Avalanche

Price analysis 4/18: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

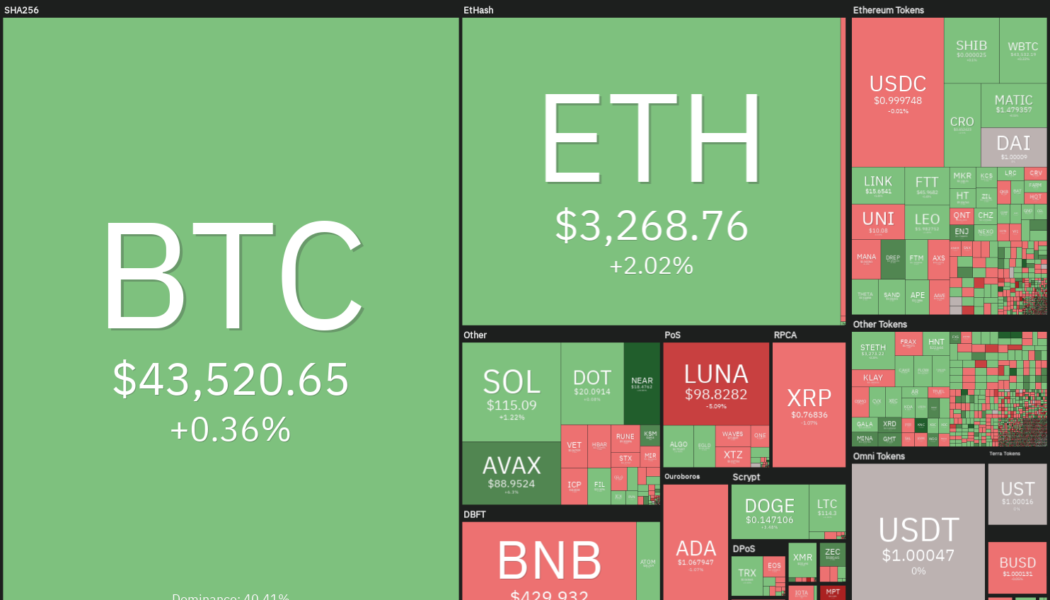

Bitcoin (BTC) and most major altcoins have started the new week on a soft note and the Crypto Fear and Greed Index has dropped into the “extreme fear” zone, suggesting that investors are still nervous. Bitcoin has declined about 17% year-to-date while the Nasdaq 100 has dropped about 16% during the same period, indicating a tight correlation between the two. In comparison, gold has risen more than 10% in 2022 and its 50-day correlation coefficient with Bitcoin “is around minus 0.4, the lowest since 2018,” according to journalist Colin Wu. Daily cryptocurrency market performance. Source: Coin360 Although the crypto price action has remained bearish, the declining balance of Bitcoin on the crypto exchanges indicates that long-term investors are unperturbed and continue to accumulate at...

Price analysis 4/15: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

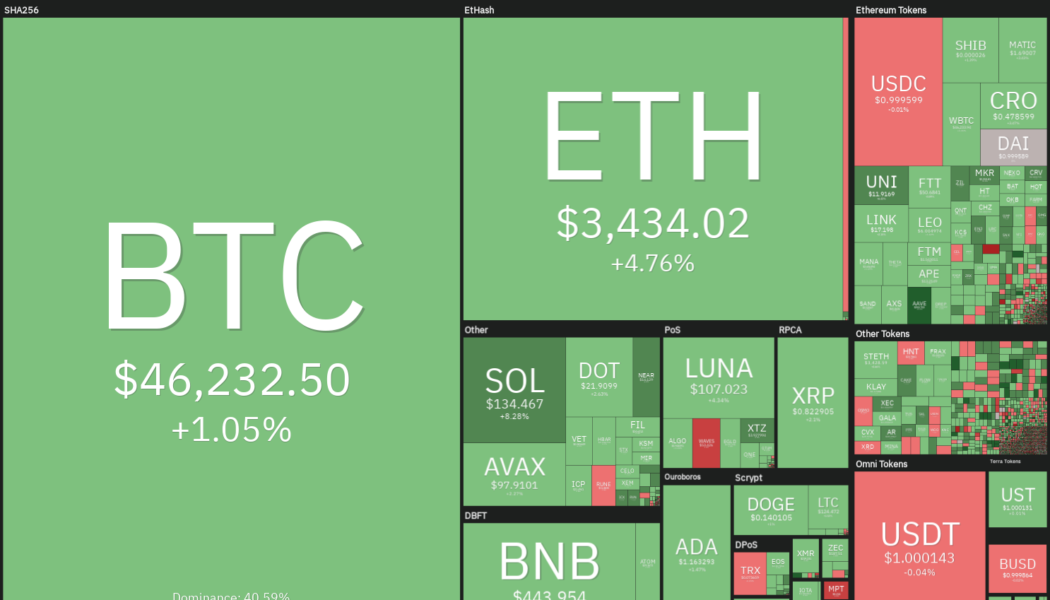

Bitcoin (BTC) remains closely correlated with the S&P 500 but the institutional investors do not seem to be waiting for a turnaround in the United States’ equities market or decoupling to happen before buying more Bitcoin. Notably, 30,000 Bitcoin moved out of Coinbase Pro in a single day, suggesting strong institutional demand. MicroStrategy, the publicly listed company, which is the largest single-wallet holder of Bitcoin, does not seem to be content with its stash of 129,219 Bitcoin. In a letter to shareholders, the firm’s CEO Michael Saylor said that the company aims to “vigorously pursue” and “increase awareness” about its Bitcoin strategy. Daily cryptocurrency market performance. Source: Coin360 Another entity that has been at the forefront of Bitcoin purchases in the p...

Price analysis 4/8: BTC, ETH, BNB, SOL, XRP, ADA, LUNA, AVAX, DOT, DOGE

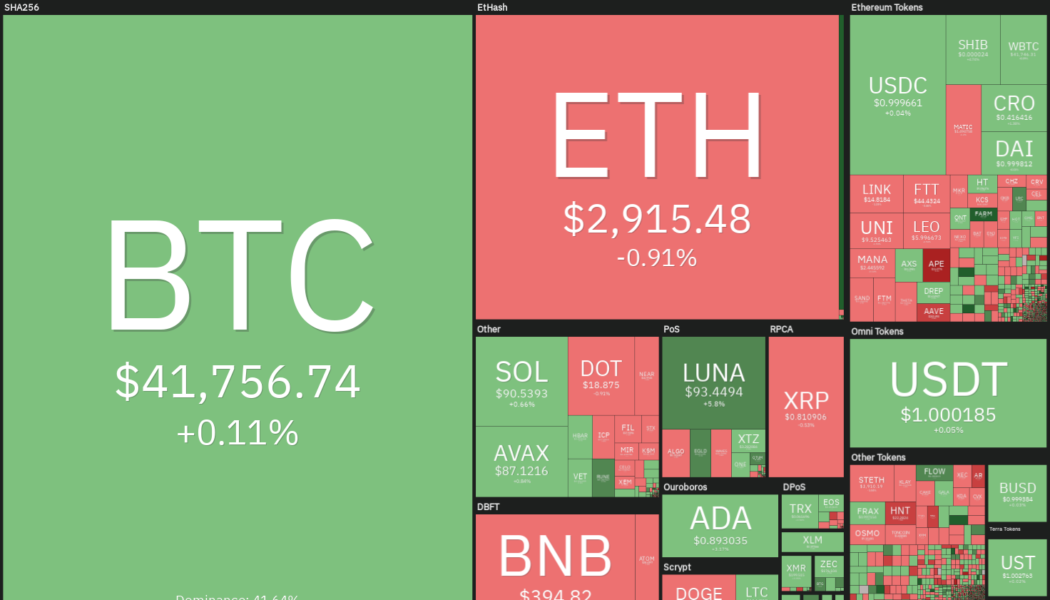

Bitcoin (BTC) and most major altcoins are attempting to defend the immediate support levels, indicating that bears sense an opportunity and are looking to take control of the price action. The short-term price action does not seem to worry the long-term Bitcoin bulls who expect a massive return in the next few years. While speaking at the Bitcoin 2022 conference in Miami, ARK Invest CEO Cathie Wood reiterated her Bitcoin price target of $1 million by 2030. Meanwhile, telecom billionaire Ricardo Salinas said during the conference that BTC and Bitcoin equities form 60% of his liquid investment portfolio. That is a massive increase from his Bitcoin exposure in 2020, which formed just 10% of his liquid assets. Daily cryptocurrency market performance. Source: Coin360 While the long-term may be ...

Kyber Network (KNC) soars after integrating with Uniswap v3 and Avalanche Rush Phase 2

The outlook for projects in the decentralized finance (DeFi) sector has begun to improve in recent months as a combination of global events have highlighted the benefits of holding funds outside of the traditional financial systems. One project that has rallied over the past few months is Kyber Network (KNC), a multi-chain cryptocurrency trading and liquidity hub that aims to offer users the best trading rates. Data from Cointelegraph Markets Pro and TradingView shows that after bouncing off a low of $2.83 on April 6, the price of KNC jumped 55.4% to hit an all-time high of $4.04 on April 8 amid a 253% spike in its 24-hour trading volume. KNC/USDT 1-day chart. Source: TradingView Three reasons for the building momentum of KNC include the integration of support for ten separate blockchain n...

AVAX traders anticipate a new ATH even as Avalanche DApp use slows

Avalanche (AVAX) jumped 43.8% between March 14 and March 31 to a $97.50 daily close, which is the highest level since Jan. 5. This layer-1 scaling solution uses a proof-of-stake (PoS) model and has amassed $9 billion in total value locked (TVL) deposited on the network’s smart contracts. AVAX token/USD at FTX. Source: TradingView Subnet adoption propels the recent price rally Some analysts attribute the rally to Avalanche’s incentive program to accelerate the adoption of subnets which was announced on March 9. According to the Avalanche Foundation, subnets enable functions that are only possible with “network-level control and open experimentation.” The program will allocate up to four million AVAX, worth roughly $340 million, to fund decentralized applications focused on gaming, nonfungib...

Price analysis 4/1: BTC, ETH, BNB, SOL, XRP, ADA, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) has clawed back much of the losses that took place in January and now the focus of traders shifts to April, which has historically been a strong month for the cryptocurrency. According to Coinglass data, Bitcoin has closed April in the red on onlthree occasions and the worst monthly loss was a 3.46% drop in 2015. Although history favors the bulls, the Whale Shadows indicator has noticed that more than 11,000 Bitcoin has left a wallet in which it had been lying dormant for seven to ten years. The movement of similar-sized quantities from dormant accounts has generally resulted in a major top, according to independent market analyst Phillip Swift. Daily cryptocurrency market performance. Source: Coin360 Along with keeping an eye on the crypto markets, traders should ...

Finance Redefined: Hoskinson talks about DApps, Coinbase Cloud launches Avalanche tools and more

The week was filled with ups and downs for the decentralized finance (DeFi) space, with several tokens registered new weekly highs. Cardano founder admitted he was wrong about his bold prediction on the number of decentralized applications (DApps) in the Cardano ecosystem, and Coinbase Cloud released a new developer tool suite for the Avalanche blockchain. SushiSwap community introduced a new proposal for a legal structure to mitigate risks for token holders and members of the Sushi protocol. We had another week another DeFi exploit with Li Finance becoming the latest victim. On the price side, most DeFi tokens in the top 100 registered double-digit gains, and the total value locked (TVL) in the DeFi market blossomed to over $130 billion. Charles Hoskinson cheekily admits he was wrong abou...

Price analysis 3/21: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins are attempting to start the new week on a positive note by bouncing off their respective support levels. Goldman Sachs became one of the first major banks in the United States to complete an over-the-counter “cash-settled cryptocurrency options trade” with the trading unit of Michael Novogratz’s Galaxy Digital. This could encourage other major banks to consider offering OTC transactions for cryptocurrencies. It is not only select nations that are showing growth in crypto adoption. A report by cryptocurrency exchange KuCoin shows that crypto transactions in Africa have soared by about 2,670% in 2022. Bitcoin Senegal founder Nourou believes that Africa could continue its thousand plus percent growth rates in the next few years. Daily cryptocurrency marke...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, AVAX, ETC, EGLD

Bitcoin (BTC) rose above $42,000 on March 19 but the bulls continue to face a strong challenge from the bears at higher levels. Although Bitcoin’s price has recovered from $37,578 on March 13, Cointelegraph market analyst Marcel Pechman highlighted that the long-to-short net ratio of top traders across three major exchanges shows that professional traders have not been buying aggressively. But while Bitcoin struggles at higher levels, select altcoins are showing strength. Twitter account BTCFuel anticipates that altcoins could be entering “the final leg up of the hype phase” and may peak in the Summer. Crypto market data daily view. Source: Coin360 Glassnode data shows that investors have withdrawn roughly 550,000 Ether (ETH) from centralized exchanges year-to-date. Due to the outflo...

Bitcoin spikes to $41.7K highs as Ethereum nears $3K reclaim

Bitcoin (BTC) saw brisk upwards action during the Wall Street trading session on March 18, conforming to predictions that higher levels would see a retest. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bets placed on $46,000 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it advanced $1,650 from daily lows to nearly matching the $41,700 high from March 16. The move buoyed traders, who began to reinforce their short-term view of levels near the top of Bitcoin’s 2022 trading range being challenged. For popular trader Pentoshi, however, such a result would not mean that BTC/USD had broken its downtrend definitively. “Macro headwinds still too strong but midterm, I think we rally bc seller exhaustion before any shot at new lows or prev low...

Price analysis 3/18: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) is facing a challenging environment in 2022 due to the surging inflation and geopolitical turmoil. Although gold has outperformed Bitcoin year-to-date, Bloomberg Intelligence senior commodity strategist Mike McGlone believes that Bitcoin could make a strong comeback. McGlone expects the current circumstances to “mark another milestone in Bitcoin’s maturation.” Another bullish sign for the long term is that the Bitcoin miners have been increasing their Bitcoin holdings since 2021. Compass Mining founder and CEO Whit Gibbs said to Cointelegraph that Bitcoin mining companies are “taking more of a bullish approach to Bitcoin.” Daily cryptocurrency market performance. Source: Coin360 Terraform Labs founder Do Kwon said that its stablecoin TerraUSD (UST) will be backed by mor...

Price analysis 3/16: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) is witnessing a see-saw battle near $40,000 with both the bulls and the bears trying to gain the upper hand. The volatility could remain high as the markets await the United States Federal Reserve’s policy decision due on March 16. Analyst Willy Woo suggests that Bitcoin could witness a capitulation event based on a cost basis, a metric that indicates the transfer of Bitcoin from inexperienced to experienced traders. Such sharp declines usually suggest the formation of market bottoms. Daily cryptocurrency market performance. Source: Coin360 However, Glassnode believes that a capitulation has been avoided because the sell-offs have been absorbed by a relatively strong market. Although 82% of the short-term holders’ coins are in loss, Glassnode considers this to be a late...