Bitcoin Analysis

Valkyrie Investments‘ Leah Wald on Bitcoin ETFs and the future of digital assets

Cointelegraph sat down with Leah Wald, CEO of digital asset investment firm Valkyrie Investments, to learn more about the importance of a Bitcoin (BTC) exchange-traded fund (ETF) and the future of digital assets. For context, Valkyrie Investments was launched in 2020 and is one of the only asset managers to have three Bitcoin-adjacent ETFs trading on the Nasdaq. Valkyrie launched a Bitcoin Strategy ETF in October 2021 that offered indirect exposure to BTC with cash-settled futures contracts following a United States Securities and Exchange (SEC) approval for a similar ETF from ProShares. Valkyrie also has a balance sheet opportunities ETF that invests in public companies with exposure to Bitcoin. In addition, the investment firm’s Bitcoin Miners ETF began trading on the Nasdaq o...

Inflation spikes in Europe: What do Bitcoiners, politicians and financial experts think?

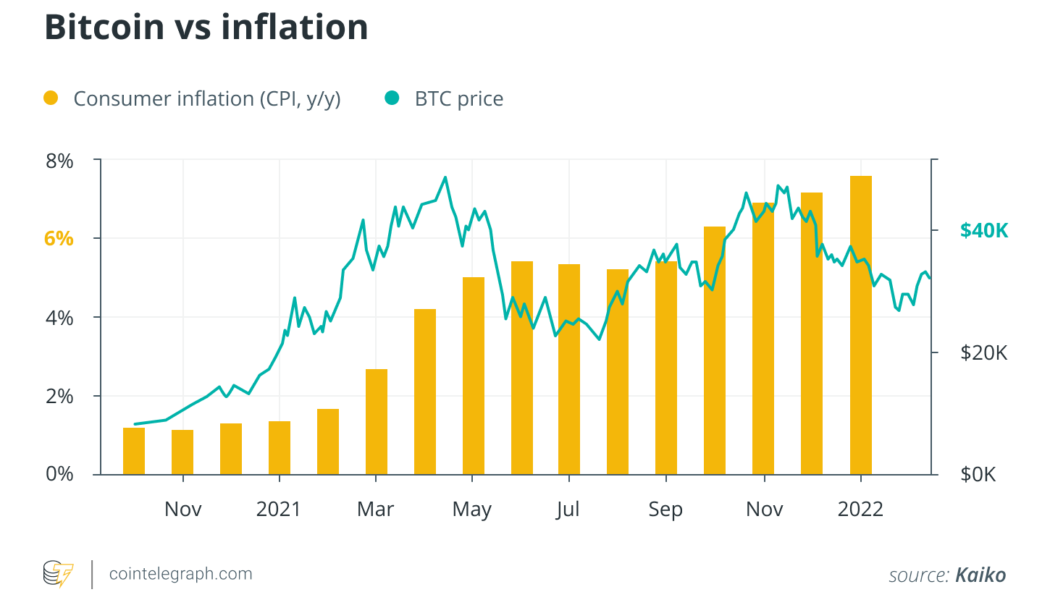

Rising prices are grabbing headlines all over the world. Across the pond in the United States, inflation recently broke a 40-year record. The situation is severe in Europe, with prices rising over 5% across the Eurozone and 4.9% in the United Kingdom. While prices rise, Bitcoin (BTC) is flatlining at around $39,000. It poses many questions: Is Bitcoin an effective hedge against rising prices, what role can Bitcoin play in a high inflation environment and did Bitcoiners know that inflation was coming? Experts from the world of Bitcoin, finance and even European politics responded to these questions, sharing their views with Cointelegraph about the alarming price rises in Europe. From data analysts Kaiko’s monthly report, the Bitcoin price marched ahead of inflation, implying...

Bitcoin rebounds over $41K after painting a ‘bullish hammer’ — Can BTC hit $64K next?

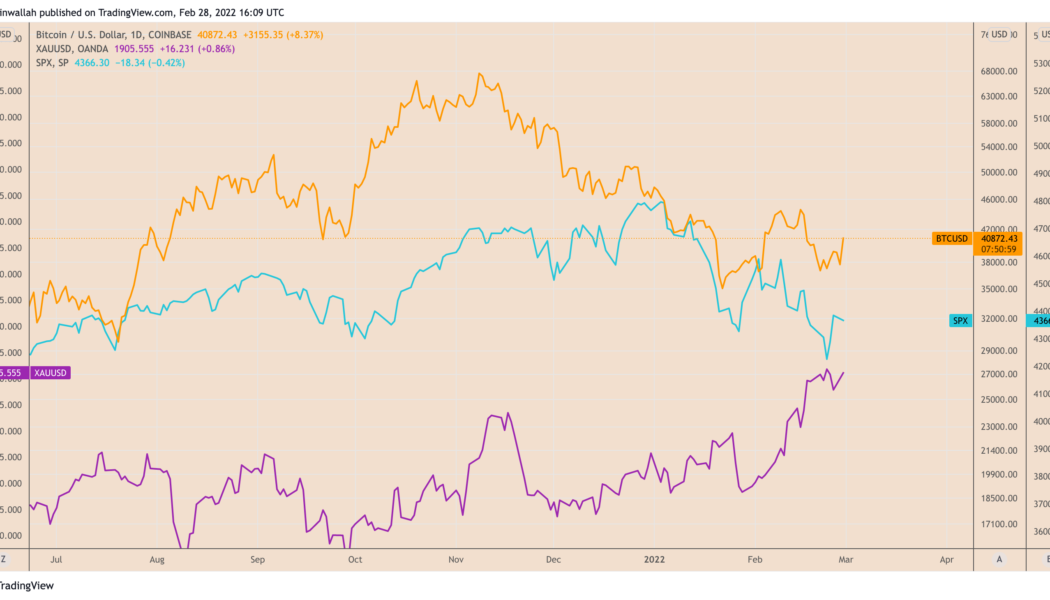

Bitcoin (BTC) rallied above $41,000 on Feb. 28 in a new sign of buying sentiment returning after last week’s brutal selloff across the risk-on markets, including the S&P 500. BTC’s price jumped by over 9% to reach $41,300, in part, as traders reacted to the ongoing development in the Russia-Ukraine crisis. In doing so, the cryptocurrency briefly broke its correlation with the U.S. stock market indexes to perform more like safe-haven gold, whose price also went higher in early trading on Feb. 28. BTC/USD versus XAUUSD and S&P 500 daily price chart. Source: TradingView Bitcoin downtrend exhausting — analyst Johal Miles, an independent market analyst, spotted “significant buying pressure” in the market, adding that its downtrend might be heading towards exhaust...

Bitcoin ‘whales’ and ‘fishes’ pause accumulation as markets weigh March 50bps hike odds

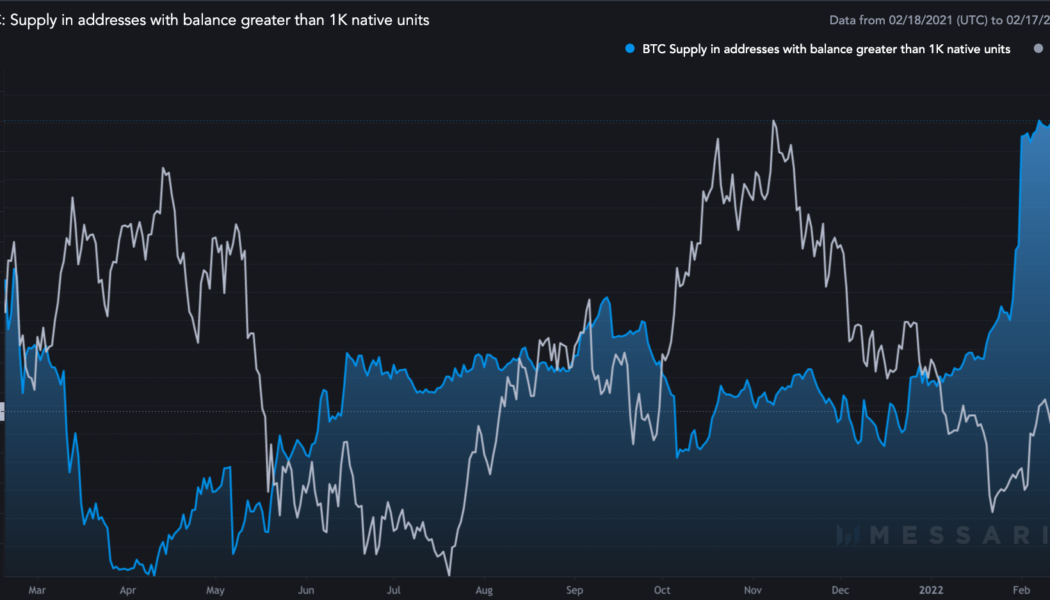

An uptick in Bitcoin (BTC) supply to whales’ addresses witnessed across January appears to be stalling midway as the price continues its intraday correction toward $42,000, the latest data from CoinMetrics shows. Whales, fishes take a break from Bitcoin The sum of Bitcoin being held in addresses whose balance was at least 1,000 BTC came to be 8.10 million BTC as of Feb. 16, almost 0.12% higher month-to-date. In comparison, the balance was 7.91 million BTC at the beginning of this year, up 2.4% year-to-date. Bitcoin supply in addresses with balance greater than 1,000 BTC. Source: CoinMetrics, Messari Notably, the accumulation behavior among Bitcoin’s richest wallets started slowing down after BTC closed above $40,000 in early February. Their supply fluctuated with...

Bitcoin crash ahead? Expert warns higher inflation could whip BTC price to $30K

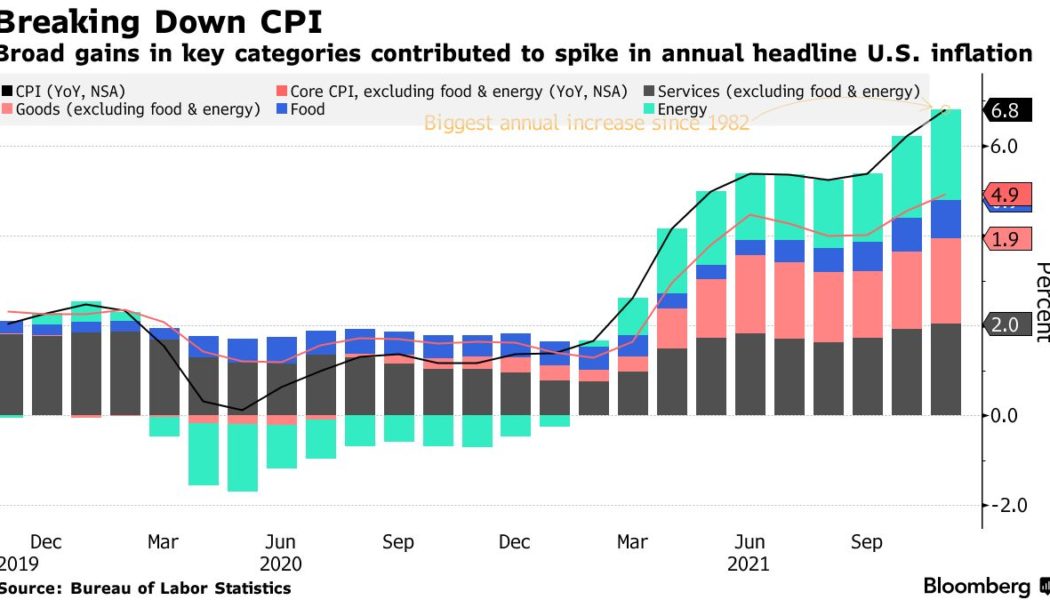

Bitcoin (BTC) may end up falling to as low as $30,000 if the U.S. inflation data to be released on Wednesday comes any higher than forecasted, warns Alex Krüger, founder of Aike Capital, a New York-based asset management firm. The market expects the widely-followed consumer price index (CPI) to rise 7.1% for the year through December and 0.4% month-over-month. This surge highlights why the U.S. Federal Reserve officials have been rooting for a faster normalization of their monetary policy than anticipated earlier. U.S. headline inflation. Source: Bureau of Labor Statistics, Bloomberg Further supporting their preparation is a normalizing labor market, including a rise in income and falling unemployment claims, according to data released on Jan. 7. “Crypto assets are at the furthest en...

- 1

- 2