Binance Coin

BNB jumps to new BTC all-time high as Elon Musk’s Twitter fuels DOGE bulls

BNB (formerly known as Binance Coin) has hit new all-time highs against Bitcoin (BTC) as excitement grows over the cryptocurrency’s future role on Twitter. BNB/BTC 1-month candle chart (Binance). Source: TradingView BNB sets new record against BTC Data from Cointelegraph Markets Pro and TradingView confirms that BNB/BTC briefly spiked above 0.15 BTC to a record 0.15267 BTC on Oct. 30. BNB, the in-house token of Binance, the largest crypto exchange by volume, has gained around 10% in the past 72 hours. The strong performance came on the back of reports that Binance was preparing to assist Twitter in eradicating bots as part of its new direction under Elon Musk. Binance had contributed $500 million to Musk’s takeover of the social media platform. “Our intern says we wired the $500 ...

Price analysis 10/21: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The 10-year Treasury yield in the United States rose to its highest level since 2008. Although this type of rally is usually negative for risky assets, the U.S. stock markets recovered ground after the Wall Street Journal reported that some officials of the Federal Reserve were concerned about the pace of the rate hikes and the risks of over-tightening. While it is widely accepted that the U.S. will enter a recession, a debate rages on about how long it could last. On that, Tesla CEO Elon Musk recently said on Twitter that the recession could last “probably until spring of ‘24,” and added that it would be nice to spend “one year without a horrible global event.” Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s (BTC) price has witnessed a massive drop from its all-time hig...

BNB Chain responds with next steps for cross-chain security after network exploit

BNB Chain, the native blockchain of Binance Coin (BNB) and the Binance crypto exchange, has been subject to security-related developments over the last month. On Thursday, Oct. 6 the network experienced a multi-million dollar cross-chain exploit. The incident caused BNB Chain to temporarily suspend all withdrawal and deposit activity on the network. Initially, the announcement of the network outage cited “irregular activity” with an update stating it was “under maintenance.” As rumors were confirmed the CEO of Binance, Changpeng Zhao tweeted out an apology for any inconvenience to the BNB Chain community. However the suspension was brief, as the BNB Chain Team announced the network was back online early on Oct. 7, just hours after the attack. As the network regained activity its validators...

Price analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

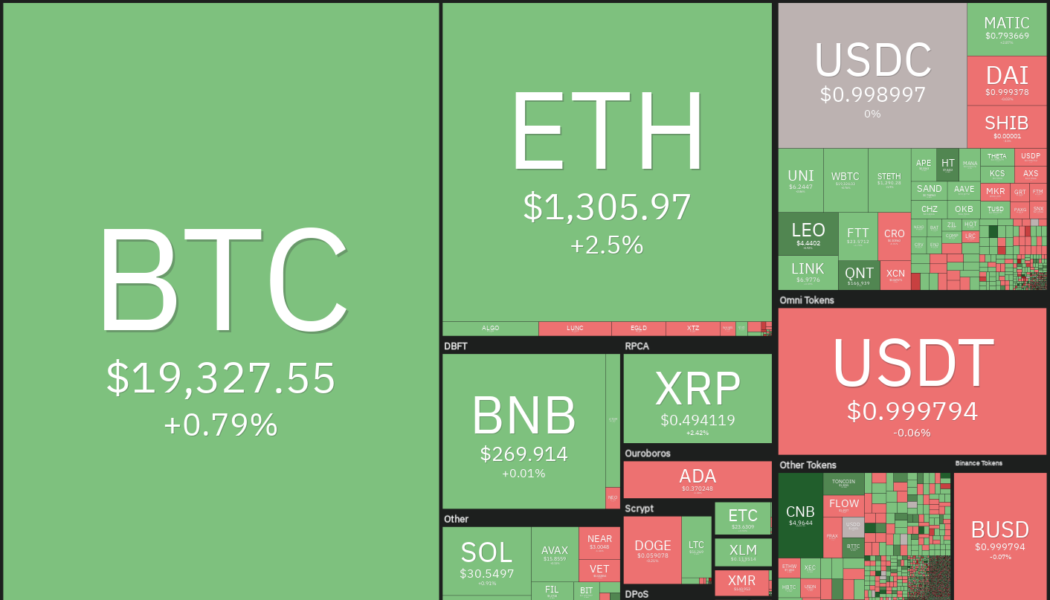

The United States Consumer Price Index (CPI) increased 8.2% annually in September, beating economists’ expectations of an 8.1% rise. The CPI print lived up to its hype and caused a sharp, but short-term increase in volatile risk assets. The S&P 500 oscillated inside its widest trading range since 2020 and Bitcoin (BTC) also witnessed a large intraday range of more than $1,323 on Oct. 13. However, Bitcoin still could not shake out of the $18,125 to $20,500 range in which it has been for the past several days. Daily cryptocurrency market performance. Source: Coin360 Both the U.S. equities markets and Bitcoin tried to extend their recovery on Oct. 14 but the higher levels attracted selling, indicating that the bears have not yet given up. Could the increased volatility culminate wit...

Price analysis 9/30: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The United States equities markets have been under a firm bear grip for a large part of the year. The S&P 500 and the Nasdaq Composite have declined for three quarters in a row, a first since 2009. There was no respite in selling in September and the Dow Jones Industrial Average is on track to record its worst September since 2002. These figures outline the kind of carnage that exists in the equities market. Compared to these disappointing figures, Bitcoin (BTC) and select altcoins have not given up much ground in September. This is the first sign that selling could be drying up at lower levels and long-term investors may have started bottom fishing. Daily cryptocurrency market performance. Source: Coin360 In the final quarter of the year, investors will continue to focus on the inflat...

Price Analysis 9/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

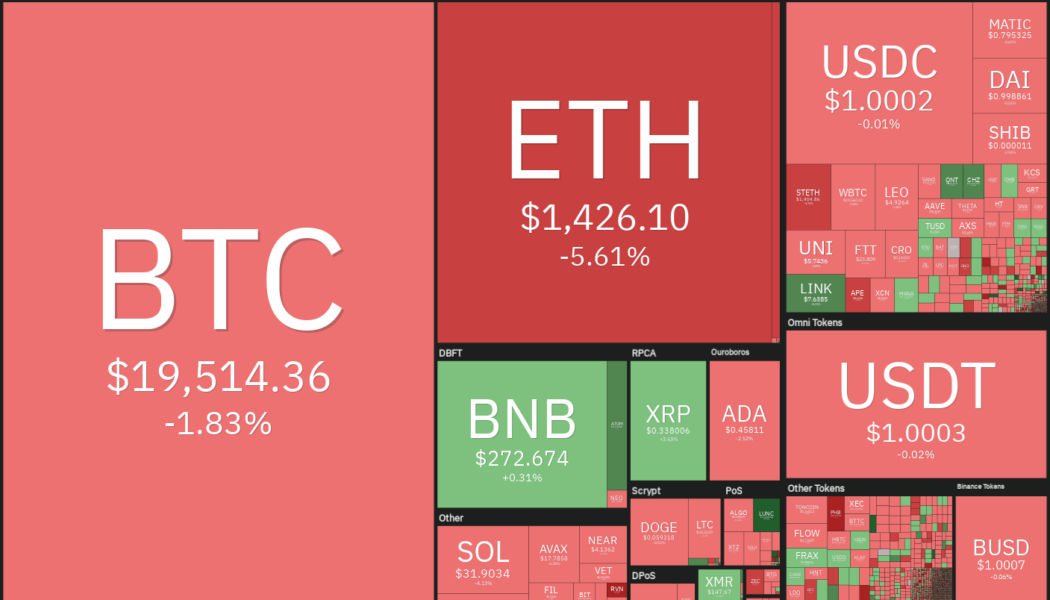

The United Kingdom is in focus following the British pound’s fall to a new all-time low against the United States dollar. The sell-off was triggered by the aggressive tax cuts announced by Prime Minister Liz Truss’s government. The 10-year gilt yields have soared by 131 basis points in September, on track for its biggest monthly increase since 1957, according to Reuters. The currency crisis and the soaring U.S dollar index (DXY) may not be good news for U.S. equities and the cryptocurrency markets. A ray of hope for Bitcoin (BTC) investors is that the pace of decline has slowed down in the past few days and the June low has not yet been re-tested. Daily cryptocurrency market performance. Source: Coin360 That could be because Bitcoin’s long-term investors do not seem to be panicking. Data f...

Price analysis 9/23: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The S&P 500 index has declined about 5% this week while the Nasdaq Composite is down more than 5.5%. Investors fear that the Federal Reserve’s aggressive rate hikes could cause an economic downturn. The yield curve between the two-year and 10-year Treasury notes, which is watched closely by analysts for predicting a recession, has inverted the most since the year 2000. Among all the mayhem, it is encouraging to see that Bitcoin (BTC) has outperformed both the major indexes and has fallen less than 4% in the week. Could this be a sign that Bitcoin’s bottom may be close by? Daily cryptocurrency market performance. Source: Coin360 On-chain data shows that the amount of Bitcoin supply held by long-term holders in losses reached about 30%, which is 2% to 5% below the level that coinci...

Price analysis 9/21: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The Federal Reserve hiked rates by 75 basis points on Sept. 21 and Fed Chair Jerome Powell projected another 125 basis points increase before the end of the year. If that happens, it will take the benchmark rate to 4.4% by the end of the year, which is sharply higher than the June estimates of 3.8%. The Fed also intimated that it only expects rate cuts to be considered in 2024. The expectation of higher rates pushed the 2-year Treasury to 4.1%, its highest level since 2007. This could attract several investors who are looking for safety in this uncertain macro environment. Higher rates are also likely to reduce the appeal of risky assets such as stocks and cryptocurrencies and may delay the start of a new uptrend. Daily cryptocurrency market performance. Source: Coin360 Even though Bitcoin...

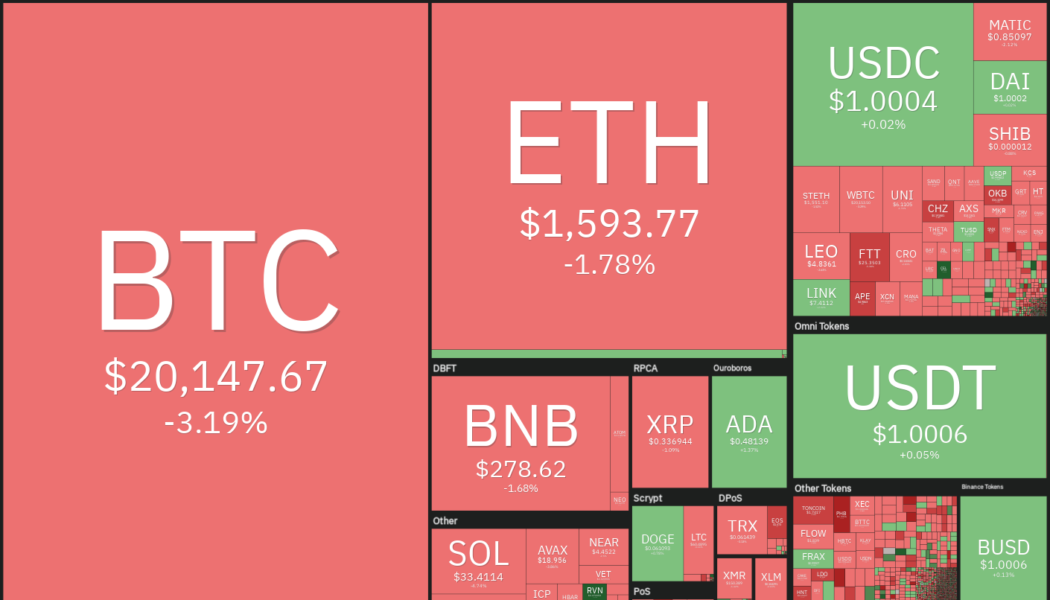

Price analysis 9/16: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The World Bank has warned of a possible global recession in 2023. In a press release on Sept. 15, the bank said that the current pace of rate hikes and policy decisions is unlikely to be enough to bring inflation down to pre-pandemic levels. Ray Dalio, the billionaire founder of Bridgewater Associates said in a blog post on Sept. 13 that if rates were to rise to about 4.5% in the United States, it would “produce about a 20 percent negative impact on equity prices.” The negative outlook for the equity markets does not bode well for the cryptocurrency markets as both have been closely correlated in 2022. Daily cryptocurrency market performance. Source: Coin360 The macroeconomic developments seem to be worrying cryptocurrency investors who sent 236,000 Bitcoin (BTC) to major cryptocurren...

Price analysis 9/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The United States equities markets and the cryptocurrency markets had been rising leading up to the Sept. 13 release of the August consumer price index data, but the rally fell apart once the data showed inflation rising, rather than falling. The negative data dashed any hope of a Federal Reserve pivot in the near term and it triggered a sharp decline in risky assets. The market capitalization of U.S. stocks plunged by about $1.6 trillion on Sept. 13 and the market cap of the cryptocurrency markets slipped below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 Statistician and independent market analyst Willy Woo, believes that Bitcoin (BTC) may have to fall further before it reaches the maximum pain experienced during previous bottoms. Woo expects Bitcoin price to dec...

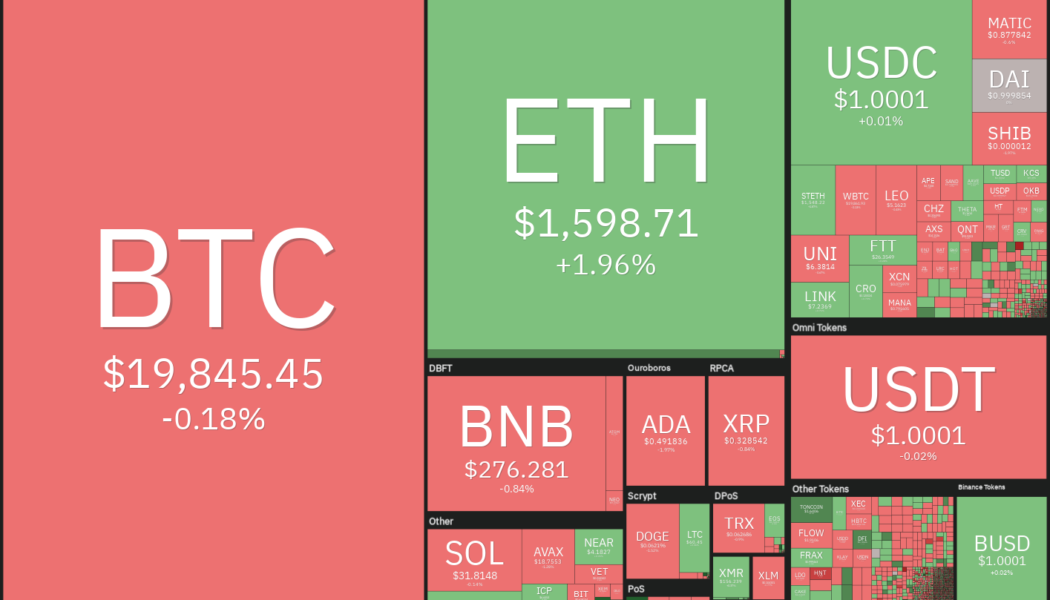

Price analysis 9/5: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The cryptocurrency markets have been quiet over the weekend. The sideways price action continues on Sept. 5 and there are unlikely to be any fresh triggers from the United States equities markets, which are closed for Labor Day. However, the bullish picture for cryptocurrencies looks clouded as the energy crisis in Europe sent the euro to a two-decade low versus the U.S. dollar. Meanwhile, the U.S. dollar index (DXY) which has an inverse correlation with the equities markets and cryptocurrencies soared above 110 for the first time since June 2002. Daily cryptocurrency market performance. Source: Coin360 A positive sign among all the mayhem is that Bitcoin (BTC) has not given up much ground over the past few days and continues to trade near the psychological level of $20,000. This suggests ...

Price analysis 9/2: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

Nonfarm payrolls rose by 315,000 jobs in August, down from the July increase of 526,000 jobs. The report was just below the Dow Jones estimate of 318,000 jobs and the slowest monthly gain since April 2021. The S&P 500 rose in response to the report, but later erased its gains, indicating that bears continue to sell on rallies. That may be because the U.S. dollar index (DXY), which had retreated from its Sept.1 20-year high, recovered part of its losses. The bears will have to pull the DXY lower to boost the prices of stocks and thcryptocurrency markets as both are usually inversely correlated with the dollar index. Daily cryptocurrency market performance. Source: Coin360 Although Bitcoin (BTC) has dropped more than 70% from its all-time high of $69,000, several traders have held on to ...