Bitcoin Mining

Bitcoin miner Core Scientific reportedly filing for Chapter 11 bankruptcy

Just days after a creditor offered to help Core Scientific avoid possible bankruptcy, reports have emerged confirming the Bitcoin (BTC) mining company’s fate. Core Scientific is reportedly filing for Chapter 11 bankruptcy protection in Texas owing to falling revenue and low BTC prices. On Dec. 14, financial services platform B. Riley offered to provide Core Scientific with $72 million in non-cash financing — $40 million with zero contingencies and $32 million with conditions — to retain value for stakeholders. The decision was made after Core’s valuation fell from $4.3 billion in July 2021 to $78 million at the time of reporting. As a direct result of an extended bear market, Core Scientific had to sell 9,618 BTC in April to stay operational. A CNBC report quoted a person familiar wit...

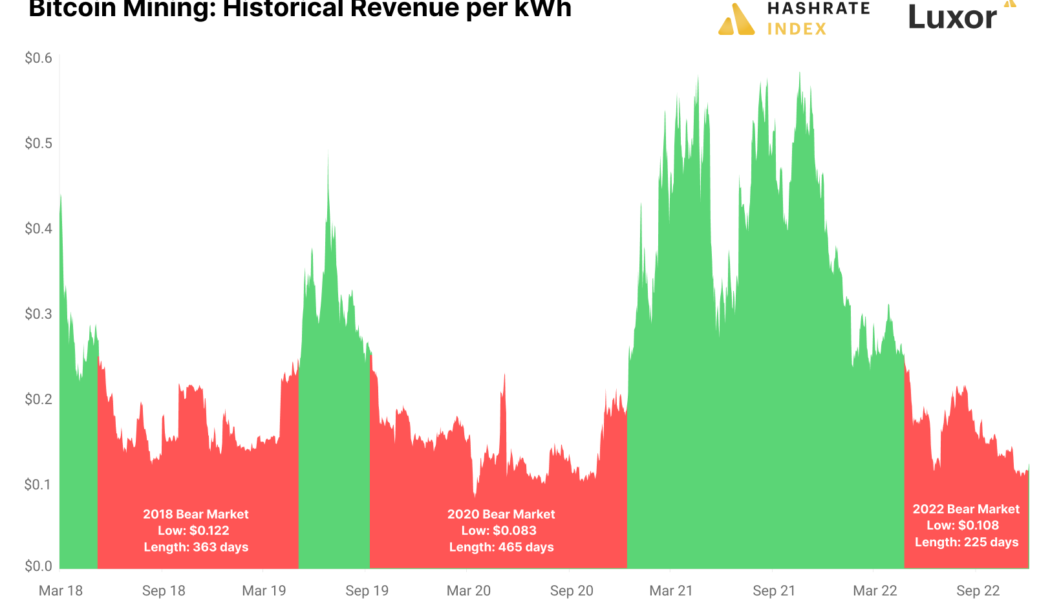

Data shows the Bitcoin mining bear market has a ways to go

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...

Bank of Russia wants to ban miners from selling crypto to Russians

The Russian central bank continues to maintain an extremely negative stance on cryptocurrencies, proposing to ban local miners from selling coins to local people. The Bank of Russia has supported the idea of legalizing cryptocurrency mining in Russia as part of a draft bill introduced in mid-November 2022. However, the Russian central bank wants to allow miners to sell their crypto only on foreign exchanges and to non-residents of Russia, the local news agency Interfax reported on Dec. 7. “We believe that cryptocurrency obtained as a result of mining can be sold exclusively using foreign infrastructure and only to non-residents,” the Bank of Russia’s press office reportedly said, adding: “In general, we adhere to the position on the inadmissibility of the circulation of digital currency on...

Bullish on Bitcoin, US Senator Ted Cruz wants Texas to be a crypto oasis

United States Senator Ted Cruz wants to make the American state of Texas an oasis for Bitcoin (BTC) and cryptocurrencies. Speaking at the Texas Blockchain Summit 2022 in late November, the politician empathized how the crypto industry can be strategic for the U.S. energy supply and technological development. Cruz argued that Bitcoin mining could be used to monetize energy created from oil and gas extraction, rather than burning it. In addition, he emphasized how mining activity can be used as an energy storage and supply alternative: “The beauty of it [Bitcoin mining] is when you’ve got substantial investment, as we do in Texas and Bitcoin mining, when you have an extreme weather event, either extreme heat, which is frequent in the state of Texas or extreme cold, whi...

Mysterious Bitcoin miner shows off oldest signature dated Jan. 2009

Online forums are integral to the Bitcoin origin story, where Satoshi Nakamoto and early contributors collaborated to discuss and create a disruptive financial system from scratch. One of the oldest Bitcoin forums — bitcointalk.org — still preserves historical discussions around creating the Bitcoin (BTC) logo and the payment system. A curious member of the bitcointalk.org forum recently sought to identify Bitcoin miners from the early days. To their surprise, an anonymous member shared a signature dating back to January 2009, just a week after Bitcoin came into existence. The oldest known Bitcoin signature shared by OneSignature. Source: bitcointalk.org “Maybe OP is inviting Satoshi?” questioned another member after confirming the legitimacy of “the oldest signature” found to date. A...

Alameda Research invested $1.15B in crypto miner Genesis Digital: Report

Crypto mining company Genesis Digital Assets was the biggest venture investment made by Alameda Research, FTX’s sister company and in the center of the exchange’s bankruptcy. Documents disclosed by Bloomberg on Dec. 3 show that Genesis Digital raised $1.15 billion from Alameda in less than nine months. The capital infusion was made before the crypto prices downturn, between August 2021 and April of this year. Genesis Digital is the major United States-based Bitcoin mining company, and it’s not related to Genesis Capital, the trading company with $175 million worth of funds locked away in an FTX trading account. Former FTX CEO Sam Bankman-Fried recently recognized participating in Alameda’s venture decisions, including the investment in Genesis Digital, despite...

Could Hong Kong really become China’s proxy in crypto?

With its partial autonomy, the island city of Hong Kong has traditionally served as “a gate to China” — the local trade center, backed by transparent English-style common law and an openly pro-business government strategy. Could the harbor, home to seven million inhabitants, inherit this role in relation to the crypto industry, becoming a proxy for mainland China’s experiments with crypto? An impulse to such questioning was given by Arthur Hayes, the former CEO of crypto derivatives giant BitMEX in his Oct. 26 blog post. Hayes believes the Hong Kong government’s announcement about introducing a bill to regulate crypto to be a sign that China is trying to ease its way back into the market. The opinion was immediately replicated in a range of industrial and mainstream media. What happe...

Core Scientific reveals financial distress in SEC filing, says its end may be near

Bitcoin miner Core Scientific filed forms with the United States Securities and Exchange Commission (SEC) on Oct. 26 indicating that will not make payments due in late October and early November. The company blamed low Bitcoin prices, increased electricity costs, an increase in the global Bitcoin hash rate and litigation with the bankrupt crypto lender Celsius for the situation. The payments the company will skip would have gone to equipment and other financing and two promissory notes. Its creditors may decide to exercise remedies such as accelerating the debt or suing the company, it noted. Those actions, in turn, could result in “events of default under the Company’s other indebtedness agreements” and more creditor remedies against the company. It adds: “The Company anticipates that exi...

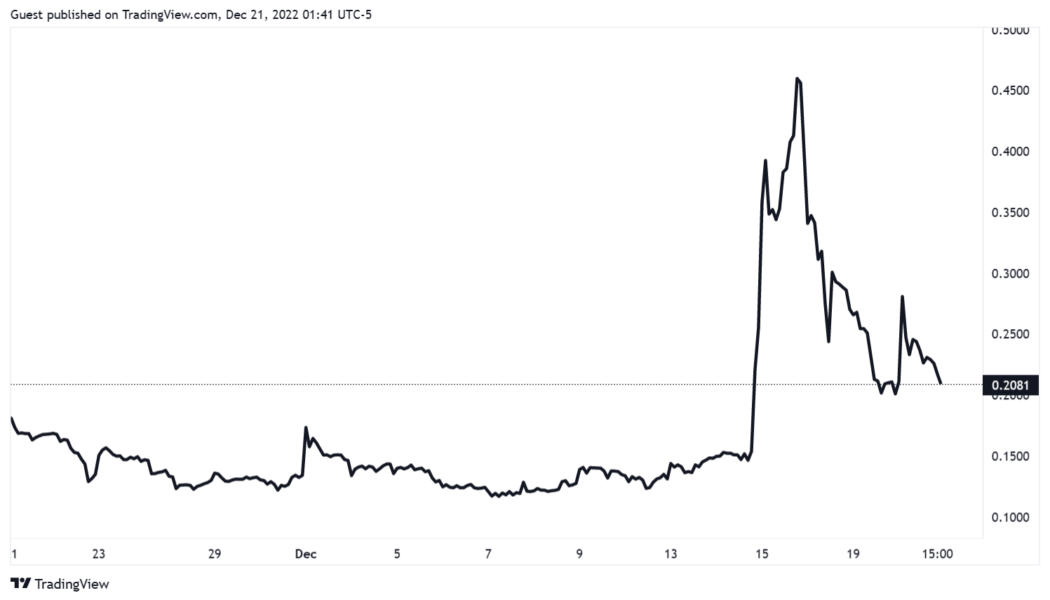

Sub-$20K Bitcoin price puts BTC miner profits under pressure as hash rate soars

October witnessed a surge in Bitcoin’s (BTC) hash rate which is pushing the metric to a new high of 245 Exahashes per second. These changes led to a sharp decrease in the hash price, resulting in a drop in the profit margins for BTC miners reaching a low of $66.8 USD/PH (per one quadrillion hashes per second) on Oct. 24, 2022. According to Luxor Technologies, “hashprice” is the revenue BTC miners earn per unit of hash rate, which is the total computational power deployed by miners processing transactions on a proof-of-work network. Hashprice Index. Source: Hash Rate Index Not only has volume been inconsistent, the Bitcoin hash rate increased last week to an average of 269 EH/s. This means the difficult hash rate has been rising since July 2022. Bitcoin market price vs Bitcoin difficulty. S...

How not to Bitcoin: User pays 1,000x fee to send 4 BTC

Fat fingers? A Bitcoin (BTC) user spent over $200 to make a transaction, paying astronomically above the average fee. In a transaction that entered Bitcoin block 760,077, a user paid 1,136,000 satoshis, (0.0136 BTC or $220.52) to move 3.8 BTC ($63,000). This extraordinarily high fee is a whopping 1,000 times the usual Bitcoin transaction fee, as at block height 760,077, the average transaction fee was roughly $0.20. Twitter user Bitcoin QnA first spotted the out-of-the-ordinary transaction, asking, “Y tho?” The Bitcoin educator told Cointelegraph that “Ultimately, we’ll never know [why they paid high], but there are a few possible answers.” QnA listed the following: “1. Using a wallet with terrible fee estimations 2. A user making a typo when manually entering their fee rat...

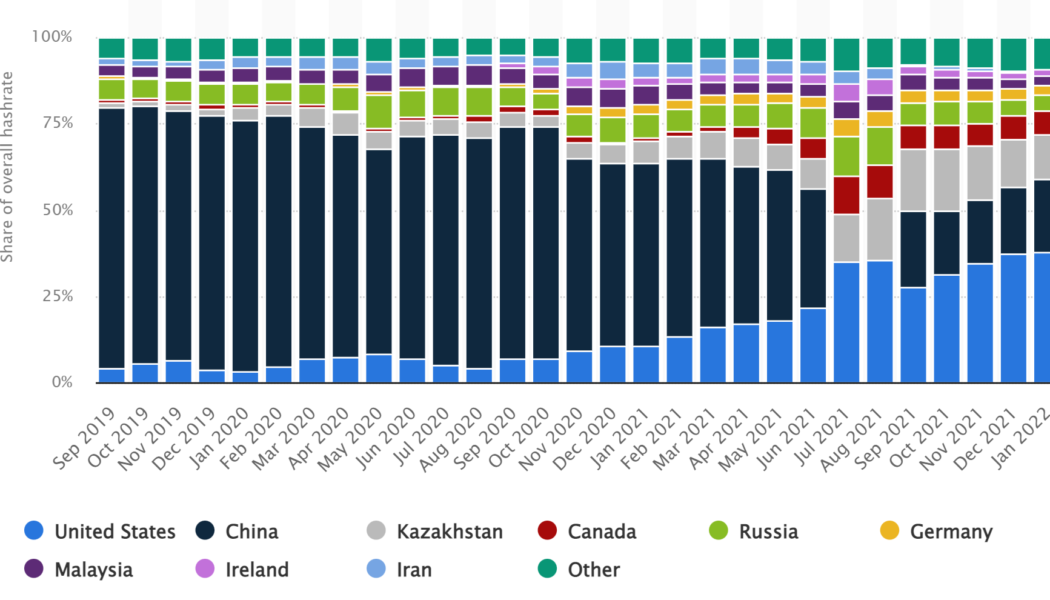

Kazakhstan among top 3 Bitcoin mining destinations after US and China

For over a year, the oil-rich Central Asian country of Kazakhstan has maintained its position as the third-biggest contributor to Bitcoin (BTC) mining after surpassing Russia back in February 2021. As of January 2022, Kazakhstan contributed to 13.22% of the total Bitcoin hash rate, positioned right after the historical leaders the United States (37.84%) and China (21.11%), as shown below. Along similar timelines, Cambridge Centre for Alternative Finance data estimated that Kazakhstan’s absolute hash rate contribution (monthly average) was 24.8 exahashes per second (Eh/s). Meanwhile, the US and China contributed 71 Eh/s and 39.6 Eh/s, respectively. The International Energy Agency (IEA), which is co-funded by the European Union, highlighted Kazakhstan’s heavy reliance on non-renewable ...

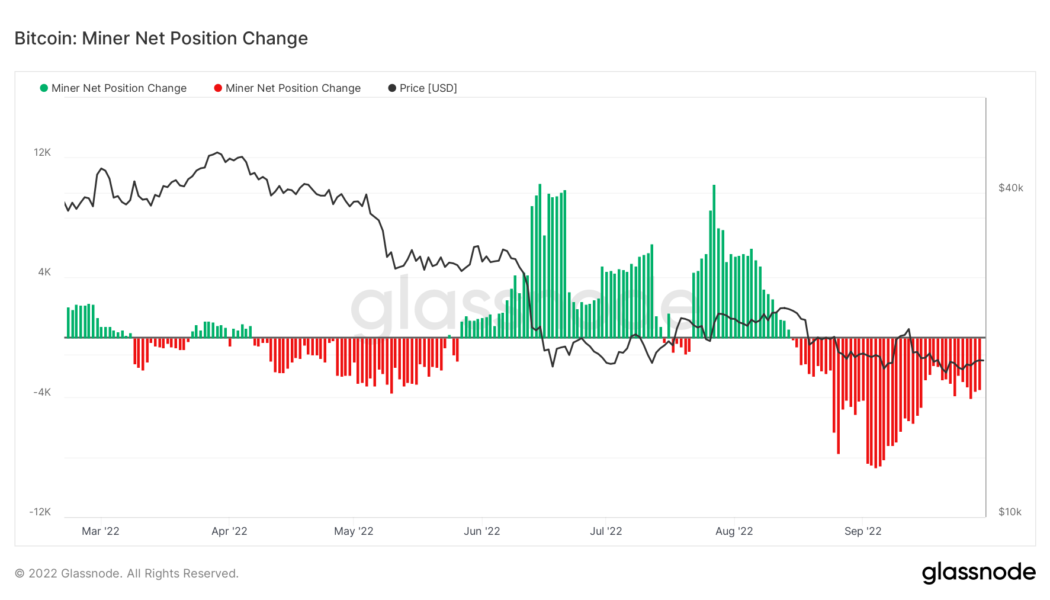

Bitcoin sees first difficulty drop in 2 months as miners sell 8K BTC

Bitcoin (BTC) miners remain under stress at current price levels as data shows large outflows from miner wallets returning. According to on-chain analytics firm Glassnode, monthly miner sales totaled up to around 8,000 BTC in September. Bitcoin miners see heavy sales In contrast to the June lows, when BTC/USD hit its current multi-year floor of $17,600, miners are currently selling considerable amounts of BTC. According to Glassnode, which tracks the 30-day change in miner balances, at the start of the month, miners were down a maximum 8,650 BTC over the month prior. Bitcoin miner net position change chart. Source: Glassnode While this subsequently reduced, taking into account changes in the BTC price, miners are still selling more than they earn on a rolling monthly basis. As of Sept. 29,...