Alameda Research

Alameda wallet under liquidator control incurred $11.5M in losses: Arkham

The liquidators of Alameda Research have reportedly incurred at least $11.5 million in losses since taking control of Alameda’s trading accounts. On Jan. 16, a Twitter thread from Arkham Intelligence reported that one wallet under the control of liquidators has seen a string of “significant losses” due to liquidations, some of which were “preventable losses.” Over the past two weeks being under Liquidator control, the account incurred significant losses: Largest single liquidation: $4.85MTotal liquidated amount: $11.5MPreventable losses: $4M+ — Arkham (@ArkhamIntel) January 16, 2023 As one example, Arkham noted that the account ending 0x997 initially had a short position of 9,000 Ether (ETH) ($10.8 million) against the collateral of $20 million in USD Coin (US...

FTX former lead engineer in talks with federal prosecutors in Bankman-Fried case

As the investigation into FTX continues, the crypto exchange’s former engineering chief, Nishad Singh, followed former FTX and Alameda Research executives Gary Wang and Caroline Ellison by reportedly meeting with federal prosecutors to cut a deal. Singh attended a proffer session during the week of Jan. 2 at the office of the United States Attorney for the Southern District of New York. Individuals may be granted limited immunity to share their knowledge with prosecutors at such meetings. Prosecutors likely sought to determine if Singh has valuable information to offer in the lawsuit against FTX founder Sam Bankman-Fried, according to a Jan. 10 Bloomberg report. Bankman-Fried also faces campaign finance violations and prosecutors are interested in Singh’s knowledge about FTX’s political do...

10 crypto tweets that aged like milk: 2022 edition

To put it lightly, it has been a wild year for the crypto sector. In the span of less than 12 months, the third-most valuable stablecoin imploded, leading to a domino effect that saw crypto lender Celsius go bankrupt, Three Arrows Capital’s founders go runabout and one of crypto’s most “altruistic” executives flown home in cuffs. In this article, Cointelegraph has selected 10 crypto-related tweets that have aged like spoilt milk. Do Kwon — “Steady lads” On May 10, just as the algo-stablecoin formerly known as TerraUSD started to fall below its dollar peg, the Terraform Labs founder attempted to allay fears of a further depeg, tweeting: “Deploying more capital – steady lads.” Well, we all know what happened after. The collapse of the Terra ecosystem in May 2022 saw more than $40 billi...

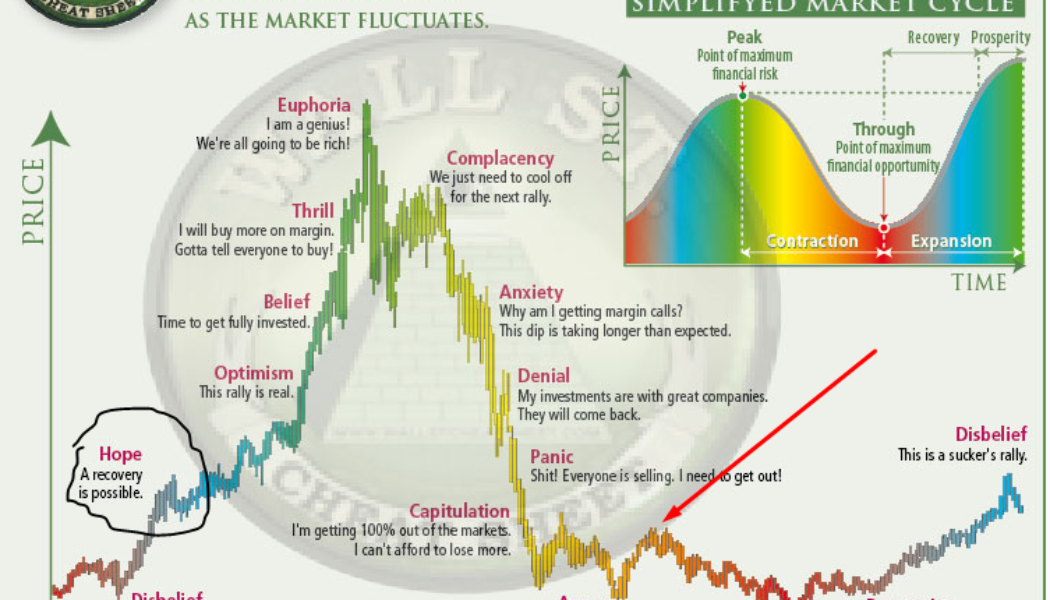

Solana joins ranks of FTT, LUNA with SOL price down 97% from peak — Is a rebound possible?

Solana (SOL), the cryptocurrency once supported by Sam Bankman-Fried, pared some losses on Dec. 30, a day after falling to its lowest level since February 2021. Solana price down 97% from November 2021 peak On the daily chart, SOL’s price rebounded to around $10.25, up over 20% from its previous day’s low of approximately $8. SOL/USD weekly price chart. Source: TradingView Nevertheless, the intraday recovery did little to offset the overall bear trend — down 97% from its record peak of $267.50 in November 2021, and down over 20% in the past week. But while the year has been brutal for markets, Solana now joins the ranks of the worst-performing tokens of 2022, namely FTX Token and LUNA, which are down around 98%. FTT (red) vs. LUNA (green) vs. SOL (blue) ...

Alameda tried to redeem 3,000 wBTC days before bankruptcy: BitGo CEO

Mike Belshe, the CEO of digital asset custodian BitGo has confirmed that Alameda Research attempted to redeem 3,000 Wrapped Bitcoin (wBTC) in the days before FTX’s bankruptcy filing on Nov. 11. During a Dec. 14 Twitter Spaces hosted by decentralized finance (DeFi) researcher Chris Blec, Belshe confirmed the firm knocked back the redemption request because the unknown Alameda representative involved didn’t pass Bitgo’s security verification process and seemed unfamiliar with how the wrapped Bitcoin burning process worked. Full convo here. This part starts at 1:09:30. https://t.co/0KQg6bzd8k — Chris Blec (@ChrisBlec) December 14, 2022 “[The security details] didn’t match the process. So we held it up and we said no, no, no, no. This is not what the burn looks like. And we need to...

FTX hires forensics team to find customers’ missing billions: Report

The new management for bankrupt crypto exchange FTX has reportedly hired a team of financial forensic investigators to track down the billions of dollars worth of missing customer crypto. Financial advisory company AlixPartners was chosen for the task and is led by former Securities and Exchange Commission (SEC) chief accountant, Matt Jacques, according to a Dec. 7 report from the Wall Street Journal. It is understood that the forensics firm will be tasked with conducting “asset-tracing” to identify and recover the missing digital assets and will complement the restructing work being undertaken by FTX. On Nov. 11 hackers drained wallets owned by FTX and FTX.US of over $450 million worth of assets. Former CEO Sam Bankman-Fried claimed in an interview recorded on Nov. 16 with crypto blogger ...

Silvergate CEO calls out ‘short sellers’ spreading misinformation

Silvergate Capital CEO Alan Lane has slammed “short sellers” and “other opportunists” for spreading misinformation over the last few weeks — just to score themselves a quick buck. In a Dec. 5 public letter, Lane said there was “plenty of speculation – and misinformation” being spread by these parties to “capitalize on market uncertainty” caused in part to FTX’s catastrophic collapse in November. His crypto-focused bank was recently forced to deny one of these so-called FUD (fear, uncertainty and doubt) campaigns last week when there was speculation that the firm was exposed to the bankrupt crypto lender BlockFi. Lane also used the latest letter to the public as an “opportunity to set the record straight” about its investment relationship with FTX, as well as the company’s “robust ris...

FTM price rebounds 50% as Fantom reveals 30 years runway (without having to sell its token)

Fantom (FTM) continued its upward momentum on Nov. 30 amid reports that the Fantom Foundation generates consistent profits and has 30 years of runway without having to sell any FTM tokens. Fantom’s FTM holdings up from 3% to 14% FTM price gained nearly 13.5% to reach $0.24, its highest level in three weeks. The rally came as a part of a broader rebound trend that started when it bottomed out at around $0.17 on Nov. 22. This amounts to a 50% price rebound in the last eight days. Interestingly, the rally picked up momentum after the Fantom Foundation’s “Architect,” Andre Cronje, released the firm’s financial records on Nov. 28, revealing that it had $340 million worth of digital assets and had been earning over $10 million annually. Notably: ...

3 reasons why the FTX fiasco is bullish for Bitcoin

The “Bitcoin-is-dead” gang is back and at it again. The fall of the FTX cryptocurrency exchange has resurrected these infamous critics that are once again blaming a robbery on the money that was stolen, and not the robber. “We need regulation! Why did the government allow this to happen?” they scream. For instance, Chetan Bhagat, a renowned author from India, wrote a detailed “crypto” obituary, comparing the cryptocurrency sector to communism that promised decentralization but ended up with authoritarianism. Perhaps unsurprisingly, his column conveniently used a melting Bitcoin (BTC) logo as its featured image. Hi all,“Crypto is now dead: FTX, a cryptocurrency exchange, collapsed last week, proving a lot of cool guys horribly wrong,” my colum...

FTX’s new CEO John Ray coldly addresses SBF’s erratic tweets

The new CEO and chief restructuring officer for the bankrupt FTX cryptocurrency exchange, John Ray, has icily responded to the erratic series of tweets from former CEO and founder Sam Bankman-Fried. The official Twitter account of FTX on Nov. 16 tweeted a statement from Ray addressing Bankman-Fried’s recent public statements, reiterating he “has no ongoing role at [FTX], FTX US, or Alameda Research Ltd. and does not speak on their behalf.” (3/3) Mr. Bankman-Fried has no ongoing role at @FTX_Official, FTX US, or Alameda Research Ltd. and does not speak on their behalf. — FTX (@FTX_Official) November 16, 2022 On Nov. 14 Bankman-Fried began a strange Twitter thread that — over the course of 40 or so hours — eventually spelled out “What HAPPENED” across nine tweets, he then went on to claim he...

Binance to liquidate its entire FTX Token holdings after ‘recent revelations’

The CEO of cryptocurrency exchange Binance, Changpeng “CZ” Zhao, said his company will liquidate the entirety of its position in FTX Token (FTT), the native token of competing exchange FTX. In a Nov. 6 tweet, Zhao said the decision was made after “recent revelations that have came to light.” In a later tweet, CZ explained the FTT liquidation was “just post-exit risk management” referring to lessons learned from the fall of Terra Luna Classic (LUNC) and how it impacted market players. He also added “we won’t support people who lobby against other industry players behind their backs.” Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t supp...

Coinbase, Alameda-backed Mara launches African crypto wallet service

Some 2 million users in Nigeria and Kenya are set to be onboarded to a new cryptocurrency wallet backed by the likes of Coinbase Ventures and Alameda Research. Mara is a digital financial ecosystem project that is kickstarting its journey with the launch of a cryptocurrency wallet for signed-up users in Nigeria. A portion of the waitlist will be onboarded through an invite-only process starting on Oct. 27, followed by the onboarding of users in Kenya and Ghana. The project is backed by cryptocurrency industry heavyweights, having raised $23 million in a fundraising round headlined by Coinbase Ventures, Alameda Research, Huobi and several other investors and venture capitalists. The Mara wallet will offer cryptocurrency brokerage services through its app, allowing users to buy, send, ...

- 1

- 2