Binance

SBF tried to destabilize crypto market to save FTX: Report

Tether executives and Binance CEO Changpeng “CZ” Zhao worried that Sam Bankman-Fried (SBF), former FTX CEO, was attempting to destabilize the crypto market aiming to save the now-bankrupt exchange, according to reports on Dec. 9. Messages seen by The Wall Street Journal of a Signal group chat named “Exchange coordination” reveals an argument between CZ and SBF on Nov. 10 about Tether’s stablecoin USDT. According to the report, CZ and others in the group worried that trades made by Alameda Research were focusing on depeg the stablecoin, which would have a ripple effect in crypto prices. Binance CEO reportedly confronted SBF: “Stop trying to depeg stablecoins. And stop doing anything. Stop now, don’t cause more damage.” SBF denied the claims in a statement to the WSJ....

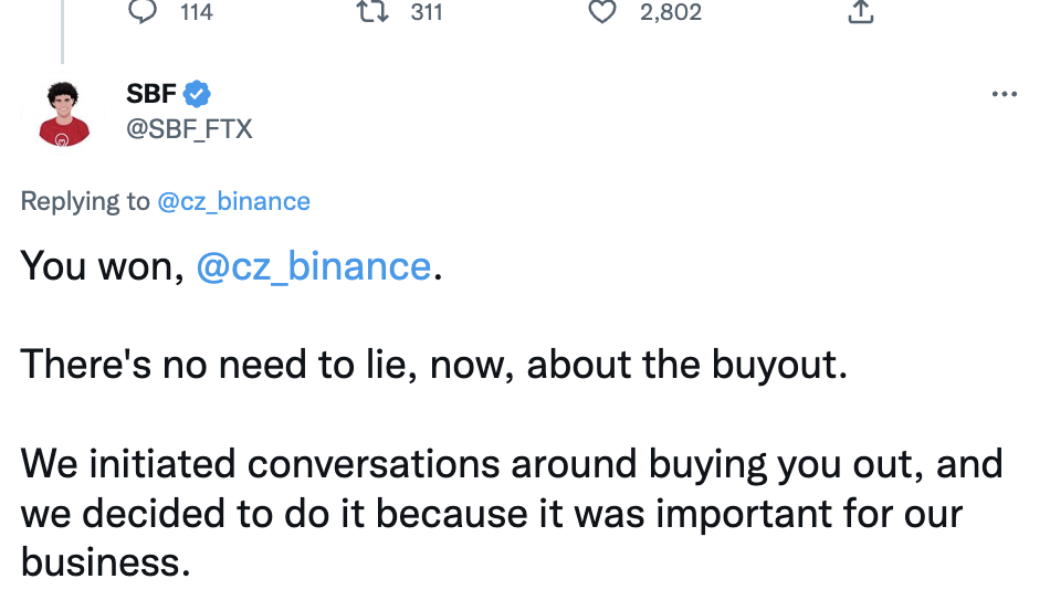

CZ and SBF duke it out on Twitter over failed FTX/Binance deal

Binance CEO Changpeng Zhao, or CZ, and former FTX CEO Sam Bankman-Fried, or SBF, have revealed new details about the failed agreement between the exchanges during FTX’s liquidity crisis in November. In a Dec. 9 Twitter thread, CZ referred to Bankman-Fried as a “fraudster,” saying Binance exited its position in FTX in July 2021 after becoming “increasingly uncomfortable with Alameda/SBF.” According to the Binance CEO, SBF was “unhinged” at the exchange pulling out — a claim that prompted an online response from the former FTX CEO. Bankman-Fried criticized CZ for his public admonition of FTX, adding details about the negotiations between the exchanges amid FTX’s reported “liquidity crunch” in November prior to the firm filing for bankruptcy. SBF said at the time that FTX had reached a ...

Coinbase takes a shot at Tether, encourages users to switch to USDC

United States-based cryptocurrency exchange Coinbase has asked its customers to convert their Tether-issued USDT (USDT) stablecoin to USD Coin (USDC), a USD-pegged stablecoin issued by Circle and co-founded by Coinbase in 2018. The cryptocurrency exchange suggested that USDC is a much more secure alternative in the wake of the FTX collapse saga and has also exempted any fee on the conversion of USDT to USDC on its platform. The firm said: “We believe that USD Coin (USDC) is a trusted and reputable stablecoin, so we’re making it more frictionless to switch: starting today, we’re waiving fees for global retail customers to convert USDT to USDC.” Stablecoins started out as an onboarding tool for the crypto exchanges in the early days of crypto, but today they have become a key mark...

Binance acquires regulated crypto exchange in Japan

Cryptocurrency exchange Binance plans to reenter the Japanese market after acquiring a 100% stake in a licensed crypto service provider in the country, Cointelegraph Japan reported. In an official public announcement on Nov. 30, Binance CEO Changpeng Zhao said the crypto exchange was committed to re-entering the Japanese market under regulatory compliance. The acquisition of Sakura Exchange BitCoin (SEBC), a Japan Financial Services Agency-licensed business, would mark the re-entry of global exchange in the Japanese market after four years. #Binance Acquires JFSA Registered Sakura Exchange BitCoin, Committed to Enter Japan Under Regulatory Compliancehttps://t.co/xfdnaY2hiO — CZ Binance (@cz_binance) November 30, 2022 Talking about the importance of the latest acquisition, a Binance spokesp...

OpenSea Seaport Protocol onboards creators and NFT holders on BNB Chain

Crypto collectibles and nonfungible token (NFT) marketplace OpenSea announced plans to integrate BNB Chain on Seaport Protocol by the end of Q4 2022. The integration will allow users to buy, list and trade BNB Chain NFTs on the OpenSea marketplace. BNB Chain was built by Binance to operate as a Web3-focused blockchain network powered by the exchange’s in-house token, Binance Coin (BNB). BNB Chain’s integration into OpenSea’s Seaport Protocol aims to provide BNB Chain creators with multiple creator payouts, real-time payouts and collection management, among others. Sharing insights into the move, Gwendolyn Regina, Investment Director at BNB Chain, revealed her intent to deliver better experiences to NFT creators and users. She added: “The integration will bring a large number of...

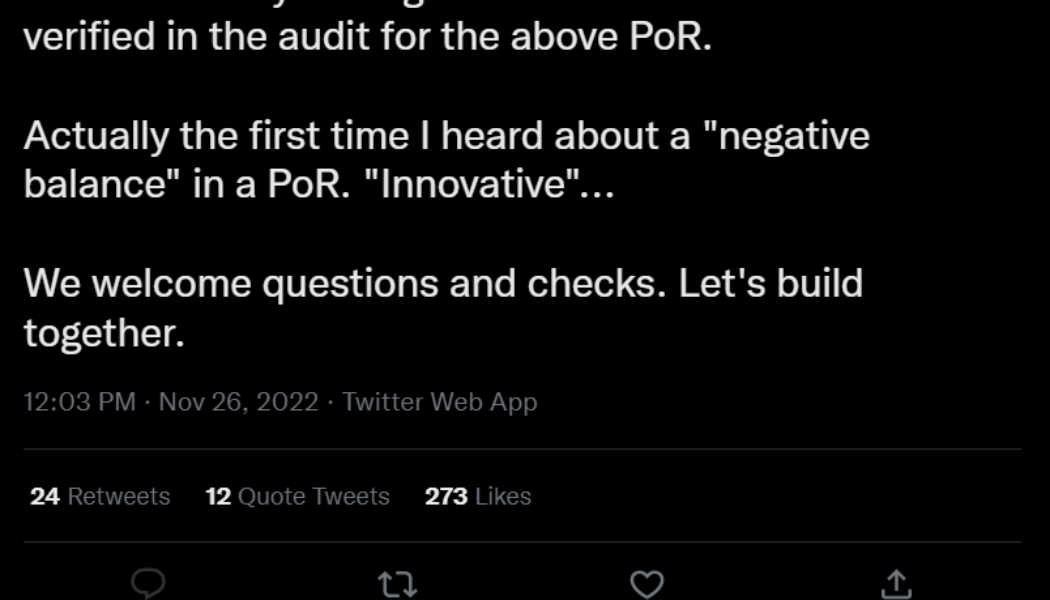

Binance proof-of-reserves is ‘pointless without liabilities’: Kraken CEO

Disclaimer: The article has been updated to reflect Binance CEO CZ’s response to the concerns raised by Kraken CEO Jesse Powell. The collapse of the crypto exchange FTX revealed the importance of proof-of-reserves in avoiding situations involving the misappropriation of users’ funds. While exchanges have proactively started sharing wallet addresses to prove the existence of users’ funds, several entrepreneurs, including Kraken CEO and co-founder Jesse Powell, called the practice “pointless” as exchanges fail to include liabilities. According to Powell, a complete proof-of-reserve audit must include the sum of client liabilities, user-verifiable cryptographic proof that each account was included in the sum and signatures proving the custodian’s control over the wallets. Whil...

Binance aims to allocate $1 billion for crypto recovery fund

Binance intends to allocate $1 billion for a proposed industry recovery fund while its CEO revealed intent in a new bid for assets of bankrupt cryptocurrency lending firm Voyager by its U.S.-based business. Speaking to BloombergTV on Nov. 24, Binance CEO Changpeng Zhao touched on a number of topics in what has been a tumultuous month for the cryptocurrency ecosystem. Chief among them was Binance’s proposed industry recovery fund which is aimed at providing financial support to promising projects in financial distress. The exchange’s founder introduced the idea in the wake of FTX’s now-infamous collapse. Related: Binance CEO denies report firm met with Abu Dhabi investors for crypto recovery fund Zhao said that details of the fund were due to be published on the exchange’s blog in the comin...

Crypto Twitter reacts to Binance CEO’s deleted tweet about Coinbase’s Bitcoin Holdings

Coinbase was trending on Twitter on Nov. 22 after Binance CEO Changpeng Zhao, known also as CZ, sent out a tweet that appeared to question Coinbase’s Bitcoin holdings. In the since deleted tweet, CZ referenced a yahoo finance article that alleged that “Coinbase Custody holds 635,000 BTC on behalf of Grayscale.” CZ added, “4 months ago, Coinbase (I assume exchange) has less than 600K,” with a link to a 4 month old article from Bitcoinist. The Binance CEO made it clear that he was simply quoting “news reports”, and not making any claims of his own. However, his tweet was not received well by the crypto community. A screenshot of CZ’s since-deleted tweet. Shortly after, Coinbase CEO Brian Armstrong indirectly responded to CZ in a series of tweets, stating; “If you see FUD ou...

Banks still show interest in digital assets and DeFi amid market chaos

The cryptocurrency sector is the Wild Wild West in comparison to traditional finance, yet a number of banks are showing interest in digital assets and decentralized finance (DeFi). This year in particular has been notable for banks exploring digital assets. Most recently, JPMorgan demonstrated how DeFi can be used to improve cross-border transactions. This came shortly after BNY Mellon — America’s oldest bank — announced the launch of its Digital Asset Custody Platform, which allows select institutional clients to hold and transfer Bitcoin (BTC) and Ether (ETH). The Clearing House, a United States banking association and payments company, stated on Nov. 3 that banks “should be no less able to engage in digital-asset-related activities than nonbanks.” Banks aware of potential While ba...

Crypto industry was ‘judge, jury and executioner’ for FTX: Pompliano

Prolific podcaster and cryptocurrency investor Anthony Pompliano has not lost faith in people or the crypto industry despite the disappointing conduct of former FTX CEO Sam Bankman-Fried. Bankman-Fried, once widely regarded as crypto’s “white knight” is now a pariah in the crypto industry due to — by his own admission — the “careless” mishandling of FTX customer funds and his ongoing strange behavior on Twitter. Appearing on Nov. 17 at the Texas Blockchain Summit, Pompliano was asked about how to ensure high-quality representation “in the halls of power,” responding that market forces eliminate bad people as quickly as bad businesses: “It might be a little counterintuitive, but the free market is a hell of a fucking referee. If you watch what just happened, this industry is who held the in...

Trust Wallet launches browser extension, integrates with Binance Pay

Following the collapse of FTX and the bank run on crypto exchanges in general, self-custody Trust Wallet is gaining momentum. In one week, the company launched the long-anticipated browser extension and collaborated with Binance, whose users can now transfer their funds directly to a Trust Wallet account. On Nov. 14, Trust Wallet launched its browser extension, now available in Google Chrome and Opera browsers. The extension lets users store, send and receive crypto across all EVM chains and Solana. A network auto-detect function provides users with a seamless dApp experience without the need to manually add networks. The extension also includes multi-wallet support, NFT support, fiat on-ramp providers, and non-EVM blockchain integrations, as well as hardware wallet support. On Nov. ...