Bitcoin Blockchain

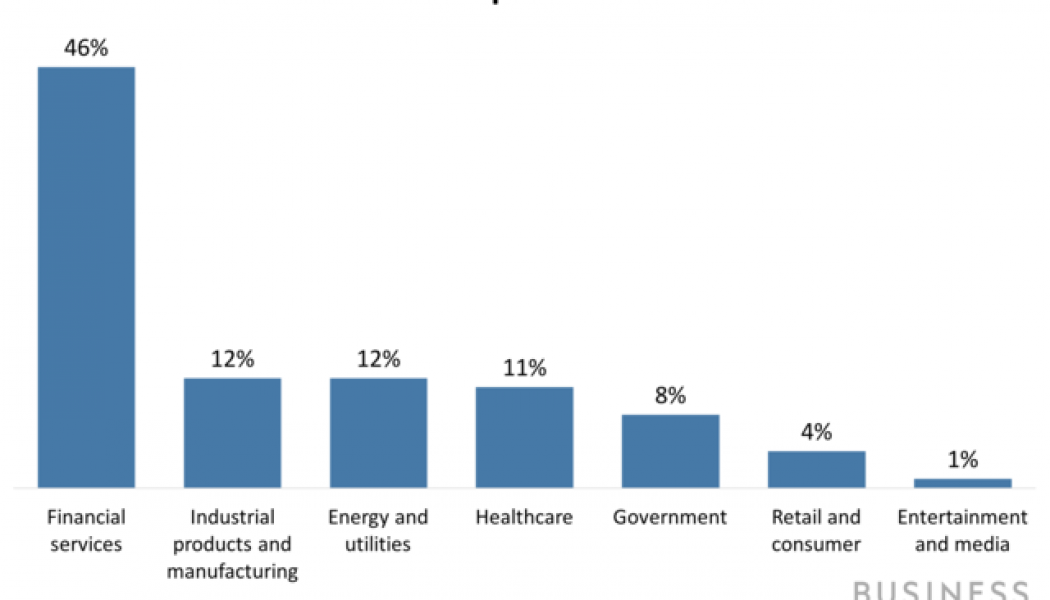

Blockchain Usage in Finance

Most people hear the term blockchain and automatically think of cryptocurrencies, like Bitcoin. We are living in an age where cryptocurrencies actually increasing in their popularity each given day, an example of it is the increasing demand for crypto trading apps. While this is still one of the most popular uses for blockchain technology, it’s still capable of much more. Let’s look at why and how this innovation is used in finance. Blockchain is a unique type of data storage. All types of information, including account numbers and transactions, can be stored as an encrypted code. These codes connect to each other to form larger blocks of data, and then blocks are chained together. The information is stored all over the world rather than in one place. Because data is encrypted ...

Bitcoin is Part of Mainstream Finance, says deVere CEO

Sourced from Ethereum World News. Bitcoin’s historic halving event on Monday underscores that the “long-term future of cryptocurrencies is secure”, says the CEO and founder of one of the world’s largest independent financial advisory organisations. The comments from deVere Group’s Nigel Green come as the world’s supply of Bitcoin was forever slashed. The highly anticipated halving event, occurring only every four years, means that less and less Bitcoin – which is limited to 21 million units – will now be mined. Monday’s was only the third ever halving. In 2012, the number of new Bitcoins issued every 10 minutes fell from 50 to 25. In 2016, it went down from 25 to 12.5. Now, in the 2020 halving, it will drop from 12.5 to 6.25. Nigel Green says that the “Bitcoin halving event has demonstrate...