Bitcoin Industry

Brain drain: India’s crypto tax forces budding crypto projects to move

India’s 30% crypto tax came into law on March 31 and was effective April 1, despite warnings from several stakeholders about its possible ill impact on the budding crypto industry. As predicted, within just a couple of weeks of the new crypto tax law coming into effect, trading volume across major crypto exchanges dropped as much as 90%. The decline in trading activity was attributed to traders either moving their funds away from centralized crypto exchanges or adopting a holding strategy over trading. Many crypto exchanges were hoping that a crypto tax would at least offer some form of recognition to the crypto ecosystem and help them get easy access to banking services. However, the effect has been the opposite. On April 7, the National Payment Corporation of India (NPCI) issued a ...

Valkyrie Investments‘ Leah Wald on Bitcoin ETFs and the future of digital assets

Cointelegraph sat down with Leah Wald, CEO of digital asset investment firm Valkyrie Investments, to learn more about the importance of a Bitcoin (BTC) exchange-traded fund (ETF) and the future of digital assets. For context, Valkyrie Investments was launched in 2020 and is one of the only asset managers to have three Bitcoin-adjacent ETFs trading on the Nasdaq. Valkyrie launched a Bitcoin Strategy ETF in October 2021 that offered indirect exposure to BTC with cash-settled futures contracts following a United States Securities and Exchange (SEC) approval for a similar ETF from ProShares. Valkyrie also has a balance sheet opportunities ETF that invests in public companies with exposure to Bitcoin. In addition, the investment firm’s Bitcoin Miners ETF began trading on the Nasdaq o...

Bitcoin cycle is far from over and miners are in it for the long haul: Fidelity report

Fidelity Digital Assets — the crypto wing of Fidelity Investments which has $4.2 trillion assets under management–shared their “two sats” on the future of the digital assets space. The key takeaways touched upon miners’ behavior and Bitcoin (BTC) network adoption. In the annual report released last week, the group shared some insights into the world of BTC mining: “As Bitcoin miners have the most financial incentive tho make the best guess as to the adoption and value of BTC (…) the current bitcoin cycle is far from over and these miners are making investments for the long haul.” The report stated that the recovery in the hash rate in 2021 “was truly astounding”, particularly when faced the world’s second-largest economy China banning Bitcoin in 2021. The rebound in hash rate s...

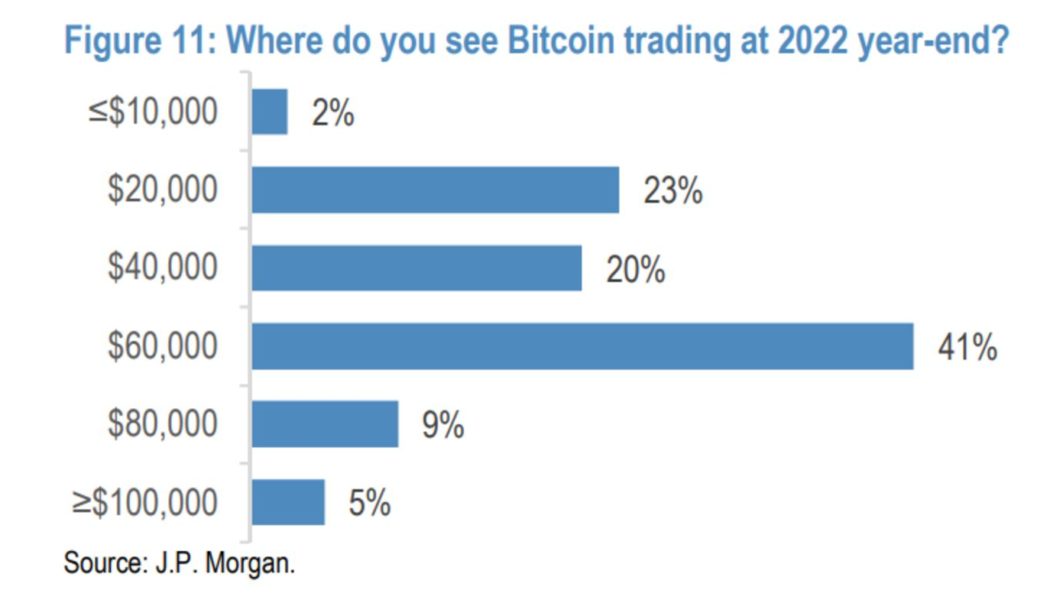

Wall Street still not convinced on Bitcoin $100K this year: JPMorgan survey

One of the world’s largest investment banks has its Bitcoin (BTC) price predictions ready for 2022. In a recent poll, JPMorgan Chase asked its clients, “Where do you see Bitcoin trading at 2022 year-end?” Just 5% said they saw the digital coin reaching $100,000, and 9% saw it breaking previous all-time highs, reaching over $80,000. The bank is known for its wealthy client portfolio. While some BTC bulls may welcome the news that 14% of JPMorgan’s clients expect at least a twofold increase, it’s not the fireworks the crypto market is accustomed to. On balance, however, the survey is generally positive. Most clients (55%) see BTC trading at $60,000 or above at the end of the year, with only one quarter expecting prices to slide from the recent lows of $40,000. “I’m not surprised by Bit...