bankruptcy

FTX owes over $3 billion to its 50 biggest creditors: Bankruptcy filing

According to a court filing on Nov. 20, FTX Trading LTD owes its top 50 creditors over $3 billion USD. The document, which was submitted through the United States bankruptcy court for the district of Delaware, was filed as part of the company’s Chapter 11 bankruptcy proceedings. FTX discloses its top 50 creditors are owed $3.1 billion. The largest creditor is owed $226 million. All names were redacted. pic.twitter.com/JGeddvMB7w — Tom Dunleavy (@dunleavy89) November 20, 2022 The filing indicated that FTX owes the top individual alone in excess of $226 million USD, with all others owed sums approximately ranging between $21 million and $203 million. The creditors’ identities are unknown, and their locations undisclosed. The document explained: “The Top 50 List is based on the Debtors’...

Getting funds out of FTX could take years or even decades: Lawyers

While investors are eager to know when they will be able to get their funds back from the now-bankrupt crypto exchange FTX, insolvency lawyers warn it could take “decades.” The crypto exchange, along with 130 affiliates filed for Chapter 11 bankruptcy protection in the United States on Nov. 11. Insolvency lawyer Stephen Earel, partner at Co Cordis in Australia said it will be an “enormous exercise” in the liquidation process to “realize” the crypto assets then work out how to distribute the funds, with the process potentially taking years, if not “decades.” This is due to the complexities that come with cross-border insolvency issues and competing jurisdictions, he said. Earel said unfortunately FTX users are in the queue with everyone else including other creditors, investors and venture ...

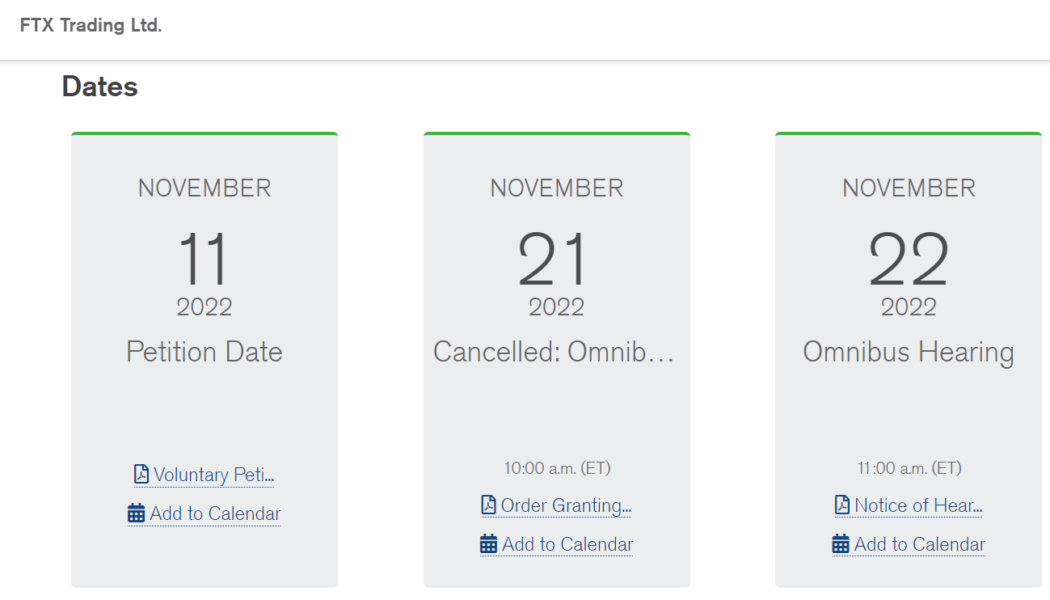

Bankrupt crypto exchange FTX begins strategic review of global assets

As part of the recent bankruptcy filing, the defunct crypto exchange FTX, along with 101 of the 130 affiliated companies, announced the launch of a strategic review of their global assets. The review is an attempt to maximize recoverable value for stakeholders. FTX, at the time led by CEO Sam Bankman-Fried (SBF), filed for Chapter 11 bankruptcy on Nov. 11 after being caught misappropriating user funds. The bankruptcy filing sought to cushion the losses of stakeholders connected to FTX and affiliated companies, a.k.a FTX debtors. 1/ Sharing a Press Release issued early today – FTX launches strategic review of its global assets. Text below (and link). https://t.co/wxz9MYnXrn — FTX (@FTX_Official) November 19, 2022 FTX debtors are in talks with financial services firm Perella Wein...

FTX collapse won’t impact everyday use of crypto in Brazil: Transfero CEO

The crumbling of the FTX crypto empire may have damaged Brazilian retail and institutional sentiment toward crypto. However, its impact won’t affect everyday citizens — who will still use crypto for cross-border transactions. Reflecting on the recent fall of FTX, Thiago César, the CEO of fiat on-ramp provider Transfero Group said that the exchange’s fall, like in many countries around the world, has hurt confidence around centralized crypto exchanges and crypto in general. Transfero Group is tied in closely with the Brazilian crypto ecosystem and FTX as it was the fiat on-and-off-ramp provider for the exchange and is also the issuer of Brazilian Stablecoin BRZ, which was listed on the now-defunct exchange. César told Cointelegraph that the collapse of the exchange had removed a...

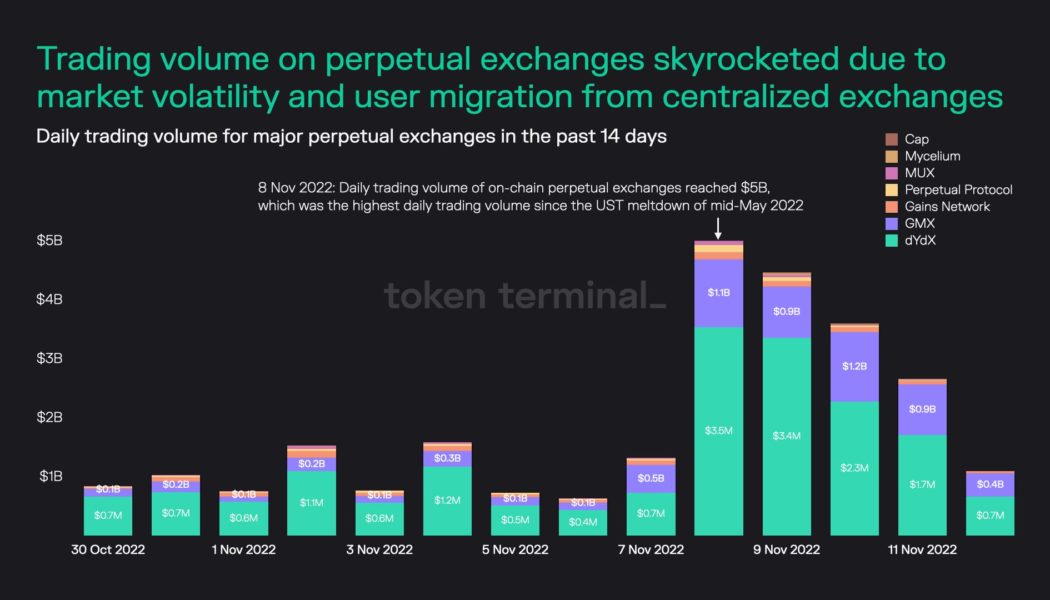

FTX is done — What’s next for Bitcoin, altcoins and crypto in general?

2022 was a tough year for crypto, and November was especially hard on investors and traders alike. While it was incredibly painful for many, FTX’s blowup and the ensuing contagion that threatens to pull other centralized crypto exchanges down with it could be positive over the long run. Allow me to explain. What people learned, albeit in the hardest way possible, is that exchanges were running fractional reserve-like banks to fund their own speculative, leveraged investments in exchange for providing users with a “guaranteed” yield. Somewhere across the crypto Twitterverse, the phrase “If you don’t know where the yield comes from, you are the yield!” is floating around. This was true for decentralized finance (DeFi), and it’s proven true for centralized crypto exchanges and platforms...

Nickel Digital, Metaplex and others continue to feel the impact of FTX collapse

Nickel Digital Asset Management is not the only company feeling the effects of FTX’s collapse and bankruptcy. NFT protocol Metaplex also laid off “several members of the Metaplex Studios team” due to the “indirect impact” from the collapse of crypto exchange FTX. The co-founder and CEO of Metaplex Studios, Stephen Hess, shared in a thread on Twitter: “While our treasury wasn’t directly impacted by the collapse of FTX and our fundamentals remain strong, the indirect impact on the market is significant and requires that we take a more conservative approach moving forward.” (3/7) While our treasury wasn’t directly impacted by the collapse of FTX and our fundamentals remain strong, the indirect impact on the market is significant and requires that we take a more conservative approach moving fo...

FTX’s new CEO John Ray coldly addresses SBF’s erratic tweets

The new CEO and chief restructuring officer for the bankrupt FTX cryptocurrency exchange, John Ray, has icily responded to the erratic series of tweets from former CEO and founder Sam Bankman-Fried. The official Twitter account of FTX on Nov. 16 tweeted a statement from Ray addressing Bankman-Fried’s recent public statements, reiterating he “has no ongoing role at [FTX], FTX US, or Alameda Research Ltd. and does not speak on their behalf.” (3/3) Mr. Bankman-Fried has no ongoing role at @FTX_Official, FTX US, or Alameda Research Ltd. and does not speak on their behalf. — FTX (@FTX_Official) November 16, 2022 On Nov. 14 Bankman-Fried began a strange Twitter thread that — over the course of 40 or so hours — eventually spelled out “What HAPPENED” across nine tweets, he then went on to claim he...

Esports team TSM suspends $210M sponsorship deal with FTX

Professional esports organization Team SoloMid (TSM) (previously TSM FTX) has suspended its $210 million sponsorship deal with the now-bankrupt FTX crypto exchange “effective immediately” following the cryptocurrency trading platform’s shock collapse last week. The United-States-based esports organization made the announcement in a Nov. 16 tweet to its 2.2 million followers, adding that the decision was made after “monitoring the evolving situation and discussing internally.” We’ve suspended our partnership with FTX effective immediately. pic.twitter.com/u8vQSWnAbX — TSM (@TSM) November 16, 2022 The $210 million deal was put to paper in Jun. 2021, which resulted in the renaming of TSM to TSM FTX. At the time of the deal, the esports organization said it would allocate its new re...

Core Scientific may consider bankruptcy following uncertain financial condition: Report

Bitcoin mining firm Core Scientific is reportedly considering a potential bankruptcy amid a group of its convertible bondholders consulting restructuring lawyers. According to a Nov. 1 report from Bloomberg Law, the Core Scientific bondholders worked with legal firm Paul Hastings following a United States Securities and Exchange Commission filing suggesting financial distress. The Oct. 26 filing indicated that the mining company was unable to meet its financial obligations in late October and early November, citing the low price of Bitcoin (BTC), rising costs of electricity, an increase in the global BTC hash rate and legal issues with crypto lending firm Celsius. Core Scientific claimed in an Oct. 19 court filing that Celsius owed the firm more than $2.1 million for post-petition charges,...

Celsius users concerned over personal info revealed in bankruptcy case

Crypto lending platform Celsius filed for Chapter 11 bankruptcy on July 13, 2022. Although the Celsius case involves digital assets, it remains subject to United States Bankruptcy Code under the Bankruptcy Court for the Southern District of New York. While this may be, a series of unusual events have ensued since Celsius filed for bankruptcy. For instance, Chief United States Bankruptcy Judge Martin Glenn — the judge overseeing the Celsius case — stated on Oct. 17 that the court will look abroad for guidance. Glenn specifically mentioned that “Legal principles that are applicable in the United Kingdom are not binding on courts in the United States,” yet he noted that these “may be persuasive in addressing legal issues that may arise in this case.” While the treatment of the Celsius c...

Crypto Biz: Bear market claims another casualty

Three Arrows Capital. Celsius. Voyager Digital. The list of crypto bankruptcies, shutdowns and trading freezes has been endless in 2022. And the year isn’t over yet. This week, German crypto bank Nuri urged its users to withdraw funds ahead of the company’s planned shutdown in December — at least Nuri’s users were given proper notice. The crypto bear has been relentlessly cleansing the market of excess, leverage, poor risk management and outright scams. If industry prognosticators are to be taken seriously, the market could see one final capitulation before conditions begin to improve. This week’s Crypto Biz chronicles Nuri’s shutdown, the latest drama surrounding Voyager Digital and Silvergate Capital’s difficult quarter. German crypto bank Nuri tells 500K users to withdraw funds ah...

Celsius Network defaults on payments to Core Scientific, causing financial unrest

Crypto lender Celsius Network’s legal journey has gained another chapter as Bitcoin (BTC) miner Core Scientific accused the company of refusing to pay its bills since filing for Chapter 11 bankruptcy, according to court papers filed on Oct. 19. Core Scientific, which is one of the largest publicly traded crypto companies, claims the default on payments is threatening its financial stability, already hurt by crypto winter and high energy costs. In the court filings, Celsius alleges that Core Scientific delayed mining rig deployment and supplied them with less power than required under their contract. Celsius is reportedly seeking a court order holding Core in contempt and ordering it to fulfill its obligations. Meanwhile, Core requested the court to compel Celsius to pay pa...