automation

Why Digital Trade is Key to Unlocking Africa’s Economic Potential

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

How Smart Will Tomorrow’s Homes Be?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Proven Consult Partners with Leading Insurance Firm in Africa to Provide Intelligent Business Automation

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

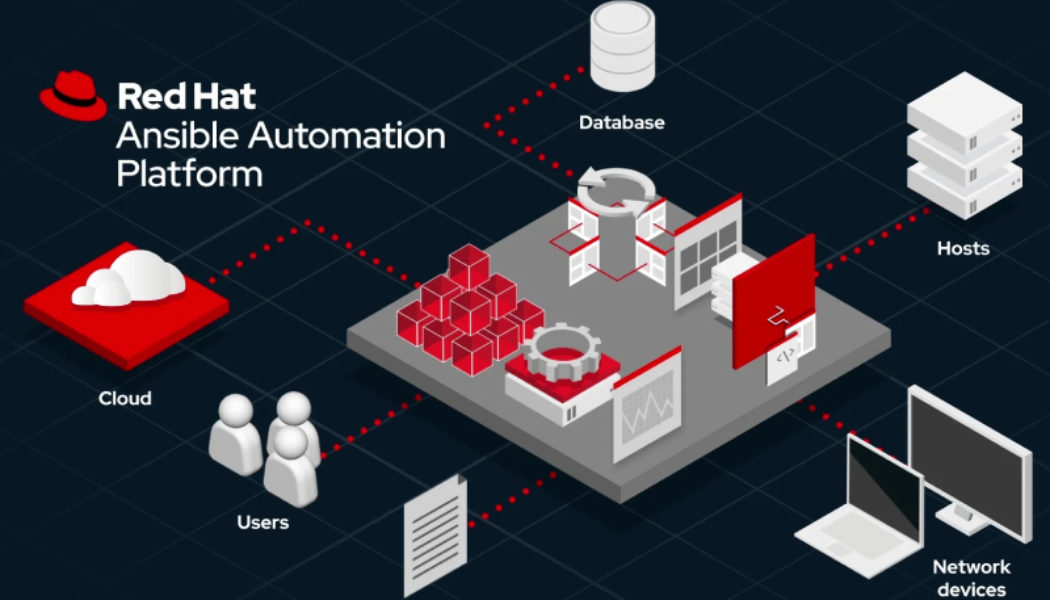

Red Hat Ansible Automation Platform Now Available on Microsoft Azure

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Why Technology is the Enabler for Excellent Customer Experiences in Hospitality

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

2022 Predictions: Innovations that will reshape business in Kenya

According to mobile marketing provider CM.com, today many businesses are still responding to changes in the business environment brought on by the COVID-19 pandemic. The global crisis introduced the necessity to innovate, forcing many to rethink how they communicate with their customers and repackage product and service offerings for the new landscape – one that is defined by digital transformation. The numbers illustrate this evolution. According to Statista, 97% of respondents to a digital transformation survey stated that the pandemic sped up digital transformation processes in their respective organisations. Global spending on digital transformation is projected to reach $1.78 trillion in 2022. But in what ways will this transformation manifest? The answer lies in technological trends ...

How Banking Can be Future-Proofed Through the Power of Data, APIs and Automation

The global pandemic has ushered in a new paradigm for the Retail Banking sector, one which demands quicker transformation to a customer-centric service that is digitised, personal and convenient. A recent Financial Industries panel discussion held by Kearney, a global consultancy, shed light on how the power of data, Application Programming Interfaces (APIs) and automation could be leveraged to satisfy these expectations and invigorate the sector. Agility is Key Hentus Honiball, Partner at Kearney, maintains that large, traditional banks with complex, cumbersome operating models and legacy technology architecture are now being threatened by agile new fintech entrants. In contrast with the siloed, product-centric approach of traditional players, responsive new players are looking to build c...

The Real Cost of Not Engineering for Agility

Natasha Anderson, Practice Lead: Software Engineering Standard Bank Group. /* custom css */ .tdi_4_2a2.td-a-rec-img{ text-align: left; }.tdi_4_2a2.td-a-rec-img img{ margin: 0 auto 0 0; } As Practice Lead for Software Engineering, I have always seen my role as being a champion for engineering improvement, promoting collaboration and continuous learning among the engineering community in my organisation. While these foundational aspects are important to organisations that leverage technology as a business outcomes enabler, the continuous pressures of a fast-changing world, exacerbated by COVID-19’s impact on our economy has allowed me to view the relationship between engineering and business success through an additional lens, which I wish to share with you. As the pandemic unfolded in the p...

53% of South Africans are Threatened by Job Automation, Research Shows

53% of South Africans believe that the risk of having their job automated has increased over the last year – more than the global average of 41% – according to a new study from Boston Consulting Group (BCG) and The Network. Additionally, 31% of workers in the digitisation and automation fields have a significantly lower perceived risk of automation in South Africa than 46% globally says Rudi van Blerk, Principal and Recruiting Director at BCG. In South Africa, the interest in developing new skills is highest among those in the early- and midcareer phases as 40% of respondents are reporting a negative impact on their work due to the effect of COVID-19 on employment, including a decrease in working time or being laid off, versus the average of 36% of global respondents. Locally, highly educa...

- 1

- 2