bankruptcy

Sam Bankman-Fried’s charitable donations sought by FTX: Report

FTX’s new management is seeking to recover millions of dollars in donations made by the crypto exchange and its former CEO Sam Bankman-Fried, reports the Wall Street Journal. At the end of September, FTX’s charity arm, Future Fund, had committed more than $160 million to over 110 nonprofit organizations, including biotech startups and university researchers developing Covid-19 vaccines and working on pandemic studies, as well as nonprofit organizations in India, China and Brazil. As per the report, Future Fund committed $3.6 million to AVECRIS, a company working on a genetic vaccine platform, and another $5 million were donated to Atlas Fellowship for scholarships and high-school summer programs in San Francisco. A spokesperson for Bankman-Fried said that charitable donat...

Three Arrows Capital founders subpoenaed on Twitter

Three Arrows Capital (3AC) founders Zhu Su and Kyle Davies were subpoenaed on Twitter on Jan. 5, after the liquidators granted permission from Singapore authorities following a United States bankruptcy court order, according to information given to Cointelegraph by advisory firm Teneo. In the case of Davies, the Southern District of New York Bankruptcy Court granted the subpoena order as he is a U.S. citizen, while the Singapore courts granted the order to both co-founders, explained a spokesperson from Teneo. As reported by Cointelegraph, liquidators’ lawyers have repeatedly failed to engage with the founders in recent months. “A communication protocol was agreed between the liquidators and founders but has not yielded satisfactory cooperation,” according to a hearing presenta...

Judge rules Celsius owns funds in Earn accounts, paving the way for stablecoin sale

Judge Martin Glenn, who is presiding over the Celsius bankruptcy case, ruled on Jan. 4 that the funds in the Celsius interest-bearing Earn program belong to Celsius under the terms of the program’s terms of use. The funds reportedly amount to more than $4 billion. “The issue of ownership of the assets in the Earn Accounts is a contract law issue,” the U.S. bankruptcy judge wrote, citing the latest version of the Earn program’s terms of use. Those terms state that lending platform Celsius held “all right and title to such Eligible Digital Assets, including ownership rights.” Related: Core Scientific shuts down 37K mining rigs it was hosting for Celsius The judge called the terms of use “unambiguous,” and pointed out that, if the funds in question belong to the debtor, their retur...

US authorities are seizing $460M in Robinhood shares tied to FTX: Report

The United States Departure of Justice has reportedly seized or was in the process of seizing more than $400 million worth of Robinhood shares linked to FTX as part of the case against the crypto exchange. According to a Jan. 4 report from Reuters, U.S. officials told a judge they were in the process of seizing assets tied to FTX and its former CEO, Sam Bankman-Fried, which included 56 million shares of Robinhood — worth roughly $468 million at the time of publication. The report comes a day after a judge in the criminal case against SBF orderedyu7po him not to access or transfer any cryptocurrency or assets from FTX or Alameda. Amid FTX’s bankruptcy proceedings, control of the Robinhood shares has been under contention as many investors and creditors look to be made whole. BlockFi, B...

Companies and investors may need to return billions in funds paid by FTX

The collapse of FTX Group may not yet be finished with its contagious spread, as clawback provisions could force businesses and investors to return billions of dollars paid in the months leading up to the crypto exchange’s collapse, an insolvency attorney told Cointelegraph. In short, a “clawback” refers to money paid out that is required to be returned due to special circumstances or events, such as an insolvent company that needs to recover funds paid within 90 days before filing for Chapter 11. If the creditor is an insider, the 90-day period is extended to one year. As a result, creditors could seek a clawback on transfers made by FTX to external parties, including the $2.1 billion paid by FTX to Binance when Binance exited its Series A investment in FTX. Changpeng “CZ” Zhao, Binance‘s...

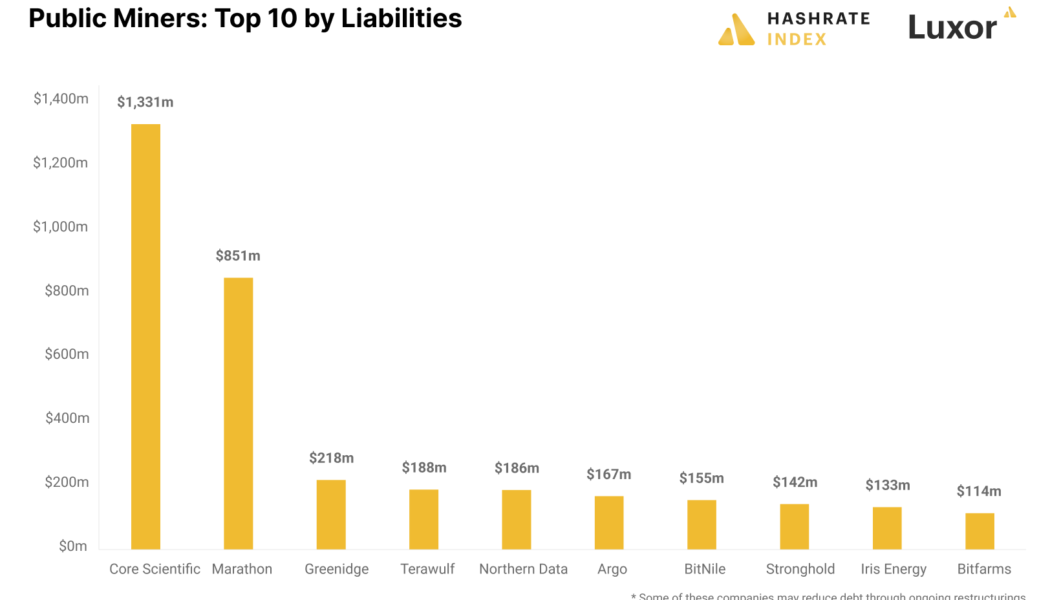

Public Bitcoin mining companies plagued with $4B of collective debt

The recent bankruptcy filing of Bitcoin (BTC) miner Core Scientific despite a $72M relief offer from creditors raised questions about the overall health of the bitcoin mining community amid a prolonged bear market. Turns out, the public bitcoin miners owe more than $4 billion in liabilities and require an immediate restructuring to get out of the unsustainably high debt levels. The Bitcoin mining community took up massive loans during the 2021 bull market, negatively impacting their bottom lines during a subsequent bear market. Bitcoin mining data analytics by Hashrate Index show that just the top 10 Bitcoin mining debtors cumulatively owe over $2.6 billion. Public Bitcoin mining companies with highest debt. Source: Hashrate Index Core Scientific, the biggest debtor among the lot — with $1...

Third parties could return FTX funds directly to customers: Law firm

More than one million creditors of failed crypto exchange FTX have been waiting to be made whole since before the firm’s bankruptcy filing on Nov. 11, but according to one expert, recipients of donations and contributions may have a legal means of returning the funds directly to investors and customers. Louise Abbott, a partner at United Kingdom-based firm Keystone Law, told Cointelegraph it was “extremely unlikely” FTX would have a legal leg to stand on in its demands for the voluntary return of political campaign donations, grants, and other contributions the firm made prior to its bankruptcy. However, many individuals and organizations — likely the result of public scrutiny — have already returned or pledged to return an estimated $6.6 million to FTX, a fraction of the millions th...

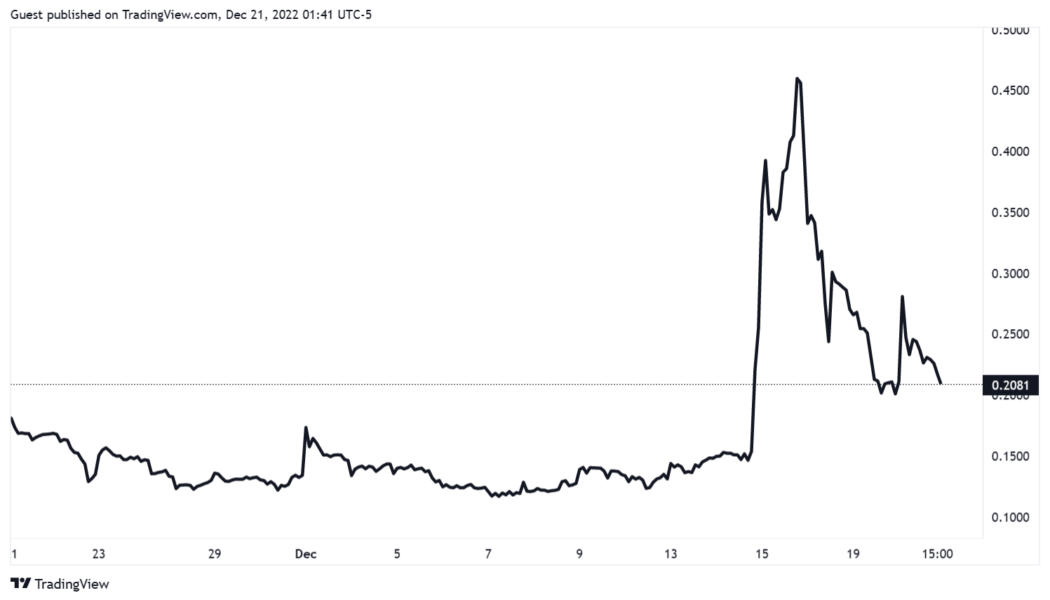

Bitcoin rebound to $18.4K? BTC price derivatives show strength at key support zone

Bitcoin (BTC) price lost 11.3% between Dec. 14 and Dec. 18 after briefly testing the $18,300 resistance. The move followed a seven-day correction of 8% in the S&P 500 futures after United States Federal Reserve Chair Jerome Powell issued hawkish statements after raising the interest rate on Dec. 14. Bitcoin price retreats to channel support Macroeconomic trends have been the main driver of recent movements. For instance, the latest bounce from the five-week-long ascending channel support at $16,400 has been attributed to the Central Bank of Japan’s efforts to contain inflation. Bitcoin 12-hour price index, USD. Source: TradingView The Bank of Japan increased the limit on government bond yields on Dec. 20, which are now trading at levels unseen since 2015. However, not everything has be...

Bitcoin miner Core Scientific reportedly filing for Chapter 11 bankruptcy

Just days after a creditor offered to help Core Scientific avoid possible bankruptcy, reports have emerged confirming the Bitcoin (BTC) mining company’s fate. Core Scientific is reportedly filing for Chapter 11 bankruptcy protection in Texas owing to falling revenue and low BTC prices. On Dec. 14, financial services platform B. Riley offered to provide Core Scientific with $72 million in non-cash financing — $40 million with zero contingencies and $32 million with conditions — to retain value for stakeholders. The decision was made after Core’s valuation fell from $4.3 billion in July 2021 to $78 million at the time of reporting. As a direct result of an extended bear market, Core Scientific had to sell 9,618 BTC in April to stay operational. A CNBC report quoted a person familiar wit...

Sam Bankman-Fried seeks to reverse decision on contesting extradition: Report

Sam Bankman-Fried, former FTX CEO, has reportedly reconsidered his earlier decision to contest extradition and is expected to appear in court in the Bahamas on Dec. 19 to seek a reversal, Reuters reported on Dec. 17 citing a person familiar with the matter. By consenting to extradition, Bankman-Fried would be able to appear in a United States court. He faces charges of conspiracy to commit wire fraud on customers and lenders, securities fraud, commodities fraud, money laundering and conspiracy to defraud the United States and violate the campaign finance law. The move follows the Bankman-Fried’s bail denial on Dec. 13 due to the “risk of flight”. The former CEO’s lawyers argued that SBF does not possess a criminal record and was suffering from depression and i...

FTX Bahamas co-CEO Ryan Salame blew the whistle on FTX and Sam Bankman-Fried

A high-ranking executive at FTX’s Bahamian entity tipped off local regulators of potential fraud perpetrated at the cryptocurrency exchange just two days before the exchange was forced to close. According to Bahamian court records filed on Dec. 14, Ryan Salame, the former co-CEO of FTX Digital Markets (FDM), told the Securities Commission of the Bahamas (SCB) on Nov. 9 that FTX was sending customer funds to its sister trading firm Alameda Research. Salame said the funds were to “cover financial losses of Alameda” and the transfer was “not allowed or consented to by their clients.” He also told the SCB only three people had the access required to transfer client assets to Alameda: Former FTX CEO Sam Bankman-Fried, FTX co-founder Zixiao “Gary” Wang and FTX engineer Nishad Singh. Ryan Salame ...

Arthur Hayes: Bitcoin bottomed as ‘everyone who could go bankrupt has gone bankrupt’

Arthur Hayes, the former CEO of crypto derivatives platform BitMEX, thinks the worst might be over for Bitcoin (BTC) this cycle as the “largest most irresponsible entities” have run out of BTC to sell. “Looking forward, pretty much everyone who could go bankrupt has gone bankrupt,” he said in the Dec. 11 interview with crypto advocate and podcaster Scott Melker. Hayes elaborates on his stance by explaining that when centralized lending firms (CELs) have financial troubles, they will often call in loans first, then sell BTC first because it operates as the “reserve asset of crypto” and “the most pristine asset and the most liquid.” “When you look at the balance sheet of any of these of the heroes, there’s no Bitcoin on it because what do they do, they sold...