Altcoin Watch

AI altcoins are pumping — Is this the beginning of the next bull market? The Market Report

This week on The Market Report, the resident experts at Cointelegraph discuss what artificial intelligence (AI) altcoins are, what their potential benefits are, how they work, and whether they can be a catalyst for a 2023 bull market. We start off this week’s show with the latest news in the markets: BTC price 3-week highs greet US CPI — 5 things to know in Bitcoin this week Bitcoin (BTC) starts a new week on a promising footing, with BTC price action near one-month highs — but can it last? The move precedes a conspicuous macroeconomic week for crypto markets, with the December 2022 Consumer Price Index (CPI) print due from the United States. Jerome Powell, chair of the Federal Reserve, will also deliver a speech on the economy, with inflation on everyone’s radar. Inside the...

A sharp drop in TVL and DApp use preceded Avalanche’s (AVAX) 16% correction

After an impressive 73% rally between July 13 and Aug. 13, Avalanche (AVAX) has faced a 16% rejection from the $30.30 resistance level. Some analysts will try to pin the correction as a “technical adjustment,” but the network’s deposits and decentralized applications reflect worsening conditions. Avalanche (AVAX) index, USD. Source: TradingView To date, Avalanche remains 83% below its November 2021 all-time high at $148. More data than technical analysis can be analyzed to explain the 16% price drop, so let’s take a look at the network’s use in terms of deposits and users. The decentralized application (DApp) platform is still a top-15 contender with a $7.2 billion market capitalization. Meanwhile, Solana (SOL), another proof-of-work (PoW) layer-1 platform, holds a $14.2 billio...

Traders target $1,400 Ethereum price after ETH drops closer to a critical support level

On June 8 the Ethereum network successfully underwent the merge to become proof-of-stake on its Ropsten testnet, but the news had little impact on ETH price. With the Ropsten upgrade now looking more like a buy the rumor, sell the news type of event, most analysts have kept a short-term bearish outlook for Ether price. Let’s take a look. ETH/USDT 1-day chart. Source: TradingView Can Ether escape the head and shoulders pattern? Twitter analyst, “Cactus”pointed out a bearish head and shoulders pattern and questioned whether Ether price would be able to follow the sharp downside that typically follows the completion of the pattern. ETH/USD 1-week chart. Source: Twitter Cactus said, “This is what we are getting excited about? Hard to be bullish any t...

LINK marines rejoice after Chainlink 2.0 brings a new roadmap and staking

Passive income opportunities are one of the biggest draws in the cryptocurrency ecosystem because it gives investors an easy opportunity to grow their portfolio size regardless of the day-to-day price action. The latest token to get a bump in its price after announcing the upcoming implementation of staking is Chainlink (LINK), the decentralized oracle network that provides important off-chain information needed for the proper functioning of smart contracts. Data from Cointelegraph Markets Pro and TradingView shows that since bouncing off a low of $6.67 on June 4, the price of LINK has increased 35% to hit a daily high of $9.00 on June 7. LINK/USDT 4-hour chart. Source: TradingView Here’s a look at what the new developments in the Chainlink ecosystem that could be backing today’s pri...

Reserve Rights (RSR) builds momentum ahead of its long-awaited mainnet launch

Bitcoin was created to give the average person a peer-to-peer economic system and a store of wealth asset that could provide financial autonomy and access to banking, especially for people living in places where financial services are sparse or non-existent. In the last five years, there have been a number of blockchain projects that aim to mirror Bitcoin’s original mission and the growing popularity of stablecoins further highlights the need for alternative financial models. One project that is beginning to see a bit of momentum is Reserve Rights (RSR), a dual-token stablecoin platform comprised of the asset-backed Reserve Stablecoin (RSV) and the RSR token which helps to keep the price of RSV stable through a system of arbitrage opportunities. Data from Cointelegraph Markets Pro an...

WEMIX gains 200%+ after stablecoin and boosted staking rewards announcement

Blockchain-based gaming, also known as GameFi, is an up-and-coming sector that could potentially be one of the primary catalysts for kickstarting the mass adoption of blockchain technology. WEMIX, a gaming protocol that operates on the Klaytn network, aims to get in on the GameFi revolution and this week, the project’s native token (WEMIX) rallied even as the wider market continued to sell-off. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $1.27 on May 12, WEMIX price climbed 269% to hit a daily high at $4.70 on May 25 as its 24-hour trading volume increased to $652 million. WEMIX/USDT 1-day chart. Source: TradingView Three reasons for the price reversal for WEMIX are the upcoming launch of WEMIX 3.0, a series of project launches and partnershi...

Polkadot parachains spike after the launch of a $250M aUSD stablecoin fund

Crypto prices have been exploring new lows for weeks and currently it’s unclear what it will take to reverse the trend. Despite the downtrend, cryptocurrencies within the Polkadot (DOT) ecosystem began to rally on May 24 and have managed to maintain gains ranging from 10% to 25%, a possible sign that certain sub-sectors of the market are on the verge of a breakout. Here’s a look at three Polkadot ecosystem protocols that have seen their token prices trend higher in recent days. Acala launches a $250 million aUSD ecosystem fund Acala (ACA) is the leading decentralized finance (DeF) platform on the Polkadot network, primarily due to the launch of aUSD, the first native stablecoin in the Polkadot ecosystem. Following the collapse of Terra’s LUNA and TerraUSD (UST), traders we...

3 red flags that signal a crypto project may be misleading investors

Satoshi Nakamoto left a large pair of shoes to fill after releasing the code for Bitcoin (BTC) to the world, helping to establish the network, then vanishing without so much as a trace. Over the years, the crypto ecosystem has seen many developers and protocol creators rise in stature to become crypto messiahs for faithful holders who eventually have their best-laid plans end in catastrophe when the protocol is hacked, rugged or abandoned by whimsical developers. 2022 is hardly halfway complete and the year has already seen a particularly bad stretch of good intentions gone awry, which have collectively helped plunge the market into bear-market territory. Here’s a closer look at each of these instances to help provide insight into how similar outcomes can be avoided in the future. So...

20% drop in the S&P 500 puts stocks in a bear market, Bitcoin and altcoins follow

Whoever coined the phrase “sell in May and go away” had brilliant insight and the performance of crypto and stock markets over the past three weeks has shown that the expression still rings true. May 20 has seen a pan selloff across all asset classes, leaving traders with few options to escape the carnage as inflation concerns and rising interest rates continue to dominate the headlines. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) taking on water below $29,000 and traders worry that losing this level will ensure a visit to the low $20,000s over the coming week. BTC/USDT 1-day chart. Source: TradingView As reported by Cointelegraph, some analysts warn that BTC could possibility decline to $22,700 based on its historical price performance fo...

BIFI gains 100%+ after Beefy Finance adds new vaults and stablecoin liquidity pools

Winston Churchill’s statement to “never let a crisis go to waste” can be applied across many aspects of society, including the recent carnage seen in the crypto market. Last week’s volatility is likely to have newer investors and those who took on heavy losses questioning the future of the burgeoning asset class, but in every bear trend there is a silver lining. One platform that appears to be capitalizing on the void created by TerraUSD’s (UST) collapse is Beefy Finance (BIFI), a multi-chain yield optimizing decentralized finance protocol. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $387.80 on May 14, BIFI spiked 168.13% to hit a daily high of $1,040 on May 16 amids a 684% increase in its 24-hour trading volume. BIFI/USDT 4-hour chart. Sourc...

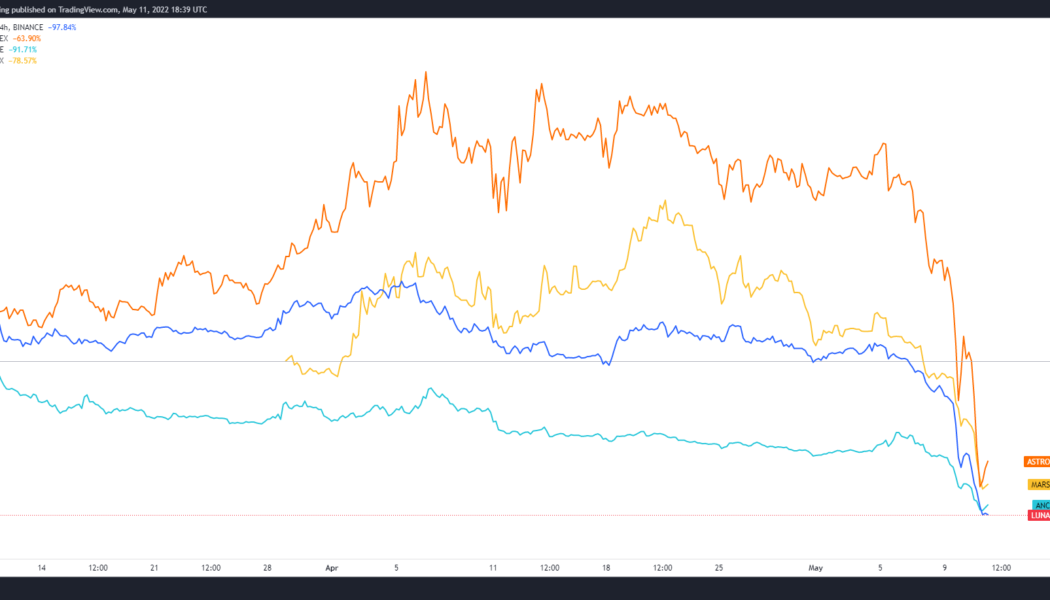

Terra contagion leads to 80%+ decline in DeFi protocols associated with UST

The knock-on effect of the collapse of Terra (LUNA) and its TerraUSD (UST) stablecoin have spread wide across the cryptocurrency market on May 11 as projects with any kind of association with the DeFi ecosystem have seen their prices hammered. The forced selling of the Bitcoin (BTC) holdings backing a portion of UST also influenced BTC’s current drop to $29,000 and analysts fear that DeFi platforms that have liquidity pools primarily comprised of UST and LUNA will collapse. LUNA, ANC, ASTRO and MARS in USDT pairings. 4-hour chart. Source: TradingView Terra-based protocols suffer Projects with the direst of outlooks are those that are hosted on the Terra protocol including Anchor Protocol (ANC), Astroport (ASTRO) and Mars Protocol (MARS). As shown in the chart above, ...