Bank of America

Gold vs BTC correlation signals Bitcoin becoming safe haven: BofA

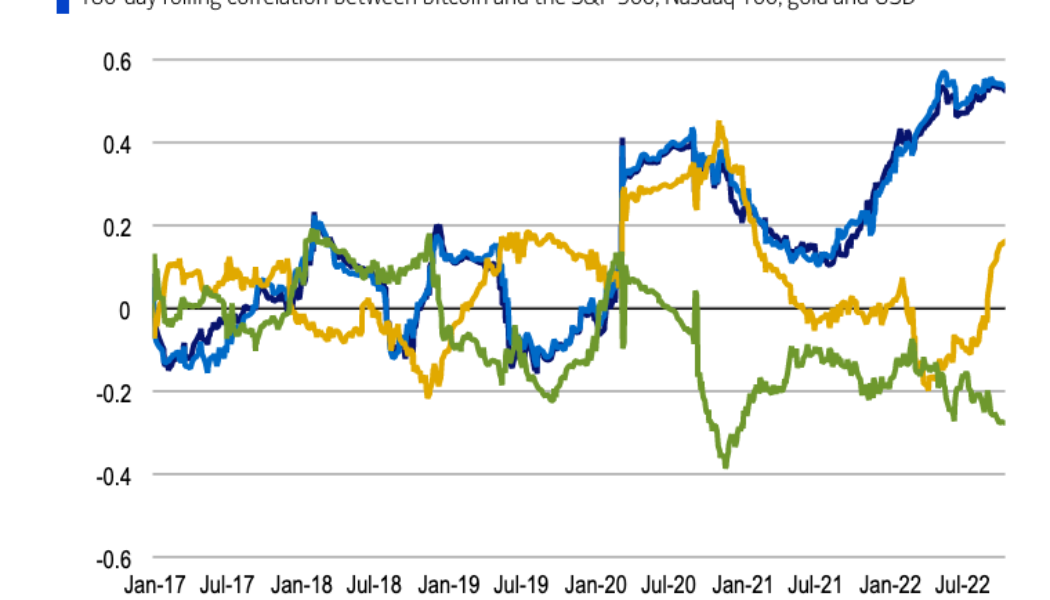

Despite the ongoing cryptocurrency bear market, investors have been increasingly looking at Bitcoin (BTC) as a safe haven, a new study suggests. The rise in the correlation between Bitcoin and gold (XAU) is one of the major indicators demonstrating investors’ confidence in BTC amid the ongoing economic downturn, according to digital strategists at the Bank of America. Bitcoin’s correlation with gold — which is commonly viewed as an inflation hedge — has been on the rise this year, hitting its highest yearly levels in early October. The growing correlation trend started on Sept. 5 after remaining close to zero from June 2021 and turning negative in March 2022, BofA strategists Alkesh Shah and Andrew Moss said in the report. “Bitcoin is a fixed-supply asset that may eventually become an infl...

Rep. Warren Davidson: Stablecoin bill has ‘outside chance’ of finalizing this year

There is a small chance the U.S. House of Representatives could pass the bill to regulate stablecoins by year-end, though it’s more likely it will pass in the first quarter of 2023, says U.S. Congressman Warren Davidson. According to a Thursday report from Kitco, Davidson made the remarks at the Annual Fintech Policy Forum on Sept. 22, where he suggested: “There’s an outside chance we find a way to get to consensus on a stablecoin bill this year.” The “stablecoin bill” seemingly refers to draft legislation aimed at “endogenously collateralized stablecoins” which came to light this week — and would place a two-year ban on new algorithmic stablecoins such as TerraUSD Classic (USTC). However, Davidson went on to say that while “there’s a chance we get...

Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

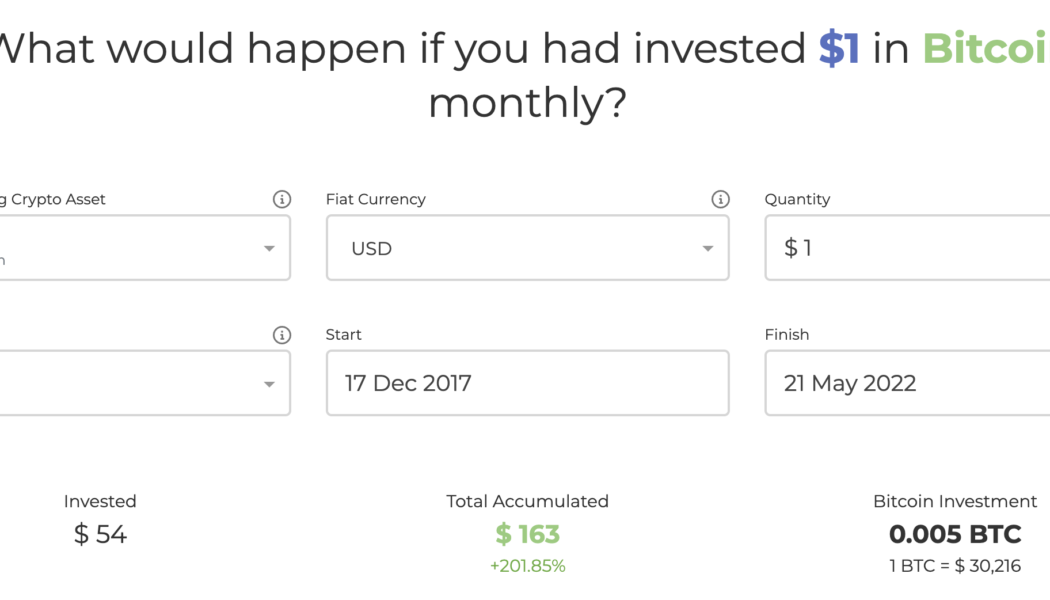

Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021. The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff. The more you look at prior $BTC price history the more one can think it’s not the bottom After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box) If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC — Rager (@Rager) May 20, 2022 This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged ...

Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021. The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff. The more you look at prior $BTC price history the more one can think it’s not the bottom After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box) If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC — Rager (@Rager) May 20, 2022 This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged ...

Downtown Launches $200M Fund to Support Indie Artists & Entrepreneurs

Downtown Music Holdings has established a fund to invest over $200 million in support of independent artists and entrepreneurs, the company announced Wednesday (March 9). The fund, which is supported by a new credit facility with Bank of America, will be spread across Downtown’s distribution, publishing administration and artist and label services operations. In a statement, Downtown Music Holdings CEO Andrew Bergman said the financing from Bank of America “enables us to expand our music services business by giving creators and business owners the ability to finance projects in an environment where the options are often unpalatable.” Downtown chief investment officer Alan Goodstadt added, “We are immensely gratified that Bank of America shares our vision of building financial solutions for...

Bank of America says stablecoin adoption and CBDC is ‘inevitable’

It appears that the U.S. will finally be moving forward to create its own central bank digital currency (CBDC) according to the Bank of America. Bank of America crypto strategists Andrew Moss and Alkesh Shah wrote in a Jan. 24 note that CBDCs “are an inevitable evolution of today’s electronic currencies,” according to a Bloomberg report. The analysts wrote: “We expect stablecoin adoption and use for payments to increase significantly over the next several years as financial institutions explore digital asset custody and trading solutions and as payments companies incorporate blockchain technology into their platforms.” Meanwhile, a Jan. 20 report titled “Money and Payments: The U.S. Dollar in the Age of Digital Transformation” from the Federal Reserve Bank (FRB) weighed up the benefits and...

Solana could become the ‘Visa of crypto’: Bank of America

Bank of America digital asset strategist Alkesh Shah has predicted that Ethereum competitor Solana could become the “Visa of the digital asset ecosystem” in a Jan 11 research note. The Solana network launched in 2020, and has since grown into the fifth largest cryptocurrency with a market capitalization of $47 billion. An order of magnitude faster than Ethereum, it has been used to settle over 50 billion transactions and mint over 5.7 million non-fungible tokens (NFTs). Critics however argue its speed comes at the cost of decentralization and reliability but Shah thinks the benefits outweigh the drawbacks: “Its ability to provide high throughput, low cost and ease of use creates a blockchain optimized for consumer use cases like micropayments, DeFi, NFTs, decentralized networks (Web3...