Altcoin Watch

Immutable X (IMX) gains 50% following the close of a $200M fundraising round

Non-fungible token (NFT) projects have been hard hit by the price decline across the cryptocurrency ecosystem and the current bearish conditions have spared few tokens from a price collapse. One project that is attempting to get back on solid footing is Immutable X (IMX), an NFT-focused layer-2 (L2) scaling solution for the Ethereum (ETH) network designed to offer near-instant transactions and zero gas fees for minting and trading. Data from Cointelegraph Markets Pro and TradingView shows that the price of IMX has climbed 69.6% since hitting a low of $1.09 on March 7 to hit a daily high of $1.86 on March 11. IMX/USDT 4-hour chart. Source: TradingView Three reasons for the reversal in IMX include the completion of a $200 million Series C funding round, the launch of new projects on the plat...

Terra, Avalanche and Osmosis lead the L1 recovery while Bitcoin searches for support

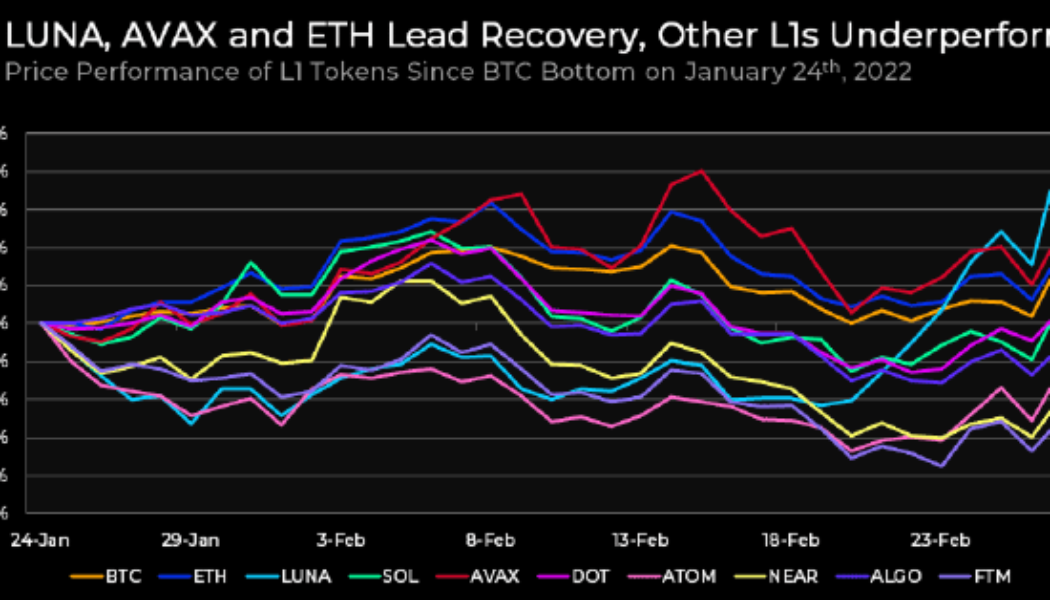

The layer-one (L1) ecosystem has received increased attention in recent months as users search for new investment opportunities in the Cosmos (ATOM), Fantom (FTM) and NEAR. Following January’s market sell-off, where Bitcoin (BTC) price dropped to bottom below $34,000, much of the L1 field has struggled to regain its momentum. Price performance of L1 tokens since Jan. 24. Source: Delphi Digital According to data from Delphi Digital, since the BTC bottom on Jan. 24, the only L1 to experience a notable gain in price include Terra (LUNA), Avalanche (AVAX) and Ethereum (ETH). Terra ecosystem growth The price growth seen in LUNA was in large part due to the announcement from the Luna Foundation Guard that it had raised $1 billion to form a Bitcoin reserve for the ecosystem’s Terra US...

Altcoin Roundup: JunoSwap, Solidly and VVS Finance give DeFi a much-needed refresh

Decentralized finance (DeFi) was the talk of the town in early 2021, but it has since taken a back seat to more appealing sectors like nonfungible tokens (NFTs), memecoins and blockchain gaming. Now that cross-chain bridges and interoperability have allowed for the easier migration of assets to competing chains, a new class of DeFi protocols is arising to challenge those left from 2021. Here’s a look at three DeFi projects that have launched on some of the up-and-coming layer-1 blockchain networks, catching the eye of the crypto community. VVS Finance VVS Finance is the largest DeFi protocol on the Cronos network, a project that emerged out of the Crypto.com ecosystem which has since been fully rebranded to Cronos (CRO). The goal of VVS Finance is to offer instant swaps with low fees...

REN price gains 65% after Catalog launch brings a cross-chain DEX to its blockchain

Decentralized finance projects like Ren pumped in 2021, only to finish the year right back where they started as high fees on Ethereum (ETH) led to decreased activity for many protocols and DeFi took a backseat to more popular sectors like nonfungible tokens (NFTs). Now, it appears as though that downtrend is in the process of reversing course after recent global events highlighted the benefits of DeFi and holding assets outside the traditional financial system. This week REN price climbed 69% from a low of $0.247 on Feb. 24 to a daily high of $0.418 on March 3. REN/USDT 4-hour chart. Source: TradingView Three reasons for the potential price reversal in REN are the launch of its first layer-one application Catalog, the launch of VarenX on Polygon and several new partnerships and inte...

3 reasons why Waves price gained 100%+ in the last week

Development never stops in the blockchain sector and projects that continuously evolve are the ones that stay at the forefront and survive over the long-term. One project attempting to stay on top of the innovation wave is Waves, a multi-purpose blockchain protocol designed to support a variety of use cases, including decentralized applications and smart contracts. Data from Cointelegraph Markets Pro and TradingView shows that the price of WAVES has rallied 120% since forming a double bottom at $8.28 on Feb. 22. WAVES/USDT 4-hour chart. Source: TradingView Three reasons for the price growth for WAVES are the recent announcement that the protocol will migrate to Waves 2.0, a partnership with Allbridge that will connect Waves with other popular blockchain networks and the upcoming laun...

Rune’s upcoming mainnet launch and Terra (LUNA) integration set off a 74% rally

2021 was a roller coaster of a year for THORChain (RUNE), which saw its price top out at $20.31 only to come crashing down below $4 as a series of hacks and declining interest in decentralized finance had the token limping into 2022. Data suggests that investors could be taking a closer look at Rune and a few potentially bullish factors could include the protocol’s recent integration with the Terra and Cosmos ecosystem, an upcoming mainnet launch and the attractive yields offered to liquidity providers. RUNE/USDT 4-hour chart. Source: TradingView Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $3.00 on Feb. 24, the price of RUNE has rallied 74.2% to a daily high at $5.23 on March 1 amid a 388% surge in its 24-hour trading volume. Rune integrates ...

3 reasons why Lido DAO Token could be on the verge of breaking its downtrend

Ethereum (ETH) and decentralized finance (DeFi) are undergoing a seismic shift as the transition to Eth2 and a proof-of-stake consensus mechanism is helping to increase the value proposition for the network which has historically has been plagued with scaling issues and high transaction costs. Alongside this transition has been the introduction of liquid staking, which is helping to add utility to DeFi and giving investors the option to do more with their assets than just lock them up indefinitely. Liquid staking could also help investors build more capital efficient portfolios. One protocol that has benefited from the shift toward liquid staking is Lido (LDO), a platform that allows investors to earn staking rewards on their tokens while also enabling them to put the resulting...

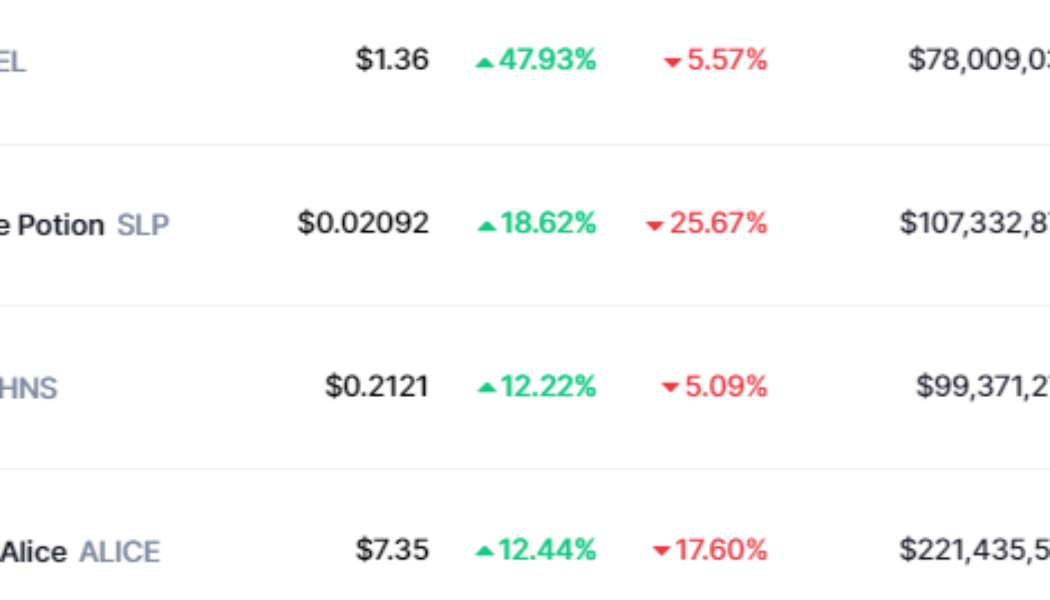

VOXEL, SLP and ALICE rally after protocol updates and a major exchange listing

Crypto markets are taking a beating but there are still a few standout performers even during this week’s volatility. One sector that has managed to rise above the noise are NFT-related altcoins and GameFi tokens. Top gainers in the collectible and NFT sector. Source: CoinMarketCap Data from Cointelegraph Markets Pro and CoinMarket Cap shows that three notable gainers over the past 48-hours were Voxies (VOXEL), Smooth Love Potion (SLP) and MyNeighborAlice (ALICE). Voxie Tactics launches its marketplace VOXEL is the native utility currency of Voxie Tactics, a free-to-play, 3-dimensional, role-playing game that combines the classic look of the popular tactical games of the 1990s and 2000s with modern game mechanics. Data from TradingView shows that after hitting a low of $0.90 on Feb. ...

Komodo (KMD) rallies 54% after major push to expand interoperability with AtomicDEX

Interoperability between separate blockchain networks has become a major theme in the cryptocurrency market over the past year, but several major exploits — such as the $321 million Wormhole exploit — have highlighted the difficulties in achieving cross-chain transfers in a secure manner. One protocol that has been gaining traction in February thanks to its alternative approach to achieving cross-chain interoperability is Komodo, an open, composable multichain platform that is home to the AtomicDEX wallet and non-custodial decentralized exchange. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $0.446 on Feb. 20, the price of the platform’s KMD token surged 54% to a daily high of $0.687 on Feb. 22. KMD/USDT 4-hour chart. Source: TradingView Three r...

NEO price climbs after China’s BSN gives the project the green light on NFT marketplaces

As the field of viable layer-1 blockchain protocols continues to expand, with newer entrants trying to solve the issue of high transaction costs and slow processing times, older projects find themselves utilizing their history and track record to set themselves apart and secure a market share that will ensure their survival through the next market cycle. Neo (NEO) fits the bill described above, and the project is attempting to stage a revival in 2022 as governments around the world slowly open to the fact that blockchains and digital currencies have certain benefits and capabilities that can be integrated into public and private enterprise. Data from Cointelegraph Markets Pro and TradingView shows that the price of NEO has climbed 60%, since hitting a low of $16.10 on Jan. 24, to hit...