Bitcoin ETF

SEC approves 9 more WisdomTree ‘blockchain-enabled’ funds

The U.S. Securities and Exchange Commission (SEC) has given the green light to nine more blockchain-enabled funds from $82 billion asset manager WisdomTree. None of these funds track crypto assets themselves, but the firm does utilize the Ethereum and Stellar blockchains to keep a secondary record of share ownership, thus making them blockchain-enabled or “digital funds” as WidsomTree describes them. The firm announced the SEC’s approval on Dec. 14, and outlined that the nine digital funds offer exposure to a host of different asset classes such as equities, commodities and floating rate treasuries. The funds are expected to launch via the WisdomTree Prime mobile app in the first quarter of 2023. “We believe that blockchain-enabled finance has the potential to improve the investor experien...

Canadian Bitcoin ETF adds 6.9K BTC in one day as GBTC discount hits record low

Bitcoin (BTC) descending to $24,000 has cost its largest institutional investment vehicle more than the average hodler. According to data from on-chain monitoring resource Coinglass on May 13, the Grayscale Bitcoin Trust (GBTC) is now trading at a nearly 31% discount. Grayscale CEO: Investors are “waiting for things to settle down” Amid ongoing market volatility this week, GBTC has seen its fledgling recovery fall flat on its face — for the time being. The so-called GBTC premium, long in negative territory and thus a discount in practice, has now reached its lowest ever. As of May 13, the discount was 30.6%, meaning that shares in GBTC traded at almost one third below the Bitcoin spot price (referred to as net asset value, or NAV). The figures mark a distinct turnaround for the...

Aussie crypto ETFs see $1.3M volume so far on difficult launch day

With crypto markets tanking, three crypto-focused exchange-traded funds (ETFs) picked a difficult day to commence trading on local exchange Cboe Australia today. The trio’s launch marks the first crypto ETFs to go live in Australia, with two of them focused on offering exposure to Bitcoin (BTC) and the other focused on Ethereum (ETH). So far the three ETFs have generated more than $1.3 million between them, and it has been estimated that they could see around $1 billion worth of inflows moving forward. The Cosmos Purpose Bitcoin Access ETF (CBTC) from Sydney-based crypto investment firm Cosmos Asset Management offers a relatively indirect route to BTC, as it “approximately tracks the performance of the USD denominated ETF non-currency hedged units (Purpose ETF Units) in the Purpose Bitcoin...

Three new crypto ETFs to begin trading in Australia this week

Australians will soon have more options for spot cryptocurrency exchange-traded funds (ETFs) after a previous hold-up was given the green light this week and new funds entered the ETF market. The latest update came late on May 9 as Cboe Australia issued a round of market notices that three funds previously delayed are expected to begin trading on Thursday, May 12. They include a Bitcoin ETF from Cosmos Asset Management, plus Bitcoin (BTC) and Ethereum (ETH) spot ETFs from 21Shares. Cboe Australia and Cosmos did not immediately respond to a request for comment, but a spokesperson from 21Shares confirmed to Cointelegraph: “We’re listing on May 12, this Thursday. The downstream issues are resolved.” On April 26, a day before three of the first crypto ETFs were set to launch, the Cboe Au...

Failure to launch: Australia’s first 3 crypto ETFs all miss launch day

The launch of Australia’s first three Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETF) scheduled for today, has been delayed as a result of further “checks” needing to be completed. The exchange listing the Bitcoin Spot ETF from Cosmos Asset Management, Cboe Australia, released a statement late Tuesday stating that “standard checks prior to the commencement of trading are still being completed” and a “further update will be provided in the coming days.” Cboe issued the same notice regarding two spot ETFs issued by 21Shares also scheduled for launch today, a Bitcoin ETF and an Ethereum ETF. It’s unclear why the products are delayed with the Australian Financial Review reporting that a “service provider downstream” — an entity such as a prime broker or major institution with the ...

SkyBridge goes all in on crypto, betting on ‘tremendous growth’ ahead

SkyBridge Capital is working on pivoting the majority of its assets under management (AUM) to digital assets, as the sector represents “tremendous growth” for the firm. The hedge fund was founded by former U.S. politician Anthony Scaramucci in 2005, and first delved into Bitcoin (BTC) in late 2020. The firm also has money deployed in other hedge funds, late-stage private tech companies and real estate, with its total AUM reported being around $7.3 billion. Skybridge now manages a $7 million Bitcoin Fund among others and has been actively working to get a spot BTC exchange-traded fund (ETF) approved by the U.S. Securities and Exchange Commission (SEC). Speaking with Bloomberg in the lead up to the annual SkyBridge Alternatives Conference (SALT) this week, Scaramucci said that the firm is re...

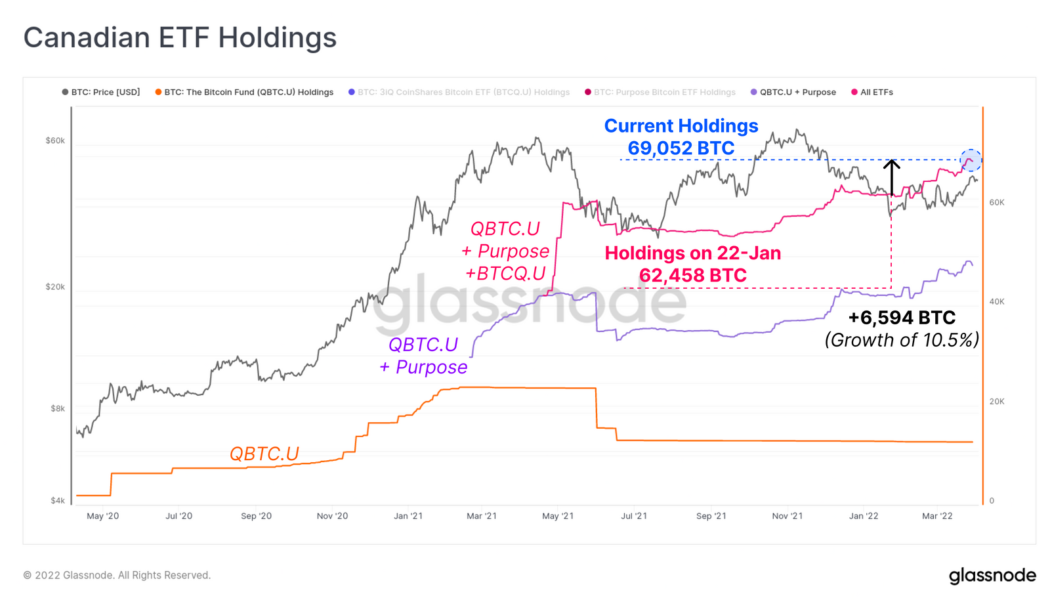

Inflows to Canadian Bitcoin ETFs hit all-time high: Glassnode

Canadian Bitcoin exchange-traded fund (ETF) holdings have increased to all-time highs according to recent research, and spot-based products are leading the way. Canadian Bitcoin ETFs have increased their holdings by 6,594 Bitcoin (BTC) since January to reach an all-time high of 69,052 total BTC held. The Purpose Bitcoin ETF saw the biggest increase in holdings over that time period with a net growth of 18.7% to 35,000 BTC, according to Glassnode. An ETF is an exchange-traded fund that allows investors to speculate on the price of an asset without having to hold any themselves. The Purpose Bitcoin ETF, a spot Bitcoin ETF, currently has about $1.68 billion in assets under management. No such spot Bitcoin ETF is currently available in the U.S. but the metrics show that investors are hung...

Grayscale gears up for legal battle with SEC over Bitcoin ETF

Grayscale CEO Michael Sonnenshein said the firm is gearing up for a legal fight if Grayscale’s Bitcoin Spot ETF product is denied by the United States Securities and Exchange Commission (SEC). In an interview with Bloomberg on Tuesday, March 29, Sonnenshein was asked if he would consider the Administrative Procedure Act (APA) lawsuit option if the application for its Bitcoin Spot ETF was denied by the financial regulator. “I think all options are on the table,” he responded, highlighting the importance of continuing to advocate for investors. The next decision date for the approval or denial of the investment product is July 6, 2022, it was previously delayed in February, and was originally filed in October 2021. “The Grayscale team has been putting the full resources of our firm behind co...

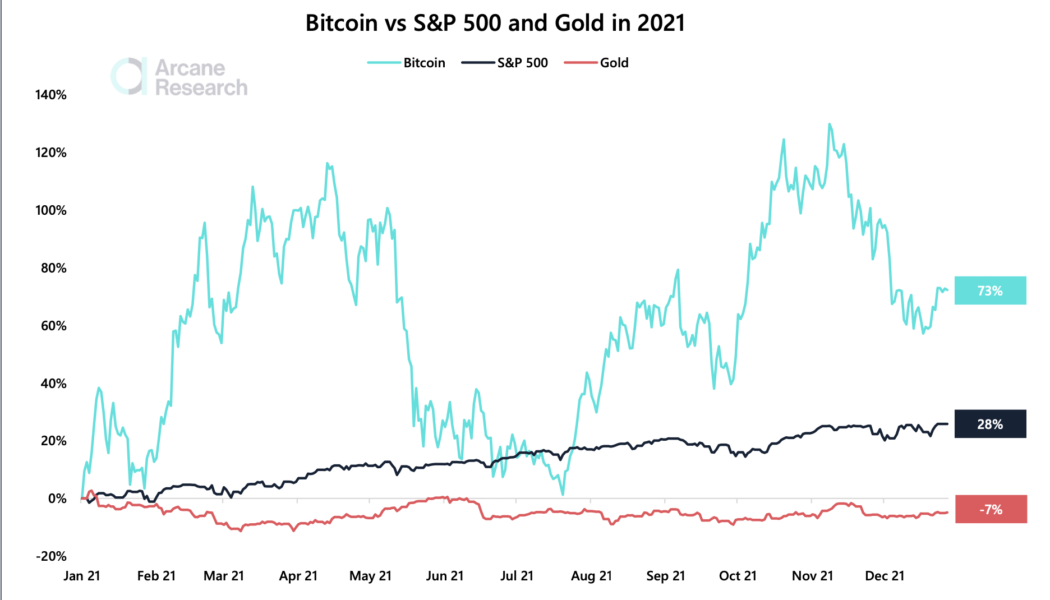

What BTC price slump? Bitcoin outperforms stocks and gold for 3rd year in a row

Bitcoin (BTC) may be down over 30% from its record high of $69,000, but it has emerged as one of the best-performing financial assets in 2021. BTC has bested the United States benchmark index the S&P 500 and gold. Arcane Research noted in its new report that Bitcoin’s year-to-date performance came out to be nearly 73%. In comparison, the S&P 500 index surged 28%, and gold dropped by 7% in the same period, which marks the third consecutive year that Bitcoin has outperformed the two. Bitcoin vs. S&P 500 vs. gold in 2021. Source: Arcane Research, TradingView At the core of Bitcoin’s extremely bullish performance was higher inflation. The U.S. consumer price index (CPI) logged its largest 12-month increase in four decades this November. “Most economists didn’t see the hig...