Bitcoin Cash

Coinbase Wallet will stop supporting BCH, ETC, XLM and XRP, citing ‘low usage’

Starting on Dec. 5, the Coinbase Wallet will no longer support four major tokens. In a Nov. 29 notice on its help pages, Coinbase said the wallet will no longer support Bitcoin Cash (BCH), XRP (XRP), Ethereum Classic (ETC), and Stellar (XLM) as well as their networks. The crypto firm cited “low usage” of the four tokens in its decision to stop support starting on Dec. 5. “This does not mean your assets will be lost,” said the announcement. “Any unsupported asset that you hold will still be tied to your address(es) and accessible through your Coinbase Wallet recovery phrase.” Source: Coinbase This story is developing and will be updated. [flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=&...

Top 5 cryptocurrencies to watch this week: BTC, ETH, BCH, AXS, EOS

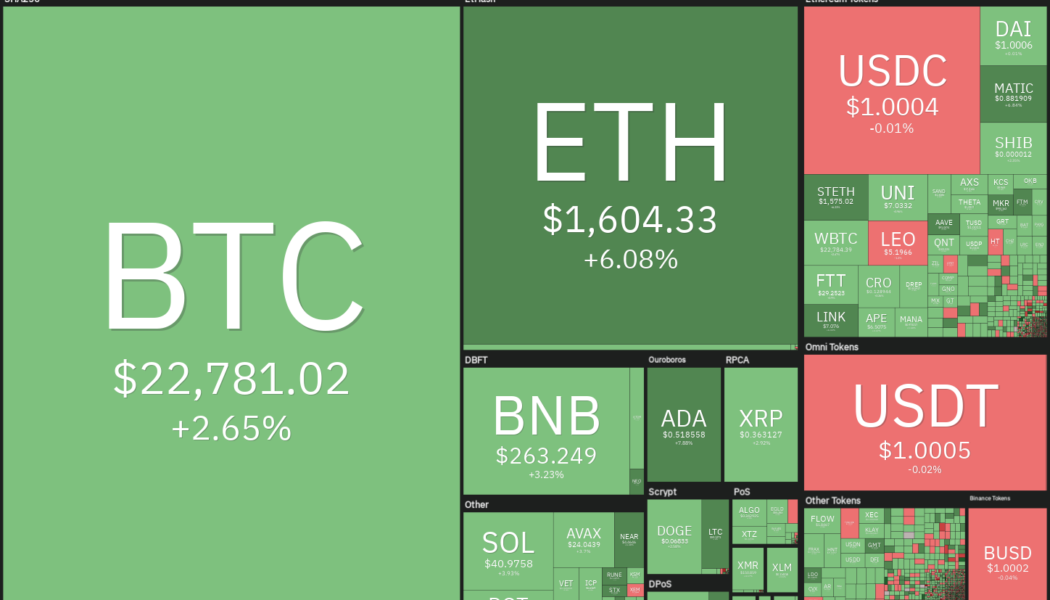

The bulls are attempting to achieve a strong weekly close for Bitcoin (BTC), while the bears are attempting to regain their advantage. Analysts are closely watching the 200-week moving average which is at $22,705 and BTC’s current setup suggests that a decisive move is imminent. Many analysts expect a weekly close above the 200-week MA to attract further buying but a break below it could signal that bears are back in the game. Although the short-term picture looks uncertain, analyst Caleb Franzen said that Bitcoin has been in an accumulation zone since May. Crypto market data daily view. Source: Coin360 Meanwhile, on-chain analytics firm CryptoQuant highlighted increasing outflows of Ether (ETH) from major exchanges, totaling $1.87 million coins on July 22. Usually, outflows fr...

Do Kwon dismisses allegation of cashing out $2.7B from Terra (LUNA), UST

Do Kwon, the CEO and co-founder of the infamous Terra (LUNA) and TerraUSD (UST) ecosystems, refuted the claims of cashing out $80 million every month for nearly three years. Numerous unconfirmed reports surfaced on June 11, claiming Kwon’s participation in draining liquidity out of LUNA and UST before the crash to purchase US dollar-pegged stablecoin such as Tether (USDT). Rumors about Kwon cashing out LUNA and UST reserves surfaced after a Twitter thread by @FatManTerra shared the alleged details on how Kwon, along with Terra influencers, managed to drain funds while artificially maintaining the liquidity. Some of you thought $80m per month was bad. That’s nothing. Here’s how Do Kwon cashed out $2.7 billion (33 x $80m!) over the span of mere months thanks to Degenbox: th...

3 red flags that signal a crypto project may be misleading investors

Satoshi Nakamoto left a large pair of shoes to fill after releasing the code for Bitcoin (BTC) to the world, helping to establish the network, then vanishing without so much as a trace. Over the years, the crypto ecosystem has seen many developers and protocol creators rise in stature to become crypto messiahs for faithful holders who eventually have their best-laid plans end in catastrophe when the protocol is hacked, rugged or abandoned by whimsical developers. 2022 is hardly halfway complete and the year has already seen a particularly bad stretch of good intentions gone awry, which have collectively helped plunge the market into bear-market territory. Here’s a closer look at each of these instances to help provide insight into how similar outcomes can be avoided in the future. So...

Dogecoin Jesus? Roger Ver resurfaces on Twitter, backs DOGE over BTC

Roger Ver, an early investor and ardent promoter of Bitcoin (BTC) which earned him the moniker “Bitcoin Jesus” has resurfaced on Twitter after a year and backed Dogecoin (DOGE) in an interview, preferring it for payments over the world’s first crypto. In an interview with Bloomberg, the Bitcoin.com founder said how he was a fan of the memecoin due to its fast transaction times and low fees: “Dogecoin is significantly better, it’s cheaper and more reliable [than Bitcoin]. If I had to pick three contenders for the world’s dominant cryptocurrency, they would be Doge, Litecoin and Bitcoin Cash.” Ver also took time in the interview to voice his support for honorary Dogecoin CEO Elon Musk’s Twitter takeover. “It’ll certainly make Twitter more attractive,” said Ver. “I am really, really grateful ...

Top 5 cryptocurrencies to watch this week: BTC, XRP, LINK, BCH, FIL

Bitcoin (BTC) and most major altcoins have been relatively quiet during the holiday period from Good Friday onward. This suggests that cryptocurrency traders are not initiating large bets during the period when the U.S. equities markets are closed. That could be because of the tight correlation between Bitcoin and the S&P 500 and the uncertainty about the equity market’s performance in the next week. While some analysts expect weakness in the near term, others believe that Bitcoin could be in a consolidation phase with a large portion of its upside in the four-year halving cycle yet to come. Josh Olszewicz, head of research at alternative asset management firm Valkyrie, said: “Interesting. Maybe we never got the blow-off top…because it hasn’t happened yet.” Crypto mar...

Bitcoin Cash and Ethereum Classic up double digits as 24-hour trading volume eclipses $100 BN

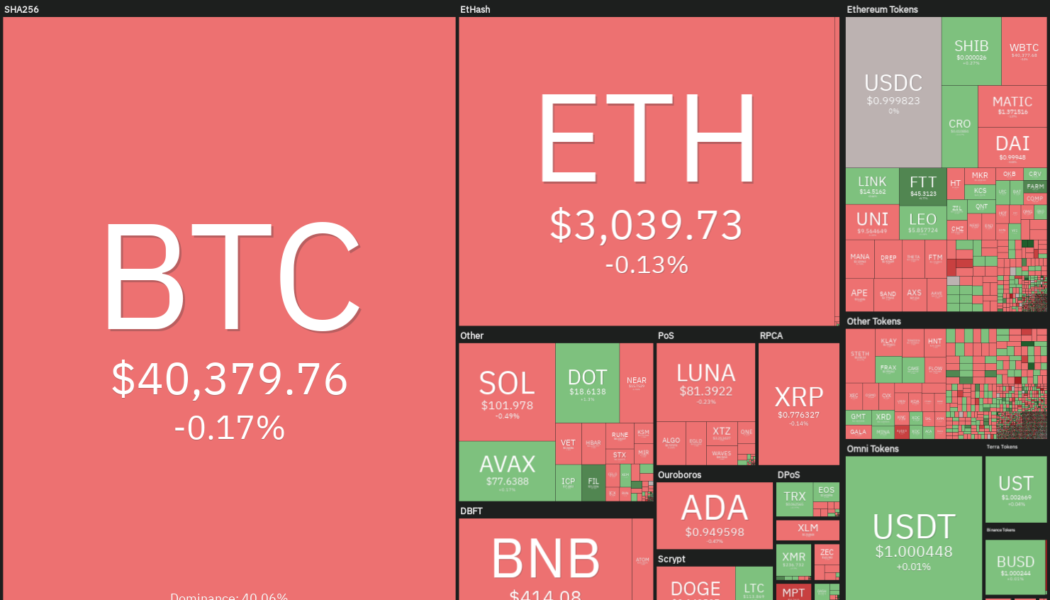

Ethereum has cleared resistance at $3,000 on Tuesday morning Other top altcoins including ADA, DOT, and XRP are trading in the green as well The majority of top cryptocurrencies appear to be gaining ground on Tuesday with the total market capital peaking above $2 trillion. Bitcoin price shot up to a multi-week high of $43,116 in the early Asian trading hours, CoinMarketCap data shows. Although the OG crypto has retreated to around $42,470 as of this writing, it is still trading in the green – up approximately 3% in the last 24 hours. Ether price crossed $3,00o on the strength of the sharp overnight ascent, touching a five-week high of $3,040. Market data further shows that ETH’s 24 hr trading volume has swelled by almost 42% to $19.688 billion. Bitcoin Cash and Ethereum Classic leading gai...

Ethereum co-founder Buterin labels Bitcoin Cash a failure

Buterin was also proud to note that he had foreseen the development of decentralised exchanges like UniSwap Hardly a day into the New Year, Ethereum co-founder Vitalik Buterin went on a “mini-tweetstorm” in which he reviewed comments he has made in the past on crypto-related matters, providing his present standing on the said subjects. One particular view that stood out from his series of tweets was his conclusion that Bitcoin Cash is now largely a failure as he sees it. Launched in August 2017, Bitcoin Cash was developed as a Bitcoin fork that offered larger transaction volumes per block and lowered fees owing to the larger blocks. In its initial stages, the token enjoyed success, and by mid-November in that year, it had surpassed Ethereum in market cap. At that point, Buterin...

SBI Group launches crypto-asset fund for Japanese investors

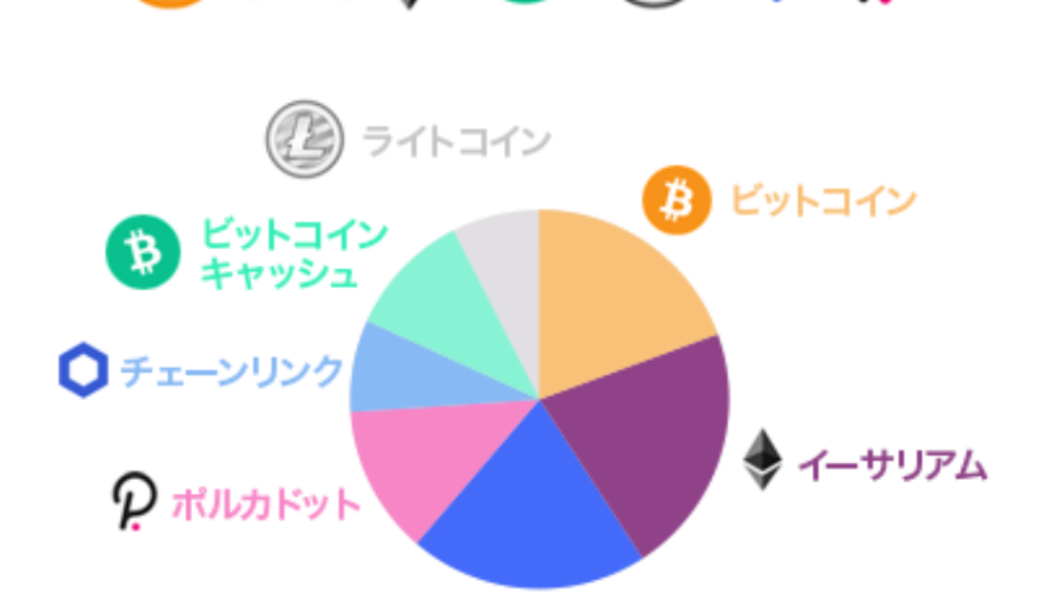

Tokyo’s biggest finserv firm, SBI Group, will now allow general Japanese investors to purchase cryptocurrencies via its newly launched ‘crypto asset fund’. The fund is composed of seven cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP, Bitcoin Cash (BCH), Chainlink (LINK) and Polkadot (DOT). The crypto-asset fund, to be traded and operated by the SBI Alternative Fund, was established on Dec. 02 with a dedicated capital of 5 million yen, worth approximately $45,000 at the time of writing. However, the company may choose to release the capital in smaller break-ups of 1 million yen each. Source: SBI According to the official statement, investors will be required to go through an application process that includes an anonymous partnership agreement with SBI Al...