Binance

Finance Redefined: DeFi market fell off the cliff in Q2, but there’s hope

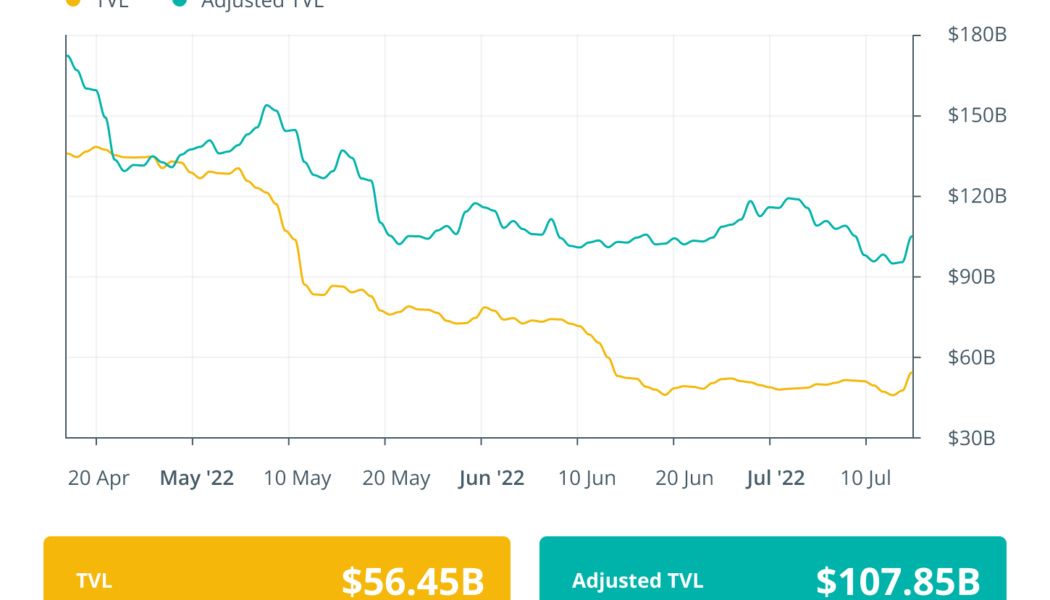

Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights, a newsletter crafted to bring you some of the major developments over the last week. This past week, the DeFi ecosystem saw several new developments despite a bearish phase brought on by the lending crisis in the crypto market. Another crypto lender, Celsius, with high stakes in DeFi protocols, filed for bankruptcy. The overall DeFi market fell to new lows in the second quarter. However, a new report indicates users haven’t given up hope. BNB Chain launched a new decentralized application (DApp) platform with an alarm feature. Vermont state regulator opened an investigation into troubled crypto lender Celsius, deeming it deeply insolvent. A DeFi researcher has predicted that Ethereum proof-of-stake...

Binance ban off the cards, says Philippine trade and industry department

A proposal to ban global cryptocurrency exchange Binance from operating in the Philippines will not gather steam due to a lack of regulations towards cryptocurrencies in the country. The Philippines’ Department of Trade and Industry (DTI) has cited no clear guidelines set out by the country’s central bank, Banko Sentral ng Pilipinas (BSP), as a dead-stop after a lobbying group called for the prohibition of Binance in early July. Local think tank Infrawatch PH had asked the DTI to investigate Binance for the promotion of its services and offerings, which the group believes was done without the necessary permits. Binance had looked to acquiesce the parties involved, telling Cointelegraph that it intends to secure virtual asset service provider and e-money issuer licenses in the Philippines. ...

Binance ban off the cards, says Philippine trade and industry department

A proposal to ban global cryptocurrency exchange Binance from operating in the Philippines will not gather steam due to a lack of regulations towards cryptocurrencies in the country. The Philippines’ Department of Trade and Industry (DTI) has cited no clear guidelines set out by the country’s central bank, Banko Sentral ng Pilipinas (BSP), as a dead-stop after a lobbying group called for the prohibition of Binance in early July. Local think tank Infrawatch PH had asked the DTI to investigate Binance for the promotion of its services and offerings, which the group believes was done without the necessary permits. Binance had looked to acquiesce the parties involved, telling Cointelegraph that it intends to secure virtual asset service provider and e-money issuer licenses in the Philippines. ...

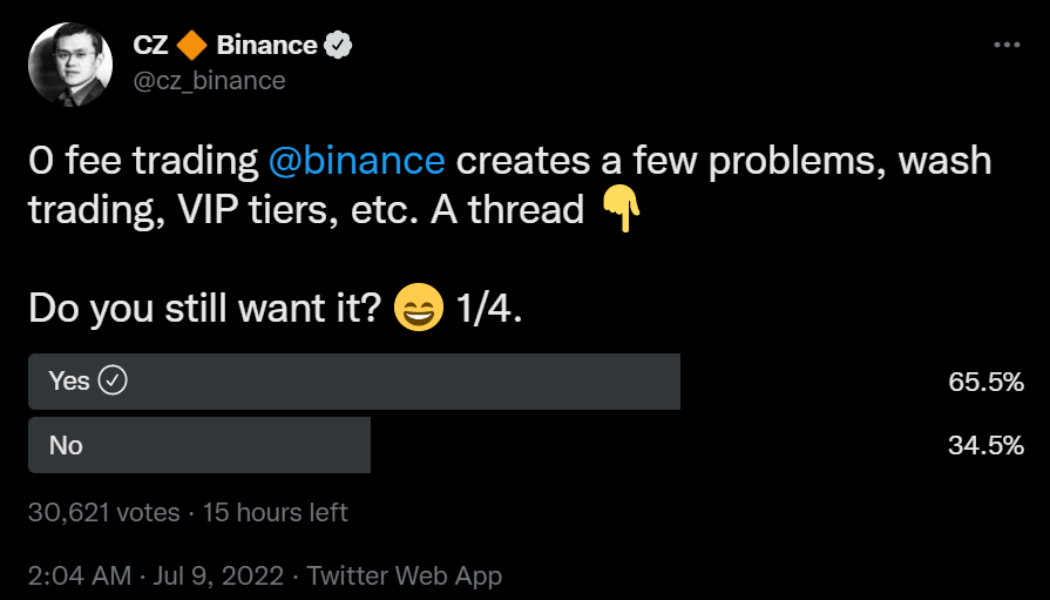

Binance users support 0-fee trading despite CZ’s wash trading concerns

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...

Binance users support 0-fee trading despite CZ’s wash trading concerns

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...

Unizen ‘CeDeFi’ smart exchange secures $200M investment from GEM

Cryptocurrency exchange Unizen has scored a $200 million investment from private equity group Global Emerging Markets (GEM) which it will use to expand its business and its ecosystem. Rather than receiving the $200 million in funding all at once, Unizen noted on June 27 that the investment will come in the form of a “capital commitment’, with part of the funding released upfront and the rest will be provided later based on achieved milestones. Unizen did not disclose what particular criteria it had to achieve to receive the funding. Unizen calls itself a “CeDeFi” exchange mixing features of both centralized exchanges (CEXs) and decentralized exchanges (DEXs), it runs on the BNB Chain, formerly called the Binance Smart Chain. It aims to attract both retail and institutional investors by fin...

‘Bad’ crypto projects should not be bailed out says Binance founder CZ

Binance founder and CEO Changpeng “CZ” Zhao argues that “bad” crypto projects should be left to fail and not receive bailouts from crypto firms with healthy cash reserves. In a June 23 blog post, CZ said that firms that have been poorly operated, poorly managed or have released poorly designed products shouldn’t receive bailouts — and should instead be left to crumble: “In short, they are just ‘bad’ projects. These should not be saved. Sadly, some of these ‘bad’ projects have a large number of users, often acquired through inflated incentives, ‘creative marketing, or pure Ponzi schemes.” “Further, in any industry, there are always more failed projects than successful ones. Hopefully, the failures are small, and the successes are large. But you get the idea. Bailouts here don’t make s...

Binance-owned Trust Wallet adds buy option via Binance Connect

Trust Wallet, a major self-custodial cryptocurrency wallet owned by the Binance crypto exchange, has completed a significant integration to enable easier crypto purchases. The Trust Wallet platform has integrated Binance’s official fiat-to-crypto provider Binance Connect, allowing users to purchase more than 200 crypto assets directly from credit or debit cards, the firm announced to Cointelegraph on June 22. Trust Wallet’s new crypto buy option is designed to simplify the process of buying crypto, enabling verified Trust Wallet users to fund their wallet with more than 40 fiat currencies. In order to add funds on Trust Wallet via Binance Connect, users will need to proceed with the similar Know Your Customer (KYC) checks to those on Binance. “It will keep a similarly high standard and pro...

Weekly Report: The latest on Panama’s crypto bill, Huobi to exit Thailand market, Circle launches a Euro-backed stablecoin, and more

Here are all the interesting headlines you missed outside the crypto market this week: Panama’s President vetoes crypto bill over money-laundering concerns Panama President Laurentino Cortizo on Thursday shot down a crypto bill introduced in September 2021 with a scope covering several cryptocurrencies, unlike El Salvador’s that major in Bitcoin. Cortizo partially vetoed the bill, citing non-compliance with the recent FAFT recommendation on fiscal transparency and prevention of money laundering. If the bill were to be approved, it would allow Panamanian natives to buy everyday goods and services using digital assets like Bitcoin, Ethereum, and Litecoin among other crypto coins. The bill would also make digital assets mainstream for settling taxes or any fee owed by the state. Additionally,...

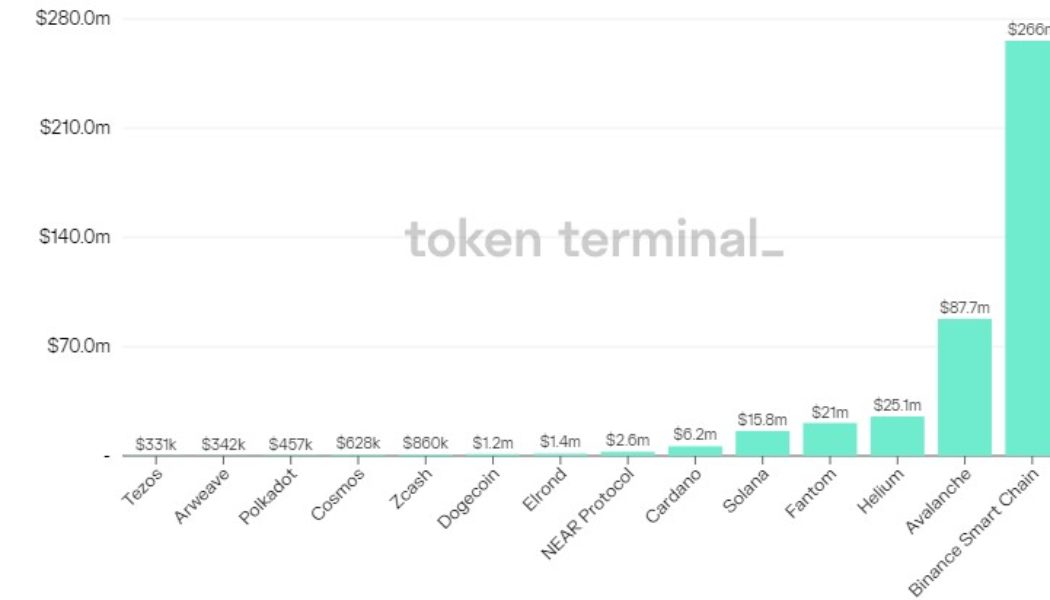

How Ankr transformed the scalability of the BNB Chain

Cryptocurrency’s tussle with scalability is well known. Ethereum suffers from sky-high gas fees making it unusable for a lot of customers, leading to a lot of alternative Layer-1’s popping up. Binance, one of the world’s leading exchanges, was one such firm to develop its very own blockchain. While some criticise the BNB Smart Chain for being centralised, one cannot argue against the basement-level fees and impressive scalability that it offers. Its impressive performance is partially due to Ankr, the Web3 infrastructure provider. Consulting with the Binance team, Ankr implemented several open-source performance improvements which transformed the network. There was a 10x increase in RPC request throughput, 75% reduction in storage requirements, a sync process that is 100x faste...

Biggest Bitcoin exchange inflows since 2018 put potential $20K bottom at risk

Bitcoin (BTC) could be on the verge of a retail major sell-off as exchange inflows spike to almost three-and-a-half-year highs. Data from on-chain analytics platform CryptoQuant shows users of 21 major exchanges sending coins to their wallets en masse on June 14. Major exchanges finish up 83,000 BTC in a single day As BTC/USD fell to lows of $20,800, panic appeared to set in among traders, and despite a reversal that at one point topped $23,000, few seemed willing to trust that the worst was over. Since then, spot price action has returned to near $21,000, while 24-hour exchange inflows reached 59,376 BTC. According to CryptoQuant data, this is the largest daily inflow since November 30, 2018. On that day, exchanges recorded 83,481 BTC of net inflows. May 9, 2022 ended with 29,082 BTC in n...