Bitcoin Mining

Australia-based crypto miner doubles hash rate after energizing Canadian rigs

Australian Bitcoin miner Iris Energy said it had increased its hash rate to more than 2.3 exahashes per second following the completion of phase two of its operations in Mackenzie, Canada. In a Monday announcement, Iris Energy said it had brought 41 megawatts of operating capacity in the British Columbia municipality online roughly two months ahead of schedule, adding 1.5 EH/s to its existing hash rate. In addition, the Bitcoin (BTC) miner expects to bring another 50 MW online in Prince George by the end of the third quarter of 2022, increasing its operating capacity to 3.7 EH/s. Iris Energy co-founder and co-CEO Daniel Roberts said the firm had energized the facility on schedule “despite the current market backdrop and ongoing international supply chain challenges.” The firm planned to de...

Argo Blockchain keeps cashing out BTC to pay the debt to Galaxy Digital

Cryptocurrency mining firm Argo Blockchain continues to sell its Bitcoin (BTC) holdings to cut its debt to Michael Novogratz’s crypto investment firm Galaxy Digital. Argo sold another 887 Bitcoin in July to reduce obligations under a BTC-backed loan agreement with Galaxy Digital, the firm announced on Friday. With the average BTC price of $22,670, the sales totaled $20.1 million, accounting for a significant part of the maximum outstanding loan balance of $50 million in Q2 2022. As of July 31, 2022, Argo held an outstanding balance of just $6.72 million under the BTC-backed loan, the announcement notes. The latest sale comes shortly after Argo sold another 637 BTC in June 2022 for $15.6 million. The firm reported that by the end of June 30, Argo had an outstanding balance of $22 million on...

Amid miner capitulation, Hut 8 maintained BTC ‘HODL strategy’ in July

Canadian Bitcoin (BTC) miner Hut 8 Mining Corp. added to its massive BTC reserves in July, as the firm maintained its long-term “HODL strategy” in the face of market volatility. The Alberta-based company generated 330 Bitcoin in July at an average production rate of 10.61 BTC per day, bringing its total reserves to 7,736 BTC. Its monthly production rate was equivalent to 113.01 BTC per exahash, the company disclosed Friday. Hut 8, which trades on the Nasdaq and Toronto stock exchanges, is one of the largest public holders of Bitcoin, according to industry data. As part of its ongoing HODL strategy, Hut 8 deposited all of its self-mined Bitcoin into custody, bucking the growing industry trend of miners selling portions of their reserves during the bear market. As Cointelegraph reported, Tex...

Core Scientific increased Bitcoin production by 10% in July amid Texas power cuts

Crypto mining firm Core Scientific reported its operations produced 1,221 Bitcoin (BTC) in July even as the company powered down several times in response to demand on the Texas power grid. In a Friday announcement, Core Scientific said its month-over-month Bitcoin production had increased from 1,106 in June to 1,221 in July — roughly 10.4%. The firm reported curtailing operations “due to extreme temperatures at multiple data centers,” but also increased the number of its self-mining servers and hashrate by 6%, to 109,000 and 10.9 exahashes per second (EH/s), respectively. JULY 2022 HIGHLIGHTS:-1,221 #Bitcoin self-mined-10.9 EH/s self-mined-+190,000 ASIC servers in operation-8.4 EH/s colocation (hosting)-Deployed first BITMAIN ANTMINER S19 XPs in the United Stateshttps://t.co/Qt2...

Antminer S19 XP dropped in a bid to swing crypto miners back into profit

With the Bitcoin (BTC) price moving at a very steady pace during the crypto winter, the return on investment (ROI) on a new mining device seems like a shot in the dark. But a mining expert explained there may be hope for miners to make a comeback to profit. Phil Harvey, the CEO of crypto consultancy firm Sabre56, told Cointelegraph that there are factors to consider when checking the potential profit of mining devices. These are mining machine specifications, costs, real ROI and the economics of mining over time. Analyzing the recently released Antminer S19 XP by mining rig provider Bitmain, Harvey noted that specs-wise, it’s the most efficient miner at the moment. In terms of costs, the crypto mining expert pointed out that the current costs of mining machines are significantly lowe...

Riot Blockchain’s Bitcoin mining productivity dropped 28% YOY amid record Texas heat

Crypto mining firm Riot Blockchain reported it produced fewer Bitcoin (BTC) in July 2022 than that in July 2021 after scaling down operations at its Texas facility. In a Wednesday announcement, Riot said its miners had produced 318 Bitcoin in July, more than 28% less than the 443 BTC the firm reported generating in July 2021. According to Riot CEO Jason Les, the firm curtailed operations by 11,717 megawatt-hours in July in response to increasing demand on Texas’ energy grid. Many parts of the Lone Star State experienced several days with temperatures over 100 degrees Fahrenheit, requiring additional power for air conditioners. “As energy demand in [Electric Reliability Council of Texas, or ERCOT] reached all-time highs this past month, the company voluntarily curtailed its energy...

Will the Bitcoin mining industry collapse? Analysts explain why crisis is really opportunity

Bitcoin mining involves a delicate balance between multiple moving parts. Miners already have to face capital and operational costs, unexpected repairs, product shipping delays and unexpected regulation that can vary from country to country — and in the case of the United States, from state to state. On top of that, they also had to contend with Bitcoin’s precipitous drop from $69,000 to $17,600. Despite BTC price being 65% down from its all-time high, the general consensus among miners is to keep calm and carry on by just stacking sats, but that doesn’t mean the market has reached a bottom just yet. In an exclusive Bitcoin miners panel hosted by Cointelegraph, Luxor CEO Nick Hansen said, “There’s going to definitely be a capital crunch in publicly listed companies or at least ...

The Merge is Ethereum’s chance to take over Bitcoin, researcher says

Ethereum researcher, Vivek Raman, is convinced that Ethereum’s (ETH) upcoming transition to a proof-of-stake system will enable it to take over Bitcoin’s (BTC) position as the most prominent cryptocurrency. “Ethereum does have, just from an economic perspective and because of the effect of the supply shock, a chance to flip Bitcoin,” said Raman in an exclusive interview with Cointelegraph. [embedded content] The Merge, a long-awaited upgrade that will complete Ethereum’s transition from a proof-of-work to a proof-of-stake system, is set to take place in September. In addition, The Merge will transform Ethereum’s monetary policy, making the network more environmentally sustainable and reducing ETH’s total supply by 90%. “After The Merge, Ether...

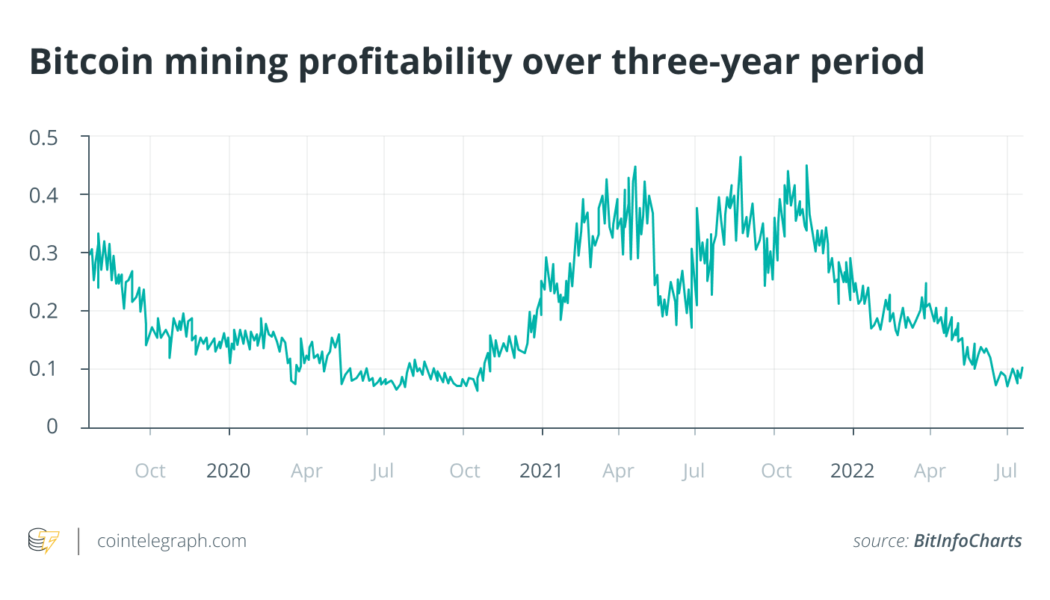

Not just Bitcoin price: Factors affecting BTC miner profitability

The ongoing cryptocurrency bear market has triggered a massive decline in Bitcoin (BTC) mining profitability as BTC mining expenses outpace the price of Bitcoin. Closely tied to the drop in the BTC price, Bitcoin mining profitability has been tanking since late 2021 and reached its lowest multi-month levels in early July 2022. According to data from crypto tracking website Bitinfocharts, BTC mining profitability tumbled to as low as $0.07 per day per 1 terahash per second (THash/s) on July 1, 2022, touching the lowest level since October 2020. The decline in BTC mining profitability has caused some big changes in the crypto mining industry. Lower Bitcoin prices fueled selling pressure as miners were pushed to sell their BTC to continue mining and pay for electricity. The majority of big cr...

Bitcoin network difficulty drops to 27.693T as hash rate eyes recovery

The difficulty in mining a block of Bitcoin (BTC) was reduced further by 5% to 27.693 trillion as network difficulty maintains its three-month-long downward streak ever since reaching an all-time high of 31.251 trillion back in May 2022. Network difficulty is a means devised by Bitcoin creator Satoshi Nakamoto to ensure the legitimacy of all transactions using raw computing power. The reduced difficulty allows Bitcoin miners to confirm transactions using lower resources, enabling smaller miners a fighting chance to earn the mining rewards. Despite the minor setback, zooming out on blockchain.com’s data reveals that Bitcoin continues to operate as the most resilient and immutable blockchain network. While the difficulty adjustment is directly proportional to the hashing power of miner...

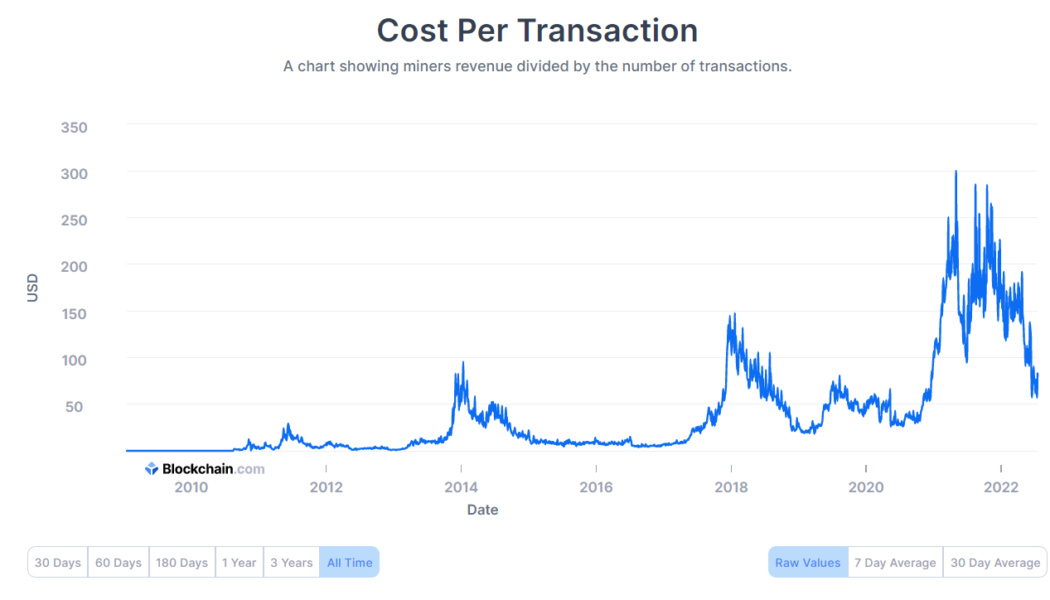

Bitcoin per transaction cost goes down every four years, coincidence?

Diving deep into the thirteen-year-old Bitcoin (BTC) ecosystem makes one come across interesting patterns powered organically by investor sentiment and market conditions. With BTC’s per transaction cost coming down to $56.846 on July 14, the ecosystem unveiled a cycle wherein the per transaction costs invariably fall every four years. The cost per Bitcoin transaction is calculated by dividing miners’ revenue by the number of transactions, thus implying an unpredictive trend — however, data from Blockchain.com reveals a pattern many would find satisfying. Bitcoin cost per transaction YTD. Source: blockchain.com The cost per transaction dropped over 81% in July 2022 from its all-time high of $300.331 in May 2021, factored by a combination of a prolonged bear market and fewer on-chain t...

US lawmakers ask about EPA, DOE monitoring of crypto mining emissions, energy consumption

Democratic legislators from both houses of the United States Congress have sent a letter to the Environmental Protection Agency (EPA) and Energy Department (DOE) to inform them of their findings on the energy consumption of cryptocurrency mining and asking the agencies to require mining to report their emissions and energy use. Meanwhile, the Paraguayan Senate, the upper house of that country’s legislature, has passed a comprehensive bill to regulate cryptocurrency and allow miners to use excess electricity generated in the country. The six U.S. lawmakers, led by crypto cynic Elizabeth Warren, noted in their July 15 letter that crypto mining in the United States has been increasing since it was banned by China last year. The seven crypto mining companies that responded to the legisla...