Banks

United Texas Bank CEO wants to ‘limit the issuance of US dollar-backed stablecoins to banks’

Scott Beck, chief executive officer of United Texas Bank, called on members of the state’s blockchain working group to recommend policy for leaving stablecoins to banks rather than crypto firms. Speaking before the Texas Work Group on Blockchain Matters in Austin on Friday, Beck suggested limiting the issuance of U.S. dollar-backed stablecoins to licensed banks rather than issuers like Circle. The United Texas Bank CEO cited a November report from the President’s Working Group on Financial Markets, in which the group said stablecoin issuers should be held to the same standards as insured depository institutions including state and federally chartered banks. “If such stablecoins are defined to be ‘money’, banks are the proper economic actor to issue and manage stablecoins,” said Beck. “Bank...

Fed adds a new layer of bureaucracy for US banks engaging in crypto asset activities

The United States Federal Reserve Board issued a letter Tuesday to its supervisory officers, staff and the banks they supervise regarding activities with crypto assets. The letter covers the preliminary steps a bank must go through before engaging in activities with crypto and instructs banks to notify the board before proceeding with those activities. The letter, signed by the directors of the regulatory and community affairs divisions, applies to all banks supervised by the Fed with no threshold of minimum assets. It begins with a warning about the risks associated with crypto, specifically mentioning evolving technology and its governance, Anti-Money Laundering and transparency and the stability of assets such as stablecoin. The Fed is monitoring banks’ activities, the letter noted: “Gi...

Board urges Bank of Central African States to introduce common digital currency: Report

The Bank of Central African States, or Banque des États de l’Afrique, which serves Cameroon, the Central African Republic, Chad, Equatorial Guinea, Gabon, and the Republic of the Congo, could be closer to releasing a central bank digital currency reportedly at the urging of its board. According to a Friday report from Bloomberg, the board sent an email calling for the regional bank to introduce a digital currency in an effort to modernize payment structures and promote regional financial inclusion. The Central African Republic, or CAR, passed legislation adopting Bitcoin (BTC) as legal tender in the country in April, but has not recognized a central bank digital currency, or CBDC. Nigeria’s central bank was one of the first in the region to launch a CBDC called the eNaira in October ...

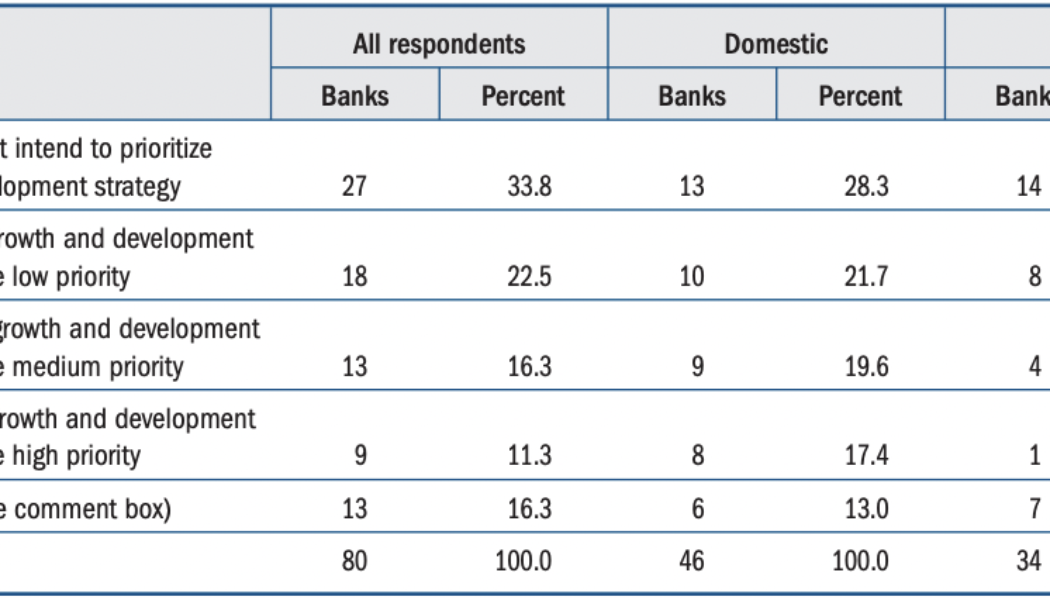

56% of banks say DLT and crypto are ‘not a priority’ in near future — Fed survey

A survey conducted by the Federal Reserve Board of the United States suggested that the majority of officials at major banks did not consider crypto-related products and services a priority in the near future. According to the results of a Fed survey released on Friday, more than 56% of senior financial officers from 80 banks said distributed ledger technology and crypto products and services were “not a priority” or were “a low priority” for their growth and development strategy for the next two years, while roughly 27% said they were a medium or high priority. However, roughly 40% of respondents in the survey said the technology was a medium or high priority for their banks for the next two to five years. Results of Fed survey from May 2022. Source: Federal Reserve Answers from surveyed ...

Dutch bank ING sells digital asset tool Pyctor to GMEX

ING Group, a Dutch multinational banking and financial services corporation, has spun out its digital asset business Pyctor to multi-asset trading infrastructure firm GMEX. GMEX has acquired ING’s institutional-grade digital asset custody solution Pyctor in a multi-million dollar deal, the companies said in a joint announcement on Monday. The Pyctor offering compliments GMEX’s MultiHub service, an institutional cross-platform business launched last year with the mission to bridge the gap between centralized finance (CeFi) and decentralized finance (DeFi), GMEX CEO Hirander Misra told Cointelegraph. Pyctor expands MultiHub with a number of digital asset-focused capabilities, including smart contract features, post-trade custodial and institutional network capabilities like the fragmentation...

Deloitte and NYDIG set up alliance to help businesses adopt Bitcoin

Professional services giant Deloitte is getting increasingly serious about Bitcoin (BTC) amid the ongoing market downturn, setting up a major initiative to promote BTC adoption. Deloitte has partnered with the Bitcoin-focused financial services firm, New York Digital Investment Group (NYDIG), to help companies of all sizes implement digital assets. According to a joint announcement on Monday, NYDIG and Deloitte are launching a strategic alliance to create a centralized approach for clients seeking advice to adopt Bitcoin products and services. The companies will work together to enable blockchain and digital asset-based services across multiple areas involving Bitcoin-related products, including banking, loyalty and rewards programs, employee benefits and others. According to the announcem...

How a DAO for a bank or financial institution will look like

DAOs can provide several services for banks, including asset management, compliance and lending. Banks today are already using blockchain technology for things like payment, clearing and settlement, trade finance, identity and syndicated loans, according to The Financial Times. However, there are still many unexplored areas in banking where a DAO-based model might be useful: Fundraising In the crypto world, initial coin offerings (ICOs) are breaking down the barrier between access to capital and traditional services like capital-raising firms. Likewise, banks can use DAOs to raise capital from a wider pool of investors via ICOs. Loans and Credit Using decentralized technology in banking can eliminate the need for gatekeepers in the lending industry. DAOs provide more secure ways for people...

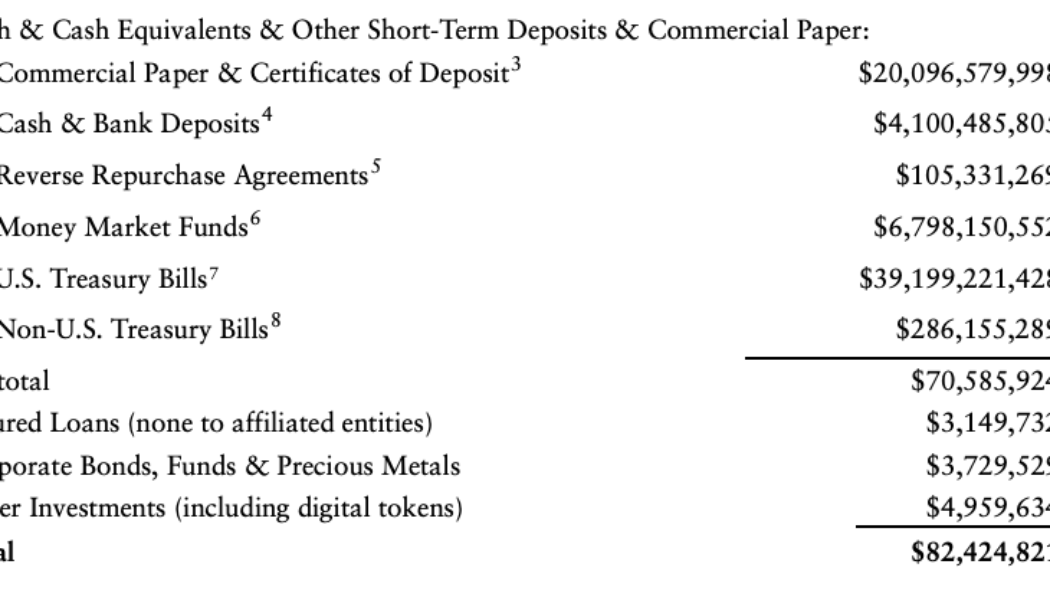

Tether aims to decrease commercial paper backing of USDT to zero

The major stablecoin company Tether is looking to eventually get rid of commercial paper backing for its U.S. dollar-based stablecoin Tether (USDT). Tether issued an official statement on Wednesday to deny reports alleging that Tether’s commercial paper portfolio is 85% backed by Chinese or Asian commercial papers and is being traded at a 30% discount. The stablecoin firm called such allegations “completely false,” reiterating that more than 47% of total USDT reserves are now the “United States Treasuries.” In its latest assurance opinion issued in May, Tether reported that commercial paper makes up less than 25% of USDT’s backing, amounting to around $21 billion as of March 31. USDT’s backing asset breakdown. Source: Tether’s assurance opinion released in May 2022 According to the latest ...

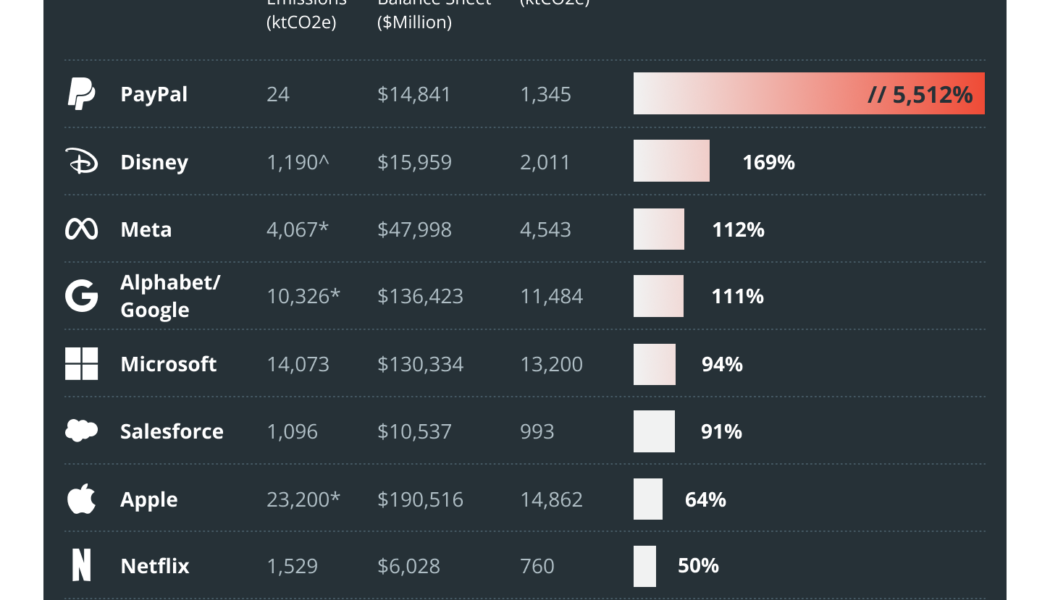

Bitcoin and banking’s differing energy narratives are a matter of perspective

The Carbon Bankroll Report was released on May 17 as a collaboration among the Climate Safe Lending Network, The Outdoor Policy Outfit and Bank FWD. The collaboration made it possible to calculate the emissions generated due to a company’s cash and investments, such as cash, cash equivalents and marketable securities. The report revealed that for several large companies, such as Alphabet, Meta, Microsoft and Salesforce, the cash and investments are their largest source of emissions. The energy consumption of the flagship proof-of-work (PoW) blockchain network, Bitcoin, has been a matter of debate in which the network and its participants, especially miners, are criticized for contributing to an ecosystem that might be worsening climate change. However, recent findings have also brought the...