing market uncertainty around potential rate hike rumors in November 2021. By January 2022, the stock market had already started showing cracks due to the increasing pressure of imminent tapering, which also negatively impacted crypto prices. BTC/USD daily price chart. ...

Models and fundamentals: Where will Bitcoin price go in 2023?

Bitcoin (BTC) had a bumpy ride throughout 2022, along with the rest of the digital asset market. The cryptocurrency began the year exchanging hands around $46,700 and is currently trading over 64% down at $16,560 at the time of writing. Consequently, the coin’s market capitalization took a tumble from around $900 billion on Jan. 1, 2022 to end the year at around $320 billion. Bitcoin Price Trend in 2022 While Bitcoin’s drop in price could be attributed to the extraordinary circumstances that the entire cryptocurrency market has been through this year, it is important to reevaluate the 2022 price predictions made by various market entities. One of the most popular predictions was that of analyst PlanB’s Bitcoin Stock-to-Flow (S2F) model. The S2F model predicted BTC to be at nearly $11...

Bitcoin Jack’s BTC trading is based on a list of risks and components

Well-known Twitter personality Bitcoin Jack, who tweets as @BTC_JackSparrow, joined Cointelegraph’s Crypto Trading Secrets podcast for an interview, which was recorded on Dec. 19. Jack covers many topics in the episode, including how he looks at the crypto space and prioritizes timing over price levels — “when” over “where.” Jack analyzes the crypto market based on a self-made list of possible risk factors. “When I look at ‘when,’ I’m trying to figure out what’s going on and what I want to see in the market to happen before I kind of think that the list of risks dissipate out of the market enough,” he explained when answering a question about Bitcoin’s (BTC) price at the time of recording. Jack mentioned that he maintains a personal list that includes crypto industry entities, global...