Asset Management

Crypto asset manager Osprey Funds lays off most of its staff: Report

Digital asset manager Osprey Funds has reportedly laid off most of its staff since the summer, underscoring the ongoing operational challenges posed by crypto’s enduring bear market. Yahoo Finance reported on Jan. 9 that Osprey Funds is currently operating with fewer than ten employees after laying off 15 staff members since the summer. CEO Greg Kling told the publication that the layoffs were consistent with the market downturn and that Osprey was not at risk of closing operations. Osprey offers accredited investors access to crypto-focused investment products, including an over-the-counter Bitcoin (BTC) trust that can be purchased inside brokerage accounts. Crypto layoffs are in fashion. The community doesn’t stay quiet. https://t.co/XJrxRXqvR9 — Cointelegraph (@Cointelegraph...

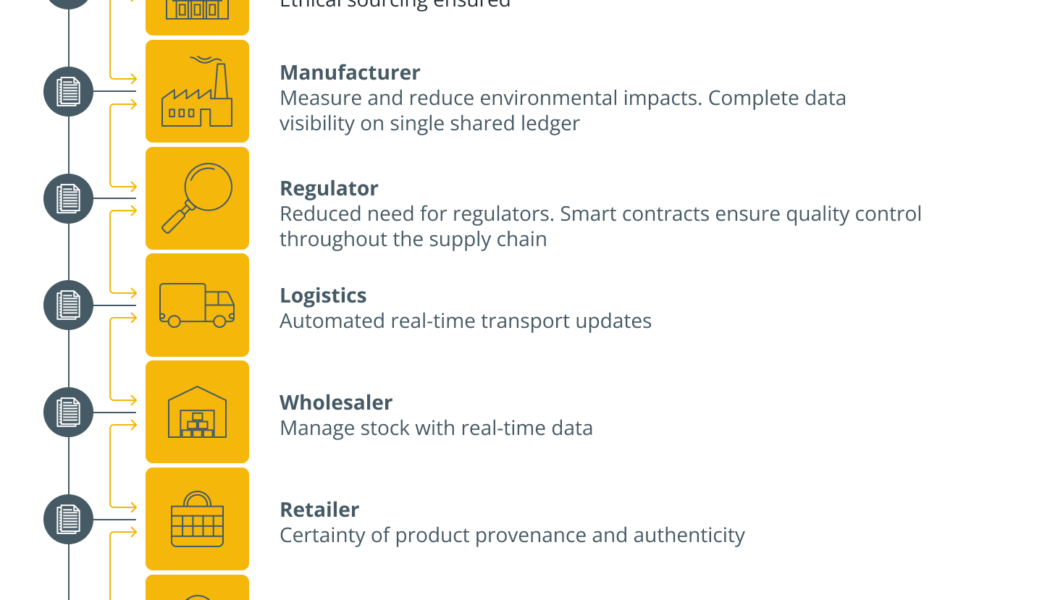

How blockchain technology is used in supply chain management?

To trace the activities along the supply chain more efficiently, concerned parties can access price, date, origin, quality, certification, destination and other pertinent information using blockchain. Traceability, as used in the supply chain sector, is the capacity to pinpoint the previous and current locations of inventory and a record of product custody. It involves tracking products as they move through a convoluted process, from raw materials to merchants and customers, after passing through many geographic zones. Traceability is one of the significant benefits of blockchain-driven supply chain innovations. As blockchain consists of decentralized open-source ledgers recording data, which is replicable among users, transactions happen in real-time. As a result, the blockchain can build...

Paradigm co-founder feels ‘deep regret’ investing in SBF and FTX

The co-founder of asset management firm Paradigm says they feel “deep regret” for having invested in FTX amid recent revelations involving FTX, Alameda Research, and Sam Bankman-Fried. In a Twitter post on Nov. 15, Matt Huang, co-founder and managing partner of Paradigm said the firm is “shocked” by the revelations surrounding the two companies and their founder, adding: “We feel deep regret for having invested in a founder and company who ultimately did not align with crypto’s values and who have done enormous damage to the ecosystem.” Matt Huang, Managing Partner and Co-Founder of Paradigm Source: Paradigm Paradigm is a crypto and Web3-focused venture capital firm based in San Francisco. In April reports suggested the firm’s assets under management totaled approximately $13.2 billi...

Sushi and Synthetix get the boot in Grayscale DeFi fund rebalancing

Digital asset management firm Grayscale, has added three new cryptocurrency assets across three main investment funds, while removing two other assets from its Decentralized Finance Fund as part of this year’s first quarterly rebalance. Grayscale removed tokens from crypto-derivatives decentralized exchange Synthetix (SNX), and decentralized exchange SushiSwap (SUSHI), from its DeFi fund after the two crypto assets failed to meet the required minimum market capitalization. No other cryptocurrencies were removed during the rebalancing. Grayscale’s DeFi fund, which was launched in July last year, currently holds approximately $8 million in assets. The digital assets remaining in the DeFi fund after the quarterly rebalance include Uniswap (UNI), Aave (AAVE), Curve (CRV), MakerDAO (MKR),...