Altcoin

Bonk token goes bonkers as traders chase after high yields in the Solana ecosystem

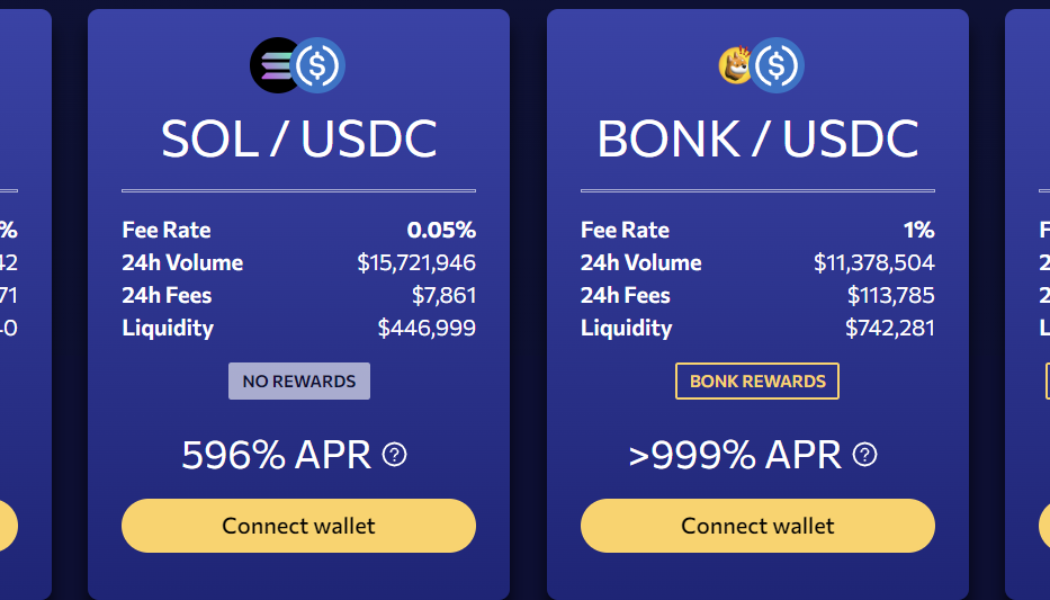

Bonk, a meme token modeled after Shiba Inu (SHIB) that launched on Dec. 25, is skyrocketing and some traders believe the token’s trading volume is potentially driving Solana’s (SOL) price up. Over the past 48 hours, SOL price has gained 34%, and in the past 24 hours, Bonk has climbed 117%, according to data from CoinMarketCap. While the wider crypto market remains suppressed, traders are hoping that Bonk could present new opportunities during the downturn. According to the project’s website, Bonk is the first dog token on the Solana blockchain. Initially, 50% of the token supply was airdropped to Solana users with a mission to remove toxic Alameda-styled token economics. The airdrop resulted in more than $20 million in trading volume according to the Solana decentralized exchange Orc...

What is USD Coin (USDC), fiat-backed stablecoin explained

USDC offers instant payments, saves users from the cryptocurrency market’s price volatility and is audited by a regulated auditing firm, making it a transparent stablecoin. However, it does not offer price appreciation opportunities, and investors may incur high transaction and withdrawal fees while dealing with USDC. One of the key advantages of the USD Coin is the speed of the transaction. Usually, one must wait a long time to send and receive USD because institutions such as banks and their complex procedures slow down the processing of transactions. Nonetheless, USDC allows instant clearing and settlement of payments. In addition, stablecoins like USDC saves users from the price volatility of cryptocurrencies, as leading American financial institutions ensure that Circle&...

ApeCoin risks 30% crash after APE staking debut in December

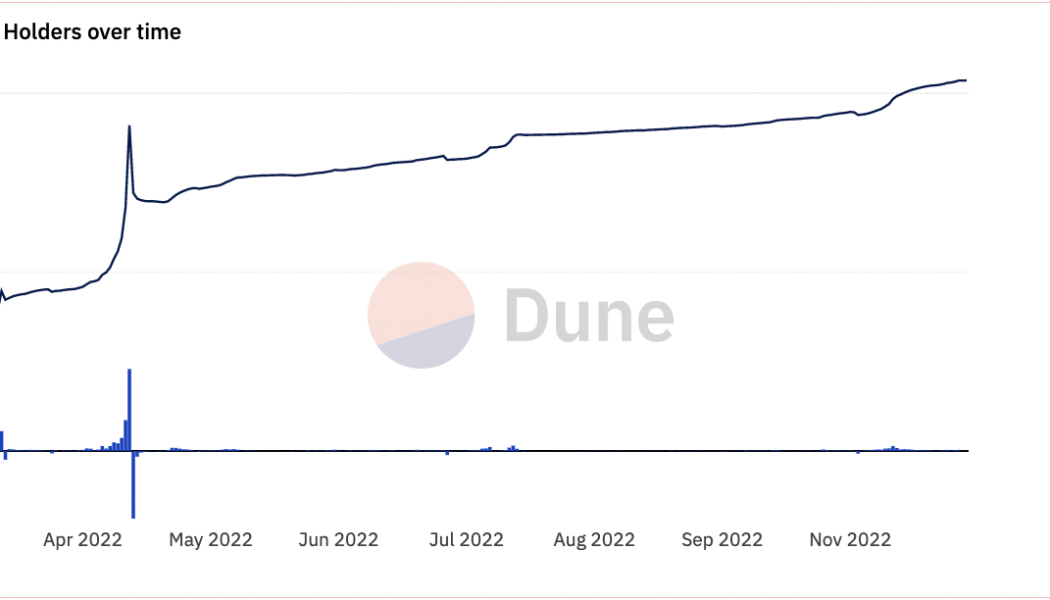

The multi-week ApeCoin (APE) market rally is nearing exhaustion owing to a mix of technical and fundamental factors. Fundamental — ApeCoin Staking launch In the past two weeks, APE’s price is up over 50% after bottoming at around $2.60. The APE/USD rebound came in line with similar recovery moves elsewhere in the crypto market. But, it outperformed top assets, including Bitcoin (BTC) and Ether (ETH), as traders pinned their hopes on ApeCoin’s staking debut. The ApeCoin Staking feature will debut on Dec. 5 at apestake.io, according to its developer Horizon Labs. It will allow users to lock their APE holdings into four staking pools — ApeCoin pool, BAYC pool, MAYC pool, and Paired pool — that will allow them to earn yield periodically. The feature announcement has resulted ...

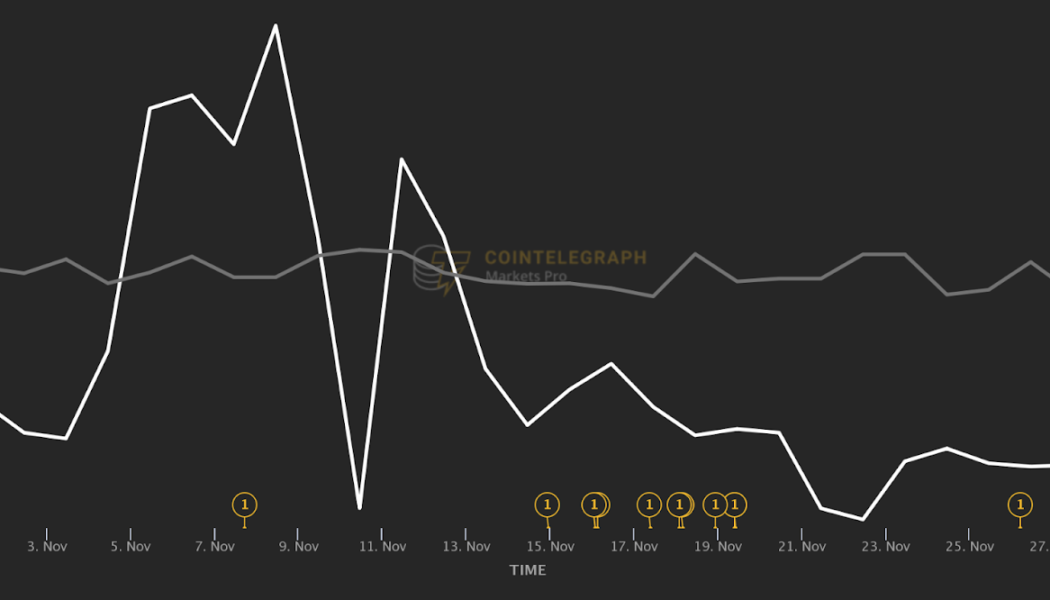

MATIC attack: How smart crypto traders “got out” before a 35% price drop

Disparities in information access and data analytics technology are what give institutional players an edge over regular retail investors in the digital asset space. The core idea behind Markets Pro, Cointelegraph’s crypto-intelligence platform powered by data analytics firm The Tie, is to equalize the information asymmetries present in the cryptocurrency market. Markets Pro bridges the gap of these asymmetries with its world-class functionality: the quant-style VORTECS™ Score. The VORTECS™ Score is an algorithmic comparison of several key market metrics for each coin utilizing years of historical data that assesses whether the outlook for an asset is bullish, bearish or neutral at any given moment based on the historical record of price action. The VORTECS™ Score is d...

DEX token GMX rallies 35% after beating Uniswap on trading fees for the first time

The price of GMX rallied to its second-highest level in history on Dec. 1 as traders assessed the decentralized exchange’s ability to evolve as a serious competitor to its top rival Uniswap (UNI). GMX established an intraday high of $54.50 in a recovery that started on Nov. 29 from $40.50. Its rally’s beginning coincided with crypto research firm Delphi Digital’s tweet on the GMX decentralized exchange, as shown below. GMX/USD four-hour price chart. Source: TradingView GMX beats Uniswap in fees for the first time Notably, GMX had earned about $1.15 million in daily trading fees on Nov. 28, which surpassed Uniswap’s $1.06 million trading fees on the same day. GMX Flipped Uniswap in Daily Fees on Nov. 28. Source: Delphi Digital This seemingly renewed buyin...

FTM price rebounds 50% as Fantom reveals 30 years runway (without having to sell its token)

Fantom (FTM) continued its upward momentum on Nov. 30 amid reports that the Fantom Foundation generates consistent profits and has 30 years of runway without having to sell any FTM tokens. Fantom’s FTM holdings up from 3% to 14% FTM price gained nearly 13.5% to reach $0.24, its highest level in three weeks. The rally came as a part of a broader rebound trend that started when it bottomed out at around $0.17 on Nov. 22. This amounts to a 50% price rebound in the last eight days. Interestingly, the rally picked up momentum after the Fantom Foundation’s “Architect,” Andre Cronje, released the firm’s financial records on Nov. 28, revealing that it had $340 million worth of digital assets and had been earning over $10 million annually. Notably: ...

Spain for the win? Top 3 fan tokens to watch during the FIFA World Cup

The FIFA World Cup in Qatar is boosting the value of national soccer team fan tokens despite the cryptocurrency bear market. World Cup Qatar hype boosts fan token prices These digital fan tokens are currently rallying despite the cryptocurrency market downturn, securing up to 170% gains from the Nov. 10 lows. At the core of the massive uptrend is the World Cup, which will be held from Nov. 20 to Dec. 18 in Qatar. Fan tokens are cryptocurrencies that enable fans to engage with and participate in their favorite team’s decisions. Moreover, they create new sponsorship opportunities for sports clubs and national squads outside of traditional revenue sources. Here’s a brief overview of the top gainers in the fan token sector, alongside their technical outlook during th...

Litecoin pre-halving fractal hints at 200% LTC price rally by July 2023

The price of Litecoin (LTC) could skyrocket by up to 200% by July 2023, coinciding with its halving event, reducing miner block rewards by 50%. Litecoin has bottomed out? Litecoin has undergone two halvings since its launch in October 2011. The first one occurred in August 2015, which reduced its block reward from 50 LTC to 25 LTC. The second happened in August 2019, which slashed the 25 LTC reward to 12.5 LTC. Interestingly, each Litecoin halving event occurred after a volatile LTC price cycle, namely an enormous price pump, followed by a similarly massive correction, a price bottom, and recovery to a local top. After the Litecoin halvings, LTCs’ price corrected from its local top, established another bottom, and followed it with another massive price rally to a new record...

Dogecoin price rallies 150% in 4 days, but DOGE now most ‘overbought’ since April 2021

The Dogecoin (DOGE) price rally extended further on Oct. 29 in hopes that the cryptocurrency would get a major boost from Elon Musk’s Twitter acquisition. Elon Musk boosts Dogecoin price again Dogecoin price jumped by nearly 75% to reach $0.146 on Oct. 29, the biggest daily gain since April 2021. DOGE/USD daily price chart. Source: TradingView Notably, the meme-coin’s massive intraday rally came as a part of a broader uptrend that started earlier this week on Oct. 25. In total, DOGE’s price gained 150% during the Oct. 25-29 price rally. The surge was also accompanied by a decent increase in its daily trading volumes. That coincided with a spike in the number of DOGE transactions exceeding $100,000, according to Santiment. Both indicators sugges a growing demand for Dogeco...

Cardano price chart paints ‘Burj Khalifa’ with 7-month losing streak — More losses ahead?

Cardano (ADA) price is in the process of painting its seventh red monthly candle in a row as the token fell to its lowest level since February 2021. The trend saw ADA’s price rising nearly 800% to $3.16 between February 2021 and September 2021, followed by a complete wipeout of those gains entering October 2022. Amusingly, the entire price action took the shape of the “Burj Khalifa,” the world’s tallest skyscraper in Dubai. Ada Khalifa pic.twitter.com/KE2SxTO3bN — Trader_J (@Trader_Jibon) October 19, 2022 ADA price eyes 35% price crash The ADA price correction began primarily in the wake of a similar downtrend across the cryptocurrency market, led by the Federal Reserve’s aggressive interest rate hikes to tame rising inflation. Even an optimistic Cardano netwo...

3 reasons why Quant Network’s QNT token may have topped after 450% gains since June

The price of Quant Network (QNT) eyes a sharp reversal after an impressive 450% rally in the past four months. QNT’s downside outlook takes cues from a flurry of technical and on-chain indicators, all suggesting that investors who backed its price rally have likely reached the point of exhaustion. QNT/USD daily price chart. Source: TradingView Here are three reasons why it could be happening. Quant’s daily active addresses drop Interestingly, the period of QNT’s massive uptrend coincided with similar upticks in its number of daily active addresses (DAA). This metric represents the number of unique addresses active on the network as a sender or receiver. As of Oct. 17, the Quant Network’s DAA reached an all-time high of 10,949, up from around 5,850 four months a...

3 signs suggesting the XRP price boom can continue in Q4 2022

XRP (XRP) has made considerable gains over the past month as traders continue to shower confidence on Ripple’s legal win against the United States Securities and Exchange Commission (SEC). For instance, the XRP price gained 25% thirty days after Ripple and the SEC filed for an immediate ruling on whether or not XRP sales violated U.S. securities laws. In comparison, Bitcoin (BTC) and Ether (ETH) are down 4% and 11% over the same period, respectively. XRP/USD versus BTC/USD and ETH/USD daily price chart. Source: TradingView Now, a flurry of indicators, ranging from on-chain to technical, hints XRP can continue its uptrend going into 2023. XRP price “bull pennant” Bull pennants are bullish continuation patterns that form as the price consolidates in a triangle-like range after...