Bitcoin Analysis

Is this a bull run or a bull trap? Watch The Market Report live

This week on The Market Report, the resident experts at Cointelegraph discuss whether the recent and long-awaited Bitcoin (BTC) price rally is a bull run and the beginning of the next bull market or whether it is just a bull trap and investors should be cautious. We start off this week’s show with the latest news in the markets: Bitcoin price breakout or bull trap? 5K Twitter users weigh in Bitcoin is trading at its highest levels in over two months, but the phrase on every trader’s lips is “bull trap.” After delivering 25% returns in a single week, BTC/USD remains under suspicion among Bitcoin bear market survivors. Crypto Twitter is abuzz with everyone from professional traders to crypto newbs weighing in on the recent price action. Some are calling it a bull trap, while others...

Bitcoin price rally over $21K prompts analysts to explore where BTC price might go next

After Bitcoin (BTC) hit a yearly high of $21,095 on Jan. 13, where is it headed next? Bitcoin is currently witnessing an uptick in bullish momentum after the positively perceived Consumer Price Index (CPI) report was followed by a strong rally across the crypto market. The recent rally in Bitcoin is creating increased volume levels and higher social engagement on whether the price is in a breakout of fakeout mode. Is the Bitcoin bear market over? While the market is still technically in a bear market compared to last week, investor sentiment is improving. According to the Fear and Greed Index, a crypto-specific metric that measures sentiment using five weighted sources, investors’ feelings about the market hit a monthly high. Bitcoin Fear and Greed index. Source: alternative.me Bitco...

How bad is the current state of crypto? On-chain analyst explains

Despite the market downturn and the widespread negative sentiment in the industry in the wake of the FTX collapse, on-chain data still show reasons to be bullish on Bitcoin (BTC). As pointed out by on-chain analyst Will Clemente, it’s enough to look at the positions of long-term holders, which reached an all-time high despite their profitability being at an all-time low. “Long-term holders buy heavily into the bear market. They set the floor, […] and then those long-term holders distribute their holdings to new market participants in the bull market,” he told Cointelegraph in an exclusive interview. Another positive trend worth noticing after the FTX collapse, in Clemente’s opinion, is that the average crypto user is increasingly turning away from exchanges and taking self-cust...

When will the crypto bear market end? Watch The Market Report

On this week’s The Market Report show, Cointelegraph’s resident experts discuss how much longer this crypto bear market could possibly last and when we could see some volatility back in the markets. To kick things off, we break down the latest news in the markets this week: Bitcoin price edges closer to $20K as ‘way worse’ US data boosts stocks A relief bounce on risk assets looks in store after Empire State Manufacturing Index numbers for October fall far short of expectations. The numbers fell to -9.1 for October, heavily below the forecast -4.3 and September’s -1.5 reading. Some industry analysts consider this to be way worse than expected, but could this actually cause Bitcoin (BTC) to rally in the near future? Bitcoin clings to $19K as trader promises capitulation ‘will happen’ B...

Autumn bulls vs. winter bears — Will October be bullish or bearish for Bitcoin? Watch Market Talks

In this week’s episode of Market Talks, we welcome Rekt Capital, a cryptocurrency analyst who shares macro research, commentary and technical analysis related to crypto markets. He publishes a popular newsletter and provides courses that help educate traders on how to make informed decisions when buying and selling cryptocurrencies. He has more than 328,000 followers across his various social media platforms, many of whom are prominent individuals, including big names like Binance CEO Changpeng Zhao. First things first, we have officially entered Q4 2022 and, more importantly, October, which has historically been a bullish month for cryptocurrencies. We ask Rekt Capital if he thinks this trend is likely to continue or if we are headed toward more downside for Bitcoin (BTC). ...

Why $20.8K is a critical level for Bitcoin | Find out now on Market Talks with Charlie Burton

In this week’s episode of Market Talks, we welcome professional trader Charlie Burton. Charlie is a professional trader with 24 years of experience and has been trading full-time since 2001. He is the founder of EzeeTrader and Charlie Burton Trading. He is also undefeated in the annual London Forex show live trade-off for the five years it was running. He has also been featured in the hugely popular BBC documentary “Trader, Millions by the Minute.” Charlie is one of the very few trading educators who is also a professional money manager trading FCA-regulated capital. The main topic of discussion with Charlie will be the current support level for Bitcoin (BTC) and why it is so critical. If Bitcoin goes below its current support, what are other major price levels you should...

Bitcoin likely to transition to a risk-off asset in H2 2022, says Bloomberg analyst

Bitcoin is likely to transition from a risk-on to a risk-off asset in the second half of 2022, as the macroeconomic environment is rapidly shifting towards a recession, said Mike McGlone, senior commodity strategist at Bloomberg, in a recent interview with Cointelegraph. McGlone predicted: “ I see it transitioning to be more of a risk-off asset like bonds and gold, then less of a risk-on asset like the stock market.” According to the analyst, the crypto market has flushed out most of the speculative excesses that marked 2021 and it is now ripe for a fresh rally. McGlone also pointed out that the Fed’s aggressive hiking of interest rates will lead the global economy to a deflationary recession, which will ultimately favor Bitcoin: “I fully expect we’re going to have a prett...

A short-term BTC rally or trend reversal? Find out now on ‘Market Talks’ with Crypto Jebb

The latest episode of Market Talks welcomes Nicholas Merten, the founder of DataDash, one of the largest cryptocurrency YouTube channels. Merten is an international speaker, thought leader and crypto analyst. He has utilized his 10-plus years of experience in traditional markets to understand the potential of cryptocurrencies and help his 515,000 YouTube subscribers make better investment decisions. One of the topics up for discussion with Merten isthe recent Bitcoin (BTC) price rally. Are the markets finally out of the sideways trend it’s been stuck in for months, or is this just another bull trap forming, with BTC to head back down below $20,000? With all seasoned traders and experts eyeing the BTC 200-week moving average, Merten is asked the significance of this indicator and why many c...

Bitcoin’s longest ‘extreme fear’ streak finally breaks

Bitcoin (BTC) on Tuesday finally escaped the “extreme fear” zone after a whopping 73 days, coinciding with a 19% weekly increase in Bitcoin (BTC) as bulls make their way back to the market. The Crypto Fear and Greed Index increased from “extreme fear” to merely “fearful” on July 19, reaching a score of 30 out of 100. It has gained slightly since then to the current index score of 31. The Index analyzes the current sentiment of the overall crypto market, scoring between 0 to 100. The index is based on mainly on Bitcoin market volatility, volume and dominance, social media sentiment, surveys and search trend data. On-chain metrics firm Santiment on Twitter noted that traders are “changing their tune” and are starting to look towards a long-term breakout of the cryptoc...

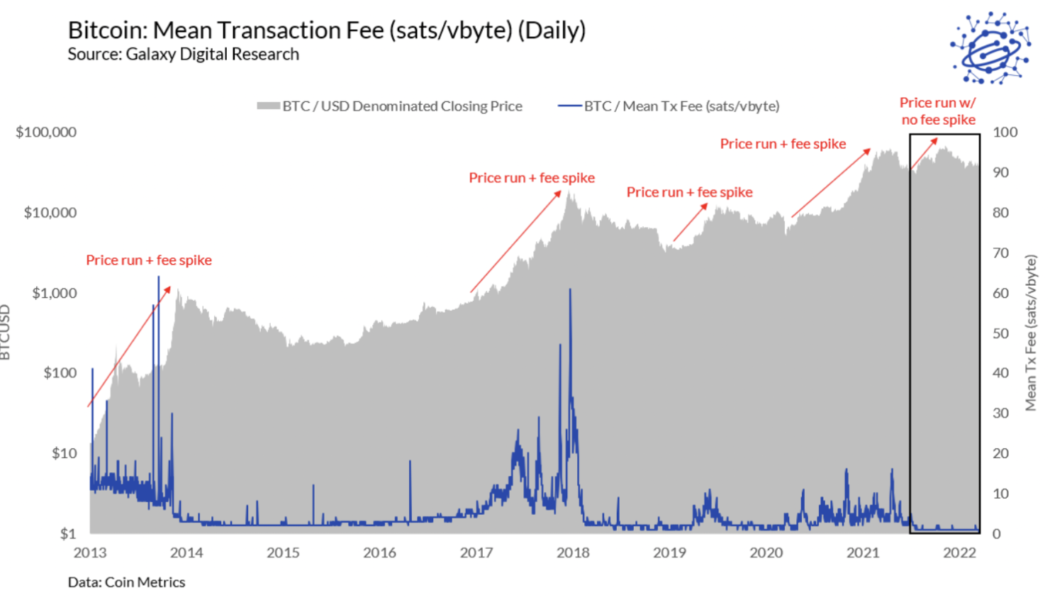

Bitcoin transaction fees hit decade lows, here’s why

It’s a great time to move Bitcoin (BTC) between wallets and exchanges. Bitcoin transaction fees have hit all-time lows in BTC, according to research by Galaxy Digital. #bitcoin fees are at all-time lows. the craziest thing? fall 2021 was the first bull run not accompanied by a major spike in fees. how is that possible? what does it mean? here’s a thread explaining the most confounding (and awesome) chart in bitcoin. (remember june 2021) pic.twitter.com/gnWssTckX2 — Alex Thorn (@intangiblecoins) April 5, 2022 As shown on the graph below, the Bitcoin mean transaction fee has plummeted to 0.00004541 Bitcoin ($2.06) in 2022, while the median is 0.00001292 Bitcoin ($0.59) which is the lowest of any year except 2011, according to the report. Graph to show the fees trending down ...

- 1

- 2