Altcoin Watch

Terra’s Mirror Protocol shows first signs of bottoming after price gains 30% in 48 hours

Mirror Protocol, a decentralized finance (DeFi) protocol built atop the Terra blockchain, was among the biggest gainers in the last 48 hours, primarily as its native token MIR rallied by over 30% to $1.48, its highest level since Jan. 22. MIR/USD four-hour price chart. Source: TradingView Has Mirror Protocol bottomed out? MIR price rose despite an absence of concrete fundamentals, a sight pretty common across crypto assets. As a result, its rally may have been purely technically-driven, especially because it originated after MIR had dropped by more than 90% in value from its May 2021 high near $13, making the token extremely oversold. IncomeSharks, an independent market analyst, called MIR’s rebound move a “no brainer,” noting that its multi-month drop had left ...

Here’s how traders got alerted to some of the biggest rallies of this week’s resurging market

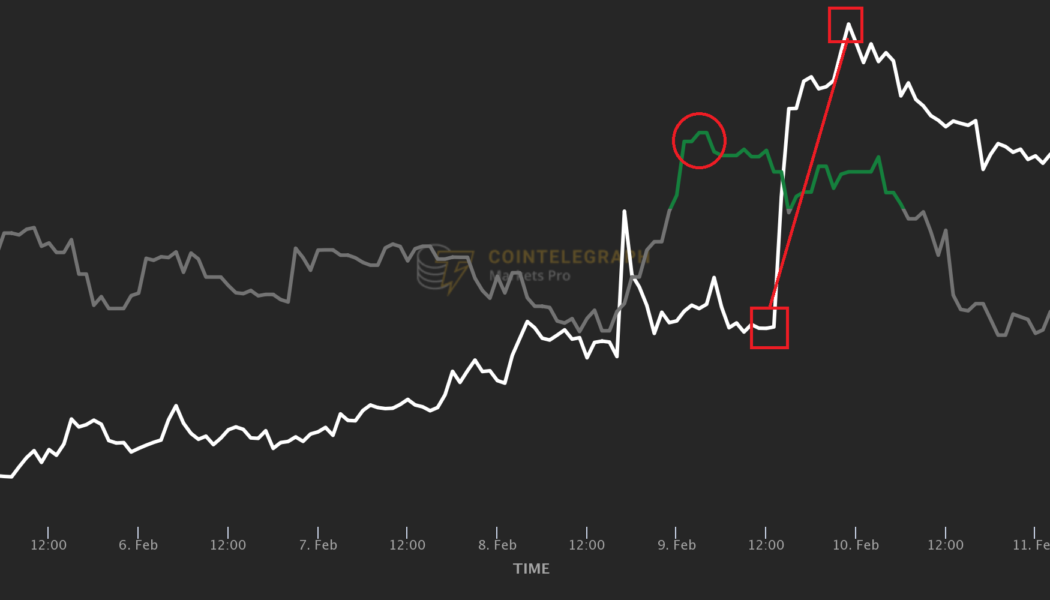

This crypto winter wasn’t a very long one. Having briefly touched $34,000 in the second half of January, Bitcoin (BTC) is on its way up again, touching the $45,000 mark on Feb. 10. Many altcoins have been catching up as well and posting double-digit weekly returns. However, not all relief rallies were equally impressive. Is there a way for traders to pick the assets that are about to pull off the strongest rebounds? Luckily, bullish marketwide reversals tend to look similar in terms of both price movement and other variables that shape market activity: rising trading volumes, spikes of online attention to individual tokens, and the elevated sentiment of social media chatter around them. Furthermore, the conditions that underlie individual assets’ rallies in a resurging crypto market often ...

Injective Protocol (INJ) rallies 100%+ after launching cross-chain support for Cosmos

Trading perpetual futures contracts in decentralized apps is a crypto sub-sector ripe for growth, especially as discussions of regulation, taxation and mandatory KYC at centralized exchanges continue to take place. One DEX platform that has begun to gain traction is Injective (INJ), an interoperable layer-one protocol designed to facilitate the creation of cross-chain Web3 decentralized finance (DeFi) applications. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $3.91 on Feb. 3, the price of INJ has rallied 157.8% to a daily high of $10.08 on Feb. 11 amidst a 1,756% spike in its 24-hour trading volume to $306 million. INJ/USDT 1-day chart. Source: TradingView Three reasons for the spike in demand for INJ include the addition of support for new assets i...

Polygon price risks 50% drop as MATIC paints inverted cup and handle pattern

Polygon (MATIC) has dropped by more than 40% from its record high of $2.92, established on Dec. 27, 2021. But if a classic technical indicator is to be believed, the token has more room to drop in the sessions ahead. MATIC price chart painting classic bearish pattern MATIC’s recent rollover from bullish to bearish, followed by a rebound to the upside, has led to the formation of what appears like an inverted cup and handle pattern — a large crescent shape followed by a less extreme upside retracement, as shown in the chart below. MATIC/USD three-day price chart featuring inverted cup and handle pattern. Source: TradingView In a “perfect” scenario, inverted cup and handle setups set the stage for a downturn ahead. As they do, the price tends to fall towards levels tha...

RNDR, NFTX and YGG bounce higher as the market rewards projects focused on utility

Everyone might be a genius during a bull market, but the real stars begin to shine when the waters get choppy. The same can be said for crypto projects and developers and once the pump is over, it’s easier for investors to separate the pump and dump projects from those with good fundamentals. Sometimes a bull market, sometimes a bear market, always a builder’s market. — a a ron (@aaroneth_) February 2, 2022 Now that Bitcoin (BTC) price has found its place back in the $42,000 to $45,000 zone, the mood across the crypto ecosystem has once again flipped bullish and projects that have continued to release new updates are being rewarded with significant jumps in price. Here’s a look at three projects that have continued to develop and draw investors despite the recent market weakness. Ren...

Renewed interest in the Metaverse sends Decentraland (MANA) price 75% higher

The influence of blockchain technology on the ongoing digital revolution cannot be overstated as the rise of the Metaverse and the integration of virtual reality is transforming the way humans interact on a global scale. One project that is beginning to gain traction in its effort to bridge the old world with the new is Decentraland (MANA), a virtual reality (VR) ecosystem built on the Ethereum network that allows users to create, engage with and monetize digital content through a variety of interactive experiences. Data from Cointelegraph Markets Pro and TradingView shows that over the past two weeks, the price of MANA has climbed 70% from a low of $1.70 on Jan. 22 to a daily high of $2.90 on Feb. 1 as the wider crypto market struggled under bearish pressure. MANA/USDT 1-day chart. ...

3 reasons why Telos (TLOS) price hit a new all-time high

It seems crypto winter is upon us and during times like these, projects that continue to forge ahead by focusing on development and expansion are often rewarded by traders who are looking to set up long positions where strong fundamentals trump the absence of short-term gains. One project that has weathered the storm in the crypto markets to establish a new all-time high is Telos (TLOS), a blockchain network created with the EOSIO software that aims to bring speed and scalability to smart contracts for decentralized finance (DeFi), nonfungible tokens (NFTs), gaming and social media. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.42 on Jan. 10, the price of TLOS has soared 229% to a new high of $1.39 thanks in part to a record-high trading volume of...

Kyber Network (KNC) bucks the market-wide downtrend with a 57% gain in January

In the crypto market volatility continues to reign supreme, and fear, uncertainty and doubt (FUD) run rampant. This makes it challenging for any project to rise above the noise and post positive price gains but there are a few projects that are showing strength during the current downturn. Kyber Network (KNC) is a multi-chain decentralized exchange (DEX) and aggregation platform designed to provide decentralized finance (DeFi) applications and their users with access to liquidity pools that provide the best rates. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a bottom of $1.18 on Jan. 6, the price of KNC has rallied 57% to a daily high at $1.87 on Jan. 27 despite the wider weakness in the crypto market. KNC/USD 4-hour chart. Source: TradingView Three re...

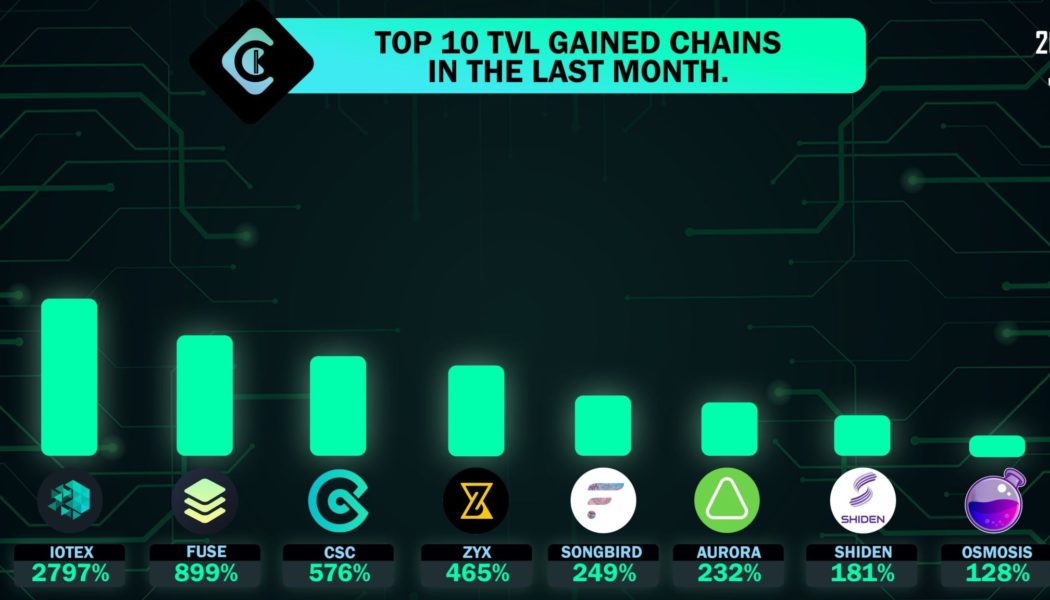

MetisDAO TVL surges by 99,800% as the layer-2 race heats up

Attracting liquidity has become a de facto arms race in the growing decentralized finance (DeFi) landscape. Projects constantly battle to attract investors’ funds by offering enticing yields for crypto holders willing to take a risk and lock up their assets, and protocols use these funds to build out their products and attract attention from larger investors. One protocol that has been gaining traction in the total value locked (TVL) race is MetisDAO, a layer-two rollup platform designed to fully support the application and business migration from Web2 to Web3. Top 10 TVL gainers over the past month. Source: CCK Ventures Alongside the growth in the TVL on its protocol, the METIS token has also received a boost of momentum, with data from Cointelegraph Markets Pro and CoinGecko showin...

Moonbeam (GLMR) launch brings EVM interoperability closer to the Polkadot network

Cross-chain compatibility with the Ethereum (ETH) network has become a necessary component for any layer-one protocol looking to remain relevant because a majority of projects and funds locked in smart contracts are found on the top-ranked smart contract platform. After years of development and promises of interoperability, the Polkadot network moved toward its first Ethereum virtual machine (EVM) compatible smart contract protocol with the launch of Moonbeam (GLMR). The platform is designed to make it easy to use Ethereum developer tools to build or re-deploy Solidity projects in a Substrate-based environment. Data from Cointelegraph Markets Pro and TradingView shows that after a volatile start, which saw its price swing from a low of $8.40 on Jan. 11 to a high of $15.97 on Jan. 14,...

MXC’s 200% gain hints that LoRaWAN IOT mining projects could rally in 2022

Cryptocurrency mining has become a hot topic of conversation over the past couple of years due to its lucrative nature and the impact the industry has on the environment. The emergence of Web3 and the increased presence of Internet of Things (IoT) devices has led to a new class of low-cost mining protocols with low-power network technology. These include LPWAN or LoRaWAN which are designed to transmit low bit rate data over long distances. One such protocol that has been gaining traction in recent months is MXC, a Web3 infrastructure protocol designed to provide geolocation-based LPWAN coverage to IoT devices around the world Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.046 on Jan. 1, the price of MXC has seen a 200% rally to a new all-time...

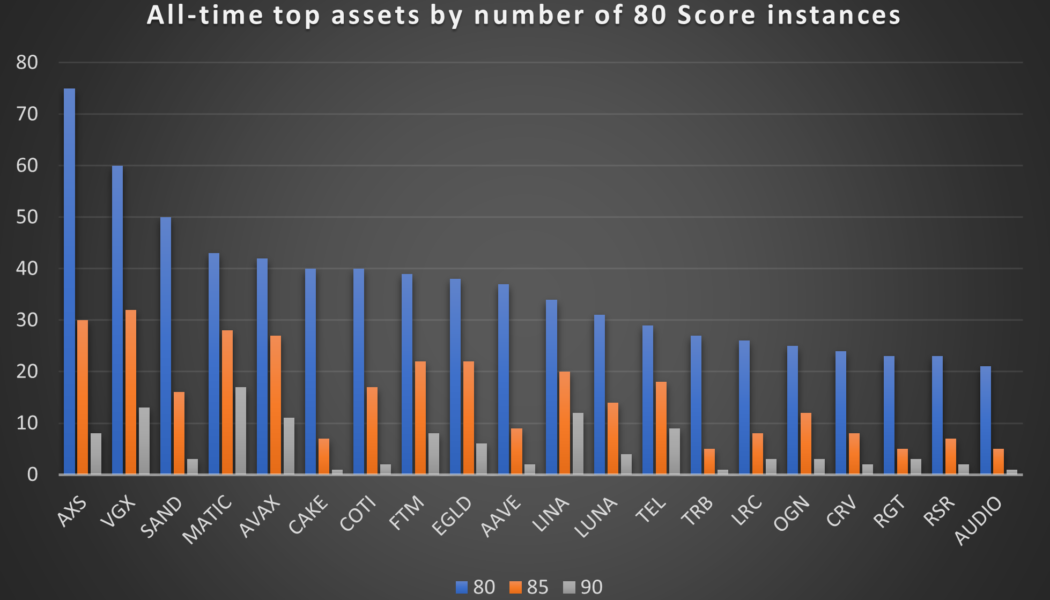

Here are the most predictable tokens of 2021 – for those who knew where to look

Digital assets’ past performance is never a guarantee of future price movement. There are never two identical situations in the crypto marketplace, so even historically similar patterns of a token’s behavior can be followed by starkly different price action charts. Still, crypto assets’ individual history of price action often rhymes, giving those who can ready this history right a massive edge over other traders. And, importantly, some tokens are much more likely than others to exhibit recurring behavior, which makes their bullish setups more recognizable ahead of time. Cointelegraph Markets Pro, a subscription-based data intelligence platform whose job is to search for regularities in crypto assets’ past trading behavior and alert traders to historically bullish conditions around individ...