Avalanche

Price analysis 2/2: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

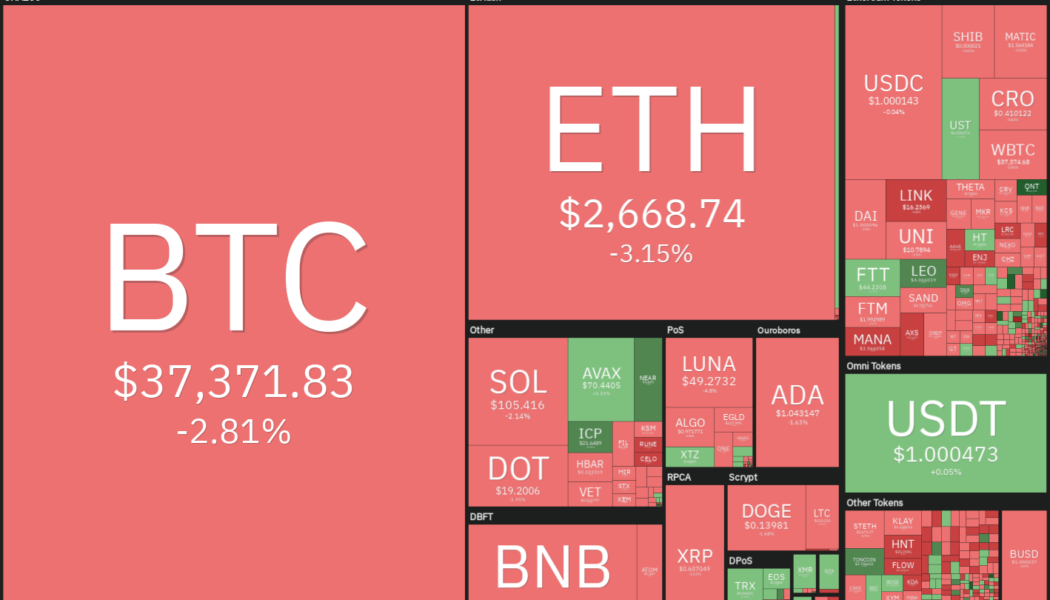

Bitcoin (BTC) rose above $39,000 on Feb. 1 but the sharp fall in the shares of PayPal may have resulted in aggressive selling by the short-term traders. However, in the long-term, large investors seem to be viewing the decline as a buying opportunity. On-chain monitoring resource Whalemap said that whales holding between 100 to 10,000 BTC have accumulated during the recent decline. Fidelity recently released a paper dubbed “Bitcoin First,” which highlights that Bitcoin is the most “secure, decentralized form of asset” and is unlikely to be overtaken by any of the altcoins “as a monetary good.” The report said that Bitcoin combines “the scarcity and durability of gold with the ease of use, storage and transportability of fiat.” Daily cryptocurrency market performance. Source: Coin360 I...

Kyber Network (KNC) bucks the market-wide downtrend with a 57% gain in January

In the crypto market volatility continues to reign supreme, and fear, uncertainty and doubt (FUD) run rampant. This makes it challenging for any project to rise above the noise and post positive price gains but there are a few projects that are showing strength during the current downturn. Kyber Network (KNC) is a multi-chain decentralized exchange (DEX) and aggregation platform designed to provide decentralized finance (DeFi) applications and their users with access to liquidity pools that provide the best rates. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a bottom of $1.18 on Jan. 6, the price of KNC has rallied 57% to a daily high at $1.87 on Jan. 27 despite the wider weakness in the crypto market. KNC/USD 4-hour chart. Source: TradingView Three re...

Price analysis 1/26: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

Bitcoin (BTC) and most major altcoins have bounced off their strong support levels but could the rally sustain to the extent that traders feel confident that a bottom in place? Bloomberg Intelligence senior commodity strategist Mike McGlone said that Bitcoin’s price is “about 30% below its 20-week moving average,” roughly at the same position, which had led to bottom formations in March 2020 and July 2021. Although Bitcoin has corrected sharply in January, the exchanges’ balances dropped from 2.428 million Bitcoin on December 28 to 2.366 million Bitcoin on Jan. 24, according to data from CryptoQuant. This indicates that investors may be stashing away their recent purchases safely. Daily cryptocurrency market performance. Source: Coin360 However, it may not be a V-shaped recovery for ...

Binance Smart Chain cedes third-place ranking to Fantom decentralised ecosystem

Fantom ranks only behind Terra and Ethereum ecosystems in total value locked as per latest DeFi market data Binance Smart Chain, Solana and Avalanche gave way to Fantom as the blockchain rose to third spot in total value locked (TVL). Gaining more than 60% in 48 hours, Fantom’s DeFi ecosystem leapfrogged Binance Smart Chain (BSC) earlier today with $12.4 billion in TVL ($500 million more than the BSC). The growth of the network has been propelled by activity in its 129 protocols, with dApps such as Matrixswap and Chainstack heavily using the chain in their expansion efforts. At the time of press, the TVL of the Fantom blockchain is $11.97 billion, up 49.5% in the last seven days. Data from DefiLlama indicates that Fantom controls 6.25% of the TVL in DeFi compared to BSC’s 6.07%...

3 possible reasons why Polkadot is playing second fiddle in the L1 race

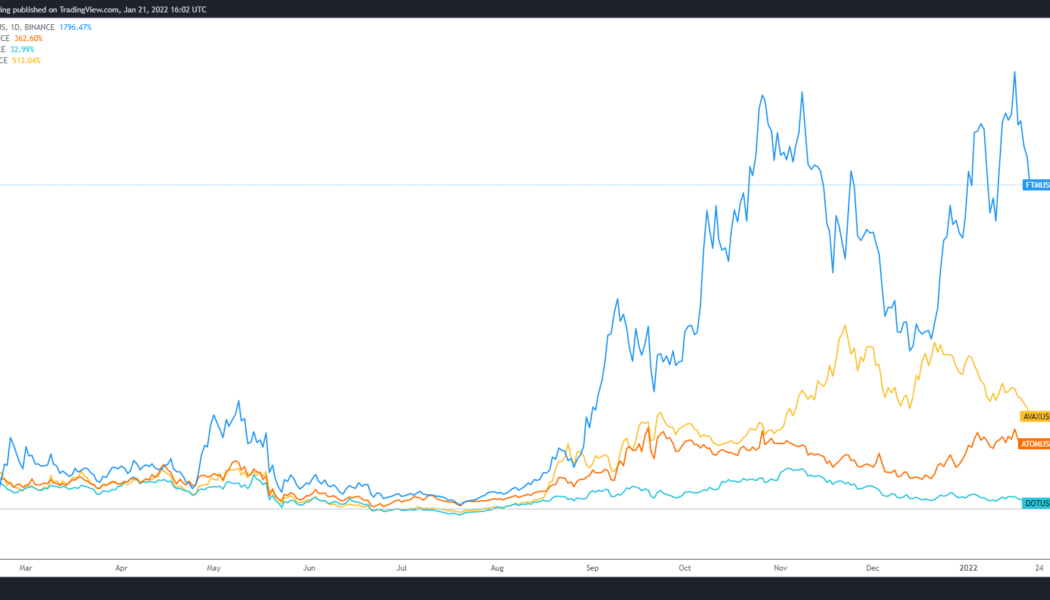

2021 was a sort of “coming-of-age” for many layer-one (L1) blockchain protocols because the growth of decentralized finance (DeFi) and nonfungible tokens (NFTs) forced users to look for solutions outside of the Ethereum (ETH) network where high fees and network congestion continued to be barriers for many. Protocols like Fantom (FTM), Avalanche (AVAX) and Cosmos (ATOM) saw their token values rise and ecosystems flourished as 2021 came to a close. Meanwhile, popular projects like Polkadot (DOT) underperformed, comparatively speaking, despite the high expectations many had for the sharded multi-chain protocol. FTM/USDT vs. AVAX/USDT vs. ATOM/USDT vs. DOT/USDT daily chart. Source: TradingView Setting aside the specific capability that each protocol offers in terms of transactions ...

Price analysis 1/21: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

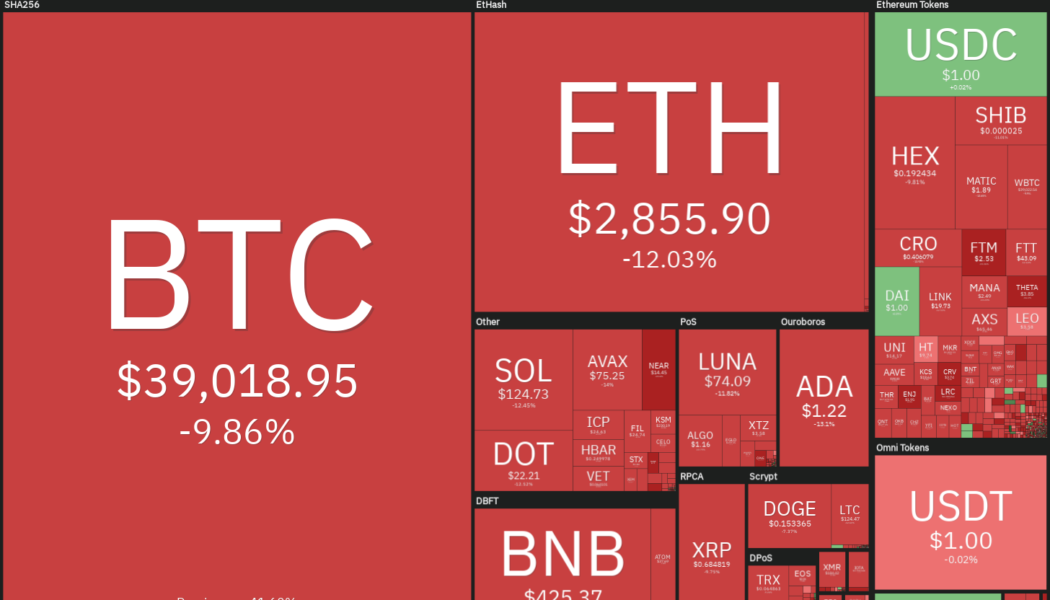

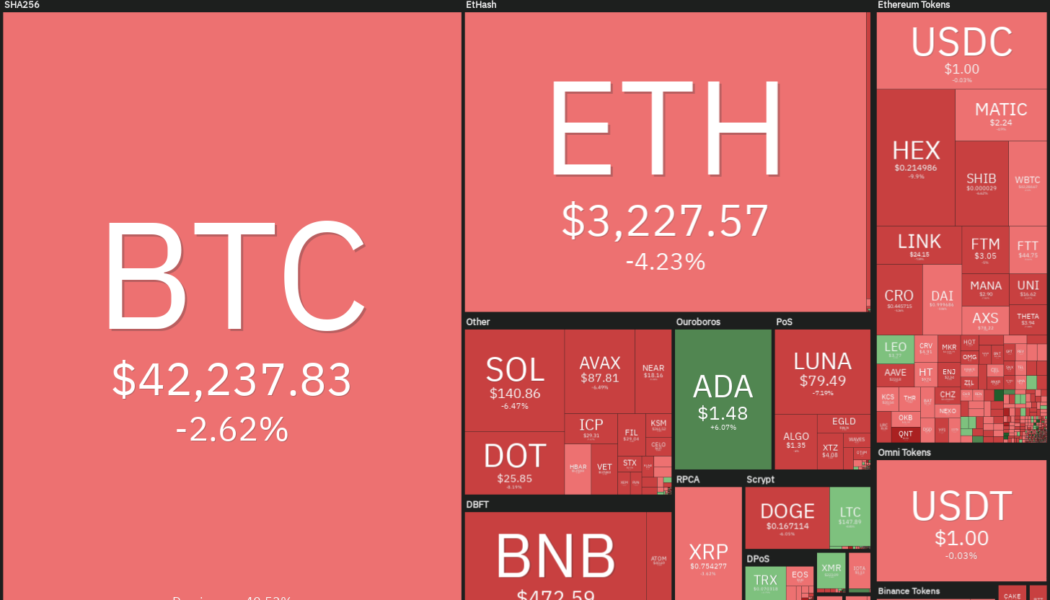

Bitcoin (BTC) and most major altcoins continue to witness a bloodbath on Jan. 21 and the result of the most recent downturn has been a $200 billion reduction in market capitalization. A new report by Huobi Research, in collaboration with Blockchain Association Singapore, forecast Bitcoin to enter a bear market in 2022. The liquidity tightening measures undertaken by the U.S. Federal Reserve and other central banks across the world and the regulatory action by authorities could play spoilsport and keep crypto prices under check. Daily cryptocurrency market performance. Source: Coin360 The calls for a bear market have not shaken up the resolve of MicroStrategy CEO Michael Saylor who is determined to hold on to the company’s Bitcoin holdings. Saylor said in a recent interview...

Price analysis 1/17: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin’s (BTC) volatility has been shrinking in the past few days. The standard deviation of daily Bitcoin returns for the last 30 and 60 days as calculated by the Bitcoin Volatility Index is at 2.63%, the least volatile it has been since November 2020. Generally, tight ranges are followed by strong price expansions. In 2020, the low volatility period in November was followed by a sharp rally in mid-December, which resulted in a supercycle that carried the price all the way to $64,854 on April 14, 2021. Daily cryptocurrency market performance. Source: Coin360 However, there is no certainty that the volatility expansion will happen only to the upside. The price could break out in either direction. Commentator Vince Prince warned that the high leverage ratio of Bitcoin could trigger a big c...

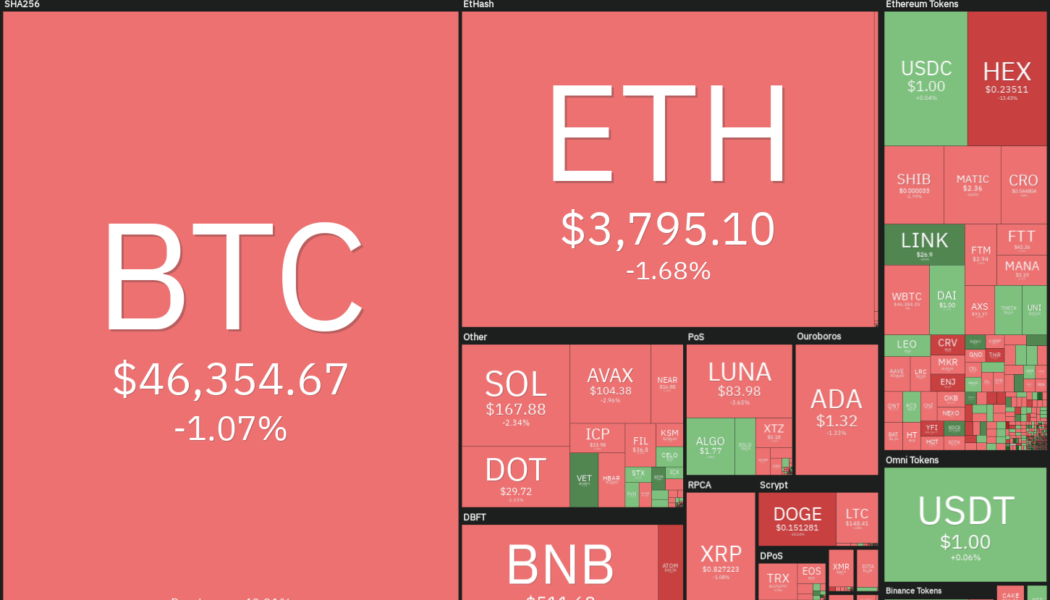

Price analysis 1/14: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins are facing selling at higher levels and buying on dips, indicating the possibility of a range formation. On-chain analysis firm Whalemap said that a “reclaim of $46,500 will look like a trend reversal,” for Bitcoin as the previous accumulation phase of 90,000 BTC was at this level. Fidelity Digital Assets said in its annual report that the “massive “ Bitcoin accumulation by Bitcoin miners suggests that the “Bitcoin cycle is far from over.” The report went on to add that more sovereign nations may “acquire Bitcoin in 2022 and perhaps even see a central bank make an acquisition.” Daily cryptocurrency market performance. Source: Coin360 Switzerland-based financial institution SEBA Bank CEO Guido Buehler said in a recent interview that if the right co...

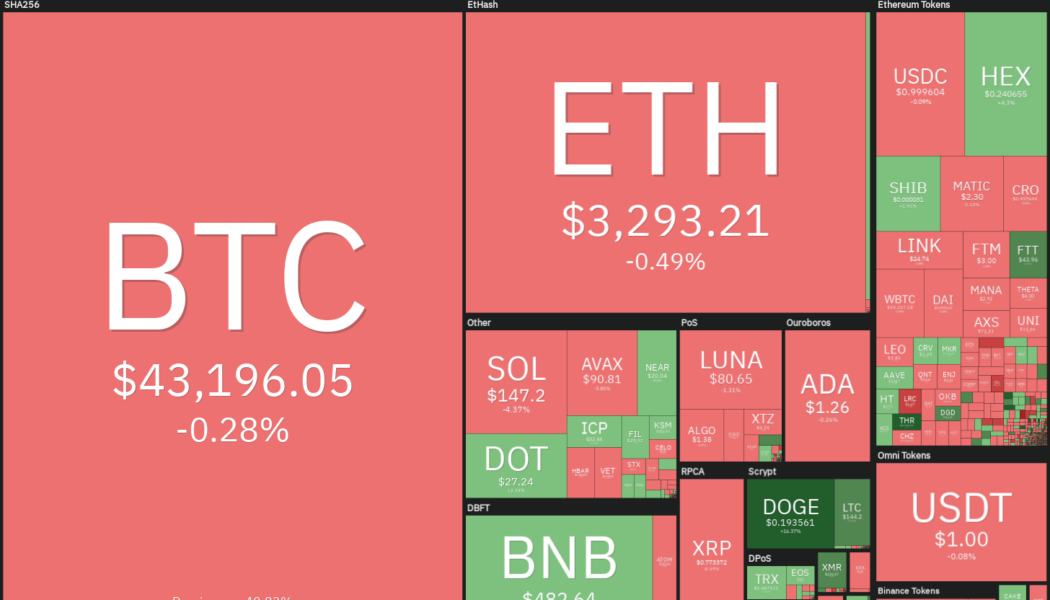

Price analysis 1/12: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins appear to have started a relief rally. Glassnode data suggests that Bitcoin addresses with a non-zero balance have risen to about 40 million, indicating increasing adoption by retail traders. Edelman Financial Engines founder Ric Edelman said that the number of Americans owning Bitcoin could rise from 24% currently to one-third by 2022. He expects this to happen as “Bitcoin is becoming more and more mainstream. People are hearing about it everywhere — it isn’t going away.” Daily cryptocurrency market performance. Source: Coin360 The investors buying Bitcoin seem to be in it for the long haul if the outflows from major exchanges are any indication. CryptoQuant data shows outflows of 29,371 BTC on Jan. 11, the highest withdrawals since Sep. 10. Could the...

Ava Labs and EV maker Togg to build smart contract-based mobility services

Turkey’s electronic vehicle (EV) manufacturer Togg has announced a strategic partnership with Ava Labs to design and build smart contract-based services aimed at improving autonomous mobility. Togg’s collaboration with Ava Labs, a team dedicated to supporting and developing the Avalanche public blockchain, was revealed at the CES 2022 event in Las Vegas. As Cointelegraph Turkey reported, the partnership aims to fast-track Togg’s Use-Case Mobility initiative, which combines different technologies and transportation solutions to produce cars with more functionalities as compared to traditional EVs. According to the official announcement, Togg has been exploring use cases around blockchain and related technologies in EVs for more than a year. With Ava Labs’ partnership, Togg intends to ...

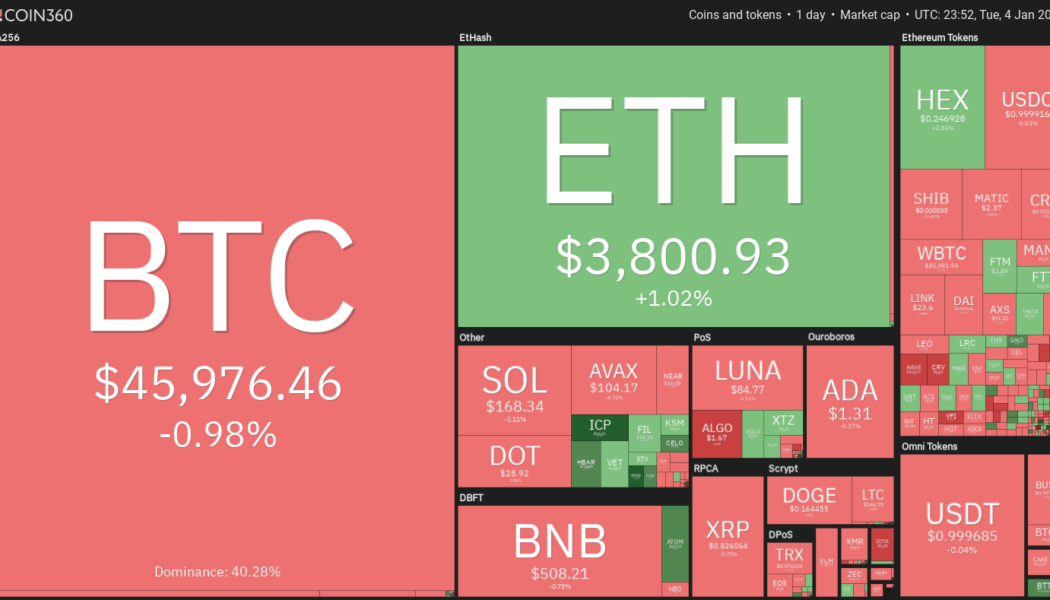

Price analysis 1/5: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins are stuck in a tight range with bulls buying near the support and bears selling at resistance levels. Usually, such tight ranges are followed by an expansion in volatility. Although a few analysts have not ruled out a quick drop to low $40,000s, most traders expect Bitcoin to rebound sharply and move up to $60,000. Goldman Sachs said in a note to investors that if Bitcoin continues to increase its market share over gold as a store of value and crosses the 50% mark, then it could rally to $100,000 over the next five years. Daily cryptocurrency market performance. Source: Coin360 On-chain analytics provider Glassnode said in its report on Monday that Bitcoin’s illiquid supply has increased to more than 76% of the total circulating supply. According to Gl...

Top 5 cryptocurrencies to watch in 2022: BTC, ETH, BNB, AVAX, MATIC

Bitcoin (BTC) witnessed a roller coaster ride in 2021 and even though BTC has corrected sharply from its all-time high at $69,000, the digital asset is still up by 60% year-to-date. During the same period, gold has dropped more than 5%. With inflation soaring in the United States and several other parts of the world, Bitcoin’s outperformance over gold shows that investors may be considering it to be a better hedge against inflation when compared to gold. During the year, the total crypto market capitalization surged to about $3 trillion, but Bitcoin’s dominance fell from about 70% at the start of the year to 40%. This shows that several altcoins have outperformed Bitcoin by a huge margin. Crypto market data daily view. Source: Coin360 As cryptocurrencies gain wider adoption, multiple...