ARK Invest

‘Wall of worry’ led to digital wallets, blockchain tech ignored: Cathie Wood

ARK Invest CEO Cathie Wood believes that digital wallets and blockchain tech were among the “game-changing innovations” that the equity markets largely ignored in 2022. In a Jan. 12 blog post on the ARK Invest website, Wood suggested that the equity market faced a “wall of worry” in 2022, caused by fears of entrenched inflation and higher interest rates and largely ignored some innovative technologies. Wood highlighted that digital wallets are “replacing cash and credit cards,” noting that they overtook cash as the top transaction method for offline commerce in 2020. Further arguing that digital wallets should not be overlooked, Wood noted that they also accounted for approximately 50% of global online commerce in 2021. After the most difficult year ever in the equity market for inno...

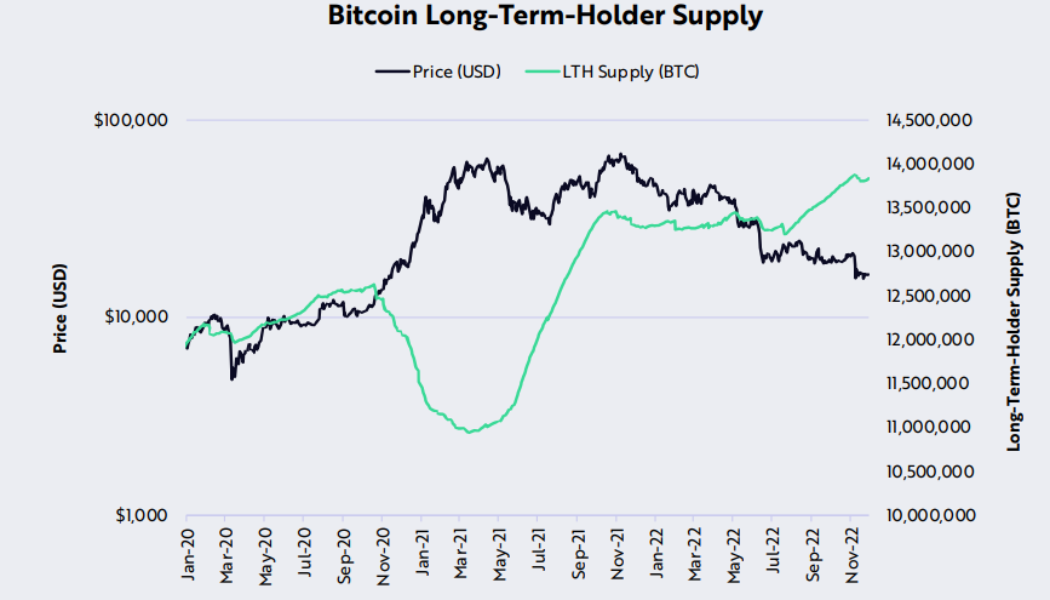

Bitcoin clings to $17K as ARK flags ‘historically significant capitulation’

Bitcoin (BTC) and decentralized blockchains are “as strong as ever” in the wake of the FTX meltdown, ARK Invest says. In the latest edition of its monthly newsletter, “The Bitcoin Monthly,” the investment giant came out firmly bullish on BTC. ARK: FTX scandal may be “most damaging event” ever With BTC price volatility ebbing into December, the industry is still reeling from ongoing FTX contagion. As lawmakers only begin to get to grips with the events, when it comes to Bitcoin, ARK is doubling down on its conviction — and setting it firmly apart from centralized alternatives. “The fall of FTX could be the most damaging event in crypto history,” one of the latest report’s “key takeaways” states. While acknowledging that even Digital Currency Group (DCG) — one of whose products, ...

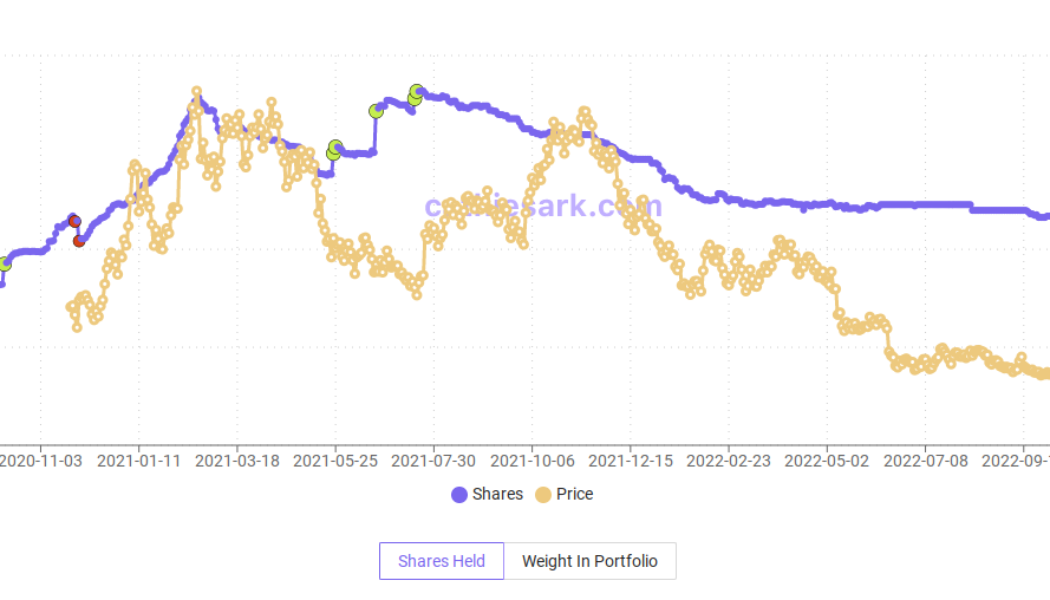

Cathie Wood’s ARK Invest adds more Bitcoin exposure as GBTC, Coinbase stock hit new lows

Bitcoin (BTC) firms’ shares are a major “buy” for asset manager ARK Invest in the midst of the FTX meltdown. The latest data confirms that ARK continues to up its holdings of both exchange Coinbase (COIN) and the Grayscale Bitcoin Trust (GBTC). Cathie Wood buys the dip With FTX contagion still rippling through the crypto industry, ARK’s decision to add exposure to two firms caught in the firing line stands out. According to numbers supplied by CEO Cathie Wood’s dedicated tracking resource, Cathie’s Ark, the firm added 176,945 GBTC shares on Nov. 21. These join a larger tranche of 273,327 shares from Nov. 15, that purchase completed just a week after FTX fell apart. ARK Invest GBTC holdings chart (screenshot). Source: Cathie’s Ark Since then, GBTC has come under the spotlight as ...

Bitcoin is now less volatile than S&P 500 and Nasdaq

Bitcoin (BTC) held gains above $21,000 into Nov. 5 as the U.S. dollar posted a rare major daily decline. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Dollar dives 2% as risk assets recover Data from Cointelegraph Markets Pro and TradingView showed BTC/USD building on prior strength to hit highs of $21,473 on Bitstamp — a new seven-week high. The pair had benefited from the latest United States economic data, while the dollar conversely suffered. The U.S. dollar index (DXY) lost 2% in a day for the first time in years, helping fuel a risk asset rally. U.S. dollar index (DXY) 1-day candle chart. Source: TradingView “And, just like that, Bitcoin took out all the highs, volume is increasing and it’s back above $21K,” Michaël van de Poppe, CEO and founder of trading firm Eig...

Cathie Wood’s Ark Invest dumps PayPal, favoring Bitcoin-friendly Cash App

Crypto investment company Ark Invest founder Cathie Wood has dumped all of the firm’s holdings of PayPal and showed greater confidence in the long-term growth of the Cash App payment system which uses the Bitcoin (BTC) Lightning Network. Wood explained her firm’s move at the Miami Bitcoin 2022 conference which wrapped up on Saturday. The Lightning Network (LN) is a layer-2 solution for Bitcoin meant to facilitate faster and cheaper transactions. Financial technology company PayPal operates the payment app Venmo as a direct competitor with Block’s (formerly Square) Cash App. “@ARKInvest has sold, completely got out of Paypal, whose Venmo is a big competitor to Cash App. (Cash App has) much more conviction – especially when it comes to bitcoin.” pic.twitter.com/mUGkdWGMFX — M...

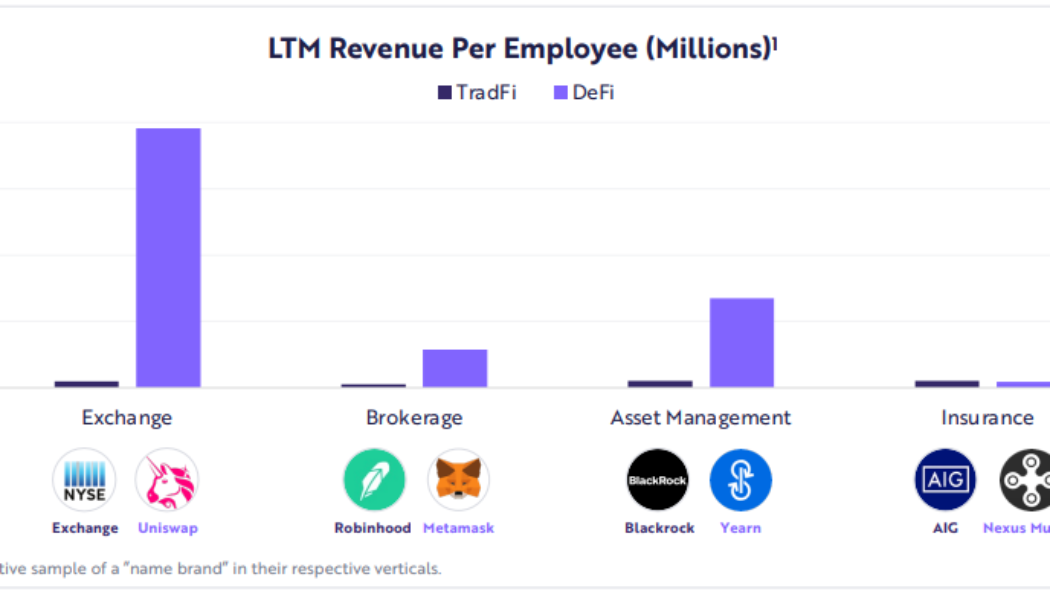

ETH to hit $20 trillion market cap by 2030: Ark Invest

A new report from Cathy Woods’ ARK Invest forecasts Ethereum (ETH) will meet or even exceed a $20 trillion market cap within the next 10 years, which would equate to a price around $170,000 to $180,000 per ETH. The report also predicted big things for Bitcoin (BTC), saying it is “likely to scale as nation-states adopt (it) as legal tender… the price of one bitcoin could exceed $1 million by 2030.” ARK Invest is a tech focused American asset management firm based in the United States with $12.43 billion AUM. #BigIdeas2022 Report is here! To enlighten investors on the impact of breakthrough technologies we began publishing Big Ideas in 2017. This annual research report seeks to highlight our most provocative research conclusions for the year. Download! https://t.co/QvUbuqVpIL — ARK Invest (@...