Avalanche

2023 Price Predictions: Metacade and Avalanche Start Off Strong in 2023

With all of the crypto investment community hopeful that we have reached a point… The post 2023 Price Predictions: Metacade and Avalanche Start Off Strong in 2023 appeared first on The Home of Altcoins: All About Crypto, Bitcoin & Altcoins | Cointext.com.

Ava Labs partners with AWS to offer one-click node deployment

Ava Labs, the developer of the Avalanche network (AVAX), has partnered with Amazon Web Services (AWS) to implement new features intended to make running a node easier, according to a Jan. 11 blog post from Ava Labs. The new features include one-click node deployment through the AWS Marketplace, AWS GovCloud integration for decentralized app (DApp) developers concerned about compliance, and the ability to create Avalanche subnets with just a few clicks. It’s official! @Amazon #ChoseAvalanche to bring scalable blockchain solutions to enterprises and governments #AWS fully supports Avalanche’s infrastructure and dApp ecosystem, including one-click node deployment, offering the best tooling for these high compliance use cases. pic.twitter.com/syInSrU9XD — Avalanche (@avalancheavax) January 11,...

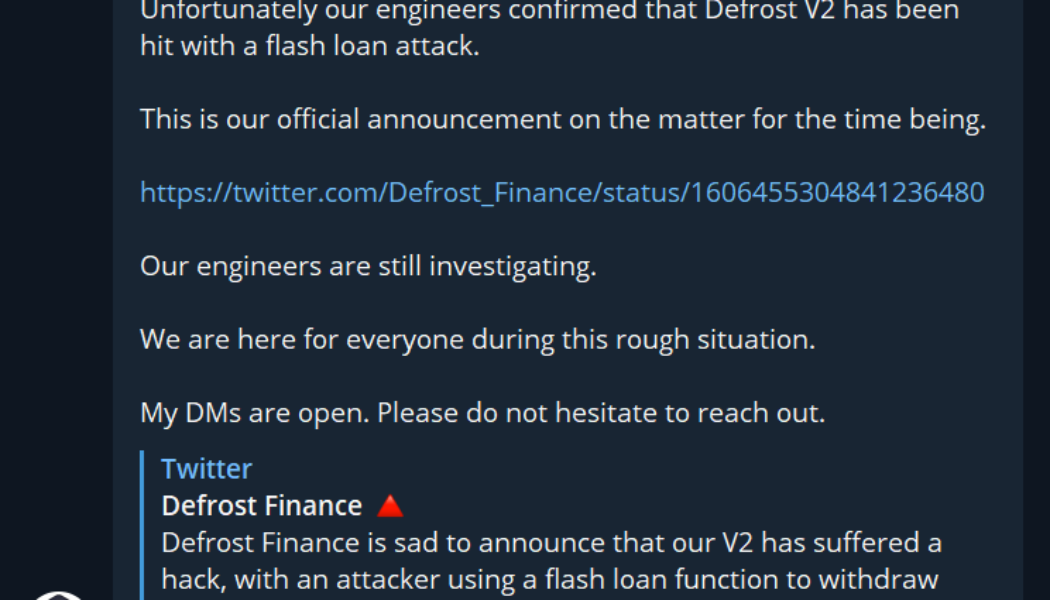

DeFi flash loan hacker liquidates Defrost Finance users causing $12M loss

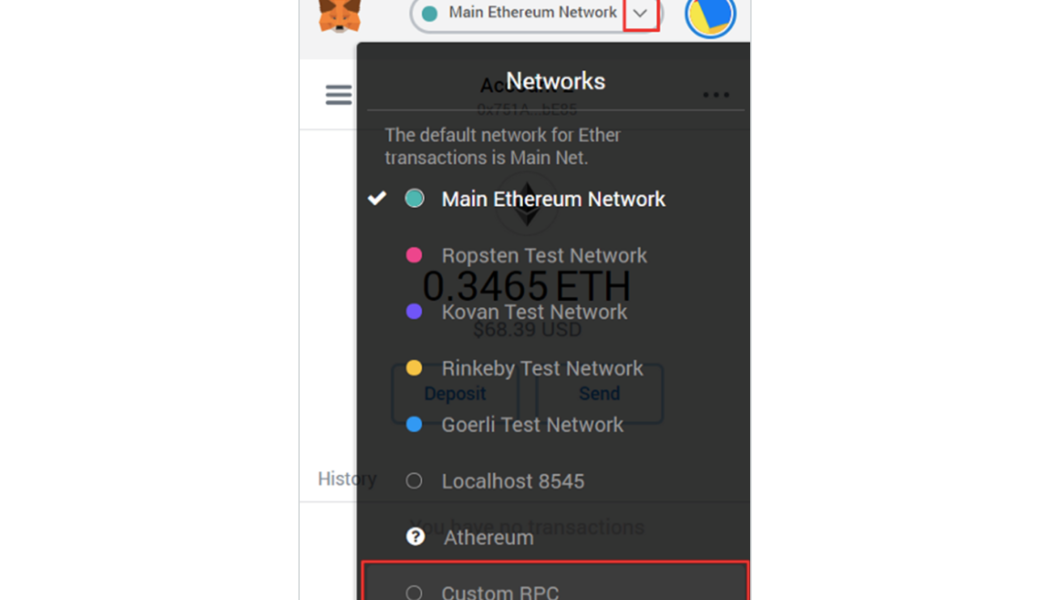

Defrost Finance, a decentralized leveraged trading platform on Avalanche blockchain, announced that both of its versions — Defrost V1 and Defrost V2 — are being investigated for a hack. The announcement came after investors reported losing their staked Defrost Finance (MELT) and Avalanche (AVAX) tokens from the MetaMask wallets. Moments after a few users complained about the unusual loss of funds, Defrost Finance’s core team member Doran confirmed that Defrost V2 was hit with a flash loan attack. At the time, the platform believed that Defrost V1 was not impacted by the hack and decided to close down V2 for further investigation. Core team member Doran confirming attack on Defrost Finance. Source: Telegram At the time, the platform believed Defrost V1 was not impacted by the hack...

Avalanche to power Alibaba Cloud’s infrastructure services in Asia

Alibaba Cloud, a.k.a Aliyun, a subset of Chinese e-commerce giant Alibaba, announced an integration with Avalanche blockchain to power the company’s Node-as-a-Service initiatives. Avalanche’s partnership with Alibaba Cloud will see the development of tools that enable users to launch validator nodes on Avalanche’s public blockchain platform in Asia. The integration will allow Avalanche developers to use Alibaba Cloud’s plug-and-play infrastructure as a service to launch new validators. Developers expecting high resource demands during peak hours can also tap into additional resources — computing, storage, and distribution — offered by Alibaba Cloud. APAC’s largest cloud service provider, Alibaba Cloud, has expanded support for #Avalanche! This integration enables develope...

VC Roundup: Web3 dev, EVM sharding and crypto banking headline blockchain funding deals

Web3 dominance within crypto funding rounds has been well documented by Cointelegraph Research. In addition to the Web3 mega funds announced recently, venture capital has also been making smaller, more targeted investments in the sector. In this week’s Venture Capital (VC) Roundup, we chronicle the latest Web3 funding initiatives and draw attention to a sharding platform, nonfungible token (NFT) marketplace, crypto banking solution and co-ownership infrastructure provider. Related: Blockchain games and metaverse projects raised $1.3B in Q3: DappRadar Gamers, athletes and content creators back WWVentures WWVentures, a boutique crypto venture firm, has raised $15 million for its Web3 fund — putting the company on track to invest in metaverse, decentralized finance and blockchain gaming...

DApp activity rises 3.7% in August for the first time since May: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. Decentralized applications, or DApps, finally showed a glimmer of recovery in August as the daily average of unique active wallets rose by 3.7% compared to May. With just under a week left for the Merge, SEBA Bank has opened Ethereum staking services for institutions. On the other side, layer-2 scalability solutions are hopeful of seeing a significant cut in their carbon emissions post Merge. This past week, two DeFi protocols became victims of coordinated flash loan attacks. On Wednesday, Avalanche-based lending protocol Nereus Finance became the victim of a crafty hack that saw a user net $371,000 worth of USD C...

Price analysis 8/19: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) and most major altcoins witnessed a sharp sell-off on Aug. 19, but there does not seem to be a specific trigger for the sudden drop. The sharp fall resulted in liquidations of more than $551 million in the past 24 hours, according to data from Coinglass. Barring a V-shaped bottom, other formations generally take time to complete as buyers and sellers try to gain the upper hand. This tends to cause several random volatile moves that may be an opportunity for short-term traders, but long-term investors should avoid getting sucked into the noise. Daily cryptocurrency market performance. Source: Coin360 Glassnode data shows that investors who purchased Bitcoin in 2017 or earlier are just doing that by holding their positions. The percentage of Bitcoin supply dormant for at least ...

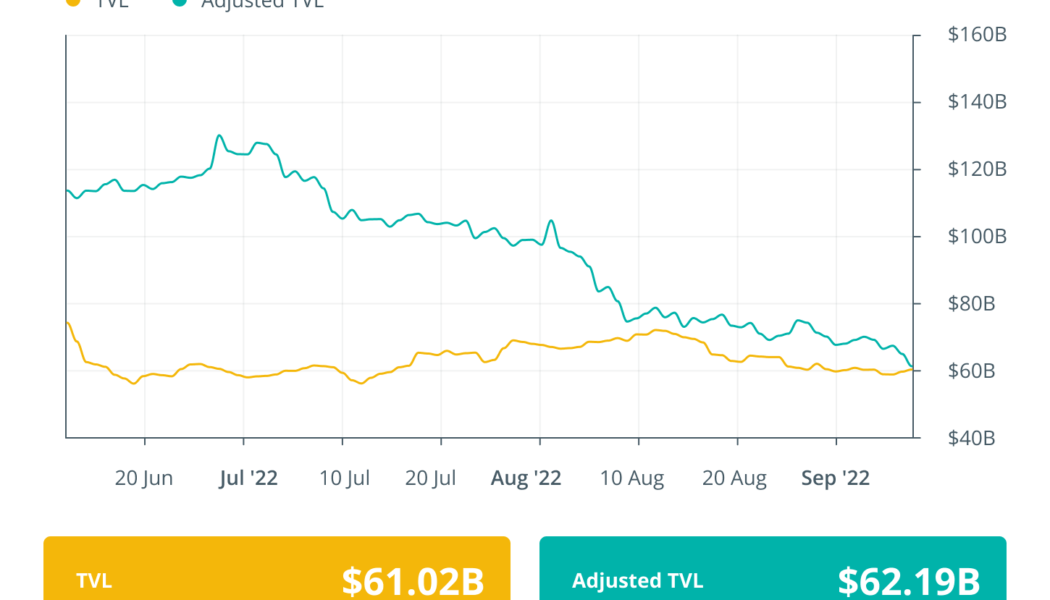

A sharp drop in TVL and DApp use preceded Avalanche’s (AVAX) 16% correction

After an impressive 73% rally between July 13 and Aug. 13, Avalanche (AVAX) has faced a 16% rejection from the $30.30 resistance level. Some analysts will try to pin the correction as a “technical adjustment,” but the network’s deposits and decentralized applications reflect worsening conditions. Avalanche (AVAX) index, USD. Source: TradingView To date, Avalanche remains 83% below its November 2021 all-time high at $148. More data than technical analysis can be analyzed to explain the 16% price drop, so let’s take a look at the network’s use in terms of deposits and users. The decentralized application (DApp) platform is still a top-15 contender with a $7.2 billion market capitalization. Meanwhile, Solana (SOL), another proof-of-work (PoW) layer-1 platform, holds a $14.2 billio...

Price analysis 8/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) has been witnessing a tough battle between the bulls and the bears near the $25,000 level. A clear winner may not emerge in the short term due to a lack of a catalyst and because there is no major macroeconomic data scheduled for this week in the United States. Data points from Asia or Europe may increase volatility, but they are unlikely to start a new directional move. Anthony Scaramucci, founder and managing partner of Skybridge Capital, in an interview with CNBC, advised investors to ride out the current uncertainty in cryptocurrencies and “stay patient and stay long term.” He expects Bitcoin to reward investors immensely with a sharp uptrend over the next six years. Daily cryptocurrency market performance. Source: Coin360 Along with the focus on Bitcoin, investors are al...

Price analysis 8/12: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) could not overcome the barrier at $25,000 on Aug. 11 even though it had two catalysts in the form of a “favorable” Consumer Price Index print and news that BlackRock — the world’s largest asset manager, overseeing over $10 trillion in total assets — had launched a spot Bitcoin investment product. In comparison, Ether (ETH) has managed to hold on to its recent gains on news that the Goerli testnet had successfully activated proof-of-stake, clearing the path for Ethereum’s mainnet transition planned for Sept. 15 or 16. Data from Santiment shows that Ether whale transactions have increased along with possible whale accumulation. Daily cryptocurrency market performance. Source: Coin360 However, analysts remain divided about the prospects of the current rec...