Altcoins

Thanks to Ethereum, ‘altcoin’ is no longer a slur

Altcoin originally meant “Bitcoin alternative” because, in the early stages of cryptocurrency development, every blockchain-based currency was seen as a sort of Bitcoin (BTC) knockoff. Cryptocurrencies back then were mainly used for payments, such as Litecoin (LTC), XRP (XRP) and Peercoin (PPC). Altcoin was used as a catchall term for cryptocurrencies other than Bitcoin. That’s changed since 2011. With the emergence of more than 20,000 cryptocurrencies, each linked to different types of crypto projects and tokens. We have also seen the dexterity of coins stretch across sectors of public chains, decentralized finance (DeFi), layer 2, decentralized autonomous organizations (DAOs), stablecoins and more. If “altcoin” refers to non-Bitcoin cryptocurrencies with the same characteristics as...

Nonfungible airdrops: Could NFA become the next big acronym in the crypto space?

Airdrops have become the bread and butter of the crypto world — for good reason. They’re an indispensable marketing tool for up-and-coming projects that want to create a buzz around their ecosystems. Done right, distributing free tokens to the public can help elevate demand — and unlock big benefits for recipients. After all, if these altcoins end up being listed on major exchanges at a later date, their value could explode. Unfortunately though, downsides have started to emerge. These campaigns aren’t just reaching enthusiasts who passionately believe in what a project has to offer, but “airdrop hunters” who are merely scouring for ways to turn a quick profit. Airdrop hunters typically want to sell off the tokens they’ve received for free — as soon as they ca...

Ethereum falls below $2,000 as top altcoins see mild mid-week losses

Ethereum has given up Tuesday’s gains after failing to sustain the grip on $2,000 Solana, Polygon, and Cardano native tokens are also trading in the red The cryptocurrency market appeared to have calmed on Tuesday following two weeks of heavy losses, but the latest winds have reversed the crypto market course again. Ethereum started the week trading marginally above $2,000, and even though it slipped below this mark during Monday’s trading session, the premier alt quickly recovered. Ether’s resilience is seemingly once again being tested in the face of a mild slump in the market on Wednesday. Other altcoins like Avalanche (AVAX) and Polygon (MATIC) have also pulled back during this period – some, markedly, by more significant margins than Ether. Ethereum price has suffered yet ...

Bitcoin clasping to remain above $30k as Solana leads altcoins in recovery

Bitcoin has mounted a slight recovery following last week’s crash to a multi-month low of $26,350 Many altcoins have charted green candles today, with Solana leading the way among the top ten coins by market cap Leading a recovery upwards of $30k this week, Bitcoin lost ground after briefly hovering above $31k yesterday. The leading digital asset had built momentum from $28,700 last Saturday, climbing as high as $31,305 early Monday before retracing as far as $29,260, CoinMarketCap data shows. The pioneer crypto has since recorded a series of minor gains and is now pushing towards $31,000 again. However, the ascent above $30,000 has not been without opposition from bears. At the time of writing, Bitcoin is exchanging hands at $30,215 – having gained approximately 1.77% in the last 24...

Binance suspends LUNA and UST withdrawals

Binance, a crypto exchange, has announced that it has suspended the withdrawal of UST and LUNA stablecoins temporarily due to bottleneck processes. This comes after the TerraUSD (UST) stablecoin de-pegged from the US dollar causing its price and that of LUNA to drop drastically. LUNA, for instance, has dropped by more than 85% today. In an official announcement issued yesterday, Binance said: ‘’Withdrawals for LUNA and UST tokens on the Terra (LUNA) network were temporarily suspended on 2022-05-10 at 02:20 AM (UTC) due to a high volume of pending withdrawal transactions. This is caused by network slowness and congestion. Binance will reopen withdrawals for these tokens once we deem the network to be stable and the volume of pending withdrawals has reduced. We will not notify users in a fur...

Robinhood makes significant strides in crypto business in Q1 despite falling revenue

On April 28, discount-brokerage platform Robinhood published its financial results for the first quarter of 2022. Year-over-year, the firm’s net revenue declined by 43% to $299 million. Specifically, revenue from cryptocurrency trading fell by 39% to $54 million during the same period. This was partly due to a decrease in the interest in meme stocks as well as an ongoing cryptocurrency bear market that dominated much of the first three months of the year. However, despite a decrease in sales, the company’s net cumulative funded accounts rose by 27% year-over-year to 22.8 million. At the same time, total assets under custody increased 15% to $93.1 billion. Robinhood took several important steps in enhancing its crypto business. First, the firm rolled out crypto wallets to the ap...

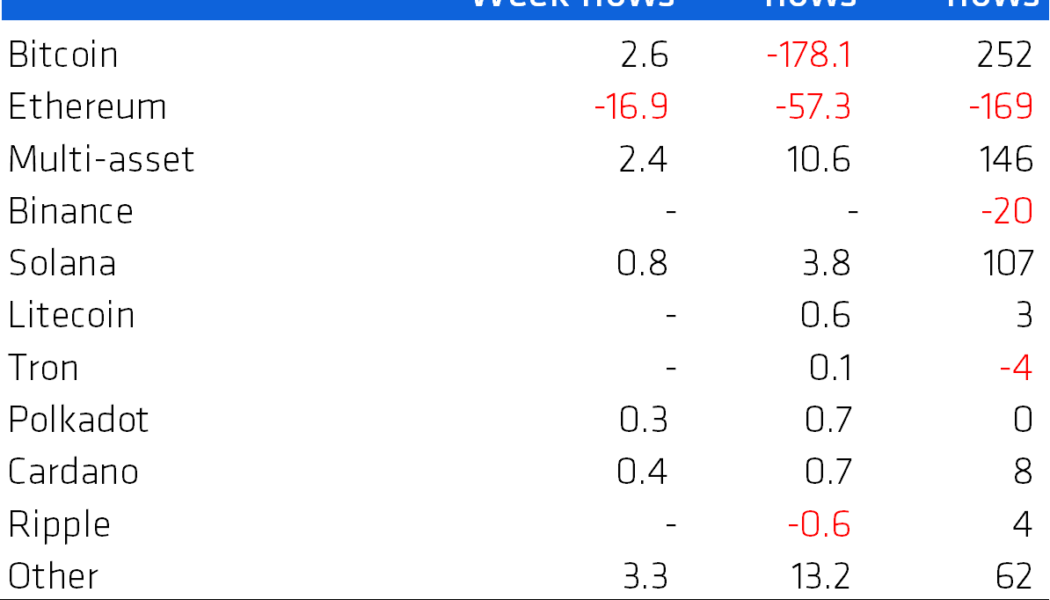

Institutional investment flows out of ETH and into competing L1 altcoins

Institutional investors have shifted their attention from Ethereum (ETH) to competing Layer 1 blockchains of late, with capital inflows for altcoin investment products increasing last week whilst Ether products posted outflows for the third week in a row. Data from CoinShares’ latest Digital Asset Fund Flows report shows that investors last week (ending April 22) loaded up on $3.5 million worth of Avalanche (AVAX), Solana (SOL), Terra (LUNA) and Algorand (ALGO) funds whilst capital outflows from Ether products totaled $16.9 million. It marks the third straight week that Ethereum products have seen outflows, bringing the total over that time to $59.3 million, equal to around 35% of the year-to-date outflows of $169 million from the second-largest blockchain. Notably, investors also favored ...

ADA slips below LUNA and SOL, USDT holds onto the third-largest stablecoin rank

Cardano’s native token ADA has lost ground and is down to ninth in market capital rankings Terra’s USD stable coin surpassed Binance USD in market capital earlier this week The crypto market is calm on Wednesday morning, with the majority of the crypto assets posting gains between 2% and 5% on the day. Solana (SOL) and Terra (LUNA) are the notable altcoins in the top ten – both registering price increases of marginally over 5% in the last 24 hours. The two tokens have surpassed Cardano’s ADA in market capital rankings on the back of this ascent. Market data shows the latter has retreated to ninth with a circulating value of just over $32 billion. SOL and LUNA, on the other hand, have equivalent figures of $35.8 billion and $33.5 billion, respectively. Terra’s stable coin races past B...

Bitcoin leads altcoins in setting up for a positive Q2

Ethereum has been consolidating around $3,500 for the last 24 hours ETH and ADA are gaining from imminent updates coming to the respective networks Recent days have seen Bitcoin enjoy a reasonable upswing in prices, carrying with it several other altcoins. The Satoshi coin has gained approximately 11% over the last two weeks and largely maintained above $45k. According to data by Coingecko, the world’s leading digital asset touched $44,347 on April 1, the lowest price level it has seen in the last week. Bitcoin was last seen changing hands at $46,160. The recent uptrend is a culmination of growth that has been building since mid-March. In the early days of last month, Bitcoin slumped, falling from $41,770 on March 1 to $39k support on March 6. Afterward, it started making signif...

Ether and Solana see $230M in Combined 24-Hr Liquidations as Bitcoin Clears $47,500

A late Sunday upward momentum has pushed the majority of cryptocurrencies in the market above previously challenging resistance zones. Bitcoin records a close above $47,200 The price of Bitcoin, the market leader, has increased by 6.29% in the last 24 hours as per market data at the time of writing. The flagship cryptocurrency cleared resistance at $47,000, breaking into the range of January highs late on Sunday. It maintained its uptrend into Monday, setting a new year-to-date high of $47,656 only a few hours ago as per CoinMarketCap data. The market swell appears to be a result of several bullish factors across the cryptocurrency sector. Most notable is the recent revelation of a $1o billion worth of Bitcoin ‘reserve’ plan by Terra blockchain founder Do Kwon. Another factor c...

Crypto markets recover from Monday’s brief dip with BTC eyeing $39k

Market activity has been largely positive in the last few hours THETA price has shot up following the pullback while Ether has cut above $2,550 The cryptocurrency sector is still reeling from late Monday’s short-lived slump that saw tokens fall to their weekly lows. Bitcoin, which appeared to have cleared $39k earlier during the day, slid from $39,060 to a 7-day low of $37,387.92 in four hours, CoinGecko data shows. The king cryptocurrency has since bounced back and is changing hands at $38,860 – up 1.40% in the last 24 hours. Ether, whose ETH/USD hourly trading chart shows positive movement, has clawed its way back above $2,575. Yesterday, the token fell to an intraday low slightly below $2,460 – a price level last touched on February 24. The pair has moved up by 1.4% today and is t...

Bitcoin and Ether prices dip as crypto market turns red ahead of the weekend

Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. Risk Warning: Investing in digital currencies, stocks, shares and other securities, commodities, currencies and other derivative investment products (e.g. contracts for d...

- 1

- 2