Banking

deadmau5 and Zytara Partner to Launch Groundbreaking Digital Banking Experience

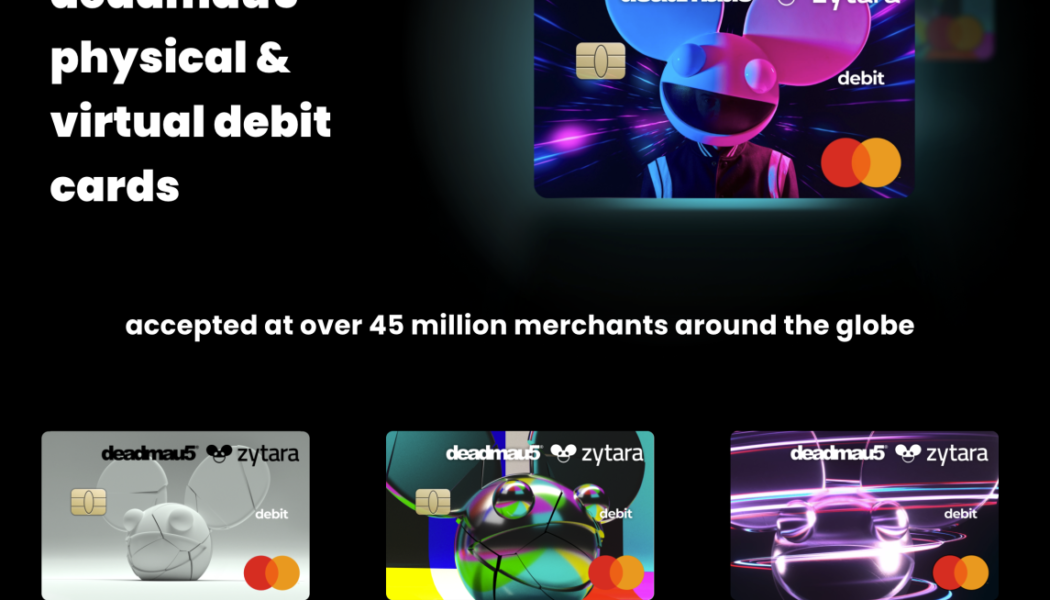

Canadian electronic music icon deadmau5 has formed a groundbreaking partnership with Zytara, an innovative fintech company, to change virtual banking as we know it. The partnership will offer the first-ever branded digital banking experience, according to a press release shared with EDM.com. Zytara’s technology is said to enable fans to “interact with deadmau5’s brand” through the company’s banking app, where they can discover merchandise, concerts, pop-ups and more. Fans will also be able to receive a deadmau5-branded virtual or physical debit card, which can be used at 45 million merchants worldwide. Zytara’s debit cards with deadmau5 branding. Zytara Scroll to Continue Recommended Articles This shape-shifting partnership is the latest i...

Bitcoin and banking’s differing energy narratives are a matter of perspective

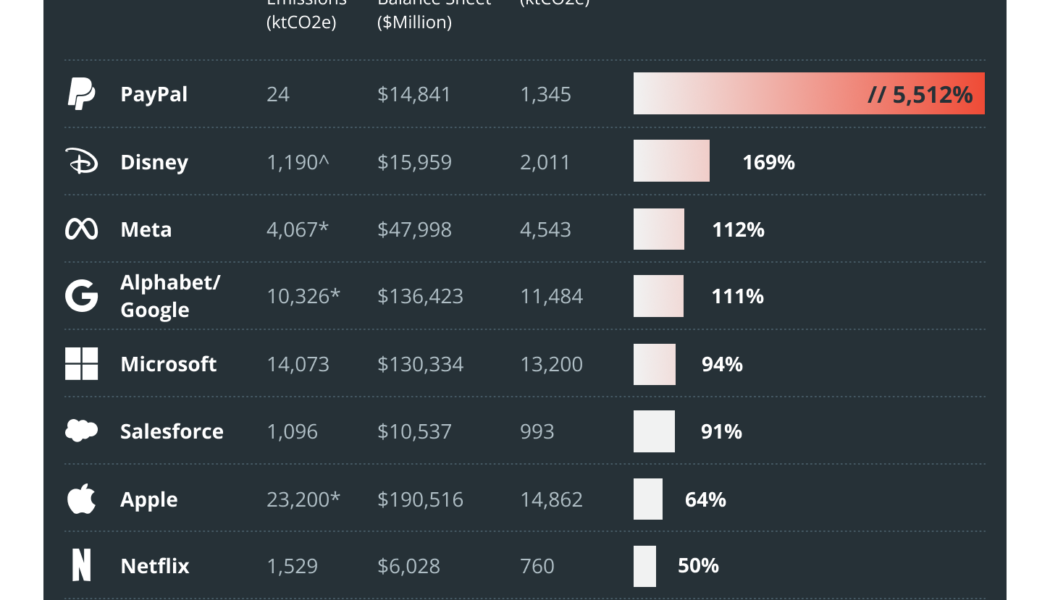

The Carbon Bankroll Report was released on May 17 as a collaboration among the Climate Safe Lending Network, The Outdoor Policy Outfit and Bank FWD. The collaboration made it possible to calculate the emissions generated due to a company’s cash and investments, such as cash, cash equivalents and marketable securities. The report revealed that for several large companies, such as Alphabet, Meta, Microsoft and Salesforce, the cash and investments are their largest source of emissions. The energy consumption of the flagship proof-of-work (PoW) blockchain network, Bitcoin, has been a matter of debate in which the network and its participants, especially miners, are criticized for contributing to an ecosystem that might be worsening climate change. However, recent findings have also brought the...

Blockchain tech offers multiple paths to financial inclusion for unbanked

Financial inclusion, accessible services and the unbanked are standard talking points in many conversations about crypto. But, the details may remain somewhat fuzzy — the people who talk about crypto are generally those already inside the financial system. There are people who are actively working to increase financial inclusion and access to services for the vast number of people who are unbanked or underserved. CBDC for the people Central bank digital currencies (CBDC) will serve different purposes in different places. In economies where individuals have moved away from high levels of cash usage, like those of the United States and the United Kingdom, there will be relatively little retail demand for CBDC, but there are places where cash is in short supply and CBDC can serve to inc...

Crypto is going mainstream: Here’s how the future founders will build on it

Crypto has long been criticized for its lack of inherent value. However, the shift toward contactless transactions amid the pandemic has emphasized the value of digital currencies and blockchain technology in the modern world. For this reason, merchants have been slow to adopt cryptocurrencies as a form of payment. As it gains widespread usage, however, we can expect to see more businesses accepting crypto in the future. The global pandemic has changed the way a lot of us do business. The shift away from cash and face-to-face transactions toward digital cashless ones has introduced many people to the convenience of paying digitally. So, it’s no surprise that crypto is starting to gain traction as a viable payment option — one that will only continue to evolve. While sti...

The FDIC wants US banks to report on current and intended crypto-related activities

The Federal Deposit Insurance Corporation, the United States government corporation that insures depositors at U.S. commercial and savings banks, issued a financial institution letter Thursday. The letter requests the institutions supervised by the agency to notify the appropriate regional director of their activities with crypto-related assets or their intentions to engage in crypto-related activities. According to the letter, “It is difficult for institutions, as well as the FDIC, to adequately assess the safety and soundness, financial stability, and consumer protection implications without considering each crypto-related activity on an individual basis.” Consequently, the FDIC wants to receive all information necessary for it to “engage with the institution regarding related risk...

Central Bank of Russia tightens P2P transactions monitoring, including those in crypto

The Central Bank of Russia (CBR) recommended that the nation’s commercial banks ramp up monitoring users’ transactions that could be aimed at circumventing CBR’s “special economic measures to counter the outflow of foreign currency abroad,” local media reported on Thursday. The recommendation includes closer oversight over crypto trading, which is named among the vehicles for withdrawing capital from Russia. The letter, sent to the banking organizations by CBR’s vice chairman Yuri Isaev on Wednesday, directs them to pay closer attention to the instances of their clients’ “unusual behavior.” This includes “abnormal” transactional activity and uncommon patterns of expenditures. Any withdrawals of money via digital currencies should also attract increased attention, the letter spec...

Citi’s digital asset co-heads resign with plans to create crypto startup

Alex Kriete, co-head of digital assets at Citi, announced his resignation from the banking giant after 11 years at the firm on Thursday via LinkedIn. He stated in his post that he intends to devote himself full-time to developing a new cryptocurrency company but provided no additional details at the time. Kriete co-led the digital assets group with Greg Girasole for less than a year since the unit launched in June 2021. Girasole also announced his departure via LinkedIn and together, he and Kriete plan to start their own blockchain-related venture. The two said they would share more details about it in the coming weeks. Kriete‘s excitement for his new undertaking stemmed from the belief that digital assets will “continue to grow in importance to global capital markets and the formatio...

BNY Mellon partners with Chainalysis to track users’ crypto transactions

The Bank of New York (BNY) Mellon has announced a partnership with blockchain-data platform Chainalysis to help track and analyze cryptocurrency products. BNY Mellon is the world’s largest custodian bank, currently overseeing $46.7 trillion in assets. Chainalysis is a blockchain-data analysis platform that offers services to traditional financial institutions, allowing large firms to manage the legal risks that come with cryptocurrency more easily. As part of the partnership, BNY will utilize Chainalysis software to track, record and make use of the data surrounding crypto assets. The risk management software offered by Chainalysis includes KYT (Know Your Transaction), Reactor, and Kryptos, with the most important being the KYT flagging system — which automatically detects whether cryptocu...

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...

What is the importance of blockchain in the RegTech ecosystem?

Financial regulators and service providers are looking for the best and most cost-effective solutions to help the banks and other financial institutions comply with the rules and do business in a compliant regulatory environment. As blockchain is already disrupting the conventional ways of doing businesses, thanks to its benefits in terms of enhanced transparency, faster procedures, decentralized and most importantly, cost-effective nature. In essence, blockchain provides the solutions for the existing problems faced by financial institutions in terms of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. As the transactions in the blockchain system are immutable, they cannot be changed and altered, providing transparency regarding AML and KYC compliance. Customer onboard...

Fed never did it: US Senate Banking head lashes out at Super Bowl crypto ads

The Super Bowl advertisements by crypto companies, including Coinbase, FTX and several others, ruled social media and news headlines for their out-of-the-box approach. However, United States Senate Banking Committee Chief Sherrod Brown was not impressed and blasted the ad-makers for not including appropriate warnings and risks involved. Brown, during the Tuesday Senate hearing on stablecoins, brought in the topic of popular crypto advertisements that aired during the Super Bowl. He said most of these ads failed to tell people about the downsides of investing in cryptocurrencies. The companies failed to mention the wild price swings and prevalent scams that occur in the market or the fact that the crypto market is not as well regulated as the traditional ones. Super Bowl advertisement ...