Assets

US authorities are seizing $460M in Robinhood shares tied to FTX: Report

The United States Departure of Justice has reportedly seized or was in the process of seizing more than $400 million worth of Robinhood shares linked to FTX as part of the case against the crypto exchange. According to a Jan. 4 report from Reuters, U.S. officials told a judge they were in the process of seizing assets tied to FTX and its former CEO, Sam Bankman-Fried, which included 56 million shares of Robinhood — worth roughly $468 million at the time of publication. The report comes a day after a judge in the criminal case against SBF orderedyu7po him not to access or transfer any cryptocurrency or assets from FTX or Alameda. Amid FTX’s bankruptcy proceedings, control of the Robinhood shares has been under contention as many investors and creditors look to be made whole. BlockFi, B...

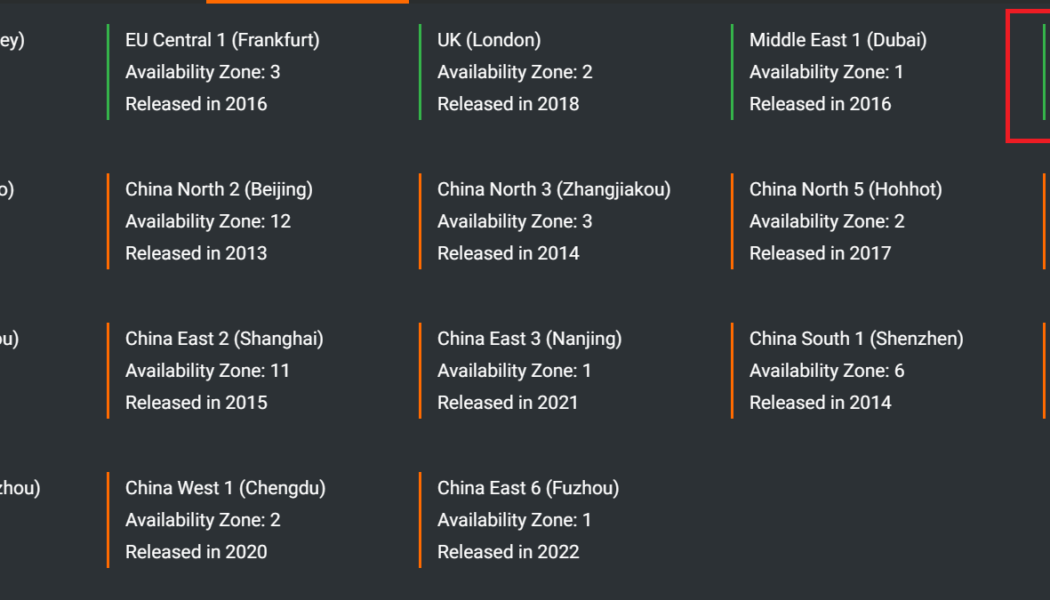

OKX cites intermittent outage amid Alibaba Cloud equipment anomaly

Crypto exchange OKX witnessed service disruptions after primary infrastructure services provider Alibaba Cloud announced a hardware failure in Alibaba Cloud’s Hong Kong data center. Alibaba Cloud Hong Kong IDC Zone C server went offline on Saturday at roughly 10 pm ET and failed to recover for over seven hours at the time of reporting. On-chain data further confirms that OKX processed no transactions during this timeline. Partial list of Alibaba Cloud’s global infrastructure. Source: Alibaba Cloud Alibaba Cloud’s website shows that the Hong Kong (China) server hosts three availability zones, which have been operational since 2014. The cloud provider confirmed the outage through an official announcement, as shown below. Alibaba Cloud’s official announcement about service disrupt...

What are crypto whale trackers and how do they work?

There are dedicated solutions to track the actions of crypto whales. These solutions can provide analytics on whale actions and, in some instances, can also make investment/trading decisions for the user. Crypto traders and investors constantly track the amount of cryptocurrencies going in and out of exchanges. When a cryptocurrency like Bitcoin or Ether (ETH) is moved in large quantities into an exchange, it is expected to see some sell action resulting in a fall in price. Conversely, if cryptocurrencies flow out of exchanges into wallets, it is considered a precursor to a rise in price. This is because when exchanges have a high net outflow of cryptocurrencies, they have reduced supply resulting in an increase in price. Oftentimes, a whale could buy cryptocurrencies on an exchange and mo...

Amendment to UK financial services bill provides regulation for crypto activities

An amendment to the Financial Services and Markets Bill now before the United Kingdom’s Parliament would extend the law’s powers to regulate financial promotion and other activities to crypto assets. The amendment was written by Member of Parliament and Financial Secretary to the Treasury Andrew Griffith. The 335-page bill was introduced in July and had its second reading in the House of Commons on Sept. 7. According to the explanatory statement accompanying the amendment, it would: “[…] clarify that the powers relating to financial promotion and regulated activities can be relied on to regulate cryptoassets and activities relating to cryptoassets.” The Financial Conduct Authority (FCA), the U.K.’s financial regulator, published a “Dear Chief Executive” letter Aug. ...

FTX reportedly considers bailing out Celsius via asset bid

Crypto exchange FTX, led by crypto billionaire Sam Bankman-Fried (SBF), is reportedly considering bailing out Celsius Network by bidding on the bankrupt lender’s assets. Coincidently, the information came out the same day Alex Mashinsky resigned as the CEO of Celsius. “I regret that my continued role as CEO has become an increasing distraction, and I am very sorry about the difficult financial circumstances members of our community are facing,” said Mashinsky while explaining his decision. For FTX, acquiring the assets of Celsius would imply the exchange’s intent to save the lending firm, similar to what FTX US did for Voyager by securing the winning bid of approximately $1.4 billion. Bloomberg reported on FTX’s interest in Celsius Network based on insights from a person familiar wit...

Crypto funds under management drop to a low not seen since July 2021

Digital asset investment products saw $141 million in outflows during the week ending on May 20, a move that reduced the total assets under management (AUM) by institutional funds down to $38 billion, the lowest level since July 2021. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, Bitcoin (BTC) was the primary focus of outflows after experiencing a decline of $154 million for the week. The removal of funds coincided with a choppy week of trading that saw the price of BTC oscillate between $28,600 and $31,430. BTC/USDT 1-day chart. Source: TradingView Despite the sizable outflow, the month-to-date BTC flow for May remain positive at $187.1 million, while the year-to-date figure stands at $307 million. On a more positive note, the multi-asset cat...

Bitcoin price spike to $39K leads traders to say ‘the panic is over for a few days’

Global financial markets and crypto markets were pummeled over the past 24-hours as the invasion of Ukraine by Russian forces sent investors scrambling and sell-offs took place across most asset classes. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) hit a low of $34,333 in the early trading hours on Feb. 24, shortly after the Ukraine incursion began, and has since climbed its way back to $38,500 after an unexpected short-squeeze may have rapped bearish investors on the knuckles. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about BTC price and how the ongoing conflict could impact crypto markets in the short-term. BTC in a “great buy area” Bitcoin’s collapse on the night of Feb. 23 was not unexp...

Dangote Cement acquires 2,000 new vehicles to enhance transportation

Dangote Cement Plc has acquired 20,000 additional vehicles to enhance the distribution of the company’s cement products in the country. The company’s Spokesman, Tony Chiejine, said in a statement made available to newsmen on Monday in Lokoja that the new vehicles, made up of trucks, trailers and tippers, were acquired at a cost of $150 million US dollars. According to him, the company had recently taken delivery of another set of trucks, trailers, bulk tankers, tippers, cargo trucks and bulk cement tankers. “These assets would meet the expected increase in demand for transportation of cement to every part of the country and create employment for over 4,000 people in Nigeria,” he said. “We have acquired the new trucks in line with our new expansion capacity in Obajana, Ibese, Gboko and the ...

Total targets more renewable electricity, LNG production by 2030

Total Companies in Nigeria has unveiled its corporate vision in line with the change of the Total Group to TotalEnergies. The organisation aims to produce more renewable electricity and Liquefied Natural Gas (LNG) by 2030. The oil major also outlined its broad energy lineup that includes oil, gas, electricity, hydrogen, biomass, wind and solar. TotalEnergies is committing $60 billion to investment in renewable energy in the next 10 years, with 10 per cent of that investment expected to come to Nigeria. Speaking at a virtual parley with journalists, the Executive General Manager, Total Country Services, Mrs. Bunmi Popoola-Mordi, highlighted steps that would help in adapting the new name, logo and visual identity of the company. THISDAY had reported that the shareholders of Total Group, had ...

Lagos governor asks security agencies to crush criminals

Lagos State Government has tightened the noose on criminal elements, as Governor Babajide Sanwo-Olu fortifies the armoury of the State Police Command with new hardware and gadgets. One hundred and fifty units of double cabin vehicles, 30 patrol saloon cars, four high-capacity troop carriers and two anti-riot water cannon vehicles are part of the crime-fighting equipment donated to the police, yesterday, by the Lagos Government to strengthen security responses across the state. President Muhammadu Buhari took inventory and inaugurated the security equipment before Governor Sanwo-Olu handed over the gears to the Inspector-General of Police (IG), Mr. Alkali Usman, for the use of Lagos Police Command. The equipment and gadgets were procured through the Lagos State Security Trust Fund (LSSTF) –...

House backs bill to prohibit bank employees from operating foreign accounts

A bill seeking to prohibit bank employees from operating foreign accounts has passed second reading at the house of representatives. The bank employees’ declaration of assets act amendment bill also seeks to mandate the bankers to declare assets of their spouses and children less than 18 years old. The Economic and Financial Crimes Commission (EFCC) had in March ordered those in the banking sector to declare their assets in accordance with the act, raising questions as to the legality of such directive. Newsmen reported that the bank employees’ declaration of assets act requires bank board members, managing director, general managers, clerks, cashiers, messengers, cleaners, drivers, and any other category of workers — whether part‐time, casual or temporary — to declare their assets. Leadin...