Bitcoin Block Size

Bitcoin’s bottom might not be in, but miners say it ‘has always made gains over any 4-year period’

Your favorite trader is saying Bitcoin (BTC) bottomed. At the same time, the top on-chain indicators and analysts are citing the current price range as a “generational buy” opportunity. Meanwhile, various crypto and finance media recently reported that Bitcoin miners sending a mass of coins to exchanges are a sign that $17,600 was the capitulation move that pins the market bottom. There’s so much assurity from various anon and doxed analysts on Crypto Twitter, yet Bitcoin price is still in a clear downtrend, and the metrics don’t fully reflect that traders are buying every dip. A critical component of BTC price that many investors often overlook is the condition and sentiment of Bitcoin miners, which is exactly why Cointelegraph had a chat with Rich Ferolo of Blockware Solutions and ...

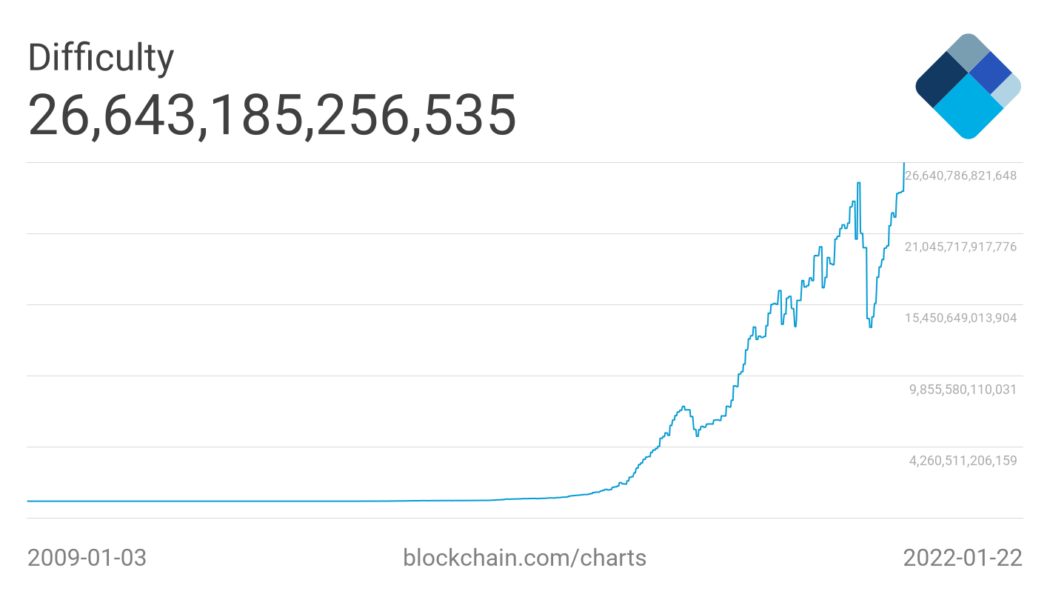

Bitcoin records all-time high network difficulty amid price fluctuations

The Bitcoin (BTC) network has recorded a new all-time high mining difficulty of 26.643 trillion with an average hash rate of 190.71 exahash per second (EH/s) — signaling strong community support despite an ongoing bear market. The Bitcoin network difficulty is determined by the overall computational power, which co-relates to the difficulty in confirming transactions and mining BTC. As evidenced by the blockchain.com data, the network difficulty saw a downfall between May and July 2021 due to various reasons including a blanket ban on crypto mining from China. BTC network difficulty. Source: Blockchain.com. As the displaced miners resumed operations from other countries, however, the network difficulty saw a drastic recovery since August 2021. As a result, on Saturday, the BTC network reco...