AML

Arthur Hayes to serve 2-year probation owning up to BitMEX’s AML mishap

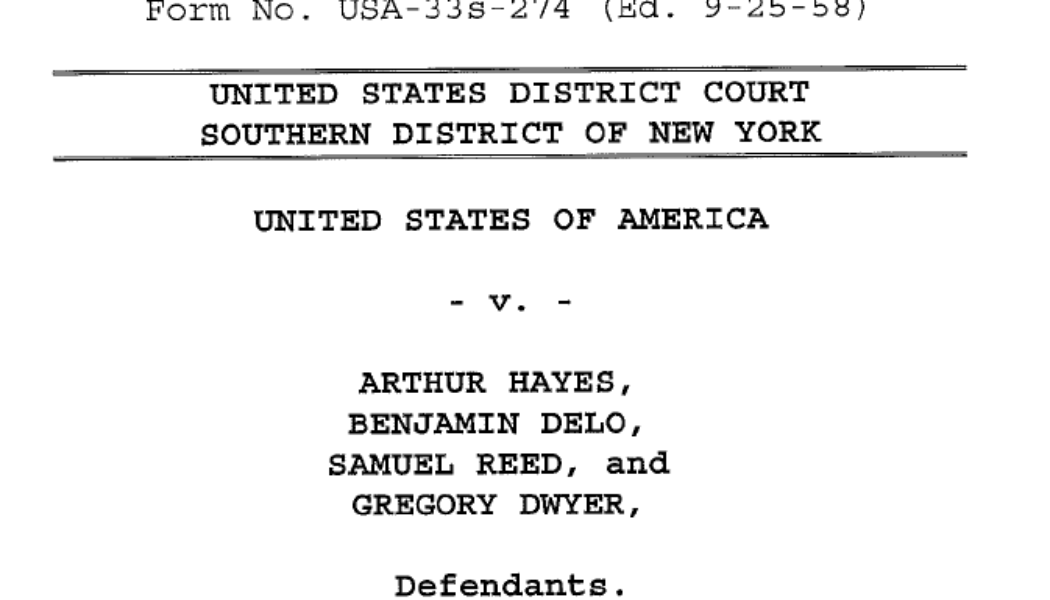

Bringing closure to the long-awaited judgment related to the money laundering activities over the BitMEX crypto exchange, one of the four federal district courthouses in New York reportedly sentenced two-year probation and six months of home detention to founder and ex-CEO Arthur Hayes. Arthur Hayes, along with the other BitMEX co-founders — Benjamin Delo and Samuel Reed — and the company’s first non-employee Gregory Dwyer, pleaded guilty to the Bank Secrecy Act (BSA) violations on Feb 24, admitting to “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program at BitMEX.” Indictment against BitMEX co-founders and employees for violating BSA. Source: Justice.gov Pleading guilty to supporting money laundering is a punishable offense, often carrying a ...

Binance pushes back against report exchange supplied customer data to Russian government

Major crypto exchange Binance challenged the accuracy of a report, which stated one of its regional heads agreed to supply Russia’s financial intelligence unit with customer data potentially related to donations for anti-corruption and anti-Putin activist Alexei Navalny. Reuters reported on Friday that Binance’s head of Eastern Europe and Russia Gleb Kostarev met with officials from Russia’s Rosfinmonitoring, a financial monitoring service linked to the country’s Federal Security Service, or FSB, in April 2021. Kostarev reportedly agreed to a request from the government body to turn over certain user data — including names and addresses — later telling an associate he didn’t have “much of a choice” in the matter. However, another unnamed crypto exc...

Crypto mixers’ relevance wanes as regulators take aim

Cryptocurrency mixers have been an interesting topic of discussion ever since the advent of cryptocurrencies and their adoption by retail investors around the world. Cryptocurrency mixers are services that essentially focus on one feature of a blockchain network: privacy. Cryptocurrency mixers, also known as tumblers, provide anonymity so no one can trace the sender or receiver of a transaction. This can help protect the identity of individuals who want to be completely anonymous and non-traceable. How cryptocurrency mixers work is that they break down the funds sent using the mixer and scramble them with other transactions. They break the link which associates the holder’s identity to the crypto they own. A process used to anonymize cryptocurrency transactions is known as Coin...

Privacy coins are surging. Will regulatory pressure stall their stellar run?

Recent weeks saw a massive surge of the so-called privacy coins’ prices — namely Monero (XMR), Dash (DASH), Zcash (ZEC) and Haven Protocol (XHV). As many other cryptocurrencies and the industry at large faced immense regulatory pressure amid the war in Ukraine, one narrative that began taking hold in the crypto space was the potential of such privacy-enhancing assets to provide investors a greater level of financial anonymity. But, can privacy coins deliver on Bitcoin’s (BTC) original promise? A good month for privacy-focused assets Over the past month, Monero has almost doubled its tally. With some minor oscillations, it rose from $134 on Feb. 24 to over $200 on March 26. ZEC showed even more impressive dynamics that hiked from $88 to $202 over the same period. DASH also pulled off ...

Bank of Israel issues draft guidelines on cryptocurrency AML/CFT

On Friday, the Bank of Israel published a draft regulation on Anti-Money-Laundering and Combatting the Financing of Terrorism (AML/CFT) risk management for the banks facilitating crypto-to-fiat transactions. The move hints at the Israeli government’s preparations to legalize and regulate the relationship between banks and virtual currency service providers (VASPs). The document cites the customers’ increased involvement with digital assets as the rationale for the new policy: “In view of the increase in customer activity in virtual currencies, and the resulting increase in customer requests to transfer money […] the Banking Supervision Department today published a draft circular dealing with managing AML/CFT risks derived from the provision to customers of payment services relat...

Ally or suspect? The war in Ukraine as a stress test for the crypto industry

It has been two weeks since Russia kicked off the first large-scale military action in Europe in the 21st century — a so-called “special operation” in Ukraine. The military conflict immediately triggered devastating sanctions against the Russian economy from the United States, the European Union and their allies and has put the crypto industry in a position that is both highly vulnerable and demanding. As the world watches closely, the crypto space must prove its own standing as a mature and financially and politically responsible community, and it must defy the allegations of being a safe haven for war criminals, authoritarian regimes and sanctioned oligarchs. Up to this point, it has been going relatively well. But despite reassurances from industry opinion leaders, some experts say that...

What is the importance of blockchain in the RegTech ecosystem?

Financial regulators and service providers are looking for the best and most cost-effective solutions to help the banks and other financial institutions comply with the rules and do business in a compliant regulatory environment. As blockchain is already disrupting the conventional ways of doing businesses, thanks to its benefits in terms of enhanced transparency, faster procedures, decentralized and most importantly, cost-effective nature. In essence, blockchain provides the solutions for the existing problems faced by financial institutions in terms of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. As the transactions in the blockchain system are immutable, they cannot be changed and altered, providing transparency regarding AML and KYC compliance. Customer onboard...

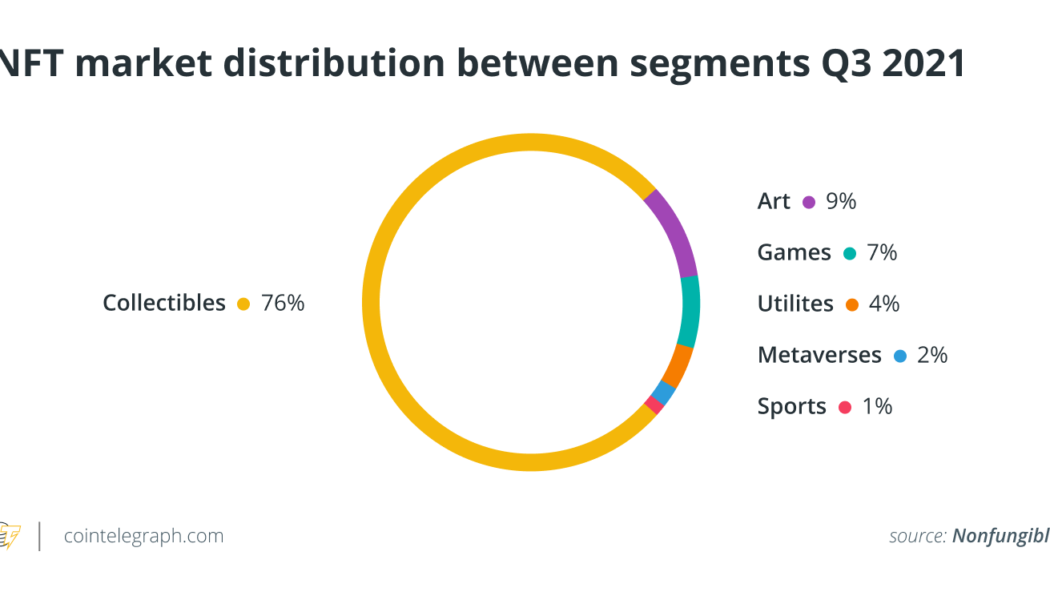

Laundering via digital pictures? A new twist in the regulatory discussion around NFTs

On Feb. 6, the United States Department of the Treasury released a report under the headline “Study of the facilitation of money laundering and terror finance through the trade in works of art.” In fact, only a tiny fraction of the 40-page document is dedicated to the “Emerging Digital Art Market,” by which the department understands the market for nonfungible tokens, or NFTs. Still, even a brief mention of the emerging NFT space in this context can have major implications for the tone of the nascent regulatory debate with regard to the asset class. What the report said The overall tone of the report is hardly alarming for the NFT space: The document casually mentions the growing interest in the digital art market both from private investors and legacy institutional players such as a...

Chainalysis report finds most NFT wash traders unprofitable

Nonfungible tokens (NFT) have taken the world by storm, resulting in mainstream interest and greater adoption of cryptocurrency. According to blockchain analysis firm Chainalysis, NFT popularity skyrocketed in 2021. Chainalysis’ “NFT Market Report” shows a minimum of $44.2 billion worth of cryptocurrency sent to Ethereum smart contracts associated with NFT marketplaces and collections last year. The report notes that this number was $106 million in 2020. While impressive, increasing scams and fraudulent activities have infiltrated the NFT space. For instance, major NFT marketplace OpenSea recently announced that its free minting tool was prone to misuse. As a result, OpenSea shared that 80% of NFTs created using this tool were either plagiarized, fake or spam. If that wasn’t bad enough, Ch...

US Treasury targets NFTs for potential high-value art money laundering

The U.S. Department of the Treasury released a study on the high-value art market, highlighting the potential in the nonfungible tokens (NFT) space to conduct illicit money laundering or terror financing operations. The treasury’s “Study of the facilitation of money laundering and terror finance through the trade in works of art” suggested that the increasing use of art as an investment or financial asset could make the high-value art trades vulnerable to money laundering: “The emerging online art market may present new risks, depending on the structure and incentives of certain activity in this sector of the market (i.e., the purchase of NFTs, digital units on an underlying blockchain that can represent ownership of a digital work of art).” The study underlines the importance of NFTs in r...

Are NFTs an animal to be regulated? A European approach to decentralization, Part 1

Nonfungible tokens (NFTs) are constantly in the news. NFT platforms are springing up like mushrooms and champions are emerging, such as OpenSea. It is a real platform economy that is emerging, like those in which YouTube or Booking.com gained a foothold. But it is a very young economy — one that is struggling to understand the legal issues that apply to it. Regulators are starting to take an interest in the subject, and there is risk of a backlash if the industry does not regulate itself quickly. And, as always, the first blows are expected east of the Atlantic. In this first article devoted to the legal framework of NFTs, we will focus on the application of the digital asset regime and financial law to NFTs in France. In a second article, we will come back to the issues of liability and c...

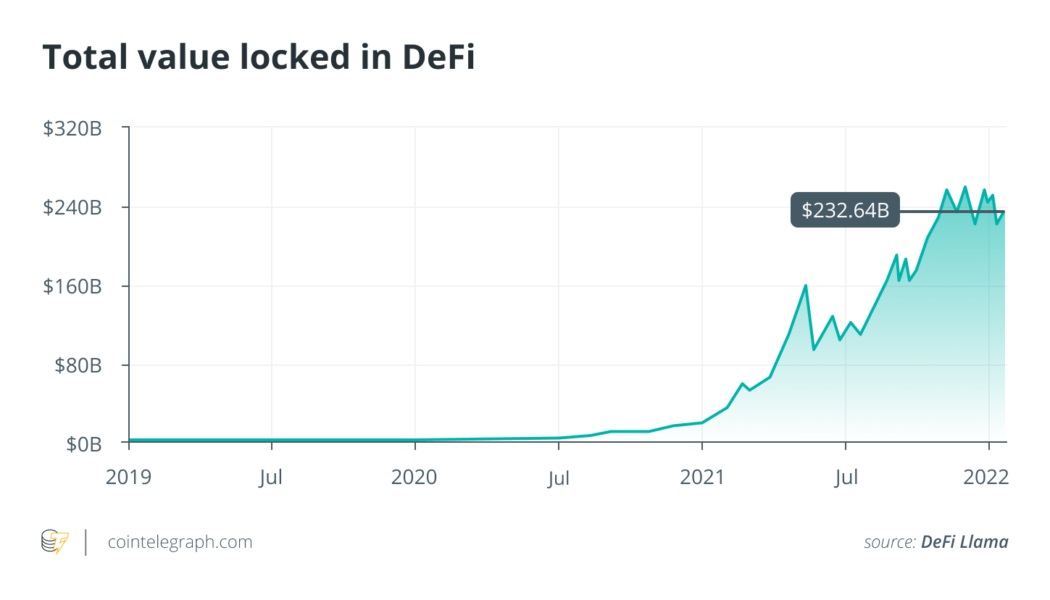

How should DeFi be regulated? A European approach to decentralization

Decentralized finance, known as DeFi, is a new use of blockchain technology that is growing rapidly, with over $237 billion in value locked up in DeFi projects as of January 2022. Regulators are aware of this phenomenon and are beginning to act to regulate it. In this article, we briefly review the fundamentals and risks of DeFi before presenting the regulatory context. The fundamentals of DeFi DeFi is a set of alternative financial systems based on the blockchain that allows for more advanced financial operations than the simple transfer of value, such as currency exchange, lending or borrowing, in a decentralized manner, i.e., directly between peers, without going through a financial intermediary (a centralized exchange, for example). Schematically, a protocol called a DApp (for decentra...