Banks

Bank of Israel issues draft guidelines on cryptocurrency AML/CFT

On Friday, the Bank of Israel published a draft regulation on Anti-Money-Laundering and Combatting the Financing of Terrorism (AML/CFT) risk management for the banks facilitating crypto-to-fiat transactions. The move hints at the Israeli government’s preparations to legalize and regulate the relationship between banks and virtual currency service providers (VASPs). The document cites the customers’ increased involvement with digital assets as the rationale for the new policy: “In view of the increase in customer activity in virtual currencies, and the resulting increase in customer requests to transfer money […] the Banking Supervision Department today published a draft circular dealing with managing AML/CFT risks derived from the provision to customers of payment services relat...

23-year-old Australian buys $314k property via planned crypto investments

A young resident from Queensland, Australia played the long game of accumulating Bitcoin (BTC) and Ethereum (ETH) over several years to eventually overcome the soaring real estate prices during the 2020 bull run and own his dream home. The 23-year-old Loi Nguyen started his journey as an investor back in 2017 by purchasing a few hundred dollars worth of BTC, ETH and traditional stocks. However, his interest in crypto reached new heights while pursuing an Economics degree: “Crypto came back into my life when I did a course at the uni on inflation. I learned that Bitcoin can be disinflationary.” Speaking to news.com.au, Nguyen revealed that the lower interest rates (less than 0.5%) offered by traditional banks could never help him break into the real estate market. By following a dollar-cost...

US Virginia Senate allows state banks to offer crypto custody services

The Senate of Virginia in the United States unanimously approved a bill amendment request that now allows traditional banks operating in the Commonwealth of Virginia to provide virtual currency custody services. Delegate Christopher T. Head introduced the bill (House Bill No. 263) back in January 2022, seeking an amendment to allow eligible banks to offer crypto custody services: “A bank may provide its customers with virtual currency custody services so long as the bank has 26 adequate protocols in place to effectively manage risks and comply with applicable laws.” The bill passed Senate with a sweeping 39-0 vote and is waiting to be signed into law by Governor of Virginia Glenn Youngkin. Banks that intend to offer this service to clients will need to adhere to three specific requir...

Wyoming’s state stablecoin: Another brick in the wall?

For a state with a small-town feel, Wyoming moves with big-city alacrity when it comes to things crypto. According to the bipartisan bill introduced into its legislature last week, a Wyoming stablecoin could debut before the end of 2022. The announcement caught even Wyoming banker and cryptocurrency champion Caitlin Long by surprise. “Didn’t know it was coming,” tweeted the Avanti Bank CEO. It also raises some questions: Is a stablecoin really needed by Wyoming’s citizens? Is it feasible? Will it upset the state’s commercial banks including its recently chartered special purpose depository institutions (SPDIs) like Avanti which has issued a stablecoin-like product itself? Moreover, is a state-issued stablecoin even constitutional? And, aren’t there enough stablecoins around alr...

Russia to seize retail deposits if sanctions go too far, official warns

In the event of harsh Western sanctions as Russian forces invade Ukraine, retail customers could risk losing their savings. Russians’ savings could be confiscated in response to sanctions against the country, according to Nikolai Arefiev, a member of the country’s Communist Party and vice-chairman of the Duma’s committee on economic policy. The Russian government can potentially seize about 60 trillion rubles ($750 billion) worth of people’s deposits should Western nations decide to block all of Russia’s foreign funds, Arefiev said in an interview with the local news agency News.ru on Monday. “If all the foreign funds are blocked, the government will have no other choice but to seize all the deposits of the population, or 60 trillion rubles in order to solve the situation,” the official st...

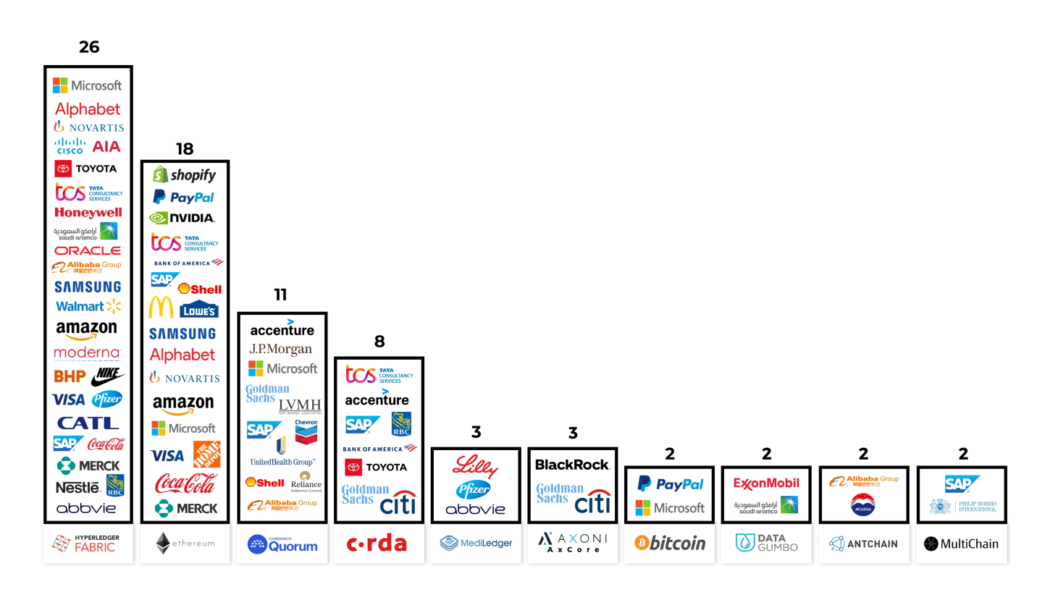

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...

3 things the crypto sector must offer to truly mainstream with TradFi

In the past year, we’ve seen the crypto economy undergo exponential expansion as heaps of money poured into various cryptocurrencies, decentralized finance (DeFi), nonfungible tokens (NFT), crypto indices, insurance products and decentralized options markets. The total value locked (TVL) in the DeFi sector across all chains has grown from $18 billion at the beginning of 2021 to $240 billion in January 2022. With so much liquidity in the ecosystem, the crypto lending space has also grown a significant amount, from $60 million at the beginning of 2021 to over $400 million by January 2022. Despite the exponential growth and the innovation in DeFi products, the crypto lending market is still only limited to token-collateralized loans, i.e. pledge one cryptocurrency as collateral to borro...

Decentralized and traditional finance tried to destroy each other but failed

The year 2022 is here, and banks and the traditional banking system remain alive despite decades of threatening predictions made by crypto enthusiasts. The only endgame that happened— a new Ethereum 2.0 roadmap that Vitalik Buterin posted at the end of last year. Even though with this roadmap the crypto industry would change for the better, 2021 showed us that crypto didn’t destroy or damage the central banks just like traditional banking didn’t kill crypto. Why? To be fair, the fight between the two was equivalently brutal on both sides. Many crypto enthusiasts were screaming about the coming apocalypse of the world’s financial systems and described a bright crypto future ahead where every item could be bought with Bitcoin (BTC). On the other hand, bankers rushed t...

NFTs and DeFi overturn a banker’s generational curse of poverty in 2 years

Brenda Gentry, a former USAA mortgage underwriter from Texas, believes that the cryptocurrency ecosystem offers a fighting chance to overcome the generational curse of poverty. Gentry, a.k.a. MsCryptoMom, left her decade-long job as a banker to pursue a full-time crypto career as her initial investments from early 2020 confirmed the “unprecedented opportunities offered by crypto.” She currently runs Gentry Media Productions, a firm that advises decentralized finance (DeFi) and nonfungible token (NFT) projects — generating up to 20 ether (ETH) each month, nearly $50,000 at the time of writing. Speaking to Cointelegraph, Gentry recollected the moment she first bought crypto: “It was early 2020 during the lockdown. I bought Bitcoin, Ethereum and Link on Coinbase. When I started, I almos...

FTX exchange floats $1M prize for banks to accept stablecoins

Cryptocurrency derivatives exchange FTX is calling on banks to reach out and discuss the possibility of accepting stablecoins in exchange for a $1 million reward. In a Tuesday Twitter post, FTX said it was exploring forming relationships with banks in different regions to allow users to have “near-instant and near-free deposits and withdrawals” through stablecoins. The exchange floated the idea of offering a $1 million prize for the first bank in each region to accept the tokens but hinted it would be open to giving more. How much would it cost to convince a bank to accept stablecoins? If we offered a $1m prize for the first bank in each region that does it is that enough? Do you work for a bank and want to discuss this? — FTX – Built By Traders, For Traders (@FTX_Official) December ...

Ukrainian bank uses Stellar to launch electronic hryvnia pilot

Tascombank, one of the oldest commercial banks in Ukraine, is launching a Stellar-based pilot for Ukraine’s national fiat currency, the hryvnia. The Stellar Development Foundation (SDF) announced on Dec. 14 a private electronic hryvnia pilot launched by Tascombank and fintech company Bitt. The electronic hryvnia pilot is being implemented under the supervision of the National Bank of Ukraine and is supported by the Ministry of Digital Transformation (MDT). Oleksandr Bornyakov, deputy minister of the MDT, said that the pilot project will provide a “technological basis for the issuance of electronic money” and is the “next key step to advance innovation of payment and financial infrastructure in Ukraine.” SDF CEO Denelle Dixon told Cointelegraph that the pilot work has already kicked off, wi...

DeFi resolving the five flaws of traditional finance, book review

Writing a book on decentralized finance is a bit like describing a riddle, wrapped in a mystery inside an enigma, to borrow from Winston Churchill. First, one must summarize the origins of modern decentralized finance, then the mechanics of the blockchain technology that provides the sector’s backbone, and only then do you arrive at DeFi’s infrastructure. It all should be done in 191 pages, too, including glossary, notes and index. It is not an undertaking for the faint of heart. Fortunately, the authors of DeFi and the Future of Finance — Duke University finance professor Campbell Harvey, Dragonfly Capital general partner Ashwin Ramachandran, and Fei Labs founder Joey Santoro — were up to the task. After recapitulating the “five flaws of traditional finance” — inefficiency, limited access...