Asia

Pakistan launches new laws to expedite CBDC launch by 2025

Regulators worldwide see central bank digital currencies (CBDCs) as a way to enhance fiat capabilities by inheriting the financial prowess of technologies that power cryptocurrencies. Pakistan joined this list by announcing new regulations to ensure the launch of an in-house CBDC by 2025. The State Bank of Pakistan (SBP) signed in new laws for Electronic Money Institutions (EMIs) — non-bank entities offering digital payment instruments — to ensure the timely issuance of a CBDC in the next three years. The World Bank helped Pakistan design the new regulations, according to local media Arab News. In addition to timeline adherence for the CBDC launch, the regulations warrant preventive measures against money laundering and terror financing while considering consumer protection and reporting r...

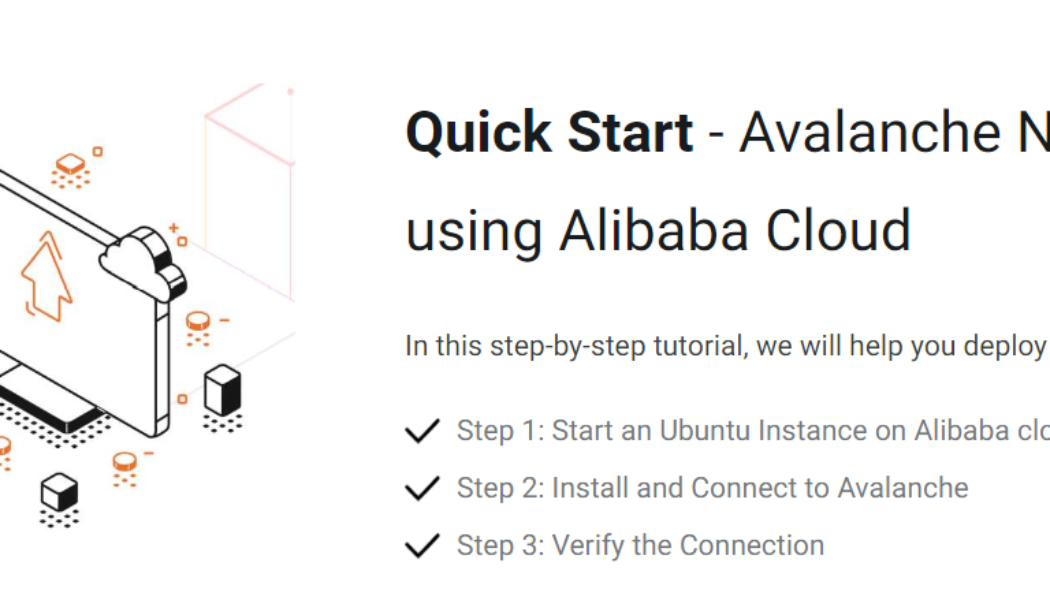

Avalanche to power Alibaba Cloud’s infrastructure services in Asia

Alibaba Cloud, a.k.a Aliyun, a subset of Chinese e-commerce giant Alibaba, announced an integration with Avalanche blockchain to power the company’s Node-as-a-Service initiatives. Avalanche’s partnership with Alibaba Cloud will see the development of tools that enable users to launch validator nodes on Avalanche’s public blockchain platform in Asia. The integration will allow Avalanche developers to use Alibaba Cloud’s plug-and-play infrastructure as a service to launch new validators. Developers expecting high resource demands during peak hours can also tap into additional resources — computing, storage, and distribution — offered by Alibaba Cloud. APAC’s largest cloud service provider, Alibaba Cloud, has expanded support for #Avalanche! This integration enables develope...

Uzbekistan issues first crypto licenses to two local ‘crypto stores’

As Uzbekistan prepares to adopt a new cryptocurrency framework in 2023, Uzbek regulators have started issuing regulatory approvals to local crypto service providers. The National Agency for Perspective Projects (NAPP), Uzbekistan’s major cryptocurrency market watchdog, has issued the nation’s first crypto licenses, according to an official announcement released on Nov. 17. The licenses officially authorize the offering of cryptocurrency-related services by two “cryptocurrency stores,” including Crypto Trade NET LLC and Crypto Market LLC. According to the information from the NAPP’s electronic license register, both Crypto Trade NET and Crypto Market are based in Tashkent. The data also refers to Kamolitdin Nuritdinov as Crypto Market’s single founder and shareholder. Behzod Achilov is...

Uzbekistan issues first crypto licenses to two local ‘crypto stores’

As Uzbekistan prepares to adopt a new cryptocurrency framework in 2023, Uzbek regulators have started issuing regulatory approvals to local crypto service providers. The National Agency for Perspective Projects (NAPP), Uzbekistan’s major cryptocurrency market watchdog, has issued the nation’s first crypto licenses, according to an official announcement released on Nov. 17. The licenses officially authorize the offering of cryptocurrency-related services by two “cryptocurrency stores,” including Crypto Trade NET LLC and Crypto Market LLC. According to the information from the NAPP’s electronic license register, both Crypto Trade NET and Crypto Market are based in Tashkent. The data also refers to Kamolitdin Nuritdinov as Crypto Market’s single founder and shareholder. Behzod Achilov is...

Could Hong Kong really become China’s proxy in crypto?

With its partial autonomy, the island city of Hong Kong has traditionally served as “a gate to China” — the local trade center, backed by transparent English-style common law and an openly pro-business government strategy. Could the harbor, home to seven million inhabitants, inherit this role in relation to the crypto industry, becoming a proxy for mainland China’s experiments with crypto? An impulse to such questioning was given by Arthur Hayes, the former CEO of crypto derivatives giant BitMEX in his Oct. 26 blog post. Hayes believes the Hong Kong government’s announcement about introducing a bill to regulate crypto to be a sign that China is trying to ease its way back into the market. The opinion was immediately replicated in a range of industrial and mainstream media. What happe...

Singapore bank DBS uses DeFi to trade FX and state securities

DBS Bank, a major financial services group in Asia, is applying decentralized finance (DeFi) for a project backed by Singapore’s central bank. DBS has started a trading test of foreign exchange (FX) and government securities using permissioned, or private, DeFi liquidity pools, the firm announced on Nov. 2. The development is part of Project Guardian, a collaborative cross-industry effort pioneered by the Monetary Authority of Singapore (MAS). Conducted on a public blockchain, the trade included the purchase and sale of tokenized Singapore government securities (SGS), the Singapore dollar (SGD), Japanese government bonds and the Japanese yen (JPY). The project has shown that trading on a private DeFi protocol enables simultaneous operations of instant trading, settlement, clearing and cust...

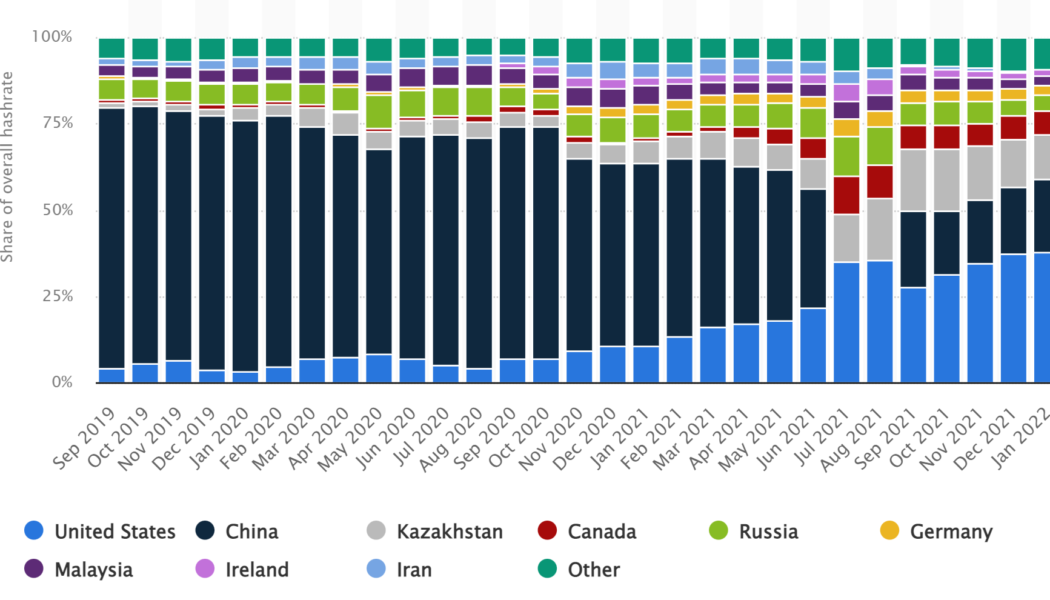

Kazakhstan among top 3 Bitcoin mining destinations after US and China

For over a year, the oil-rich Central Asian country of Kazakhstan has maintained its position as the third-biggest contributor to Bitcoin (BTC) mining after surpassing Russia back in February 2021. As of January 2022, Kazakhstan contributed to 13.22% of the total Bitcoin hash rate, positioned right after the historical leaders the United States (37.84%) and China (21.11%), as shown below. Along similar timelines, Cambridge Centre for Alternative Finance data estimated that Kazakhstan’s absolute hash rate contribution (monthly average) was 24.8 exahashes per second (Eh/s). Meanwhile, the US and China contributed 71 Eh/s and 39.6 Eh/s, respectively. The International Energy Agency (IEA), which is co-funded by the European Union, highlighted Kazakhstan’s heavy reliance on non-renewable ...

Uzbeki police get ‘how to seize crypto’ training from UN security org

The Organization for Security and Co-operation in Europe (OSCE) organized a five-day training course on cryptocurrencies and Dark Web investigation for Uzbekistan’s police and prosecution forces. The course is a part of OSCE’s consistent efforts to educate Central Asian law enforcers on the emerging technologies that criminals might abuse in a strategically important region for the global drug trade. As the official press release from Oct. 21 goes, representatives from the General Prosecutor’s Office, the Ministry of Internal Affairs and the State Security Service attended the training from Oct. 17 to 21 to learn about the main concepts and key trends in the areas of internetworking, anonymity and encryption, cryptocurrencies, obfuscation techniques, Dark Web and the Tor networ...

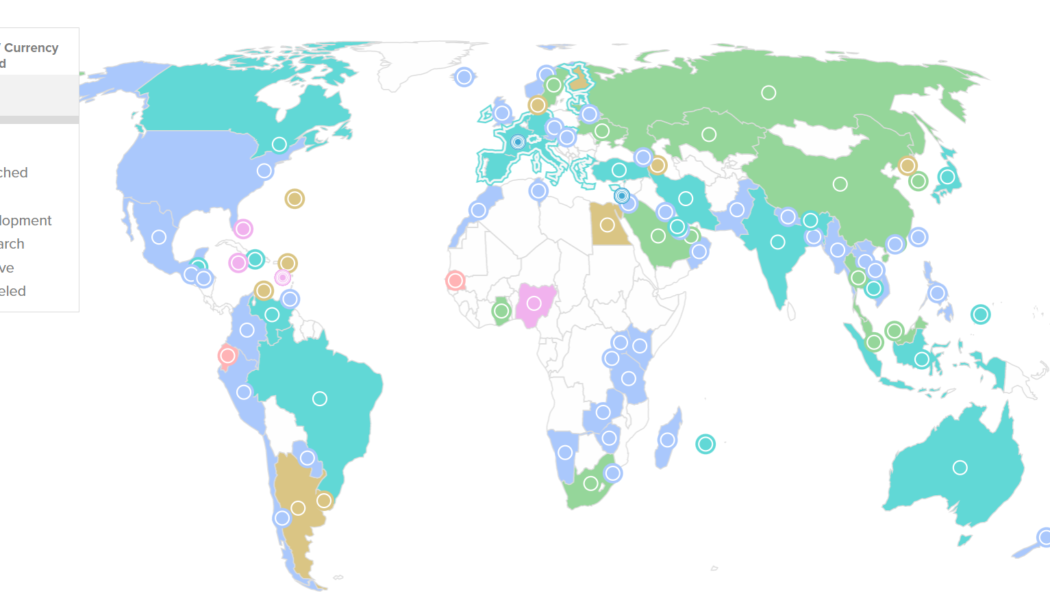

NFTs ‘biggest on-ramp’ to crypto in Central, Southern Asia and Oceania — report

Nonfungible tokens (NFTs) may be the biggest driver of crypto adoption in Central, Southern Asia, and Oceania (CSAO), a new report has found. According to a Sept. 21 Chainalysis post titled “Crypto Adoption Steadies in South Asia, Soars in the Southeast,” NFT-related actions accounted for 58% of all web traffic going to cryptocurrency services from this region in the second quarter of 2022. Meanwhile another 21% of traffic in the quarter went to websites of play-to-earn (P2E) blockchain games, with major titles including Axie Infinity, STEPN and Battle Infinity. Chainalysis noted that P2E blockchain games are “intimately related” to NFTs, as most P2E games feature in-game items in the form of NFTs that can be sold on marketplaces like MagicEden and OpenSea, thus meaning: ...

Exiled Myanmar democratic leaders want to issue CBDC to fund the revolution

Half a year after the military junta in Myanmar revealed its plans to launch a digital currency, the country’s government, ousted in a coup in 2021, voices its own intention to launch one using frozen national funds. In a Sept. 6 interview with Bloomberg, the minister of planning of exiled Myanmar’s National Unity Government, Tin Tun Naing, asked for the “U.S. blessing” to use “virtually” the country’s reserves, frozen by the Federal Reserve Bank of New York since Feb. 2021. The funds Naing mentions have been frozen on Singaporean, Thai and Japanese accounts and could amount to billions of dollars according to Bloomberg. While Naing doubts the United States could decide to allocate these assets directly to National Unity Government, he points to the possibility of using them as ...

Over a quarter of Asian Pacific ‘emerging giant’ startups tied to blockchain: Report

The Asia Pacific region is seeing a major business shift with increasing numbers of new technology startups appearing, even as venture capital investment is decreasing compared to last year. A report from Big Four accountant KPMG and international banking company HSBC based on a survey of 6,472 Asian Pacific startups found that over a quarter of them are blockchain related. Nonfungible tokens, or NFTs, led the way among sectors where Asian Pacific “emerging giants” were active, followed directly by decentralized finance, also known as DeFi. Electric vehicle charging infrastructure, quantum computing and robotic processing automation rounded out the top five sectors. Blockchain real estate and decentralized autonomous organizations (DAOs) ranked 14th and 15th, respectively, on the sam...

Fed policy and crumbling market sentiment could send the total crypto market cap back under $1T

The total crypto market capitalization broke above $1 trillion on July 18 after an agonizing thirty-five-day stint below the key psychological level. Over the next seven days, Bitcoin (BTC) traded flat near $22,400 and Ether (ETH) faced a 0.5% correction to $1,560. Total crypto market cap, USD billion. Source: TradingView The total crypto capitalization closed July 24 at $1.03 trillion, a modest 0.5% negative seven-day movement. The apparent stability is biased toward the flat performance of BTC and Ether and the $150 billion value of stablecoins. The broader data hides the fact that seven out of the top-80 coins dropped 9% or more in the period. Even though the chart shows support at the $1 trillion level, it will take some time until investors regain confidence to invest in cryptocurrenc...