Banks

Crypto adoption via regulation: Setting rules for centralized exchanges

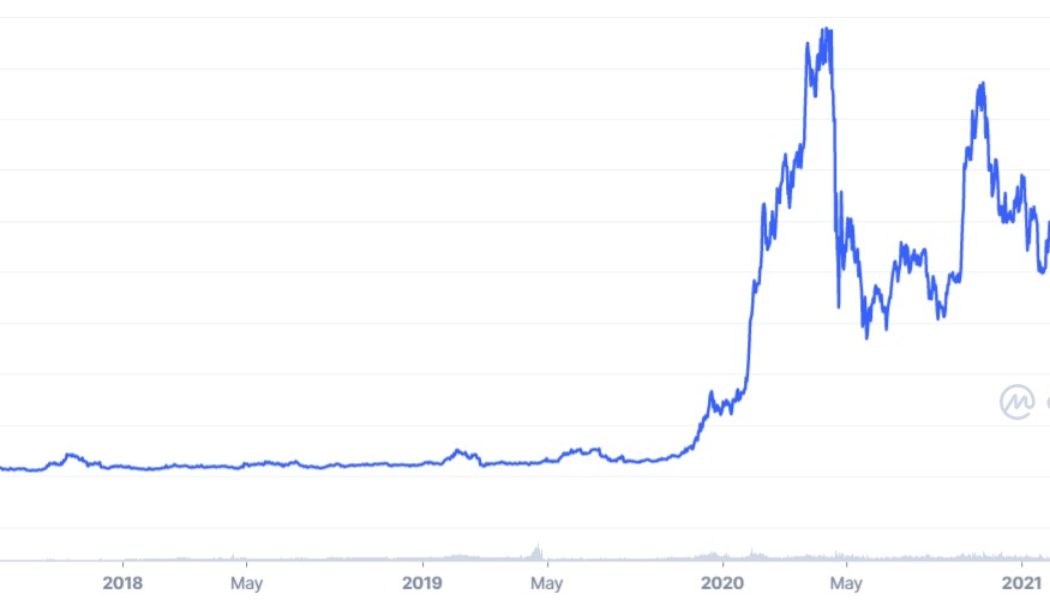

Centralized cryptocurrency exchanges have become the backbone of the nascent crypto ecosystem, making way for retail and institutional traders to trade cryptocurrencies despite a constant fear of government crackdowns and lack of support from policymakers. These crypto exchanges over the years have managed to put self-regulatory checks and implemented policies in line with the local financial regulations to grow despite the looming uncertainty. Cryptocurrency regulation continues to occupy mainstream debates and experts’ opinions, but despite public demand and requests from stakeholders of the nascent ecosystem, policymakers continue to overlook the rapidly growing sector that reached a market capitalization of $3 trillion at the peak of the bull run in 2021. Over the past five years...

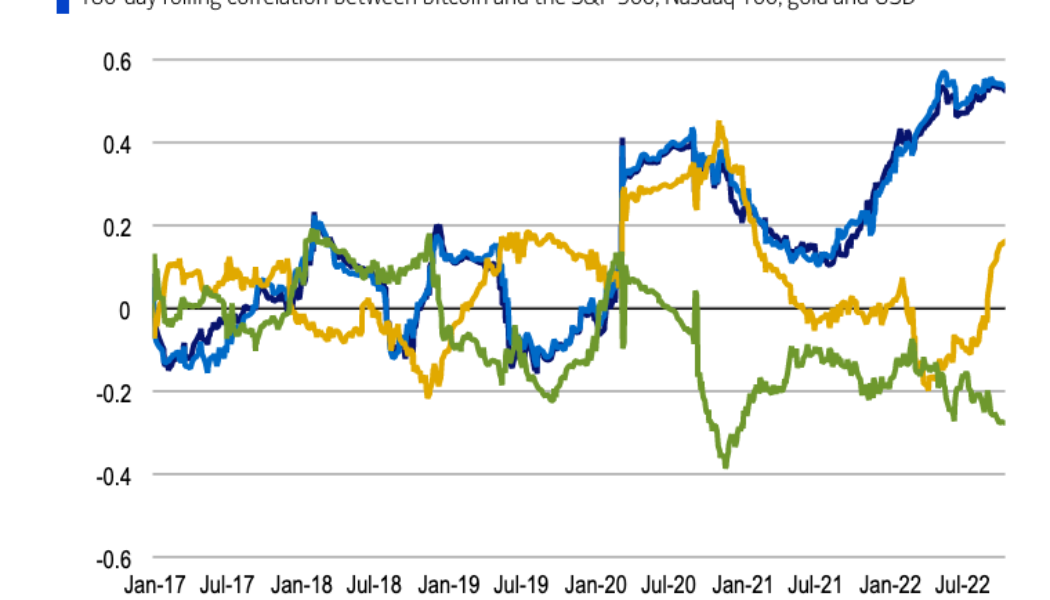

Gold vs BTC correlation signals Bitcoin becoming safe haven: BofA

Despite the ongoing cryptocurrency bear market, investors have been increasingly looking at Bitcoin (BTC) as a safe haven, a new study suggests. The rise in the correlation between Bitcoin and gold (XAU) is one of the major indicators demonstrating investors’ confidence in BTC amid the ongoing economic downturn, according to digital strategists at the Bank of America. Bitcoin’s correlation with gold — which is commonly viewed as an inflation hedge — has been on the rise this year, hitting its highest yearly levels in early October. The growing correlation trend started on Sept. 5 after remaining close to zero from June 2021 and turning negative in March 2022, BofA strategists Alkesh Shah and Andrew Moss said in the report. “Bitcoin is a fixed-supply asset that may eventually become an infl...

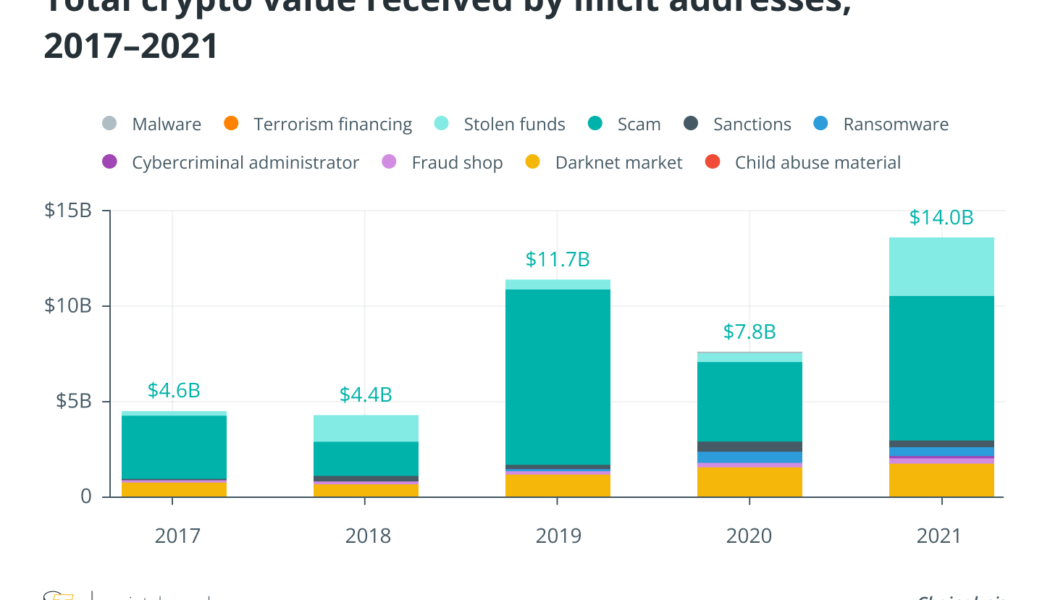

Institutional crypto adoption requires robust analytics for money laundering

Institutions have begun to take crypto seriously and have entered the space in numerous ways. As noted in a previous analysis, this has resulted in banks and fintechs looking at custody products and services for their clients. However, as custodians of clients’ assets, banks must also ensure they are clean assets and stay compliant. This is where on-chain analytics solutions have a huge role to play in understanding patterns in transactions to identify money laundering and other spurious activities within the cryptocurrency and digital assets space. According to a report by Chainalysis, over $14 billion of illicit transactions took place in 2021. Therefore, it is critical to build the foundational infrastructure around Anti-Money Laundering (AML) to support the growing institutional ...

Basel Committee: Banks worldwide reportedly own €9.4 billion in crypto assets

According to a new study published by the Basel Committee on Banking Supervision, a supranational organization responsible for setting the standards on bank capital, liquidity and funding, 19 out of 182 global banks supervised by the committee reported that theyowned digital assets. Combined, their total exposure to crypto is estimated to be €9.4 billion ($9.38 billion). In context, this represents 0.14% of the total risk-weighted asset composition of the 19 crypto-owning banks surveyed. When taken into account overall, cryptocurrencies only comprise about 0.01% of the total risk-weighted assets of all 182 banks under the Basel Committee’s supervision. Two banks made up more than half of the overall crypto-asset exposures, while four more comprised approximately 40% of the rema...

What is the economic impact of cryptocurrencies?

Although the cryptocurrency market appears to grow in a positive feedback loop, that does not mean that (un)expected events may not impact the trajectory of the ecosystem as a whole. Although blockchain and cryptocurrencies are fundamentally meant as ‘trustless’ technologies, trust remains key there where humans interact with one another. The cryptocurrency market is not only impacted by the broader economy, but it may also generate profound effects by itself. Indeed, the Terra case shows that any entity — were it a single company, a venture capital firm or a project issuing an algorithmic stablecoin — can potentially set into motion or contribute to a “boom” or “bust” of the cryptocurrency ma...

Crypto startup to save iconic fiat money sculpture with 1M euros in funding

The paths of traditional finance and the cryptocurrency industry have intersected again, with a crypto startup coming to save the iconic “Euro-Skulptur” monument in Frankfurt. Frankfurt-based crypto startup Caiz Development will provide 1 million euros, or about $961,000, in funding over the next five years to rescue the famous sculpture depicting the symbol for the Euro. Announcing the news on Tuesday, Caiz said that the firm saw a good marketing opportunity in supporting the sculpture by obtaining unique exposure. Through the funding, the firm was able to put its product board next to the 14-meter-high art installation bearing 12 yellow stars, which represent the original members of the currency union. Euro monument and Caiz’s marketing program. Source: Caiz Development The iconic euro s...

JPMorgan CEO calls crypto ‘decentralized Ponzi schemes’

While testifying before United States (U.S.) lawmakers, JPMorgan Chase CEO Jamie Dimon referred to himself as a “major skeptic” on “crypto tokens that you call currency like Bitcoin,” labeling them as “decentralized Ponzi schemes.” Dimon was asked what keeps him from being more active in the crypto space during an oversight hearing held by the House Financial Services Committee on Sept. 21. Dimon emphasized that he sees value in blockchain, decentralized finance (DeFi), ledgers, smart contracts, and “tokens that do something,” but then proceeded to lambast crypto tokens that identify as currencies. Asked for his thoughts about the draft U.S. stablecoin bill, Dimon said he believes that there is nothing wrong with stablecoins that are properly regulated and that the regulation sh...

Abra announces plans for US bank supporting digital assets

Cryptocurrency trading platform Abra said it was “in the process of” establishing a United States-based state-chartered bank allowing clients to deposit digital assets. In a Monday announcement, Abra said the bank, named Abra Bank, would be regulated to operate within the U.S. and give customers the ability to use digital assets in seemingly the same way as fiat at traditional banks. The company also planned to launch Abra International, a digital asset-focused business based outside the U.S. “The best way to become the default Web3 wallet and crypto bank for everyone is by embracing a global regulatory framework that provides for transparency, oversight, security, and agency,” said Abra. We have some BIG news. Today we’re announcing the formation of Abra Bank and the launch of Abra Boost,...

Aussies already lost $242M to investment and crypto scams in 2022

Australians have continued getting duped by investment and crypto-related scams, losing 242.5 million Australian dollars to scammers so far in 2022, according to Scamwatch’s latest data. From January to July of this year, the majority of all funds lost to scams of all types were investment scams, which range from romance baiting scams to classic Ponzi schemes and cryptocurrency scams. The figure is already 36% higher than the figures across all of 2021, which revealed that Australians lost 178.2 million AUD to investment scams in the year. Source: Scamwatch It’s a threat that has prompted consumer advocates to push for banks to shoulder more responsibility for reimbursing scams to “drive greater investment in stopping fraud.” According to a Sept. 8 report from the Austral...

Amid crypto winter, Nexo commits additional $50M to buyback program

Crypto lending platform Nexo has increased the size of its buyback program, giving the company more discretionary ability to repurchase its native token to boost interest payments or make strategic investments in the future. On Tuesday, Nexo disclosed that its board of directors had committed an additional $50 million to buybacks, building off the company’s initial $100 million repurchase program launched in November 2021. The approval green lights the discretionary repurchase of up to $50 million worth of NEXO tokens on the open market. NEXO is the platform’s native cryptocurrency, giving users the ability to earn interest and lock in lower rates for borrowing. The token currently has a market capitalization of $563.6 million and 24-hour trading volumes of $46.7 million, according to Nexo...

Siam Commercial Bank abandons plans to purchase $500M stake in crypto exchange Bitkub

Thailand’s oldest bank has scrapped plans it first announced in November 2021 to become the majority shareholder of crypto exchange Bitkub. In a Thursday announcement, Siam Commercial Bank’s SCB X Group said it would no longer be paying 17,850 million Baht — roughly $536 million in November and $497 million at the time of publication — to acquire a 51% stake in the Thailand-based crypto exchange. The bank cited concerns with Bitkub “resolving various issues” according to recommendations from the country’s Securities and Exchange Commission without a definite timeline. According to the SCB, the company conducted a due diligence exercise on Bitkub following the November 2021 announcement it planned to become a majority shareholder, resulting in “many opportunities for cooperation in various ...

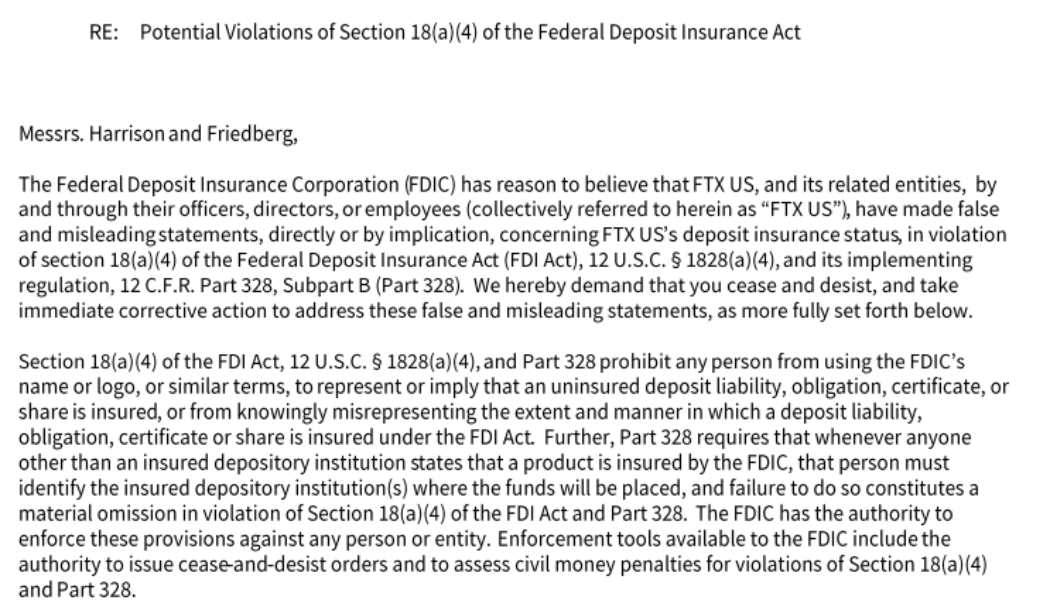

FTX US among 5 companies to receive cease and desist letters from FDIC

The Federal Deposit Insurance Corporation (FDIC) has issued cease and desist letters to five companies for allegedly making false representations about deposit insurance related to cryptocurrencies. FDIC issued a Friday press release disclosing cease and desist letters for cryptocurrency exchange FTX US and websites SmartAssets, FDICCrypto, Cryptonews and Cryptosec. In the letters, which were issued on Thursday, the government agency alleges that these organizations misled the public about certain cryptocurrency-related products being insured by FDIC. “These representations are false or misleading,” the FDIC said in regard to “certain crypto-related products” being FDIC-insured or that “stocks held in brokerage accounts are FDIC-insured.” The regulator said these companies must “take immed...