Bitcoin miners

Blockstream raising funds for mining at 70% lower company valuation

The depths of a bear market may not be the best time to raise funds but that is exactly what Blockstream is doing. The crypto infrastructure firm is seeking fresh funding, but at a much lower valuation than previous rounds, according to a Dec. 7 Bloomberg report. Blockstream was valued at $3.2 billion when it held its last Series B funding round raising $210 million in August 2021. Today that valuation may have fallen almost 70% to below $1 billion according to the report. The company, founded in 2014, has raised a total of $299 million in funding over four rounds, according to CrunchBase. Blockstream CEO and cryptographer Adam Back did not share details of the latest funding round but did reveal that the capital will be invested into expanding the firm’s mining capacity. “We rapidly sold ...

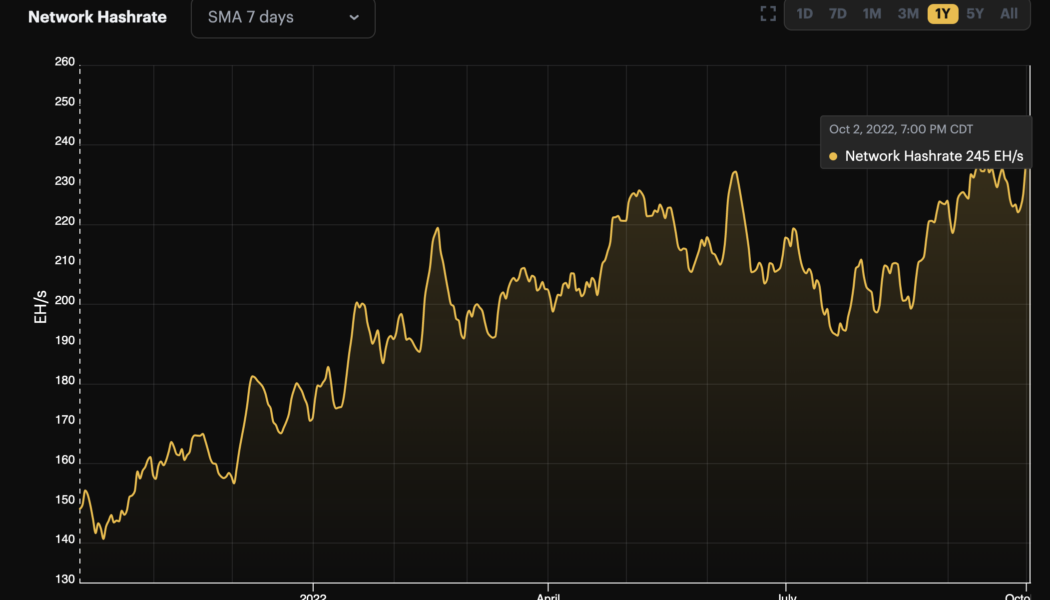

Bitcoin miner profitability under threat as hash rate hits new all-time high

The Bitcoin hash rate hit a new all-time high above 245 EH/s on Oct. 3, but at the same time, BTC miner profitability is near the lowest levels on record. With prices in the low $20,000 range and the estimated network-wide cost of production at $12,140, Glassnode analysis suggests “that miners are somewhat on the cusp of acute income distress.” Bitcoin network hash rate. Source: Hashrate Index Generally, difficulty, a measure of how “difficult” it is to mine a block, is a component of determining the production cost of mining Bitcoin. Higher difficulty means additional computing power is required to mine a new block. Utilizing a Difficulty Regression Model, the data shows an R2 coefficient of 0.944 and the last time the model flashed signs of the miners’ distress was during BTC...

Could Bitcoin miners’ troubles trigger a ‘death spiral’ for BTC price?

A July 9 post by @PricedinBTC on the “cost to mine Bitcoin” in the United States gathered the crypto community’s attention, especially considering the recent headlines that BTC miners have made. The crypto bear market and growing energy costs have caused a perfect storm for the mining sector and this has led some companies to lay off employees and others to defer all capital expenditures. Some went as far as raising concerns of Bitcoin miners hitting a “death spiral.” In bear markets like this, inevitably a Bitcoin critic comes out and says that Bitcoin will soon collapse from a “miner death spiral”, meaning that miners will go offline because it is not profitable to run their operations, and then Bitcoin’s hash rate will fall, causing its… — Cory Klippsten (@coryklippste...

Iran bans cryptocurrency mining for four months

Iran is temporarily banning cryptocurrency mining after some of the country’s major cities experienced repeated blackouts. President Hassan Rouhani said that the ban would last until September 22nd. The country has experienced summer blackouts in years past, and while the current round of outages is mostly being blamed on a drought that’s affecting the country’s ability to generate hydroelectric power, it seems that the Iranian government is eager to cut down on any aggravating factors. Power-hungry cryptocurrency mining operations, for instance. According to the BBC, Iran operates a program where Bitcoin miners must register with with the government, pay extra for electricity, and sell their coins to the central bank. President Rouhani stated that the legal mining operations in the countr...